Executive Summary

The global railcar leasing market is experiencing steady growth due to the rising demand for efficient and cost-effective transportation solutions. Railcar leasing offers several advantages, including reduced capital expenditure, flexibility, and the ability to cater to varying transportation needs. The market is driven by factors such as increased environmental consciousness, expanding industrial activities, and the growing need for reliable transportation infrastructure.

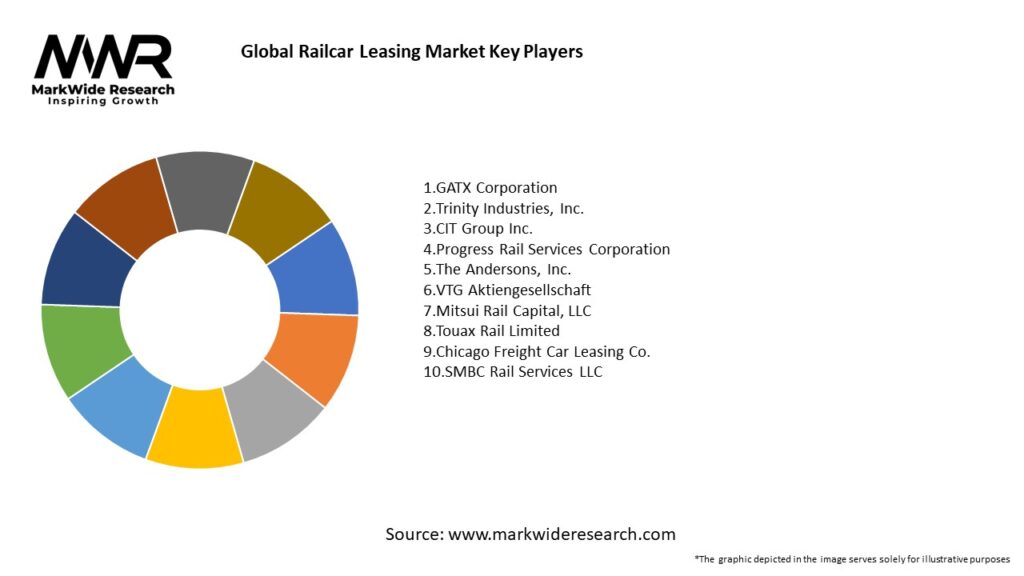

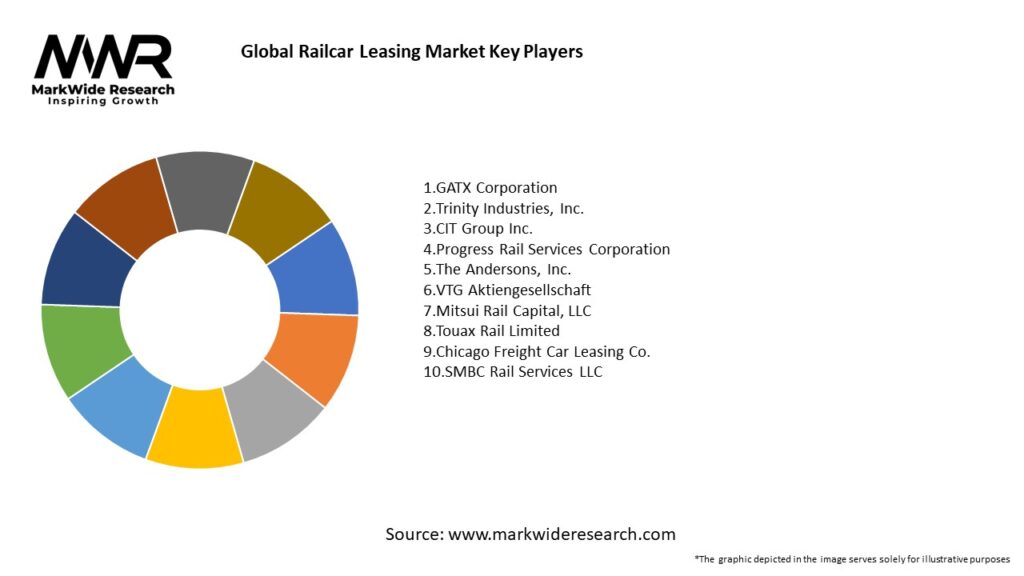

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

- Growing demand for rail transportation: The increasing need for sustainable and efficient transportation solutions has fueled the demand for railcar leasing services globally.

