444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Enterprise Risk Management (ERM) refers to the process of identifying, evaluating, and managing risks that organizations face. The North America Enterprise Risk Management Market includes the United States, Canada, and Mexico, and it has seen steady growth in recent years. This growth is expected to continue over the next decade, driven by a growing need for companies to effectively manage risk in an ever-changing business environment.

Enterprise Risk Management is a process that allows organizations to identify and mitigate risks before they become a problem. By analyzing risks, companies can develop strategies to mitigate or avoid them, which can help them avoid financial losses, legal issues, and other problems. ERM is a critical component of business management, as it allows companies to operate in a manner that is both efficient and effective.

Executive Summary

The North America Enterprise Risk Management Market has seen significant growth in recent years, driven by the increasing need for companies to manage risks effectively. The market is expected to continue growing over the next decade, driven by factors such as advancements in technology, growing competition, and regulatory requirements. The Covid-19 pandemic has also had a significant impact on the market, with many companies seeking to mitigate the risks associated with the pandemic. The key players in the market include IBM Corporation, SAP SE, Oracle Corporation, and Deloitte Touche Tohmatsu Limited.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Technology Integration: The increasing integration of AI, machine learning, and analytics into ERM systems is improving risk identification, assessment, and mitigation strategies, making it easier for organizations to manage complex risk scenarios.

Regulatory Pressures: Increasing government regulations and industry-specific compliance requirements are driving the adoption of ERM solutions, particularly in highly regulated industries such as finance, healthcare, and energy.

Cybersecurity Concerns: With the rise of cyber threats, organizations are prioritizing the management of IT and cybersecurity risks through ERM frameworks to protect their data, infrastructure, and reputation.

Cloud Adoption: The shift towards cloud-based ERM solutions is growing in North America, as these solutions offer flexibility, cost-efficiency, and easier scalability for businesses of all sizes.

Market Drivers

Several factors are driving the growth of the North America Enterprise Risk Management Market:

Rising Regulatory Compliance Requirements: Increasing regulatory demands, such as the implementation of the Dodd-Frank Act and the Sarbanes-Oxley Act in the U.S., are pushing businesses to adopt ERM solutions to ensure compliance and reduce the risk of financial penalties.

Cybersecurity Threats: As organizations continue to face growing cybersecurity threats, the need to integrate IT risk management into broader ERM frameworks is becoming critical for protecting sensitive data and systems from cyberattacks.

Complexity in Risk Landscape: The evolving risk landscape, including economic uncertainty, geopolitical tensions, and environmental risks, has prompted companies to adopt ERM frameworks to gain better visibility and control over various types of risks.

Digital Transformation: As businesses undergo digital transformation, they are increasingly adopting ERM solutions that integrate with other enterprise technologies such as ERP, CRM, and BI systems, ensuring that risk management is an integral part of daily operations.

Cost Efficiency and Flexibility: Cloud-based ERM solutions are becoming more popular due to their cost-effectiveness and scalability, making them accessible to organizations of all sizes, from SMEs to large enterprises.

Market Restraints

Despite the growth potential, the North America Enterprise Risk Management Market faces several challenges:

High Implementation Costs: The initial cost of implementing ERM systems, including software, training, and consulting services, can be significant, especially for small and medium-sized enterprises (SMEs), potentially limiting their adoption of these solutions.

Complexity of Integration: Integrating ERM systems into existing IT infrastructure and aligning them with business processes can be complex and time-consuming, requiring specialized knowledge and expertise.

Lack of Skilled Professionals: The shortage of professionals with expertise in risk management and ERM systems can hinder the successful adoption and operation of ERM solutions within organizations.

Data Privacy Concerns: As organizations collect and analyze large volumes of data for risk assessment, concerns around data privacy and security are becoming more prevalent, especially in industries such as healthcare and finance.

Market Opportunities

The North America Enterprise Risk Management Market presents numerous growth opportunities:

Cloud-Based ERM Solutions: The growing demand for flexible, scalable, and cost-effective cloud-based solutions is creating opportunities for ERM providers to develop cloud-native platforms that can be easily adopted by organizations of all sizes.

Integration with AI and Big Data: The integration of AI and big data analytics into ERM systems allows organizations to gain predictive insights, automate risk assessments, and enhance decision-making, presenting a significant growth opportunity for ERM solution providers.

Focus on Cyber Risk Management: With the increasing frequency of cyberattacks, the need for comprehensive cybersecurity risk management solutions is growing, creating a demand for ERM systems that integrate IT risk management capabilities.

