444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The transaction monitoring market has witnessed substantial growth in recent years due to the increasing need for effective fraud detection and prevention in various industries. Transaction monitoring refers to the process of analyzing and scrutinizing financial transactions to identify and prevent suspicious activities, such as money laundering, terrorist financing, and other financial crimes. This market analysis delves into the key insights, trends, and developments shaping the transaction monitoring market.

Transaction monitoring involves the systematic analysis and examination of financial transactions to identify any irregularities or patterns that may indicate potential fraudulent activities. It encompasses the monitoring of various types of transactions, including electronic fund transfers, credit card transactions, wire transfers, and more. By leveraging advanced technologies and analytical tools, organizations can detect and mitigate risks associated with financial crimes, ensuring regulatory compliance and safeguarding their operations.

Executive Summary

The transaction monitoring market is witnessing significant growth, driven by the rising instances of financial fraud and the increasing adoption of stringent regulatory frameworks. This analysis provides a comprehensive overview of the market, highlighting key market insights, drivers, restraints, opportunities, and market dynamics. It also explores regional analysis, competitive landscape, segmentation, category-wise insights, and key industry developments. Moreover, it offers valuable suggestions for industry participants and stakeholders and presents a future outlook for the transaction monitoring market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Restraints

Market Opportunities

Market Dynamics

The transaction monitoring market is driven by a combination of factors, including regulatory requirements, technological advancements, industry trends, and the evolving landscape of financial crimes. The market is highly dynamic, with continuous innovations and updates to meet the ever-changing needs and challenges in fraud detection and prevention.

Regional Analysis

The transaction monitoring market exhibits significant regional variations due to variations in regulatory frameworks, industry verticals, and adoption rates of advanced technologies. North America dominates the market, primarily driven by stringent regulations imposed by regulatory bodies such as FinCEN and the Office of Foreign Assets Control (OFAC). Europe follows closely, with countries like the UK, Germany, and France actively adopting transaction monitoring solutions to combat financial crimes. The Asia Pacific region is witnessing substantial growth, driven by the increasing adoption of digital payment systems and efforts to strengthen anti-money laundering measures.

Competitive Landscape

Leading Companies in the Transaction Monitoring Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