- Cost-effective and flexible option: Railcar leasing provides businesses with a cost-effective and flexible alternative to purchasing railcars outright, allowing them to allocate capital to other strategic areas.

- Rising industrial activities: The expanding industrial sector, particularly in emerging economies, has created a significant demand for railcar leasing services to facilitate the movement of goods.

- Infrastructure development: Government initiatives and investments in rail infrastructure development projects worldwide have positively impacted the railcar leasing market.

Market Drivers

The global railcar leasing market is driven by several key factors, including:

- Environmental benefits: Rail transportation is considered a greener alternative to other modes of transportation, as it emits fewer greenhouse gases and reduces carbon footprints.

- Cost-efficiency: Leasing railcars eliminates the need for substantial upfront investments, making it a more cost-effective option for businesses, especially smaller companies with limited capital.

- Growing industrial activities: The expansion of industries such as manufacturing, oil and gas, chemicals, and agriculture has increased the demand for rail transportation and subsequently boosted the railcar leasing market.

- Infrastructure development: Government investments in rail infrastructure projects, such as the construction of new railway lines and the modernization of existing tracks, have improved the overall railcar leasing market outlook.

Market Restraints

Despite the positive growth prospects, the global railcar leasing market faces certain challenges:

- Regulatory hurdles: The rail industry is subject to various regulations and safety standards, which may pose challenges for market participants and impact the leasing process.

- Economic fluctuations: Economic uncertainties and fluctuations in freight demand can affect the railcar leasing market, as businesses may reduce their transportation expenses during periods of economic downturn.

- Infrastructure limitations: In some regions, limited rail infrastructure or inadequate connectivity can hamper the growth of the railcar leasing market.

- Capital-intensive nature: The acquisition and maintenance of railcars require significant capital investments, which may deter potential market entrants or restrict the growth of existing players.

Market Opportunities

The global railcar leasing market presents several opportunities for growth and expansion:

- Emerging markets: Rapid industrialization and urbanization in emerging economies offer significant growth potential for railcar leasing companies as they cater to the increasing transportation needs of these regions.

- Technological advancements: The adoption of advanced technologies such as telematics, IoT, and data analytics in railcar leasing operations can enhance efficiency, reduce maintenance costs, and improve overall customer experience.

- Green initiatives: The increasing focus on sustainability and the transition towards cleaner transportation modes present opportunities for railcar leasing companies to position themselves as environmentally friendly partners.

- Diverse industry applications: Railcar leasing is not limited to specific industries and can cater to a wide range of sectors such as chemicals, automotive, agriculture, and energy, providing opportunities for market expansion and diversification.

Market Dynamics

The global railcar leasing market is dynamic and influenced by various factors:

- Changing customer preferences: Shifting customer preferences towards environmentally friendly transportation options and the demand for flexible leasing solutions drive market dynamics.

- Industry collaborations: Partnerships between railcar leasing companies and industry participants, including manufacturers, logistics providers, and retailers, contribute to market growth and service enhancements.

- Technological advancements: The integration of digital technologies and data-driven solutions in railcar leasing operations improves efficiency, maintenance, and asset management, enhancing market dynamics.

- Economic and geopolitical factors: Economic conditions, trade policies, and geopolitical events can impact the railcar leasing market, creating both challenges and opportunities for industry players.

Regional Analysis

The global railcar leasing market exhibits regional variations in terms of market size, growth potential, and market dynamics. The key regions analyzed in this report include:

- North America: The railcar leasing market in North America is mature and well-established, driven by the extensive railway network, industrial activities, and the presence of major market players.

- Europe: Europe has a well-developed rail infrastructure and strict environmental regulations, which contribute to the growth of the railcar leasing market. The region also emphasizes sustainable transportation solutions.

- Asia Pacific: Rapid industrialization, urbanization, and infrastructure development initiatives in countries like China and India are driving the growth of the railcar leasing market in the Asia Pacific region.

