444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

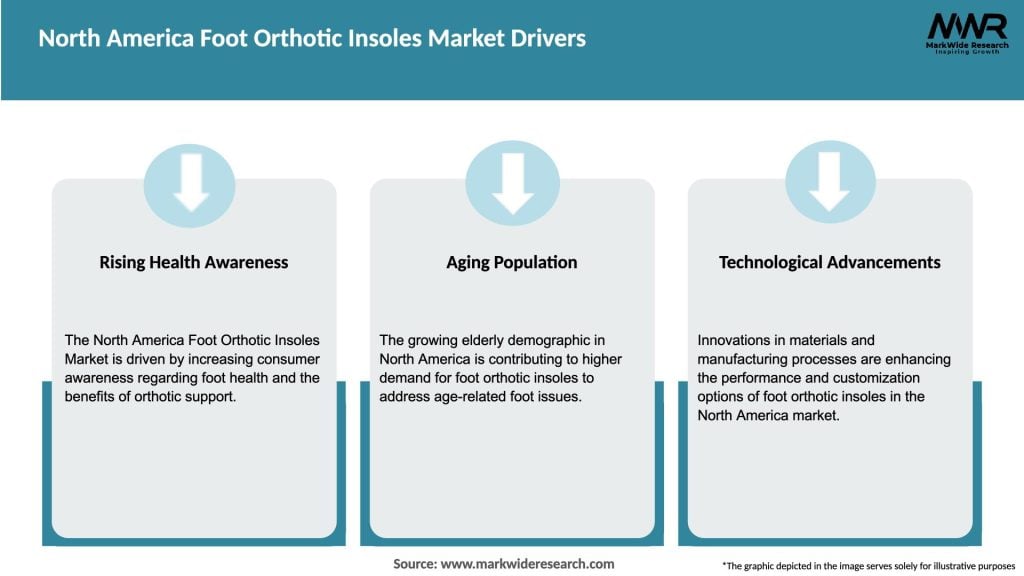

The North America Foot Orthotic Insoles Market is expected to grow at a CAGR of 5.5% during the forecast period (2021-2026). Foot orthotic insoles are custom-made medical devices that are designed to improve foot and ankle alignment and provide support for people suffering from foot and ankle conditions. The demand for foot orthotic insoles is driven by the increasing incidence of foot and ankle injuries, the growing awareness of foot health, and the rise in the aging population. These factors have resulted in the growth of the North America Foot Orthotic Insoles Market, which is expected to reach $1.7 billion by 2026.

Foot orthotic insoles are inserts that are placed inside shoes to provide support, cushioning, and stability to the feet. They are used to treat various foot and ankle conditions such as plantar fasciitis, flat feet, and heel spurs. Foot orthotic insoles are custom-made to fit the patient’s foot and are designed to correct biomechanical imbalances and improve foot and ankle alignment. They are made from a variety of materials such as foam, rubber, and plastic and are available in different shapes and sizes.

Executive Summary

The North America Foot Orthotic Insoles Market is expected to grow at a CAGR of 5.5% during the forecast period (2021-2026). The demand for foot orthotic insoles is driven by the increasing incidence of foot and ankle injuries, the growing awareness of foot health, and the rise in the aging population. The market is characterized by the presence of several players offering a range of foot orthotic insoles. Custom-made foot orthotic insoles account for the largest market share owing to their high efficacy in treating foot and ankle conditions. The United States is the largest market for foot orthotic insoles in North America, followed by Canada.

