444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Food Processing Blades Market: Overview

The food processing industry has been growing rapidly in recent years, driven by a rise in consumer demand for packaged and processed food. One of the most important components of food processing is the use of blades in the manufacturing process. Food processing blades are used for various purposes, such as cutting, grinding, slicing, dicing, and shredding. These blades are made from different materials, such as stainless steel, ceramic, and carbon steel, and are available in different sizes and shapes to suit different applications.

The food processing blades market is witnessing significant growth, thanks to the increasing demand for processed food and the adoption of advanced manufacturing techniques. In this article, we will explore the food processing blades market in detail, covering its meaning, executive summary, key market insights, market analysis, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, Covid-19 impact, key industry developments, analyst suggestions, future outlook, and conclusion.

Meaning

Food processing blades refer to the blades used in the food processing industry to cut, grind, slice, dice, and shred different types of food items. These blades are made from different materials, such as stainless steel, ceramic, and carbon steel, and are available in different sizes and shapes to suit different applications. Food processing blades are used in various food processing machines, such as mixers, grinders, slicers, and choppers.

Executive Summary

The food processing blades market is witnessing significant growth, thanks to the increasing demand for processed food and the adoption of advanced manufacturing techniques. The global food processing blades market was valued at USD 8.4 billion in 2020 and is expected to grow at a CAGR of 5.7% from 2021 to 2028. The major factors driving the growth of the market include the increasing demand for processed food, the adoption of advanced manufacturing techniques, and the rising popularity of automation in the food processing industry. On the other hand, the market is restrained by the high cost of food processing blades and the availability of alternative processing technologies.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

• The global food processing blades market was valued at USD 8.4 billion in 2020 and is expected to grow at a CAGR of 5.7% from 2021 to 2028.

• The market is driven by the increasing demand for processed food and the adoption of advanced manufacturing techniques.

• The market is restrained by the high cost of food processing blades and the availability of alternative processing technologies.

• The market is characterized by the presence of a large number of players, both global and regional.

• The market is highly competitive, with players focusing on product innovation and differentiation to gain a competitive edge.

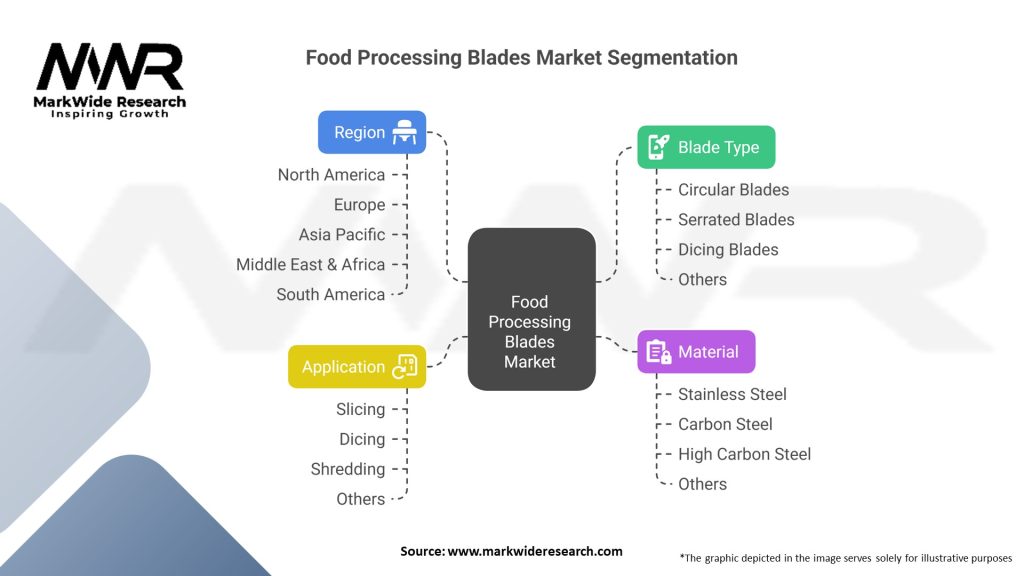

• The market is segmented based on type, material, application, and region.