Expansion of Healthcare and Financial Sector Adoption: The healthcare and financial sectors, both heavily regulated, present significant growth opportunities for ERM providers as they seek to enhance compliance and improve risk management processes.

Market Dynamics

The North America Enterprise Risk Management Market is influenced by several key dynamics:

Technological Advancements: Advances in AI, machine learning, and predictive analytics are enhancing the capabilities of ERM systems, allowing organizations to manage risk more effectively and proactively.

Regulatory Landscape: Evolving regulations and industry standards are pushing organizations to adopt more sophisticated risk management frameworks. Compliance requirements are driving the growth of the market, particularly in sectors like finance, healthcare, and energy.

Increased Focus on Business Continuity: The growing emphasis on business continuity and resilience in the face of potential disruptions, such as natural disasters, cyberattacks, and economic volatility, is driving the need for comprehensive ERM solutions.

Integration of Risk Management Across the Enterprise: There is a growing trend to integrate risk management across all levels of the organization, ensuring that risk assessments are a part of daily operations and business decision-making.

Regional Analysis

The North America Enterprise Risk Management Market is dominated by the United States, which is home to a large number of companies adopting ERM frameworks due to stringent regulatory requirements, a strong focus on cybersecurity, and the need to manage complex operational risks. Canada also presents significant growth opportunities, particularly in industries such as energy, finance, and healthcare, where risk management practices are critical.

United States: The U.S. is the largest market for ERM solutions in North America, driven by the demand for regulatory compliance, business continuity, and IT security solutions. Major industries, including finance, healthcare, and manufacturing, are leading adopters of ERM frameworks.

Canada: The Canadian market is experiencing steady growth, particularly in industries such as energy and natural resources, where managing environmental, regulatory, and financial risks is a priority. Government regulations and the focus on sustainability are key drivers for ERM adoption.

Competitive Landscape

Leading Companies in the North America Enterprise Risk Management Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

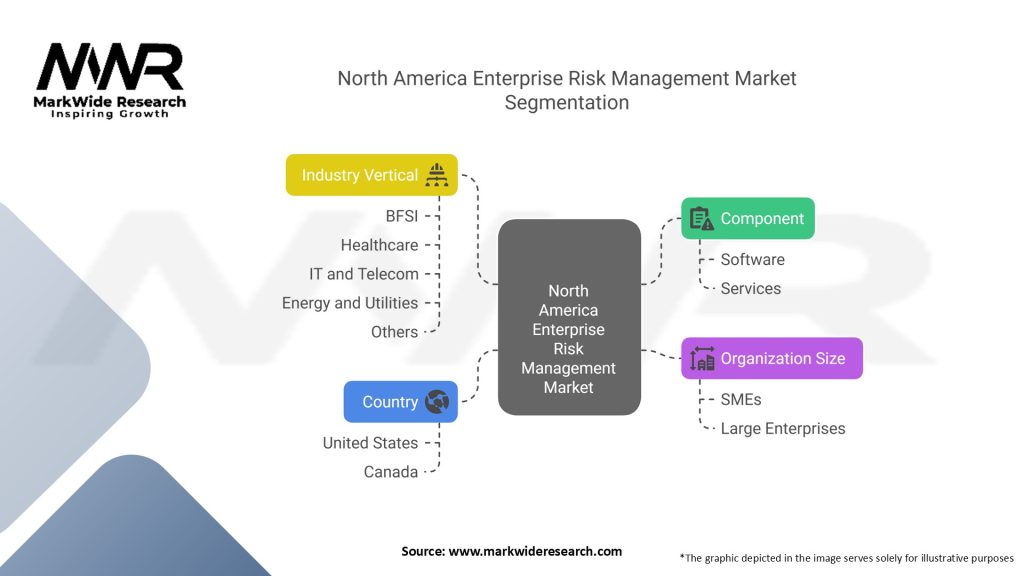

Segmentation

The North America Enterprise Risk Management Market can be segmented based on:

Deployment Mode: On-Premises, Cloud-Based.

Solution Type: Risk Assessment, Risk Mitigation, Risk Monitoring, Compliance Management.

End-User Industry: Financial Services, Healthcare, Energy, Manufacturing, IT & Telecom, Others.

Category-wise Insights

Risk Assessment: Risk assessment solutions help organizations identify and evaluate potential risks, enabling proactive decision-making and mitigation strategies. These solutions are critical in industries such as finance, healthcare, and manufacturing.

Risk Mitigation: Risk mitigation solutions are designed to reduce the impact of identified risks by implementing control measures and strategies. These solutions are widely adopted in sectors like IT & Telecom, manufacturing, and energy.