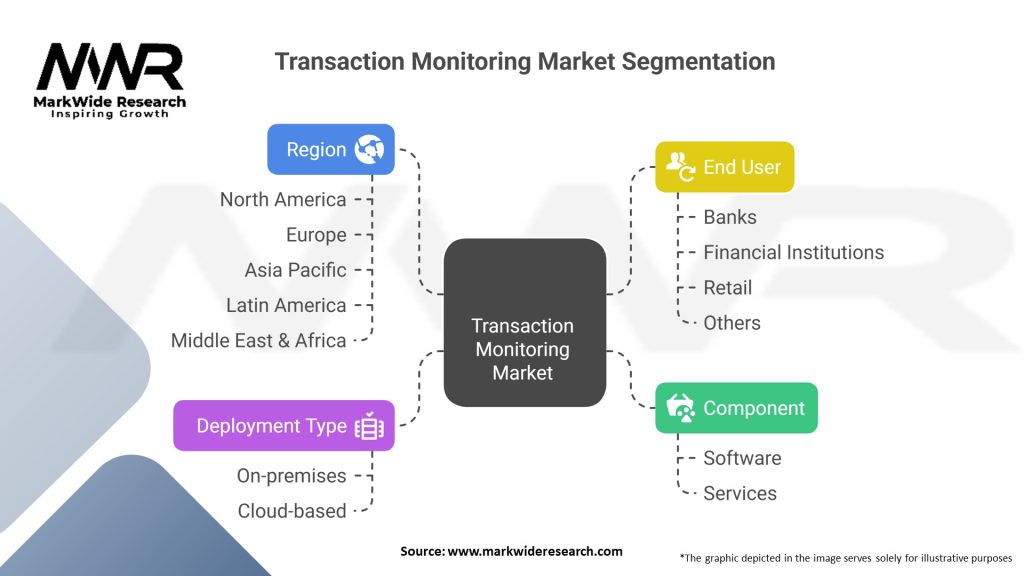

Segmentation

The transaction monitoring market can be segmented based on various factors, including deployment mode, organization size, industry verticals, and geographic regions. Deployment modes include on-premises, cloud-based, and hybrid solutions. Organization size segments typically include small and medium-sized enterprises (SMEs) and large enterprises. Industry verticals that heavily rely on transaction monitoring solutions include banking and financial services, insurance, healthcare, e-commerce, and gaming.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the transaction monitoring market. The shift towards remote work and increased reliance on digital transactions has led to an uptick in financial crimes and fraudulent activities. Organizations have recognized the need to strengthen their transaction monitoring capabilities to combat emerging risks. The pandemic has accelerated the adoption of advanced technologies, such as AI and ML, to detect and prevent fraudulent activities in real-time.

Key Industry Developments

Analyst Suggestions

Future Outlook

The transaction monitoring market is expected to witness substantial growth in the coming years. Factors such as increasing instances of financial fraud, regulatory requirements, and advancements in technology will drive market expansion. The integration of AI, ML, and big data analytics will revolutionize transaction monitoring, enabling organizations to detect and prevent fraudulent activities with greater accuracy and efficiency. Cloud-based solutions, cross-channel monitoring, and enhanced visualization tools will also play a significant role in shaping the future of the transaction monitoring market.

The market is expected to experience robust growth as organizations across various industries recognize the importance of implementing robust transaction monitoring systems to combat financial crimes effectively. The increasing adoption of digital payment methods, the emergence of new channels, and the globalization of transactions further contribute to the market’s growth potential.

The integration of AI and ML technologies will play a pivotal role in shaping the future of transaction monitoring. These technologies will enable organizations to analyze vast amounts of data in real-time, identify complex patterns, and detect fraudulent activities with higher accuracy. Predictive analytics and anomaly detection algorithms will become more sophisticated, empowering organizations to stay one step ahead of financial criminals.

Cloud-based transaction monitoring solutions will gain traction due to their scalability, flexibility, and cost-efficiency. Organizations will increasingly opt for cloud deployments to leverage the benefits of real-time data processing, seamless updates, and centralized management. Cloud-based solutions will also enable easier integration with other cybersecurity and risk management systems, providing a comprehensive approach to financial crime prevention.

Conclusion

In conclusion, the transaction monitoring market is poised for significant growth as organizations prioritize fraud detection and prevention. The integration of AI, ML, and advanced analytics, along with the adoption of cloud-based solutions and cross-channel monitoring, will drive the market’s evolution. With stringent regulations and the increasing sophistication of financial crimes, organizations must invest in robust transaction monitoring systems to safeguard their operations, protect their customers, and maintain regulatory compliance in an ever-changing landscape. By staying abreast of technological advancements and industry trends, organizations can proactively combat financial crimes and mitigate risks, ensuring a secure and trustworthy financial environment.

What is transaction monitoring?

Transaction monitoring refers to the process of reviewing and analyzing financial transactions to detect suspicious activities, fraud, or compliance violations. It is a critical component in various sectors, including banking, finance, and e-commerce.

What are the key companies in the transaction monitoring market?

Key companies in the transaction monitoring market include FICO, NICE Actimize, SAS Institute, and ACI Worldwide, among others.

What are the main drivers of growth in the transaction monitoring market?

The main drivers of growth in the transaction monitoring market include the increasing need for regulatory compliance, the rise in financial fraud cases, and the growing adoption of digital payment systems across various industries.

What challenges does the transaction monitoring market face?

Challenges in the transaction monitoring market include the complexity of regulatory requirements, the high costs associated with implementing advanced monitoring systems, and the difficulty in accurately detecting false positives in transaction data.

What opportunities exist in the transaction monitoring market?

Opportunities in the transaction monitoring market include the integration of artificial intelligence and machine learning technologies to enhance detection capabilities, the expansion of services to emerging markets, and the increasing demand for real-time monitoring solutions.

What trends are shaping the transaction monitoring market?

Trends shaping the transaction monitoring market include the growing emphasis on automated compliance solutions, the use of big data analytics for improved transaction insights, and the rising importance of customer-centric approaches in monitoring practices.

Transaction Monitoring Market:

| Segmentation | Details |

|---|---|

| Component | Software, Services |

| Deployment Type | On-premises, Cloud-based |

| End User | Banks, Financial Institutions, Retail, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Transaction Monitoring Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at