Market Analysis

The food processing blades market is witnessing significant growth, thanks to the increasing demand for processed food and the adoption of advanced manufacturing techniques. The global food processing blades market was valued at USD 8.4 billion in 2020 and is expected to grow at a CAGR of 5.7% from 2021 to 2028. The market is characterized by the presence of a large number of players, both global and regional, offering a wide range of products to cater to the diverse needs of customers.

The market is driven by the increasing demand for processed food, which is primarily driven by changing consumer preferences and lifestyle patterns. Processed food offers convenience, longer shelf life, and ease of preparation, making it an attractive option for consumers. This, in turn, has led to an increase in the demand for food processing blades, which are essential components of food processing equipment. Additionally, the adoption of advanced manufacturing techniques, such as automation and robotics, is driving the growth of the market. These technologies enable food processing companies to improve efficiency, reduce costs, and enhance product quality, thus boosting the demand for food processing blades.

On the other hand, the market is restrained by the high cost of food processing blades and the availability of alternative processing technologies. Food processing blades are often made from high-quality materials, such as stainless steel or ceramic, which can be expensive. Moreover, alternative processing technologies, such as ultrasonic cutting or high-pressure processing, are gaining popularity in the food processing industry, which may hamper the growth of the food processing blades market.

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The food processing blades market is highly competitive, with players focusing on product innovation and differentiation to gain a competitive edge. The market is characterized by the presence of a large number of players, both global and regional, offering a wide range of products to cater to the diverse needs of customers.

The market is segmented based on type, material, application, and region. Based on type, the market is segmented into rotary blades, straight blades, and circular blades. Based on material, the market is segmented into stainless steel, ceramic, and carbon steel. Based on application, the market is segmented into meat processing, bakery and confectionery, fruits and vegetables, and others. Based on region, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Regional Analysis

North America dominates the food processing blades market, owing to the high adoption of advanced manufacturing techniques in the region. The region is also witnessing significant growth in the demand for processed food, driven by changing consumer preferences and lifestyle patterns. Europe is the second-largest market for food processing blades, driven by the presence of a large number of food processing companies in the region. The region is also witnessing significant growth in the demand for organic and natural food products, which may boost the demand for customized food processing blades.

The Asia-Pacific region is expected to witness significant growth in the food processing blades market, driven by the expansion of the food processing industry in the region. Rising disposable incomes and changing consumer preferences are driving the demand for processed food in the region, which may boost the demand for food processing blades. The region is also witnessing significant growth in the adoption of advanced manufacturing techniques, which may further boost the demand for food processing blades.

Latin America and the Middle East & Africa are expected to witness moderate growth in the food processing blades market, owing to the growing demand for processed food in these regions. However, the market may be restrained by the availability of alternative processing technologies and the high cost of food processing blades.

Competitive Landscape

Leading Companies in the Food Processing Blades Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The food processing blades market is segmented based on type, material, application, and region.

By Type:

• Rotary Blades • Straight Blades • Circular Blades

By Material:

• Stainless Steel • Ceramic • Carbon Steel

By Application:

• Meat Processing • Bakery and Confectionery • Fruits and Vegetables • Others

By Region:

• North America • Europe • Asia-Pacific • Latin America • Middle East & Africa

Category-wise Insights

Meat Processing:

Meat processing is the largest application segment of the food processing blades market, owing to the high demand for processed meat products, such as sausages, bacon, and ham. Meat processing requires specialized processing techniques, which may require customized food processing blades.

Bakery and Confectionery:

Bakery and confectionery is another significant application segment of the food processing blades market, driven by the increasing demand for processed bakery and confectionery products, such as cakes, cookies, and chocolates. Bakery and confectionery processing also requires specialized processing techniques, which may require customized food processing blades.

Fruits and Vegetables:

The fruits and vegetables application segment of the food processing blades market is expected to witness significant growth, driven by the increasing demand for processed fruits and vegetables products, such as canned fruits and vegetables, frozen fruits and vegetables, and dried fruits and vegetables. Processing of fruits and vegetables also requires specialized processing techniques, which may require customized food processing blades.