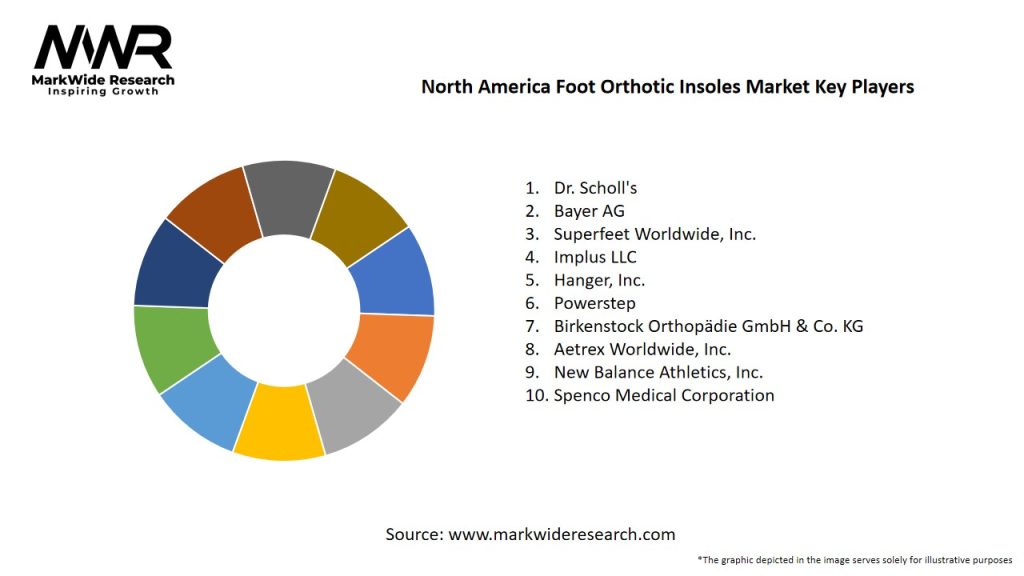

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The North America Foot Orthotic Insoles Market is characterized by the presence of several players offering a range of foot orthotic insoles. The market is highly competitive, with companies competing on the basis of product differentiation, pricing, and distribution channels. Custom-made foot orthotic insoles account for the largest market share owing to their high efficacy in treating foot and ankle conditions. However, prefabricated foot orthotic insoles are gaining popularity owing to their lower cost and ease of availability.

Regional Analysis

The United States is the largest market for foot orthotic insoles in North America, followed by Canada. The high prevalence of foot and ankle injuries, the growing awareness of foot health, and the rise in the aging population are the key factors driving the growth of the market in the United States. In Canada, the market is driven by the increasing adoption of foot orthotic insoles among athletes.

Competitive Landscape

Leading Companies in the North America Foot Orthotic Insoles Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

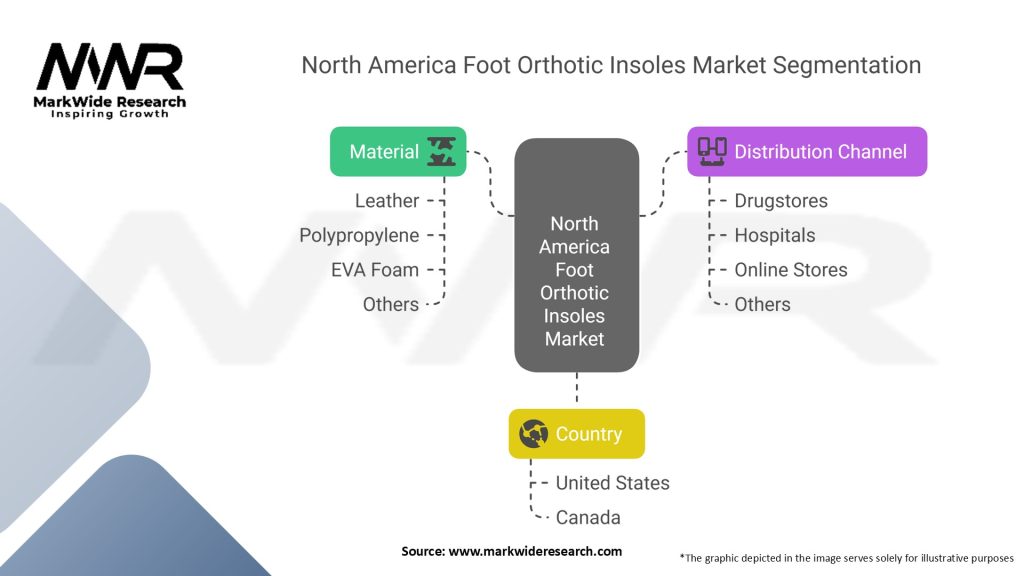

The North America Foot Orthotic Insoles Market is segmented on the basis of type, material, and distribution channel.