- Latin America: Increasing trade activities, the expansion of manufacturing industries, and government initiatives to modernize rail infrastructure are propelling the railcar leasing market in Latin America.

- Middle East & Africa: The railcar leasing market in this region is driven by infrastructure development projects, increasing oil and gas activities, and the growing need for efficient transportation solutions.

Competitive Landscape

Leading companies in the Global Railcar Leasing Market:

- GATX Corporation

- Trinity Industries, Inc.

- CIT Group Inc.

- Progress Rail Services Corporation

- The Andersons, Inc.

- VTG Aktiengesellschaft

- Mitsui Rail Capital, LLC

- Touax Rail Limited

- Chicago Freight Car Leasing Co.

- SMBC Rail Services LLC

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

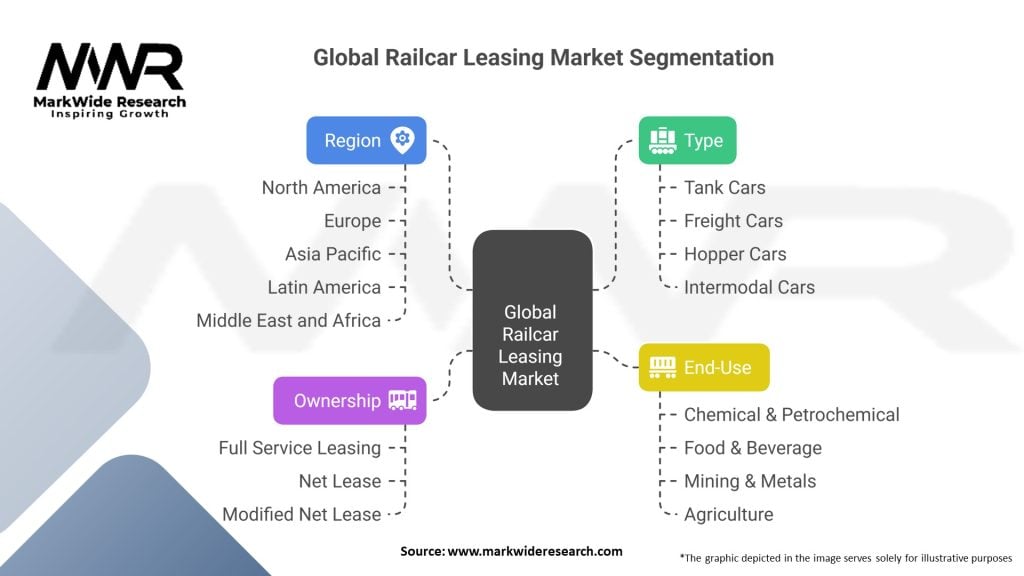

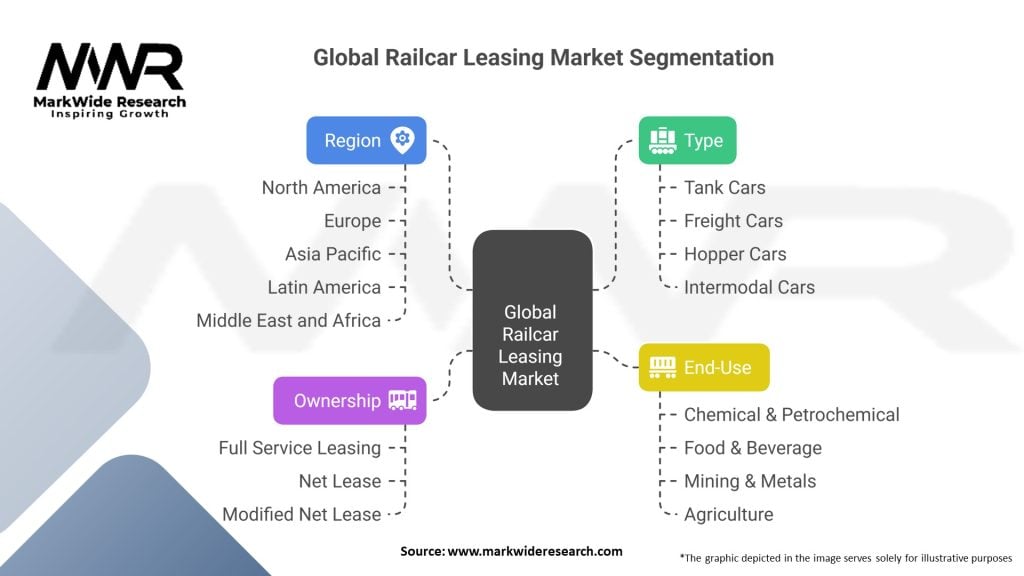

Segmentation

The railcar leasing market can be segmented based on various factors such as railcar type, lease type, end-user industry, and geography. The key segments of the market include:

