444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The alginates and derivatives market is witnessing significant growth and is projected to continue expanding in the coming years. Alginates are natural polysaccharides derived from brown seaweed and have a wide range of applications across various industries. They are widely used as thickeners, stabilizers, gelling agents, and emulsifiers in food and beverage, pharmaceuticals, cosmetics, and other industries.

Alginates are extracted from brown seaweed, primarily found in coastal regions. These natural polysaccharides consist of blocks of α-L-guluronic acid and β-D-mannuronic acid, which give them unique properties. Alginates have the ability to form gels in the presence of divalent cations like calcium and are known for their high water-holding capacity, viscosity, and film-forming properties.

Executive Summary

The global alginates and derivatives market has been experiencing steady growth due to their versatile applications in various industries. The market is driven by factors such as increasing demand for natural and sustainable ingredients, growing applications in the food and pharmaceutical industries, and advancements in extraction and processing technologies. However, certain challenges such as the availability of raw materials, regulatory constraints, and the impact of the COVID-19 pandemic have affected the market growth to some extent.

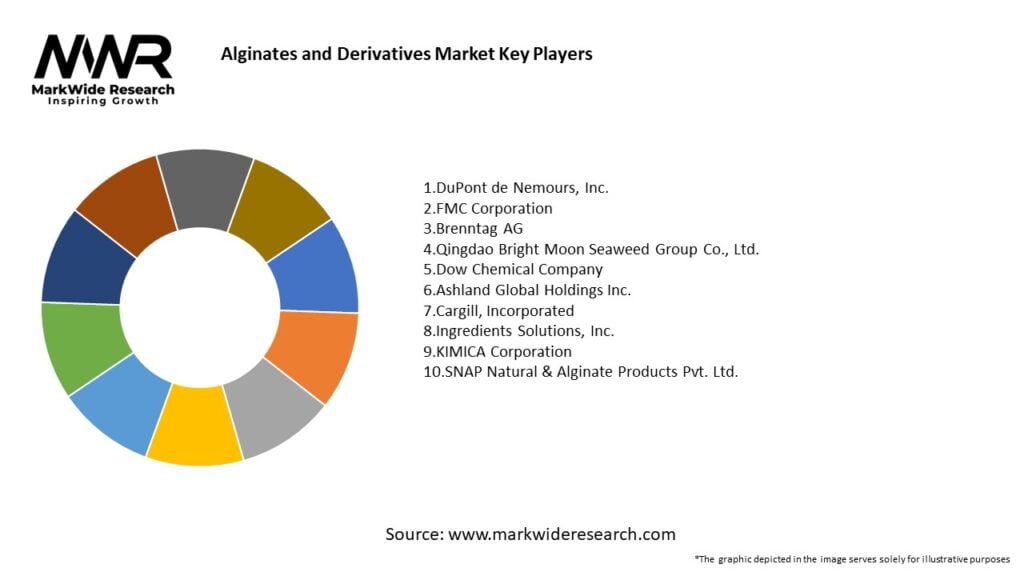

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the alginates and derivatives market:

Market Restraints

Despite the positive growth prospects, the alginates and derivatives market faces certain challenges:

Market Opportunities

The alginates and derivatives market offers several opportunities for growth and expansion:

Market Dynamics

The alginates and derivatives market is characterized by dynamic factors that influence its growth and development. These dynamics include market drivers, restraints, opportunities, and trends, which shape the overall landscape of the industry.

Market drivers, such as the increasing demand for natural and sustainable ingredients and expanding applications in various industries, propel the growth of the market. On the other hand, market restraints, such as raw material availability, regulatory constraints, and cost implications, pose challenges to market players.

However, market opportunities exist for manufacturers who can tap into the growing demand for organic and clean-label products, expand in emerging markets, invest in research and development, and collaborate with end-users. By effectively navigating these dynamics, companies can position themselves for success and growth in the alginates and derivatives market.

Regional Analysis

The alginates and derivatives market exhibits regional variations in terms of demand, consumption patterns, and market players. The market can be segmented into key regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

Competitive Landscape

Leading Companies in the Alginates and Derivatives Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The alginates and derivatives market can be segmented based on product type, application, and end-use industry.