Key Benefits for Industry Participants and Stakeholders

Enhanced Risk Visibility: ERM systems provide a comprehensive view of organizational risks, enabling businesses to identify, assess, and address potential threats more effectively.

Regulatory Compliance: ERM solutions help organizations meet compliance requirements, reducing the risk of fines, penalties, and reputational damage.

Improved Decision-Making: By integrating risk management into the decision-making process, ERM frameworks ensure that business decisions are made with a clear understanding of potential risks and their impact.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Cloud-Based ERM Solutions: The shift towards cloud computing is enabling organizations to adopt more scalable, flexible, and cost-effective ERM solutions, driving the market’s growth.

AI and Automation: The integration of AI and machine learning into ERM systems is enhancing real-time risk analysis, improving decision-making, and reducing manual efforts.

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the North America Enterprise Risk Management Market, as companies seek to manage the risks associated with the pandemic. This has led to an increased demand for ERM solutions that can help companies mitigate the risks associated with remote work, supply chain disruptions, and financial volatility. Additionally, the pandemic has highlighted the importance of effective risk management and has led to an increased focus on risk management across all industries.

Key Industry Developments

The North America Enterprise Risk Management Market has seen several key developments in recent years, including the development of more advanced ERM software solutions and the increasing use of data analytics and artificial intelligence in risk management. Additionally, there has been a growing focus on sustainability and environmental risk management, as companies seek to meet the growing demand for eco-friendly products and services.

Analyst Suggestions

Analysts suggest that companies in the North America Enterprise Risk Management Market should focus on developing new and innovative ERM solutions that can help them stay ahead of the competition. Additionally, there is a need for companies to focus on sustainability and environmental risk management, as this is an area of growing importance for consumers and regulators. Companies should also consider the impact of the Covid-19 pandemic on their risk management strategies and should develop solutions that can help them manage the risks associated with the pandemic.

Future Outlook

The North America Enterprise Risk Management Market is expected to continue growing in the long term, driven by the increasing need for effective risk management and the growing importance of sustainability and environmental risk management. Technological advancements and regulatory requirements are also expected to drive the growth of the market. However, there are challenges that the market will need to overcome, including the high cost of implementing ERM solutions and the increasing threat of cybersecurity risks.

Conclusion

The North America Enterprise Risk Management Market is a growing market, driven by the increasing need for effective risk management and the growing importance of sustainability and environmental risk management. The market is expected to continue growing in the long term, driven by technological advancements, regulatory requirements, and increasing competition. Companies in the market should focus on developing new and innovative ERM solutions that can help them stay ahead of the competition, while also addressing the challenges of the high cost of implementing ERM solutions and the increasing threat of cybersecurity risks.

What is Enterprise Risk Management in the context of North America?

Enterprise Risk Management (ERM) in North America refers to the systematic approach organizations use to identify, assess, and manage risks that could impact their operations and objectives. This includes risks related to finance, compliance, operations, and strategic planning.

Who are the key players in the North America Enterprise Risk Management Market?

Key players in the North America Enterprise Risk Management Market include companies like RiskLens, LogicManager, and RSA Security, which provide various ERM solutions and services to organizations across different sectors, among others.

What are the main drivers of growth in the North America Enterprise Risk Management Market?

The main drivers of growth in the North America Enterprise Risk Management Market include increasing regulatory requirements, the need for improved decision-making processes, and the rising awareness of risk management’s importance in strategic planning across industries.

What challenges does the North America Enterprise Risk Management Market face?

Challenges in the North America Enterprise Risk Management Market include the complexity of integrating ERM frameworks into existing business processes, the evolving nature of risks, and the need for continuous training and awareness among employees.

What opportunities exist in the North America Enterprise Risk Management Market?

Opportunities in the North America Enterprise Risk Management Market include the adoption of advanced technologies like AI and machine learning for risk assessment, the growing demand for customized ERM solutions, and the expansion of ERM practices in small and medium-sized enterprises.

What trends are shaping the North America Enterprise Risk Management Market?

Trends shaping the North America Enterprise Risk Management Market include the increasing focus on cybersecurity risks, the integration of sustainability into risk management practices, and the use of data analytics to enhance risk identification and mitigation strategies.

North America Enterprise Risk Management Market

| Segmentation | Details |

|---|---|

| Component | Software, Services |

| Organization Size | Small and Medium Enterprises (SMEs), Large Enterprises |

| Industry Vertical | BFSI, Healthcare, IT and Telecom, Energy and Utilities, Others |

| Country | United States, Canada |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the North America Enterprise Risk Management Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at