By Type:

By Material:

By Distribution Channel:

Category-wise Insights

Custom-made foot orthotic insoles account for the largest market share owing to their high efficacy in treating foot and ankle conditions. The foam material segment is expected to witness the highest growth owing to its lightweight and shock-absorbing properties. The hospital pharmacies segment is expected to hold the largest market share owing to the availability of skilled professionals and the need for custom-made foot orthotic insoles.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the North America Foot Orthotic Insoles Market. The outbreak has resulted in the closure of several manufacturing facilities and disrupted the supply chain, leading to a shortage of foot orthotic insoles. Moreover, the economic downturn caused by the pandemic has resulted in a decline in demand for foot orthotic insoles. However, the market is expected to recover in the post-pandemic period owing to the growing awareness of foot health and the increasing adoption of foot orthotic insoles among athletes.

Key Industry Developments

Analyst Suggestions

Future Outlook

The North America Foot Orthotic Insoles Market is expected to grow at a CAGR of 5.5% during the forecast period (2021-2026). The market is characterized by the presence of several players offering a range of foot orthotic insoles. Custom-made foot orthotic insoles account for the largest market share owing to their high efficacy in treating foot and ankle conditions. The foam material segment is expected to witness the highest growth owing to its lightweight and shock-absorbing properties. The market is expected to recover in the post-pandemic period owing to the growing awareness of foot health and the increasing adoption of foot orthotic insoles among athletes.

Conclusion

The North America Foot Orthotic Insoles Market is driven by the increasing incidence of foot and ankle injuries, the growing awareness of foot health, and the rise in the aging population. Custom-made foot orthotic insoles account for the largest market share owing to their high efficacy in treating foot and ankle conditions. The market is highly competitive, with companies competing on the basis of product differentiation, pricing, and distribution channels. The United States is the largest market for foot orthotic insoles in North America, followed by Canada. The market is expected to recover in the post-pandemic period owing to the growing awareness of foot health and the increasing adoption of foot orthotic insoles among athletes.

What are foot orthotic insoles in the North America Foot Orthotic Insoles Market?

Foot orthotic insoles are specialized inserts designed to provide support, alignment, and comfort to the feet. They are commonly used to alleviate pain, improve posture, and enhance overall foot function.

Who are the key players in the North America Foot Orthotic Insoles Market?

Key players in the North America Foot Orthotic Insoles Market include Superfeet Worldwide, Dr. Scholl’s, Powerstep, and Sole. These companies are known for their innovative products and strong market presence, among others.

What are the main drivers of growth in the North America Foot Orthotic Insoles Market?

The growth of the North America Foot Orthotic Insoles Market is driven by increasing awareness of foot health, rising prevalence of foot-related disorders, and a growing demand for customized orthotic solutions. Additionally, the aging population contributes to the market expansion.

What challenges does the North America Foot Orthotic Insoles Market face?

Challenges in the North America Foot Orthotic Insoles Market include the high cost of custom orthotics, competition from over-the-counter products, and varying regulations across states. These factors can hinder market penetration and consumer adoption.

What opportunities exist in the North America Foot Orthotic Insoles Market?

Opportunities in the North America Foot Orthotic Insoles Market include advancements in materials and technology, increasing partnerships between healthcare providers and manufacturers, and the potential for growth in e-commerce sales. These factors can enhance accessibility and consumer reach.

What trends are shaping the North America Foot Orthotic Insoles Market?

Trends in the North America Foot Orthotic Insoles Market include the rise of eco-friendly materials, personalized orthotic solutions, and the integration of digital health technologies. These trends reflect a shift towards sustainability and enhanced consumer experience.

North America Foot Orthotic Insoles Market

| Segmentation | Details |

|---|---|

| Material | Leather, Polypropylene, EVA Foam, Others |

| Distribution Channel | Drugstores, Hospitals, Online Stores, Others |

| Country | United States, Canada |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the North America Foot Orthotic Insoles Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at