Segmentation allows for a better understanding of market dynamics and helps market players target specific customer segments more effectively.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the alginates and derivatives market can benefit in several ways:

SWOT Analysis

A SWOT analysis provides an overview of the strengths, weaknesses, opportunities, and threats in the alginates and derivatives market:

A thorough understanding of these factors can help industry participants leverage strengths, address weaknesses, capitalize on opportunities, and mitigate threats in the alginates and derivatives market.

Market Key Trends

Several key trends are shaping the alginates and derivatives market:

COVID-19 Impact

The COVID-19 pandemic has had both positive and negative impacts on the alginates and derivatives market:

Positive Impact:

Negative Impact:

Key Industry Developments

Some key industry developments in the alginates and derivatives market include:

Analyst Suggestions

Based on market trends and dynamics, analysts suggest the following strategies for industry participants in the alginates and derivatives market:

Future Outlook

The future outlook for the alginates and derivatives market is positive, with several factors driving its growth. The increasing demand for natural and sustainable ingredients, expanding applications in various industries, and advancements in extraction and processing technologies are expected to fuel market expansion.

As consumer awareness regarding health and wellness continues to rise, the demand for clean-label and natural products is expected to grow. Alginates and derivatives, with their eco-friendly and functional properties, are well-positioned to meet these consumer demands.

Furthermore, the expansion of the food processing, pharmaceutical, and cosmetics industries, particularly in emerging markets, will provide new opportunities for market players to expand their presence and tap into untapped markets.

However, challenges such as raw material availability, regulatory constraints, and cost implications need to be addressed to ensure sustainable market growth. Industry participants should focus on sustainable sourcing practices, process optimization, and strategic collaborations to overcome these challenges.

Overall, the alginates and derivatives market is poised for continued growth, driven by the demand for natural and sustainable ingredients, advancements in technology, and the pursuit of innovative applications. By adopting a customer-centric approach, staying ahead of market trends, and embracing sustainability, companies can position themselves for success in this dynamic market.

Conclusion

The alginates and derivatives market presents exciting opportunities for industry participants. By leveraging the natural and sustainable properties of alginates, companies can cater to the growing demand for clean-label products in various industries.

In conclusion, the alginates and derivatives market presents a promising landscape for industry participants. By harnessing the potential of these natural ingredients, companies can create value, meet consumer demands, and contribute to sustainable development. With strategic planning, innovation, and a customer-centric approach, industry players can thrive in this dynamic market and shape the future of alginates and derivatives.

What are alginates and derivatives?

Alginates and derivatives are natural polysaccharides derived from brown seaweed, commonly used as thickening agents, stabilizers, and gelling agents in various industries, including food, pharmaceuticals, and cosmetics.

Who are the key players in the Alginates and Derivatives Market?

Key players in the Alginates and Derivatives Market include companies like DuPont, FMC Corporation, and KIMICA Corporation, among others.

What are the growth factors driving the Alginates and Derivatives Market?

The growth of the Alginates and Derivatives Market is driven by increasing demand in the food industry for natural additives, the rising popularity of plant-based products, and the expanding applications in pharmaceuticals and personal care products.

What challenges does the Alginates and Derivatives Market face?

Challenges in the Alginates and Derivatives Market include fluctuations in raw material availability, competition from synthetic alternatives, and regulatory hurdles related to food safety and labeling.

What opportunities exist in the Alginates and Derivatives Market?

Opportunities in the Alginates and Derivatives Market include the development of innovative applications in the medical field, such as drug delivery systems, and the growing trend towards sustainable and eco-friendly products.

What trends are shaping the Alginates and Derivatives Market?

Trends in the Alginates and Derivatives Market include the increasing use of alginates in clean label products, advancements in extraction technologies, and a shift towards biodegradable packaging solutions.

Alginates and Derivatives Market:

| Segmentation Details | Details |

|---|---|

| By Type | Sodium Alginate, Calcium Alginate, Potassium Alginate, Others |

| By Application | Food & Beverages, Pharmaceutical, Industrial, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Alginates and Derivatives Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at