- By Railcar Type:

- Tank Cars

- Hopper Cars

- Box Cars

- Flat Cars

- Gondola Cars

- Others

- By Lease Type:

- Full-Service Leasing

- Net Leasing

- Modified Net Leasing

- By End-User Industry:

- Chemicals

- Automotive

- Agriculture

- Energy

- Food & Beverages

- Construction

- Others

- By Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Category-wise Insights

- Tank Cars:

- Tank cars are widely used for the transportation of liquid and gas commodities such as petroleumproducts, chemicals, and liquefied gases.

- The demand for tank car leasing is driven by the growth of industries such as oil and gas, chemicals, and food processing.

- Hopper Cars:

- Hopper cars are primarily used for the transportation of bulk materials such as coal, grains, and aggregates.

- The demand for hopper car leasing is influenced by the agricultural sector, construction activities, and the energy industry.

- Box Cars:

- Box cars are enclosed railcars used for the transportation of general merchandise, packaged goods, and appliances.

- The demand for box car leasing is driven by industries such as retail, manufacturing, and consumer goods.

- Flat Cars:

- Flat cars have an open design without sides or roofs, making them suitable for transporting heavy or oversized cargo such as machinery, vehicles, and containers.

- The demand for flat car leasing is influenced by the construction industry, intermodal transportation, and logistics operations.

- Gondola Cars:

- Gondola cars are open-top railcars used for transporting bulk materials like coal, ore, and aggregates.

- The demand for gondola car leasing is driven by industries such as mining, construction, and steel production.

Key Benefits for Industry Participants and Stakeholders

- Cost savings: Railcar leasing allows businesses to avoid the high upfront costs associated with purchasing railcars, enabling them to allocate capital to other critical areas of their operations.

- Flexibility: Leasing provides businesses with the flexibility to adapt to changing transportation needs, such as fluctuations in demand or seasonal variations.

- Maintenance and repair: Railcar lessors are responsible for the maintenance and repair of leased railcars, reducing the burden on lessees and ensuring optimal performance.

- Asset management: Railcar leasing companies provide comprehensive asset management services, including tracking, maintenance scheduling, and lifecycle management.

- Access to specialized railcars: Leasing offers businesses access to a diverse range of specialized railcars tailored to specific industry requirements, without the need for significant investments.

SWOT Analysis

Strengths:

- Cost-effective alternative to purchasing railcars outright.

- Flexibility to adapt to changing transportation needs.

- Access to a diverse fleet of railcars tailored to industry requirements.

- Reduced maintenance and repair responsibilities for lessees.

- Ability to leverage advanced technologies for improved operations.

Weaknesses:

- Dependence on the overall economic and industrial growth for sustained demand.

- Potential regulatory challenges and compliance requirements.

- Limited control over asset availability during periods of high demand.

- Capital-intensive nature for railcar lessors due to acquisition and maintenance costs.

- Vulnerability to market fluctuations and the impact of external factors.

Opportunities:

- Expansion into emerging markets with rapid industrialization and infrastructure development.

- Technological advancements for improved operational efficiency and customer experience.

- Growing demand for sustainable transportation solutions and environmentally friendly practices.

- Collaboration with industry stakeholders to enhance service offerings and market reach.

- Diversification into specialized railcar segments to cater to specific industry requirements.

Threats:

- Economic downturns affecting overall freight demand and transportation expenses.

- Intense competition among railcar leasing companies leading to pricing pressures.

- Regulatory changes impacting lease agreements and compliance requirements.

- Disruptions in the global supply chain and trade policies.

- Challenges related to rail infrastructure limitations and connectivity in certain regions.