Key Benefits for Industry Participants and Stakeholders

• The food processing blades market offers a wide range of opportunities for industry participants and stakeholders, such as food processing companies, blade manufacturers, and distributors.

• The increasing demand for processed food and the adoption of advanced manufacturing techniques provide a favorable environment for the growth of the food processing blades market.

• The expansion of the food processing industry in emerging markets, such as Asia-Pacific and Latin America, provides a significant growth opportunity for industry participants.

SWOT Analysis

Strengths:

• Increasing demand for processed food • Adoption of advanced manufacturing techniques • Growing popularity of automation in the food processing industry

Weaknesses:

• High cost of food processing blades • Availability of alternative processing technologies

Opportunities:

• Growing demand for organic and natural food products • Expansion of the food processing industry in emerging markets

Threats:

• Intense competition in the market • Availability of substitute

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the food processing blades market. On the one hand, the pandemic has led to an increase in the demand for processed food, as consumers stock up on essential items. This, in turn, has boosted the demand for food processing blades. On the other hand, the pandemic has led to disruptions in the global supply chain, which may hamper the growth of the food processing blades market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The food processing blades market is expected to witness significant growth in the coming years, driven by the increasing demand for processed food and the adoption of advanced manufacturing techniques. The expansion of the food processing industry in emerging markets, such as Asia-Pacific and Latin America, provides a significant growth opportunity for industry participants. However, the market may be restrained by the availability of alternative processing technologies and the high cost of food processing blades.

Conclusion

The food processing blades market is witnessing significant growth, thanks to the increasing demand for processed food and the adoption of advanced manufacturing techniques. The market is characterized by the presence of a large number of players, both global and regional, offering a wide range of products to cater to the diverse needs of customers. The market is highly competitive, with players focusing on product innovation and differentiation to gain a competitive edge. The market is segmented based on type, material, application, and region. The expansion of the food processing industry in emerging markets, such as Asia-Pacific and Latin America, provides a significant growth opportunity for industry participants. However, the market may be restrained by the availability of alternative processing technologies and the high cost of food processing blades.

What are food processing blades?

Food processing blades are specialized cutting tools designed for various applications in the food industry, including slicing, dicing, and chopping. They are essential for ensuring efficiency and precision in food preparation and processing.

Who are the key players in the Food Processing Blades Market?

Key players in the Food Processing Blades Market include companies like HRS Heat Exchangers, Hattori Hanzo, and Hoshizaki, which are known for their innovative blade designs and high-quality manufacturing processes, among others.

What are the growth factors driving the Food Processing Blades Market?

The Food Processing Blades Market is driven by the increasing demand for processed food, advancements in blade technology, and the growing focus on food safety and hygiene standards. Additionally, the rise in automation in food processing is contributing to market growth.

What challenges does the Food Processing Blades Market face?

Challenges in the Food Processing Blades Market include the high cost of advanced materials and the need for regular maintenance and replacement of blades. Furthermore, competition from alternative cutting technologies can also pose a challenge.

What opportunities exist in the Food Processing Blades Market?

Opportunities in the Food Processing Blades Market include the development of eco-friendly blades and the expansion into emerging markets where food processing is on the rise. Innovations in blade design and materials also present significant growth potential.

What trends are shaping the Food Processing Blades Market?

Trends in the Food Processing Blades Market include the increasing adoption of automation and smart technologies in food processing, as well as a growing emphasis on sustainability and energy efficiency in blade manufacturing. Additionally, customization of blades for specific food types is becoming more prevalent.

Food Processing Blades Market

| Segmentation | Details |

|---|---|

| Blade Type | Circular Blades, Serrated Blades, Dicing Blades, Others |

| Material | Stainless Steel, Carbon Steel, High Carbon Steel, Others |

| Application | Slicing, Dicing, Shredding, Others |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, South America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Food Processing Blades Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at