Market Key Trends

- Increasing adoption of digital technologies: Railcar leasing companies are embracing digital solutions such as telematics, IoT, and data analytics to optimize asset utilization, enhance maintenance processes, and improve customer experience.

- Focus on sustainability: The railcar leasing industry is witnessing a growing emphasis on sustainable transportation practices, including the use of eco-friendly railcars, reduced emissions, and energy-efficient operations.

- Shift towards long-term leasing contracts: Market trends indicate a move towards longer lease durations, as businesses seek stability, predictability, and cost savings through extended partnerships with railcar lessors.

- Integration of value-added services: Railcar leasing companies are expanding their service offerings to include value-added services such as logistics support, maintenance and repair, and supply chain optimization, providing comprehensive solutions to their customers.

- Collaborations and strategic partnerships: Industry players are forming strategic alliances, partnerships, and joint ventures to expand their market presence, access new geographies, and leverage complementary expertise for mutual growth.

Covid-19 Impact

The global railcar leasing market experienced the impact of the COVID-19 pandemic. The lockdowns, travel restrictions, and disruptions in global supply chains resulted in reduced demand for rail transportation and affected the overall market. However, as economies recover and trade activities resume, the railcar leasing market is expected to rebound. The focus on sustainable transportation, infrastructure development, and the need for efficient logistics solutions will drive the market’s recovery and growth post-pandemic.

Key Industry Developments

- Investments in rail infrastructure: Governments worldwide are investing in rail infrastructure development projects to enhance connectivity, increase capacity, and improve the efficiency of rail transportation, positively impacting the railcar leasing market.

- Technological advancements: The railcar leasing industry is witnessing advancements in technologies such as IoT, telematics, and data analytics, enabling better asset management, predictive maintenance, and operational optimization.

- Expansion into emerging markets: Railcar leasing companies are expanding their operations into emerging markets such as Asia Pacific, Latin America, and Africa, capitalizing on the region’s industrial growth and increasing demand for rail transportation.

- Green initiatives and sustainability focus: Market players are actively pursuing environmentally friendly practices, including the adoption of eco-friendly railcars, reduced emissions, and energy-efficient operations, aligning with global sustainability goals.

Analyst Suggestions

- Embrace digital transformation: Railcar leasing companies should leverage digital technologies to streamline operations, improve asset utilization, enhance maintenance processes, and provide real-time insights to customers.

- Focus on sustainability: Market participants should prioritize sustainable practices, including the adoption of energy-efficient technologies, green railcars, and reduced carbon emissions, to align with evolving customer preferences and regulatory requirements.

- Strengthen partnerships and collaborations: Strategic alliances, partnerships, and collaborations with industry stakeholders can provide opportunities for market expansion, access to new geographies, and complementary expertise.

- Offer value-added services: Railcar leasing companies should consider diversifying their service offerings to include value-added services such as logistics support, maintenance and repair, and supply chain optimization, providing comprehensive solutions to customers.

- Monitor market trends and emerging technologies: Staying updated on market trends, technological advancements, and industry developments will enable railcar leasing companies to adapt to changing customer needs, seize new opportunities, and maintain a competitive edge.

Future Outlook

The global railcar leasing market is poised for growth in the coming years. The focus on sustainable transportation, infrastructure development initiatives, and the increasing demand for cost-effective and flexible transportation solutions will drive market expansion. Technological advancements, digital transformation, and collaborations with industry stakeholders will shape the future of the railcar leasing market, providing enhanced services, improved asset management, and a seamless customer experience. As the world recovers from the impact of the COVID-19 pandemic, the railcar leasing market will play a crucial role in facilitating global trade, supporting economic growth, and meeting the evolving transportation needs of various industries.

Conclusion

The global railcar leasing market offers cost-effective, flexible, and environmentally friendly transportation solutions to businesses across industries. The market is driven by factors such as the demand for sustainable transportation, infrastructure development initiatives, and the need for efficient logistics solutions. While the market faces challenges such as regulatory hurdles and economic fluctuations, it also presents opportunities for expansion into emerging markets, technological advancements, and collaborations with industry stakeholders. By embracing digital transformation, focusing on sustainability, and diversifying their service offerings, railcar leasing companies can position themselves for success in the future.