444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global mobile phone insurance ecosystem market has witnessed significant growth in recent years, driven by the increasing adoption of smartphones and rising incidences of phone theft, accidental damage, and loss. The mobile phone insurance ecosystem includes various stakeholders, such as insurance companies, network operators, device manufacturers, and retailers, who provide insurance coverage, repair and replacement services, and device financing options to consumers.

Meaning

Mobile phone insurance is a type of protection that covers the cost of repairing or replacing a mobile device if it gets damaged, lost, or stolen. The mobile phone insurance ecosystem includes various players, such as insurers, network operators, device manufacturers, and retailers, who work together to offer insurance coverage, repair and replacement services, and device financing options to consumers.

Executive Summary

The global mobile phone insurance ecosystem market is projected to reach a value of USD 30.9 billion by 2025, growing at a CAGR of 12.5% during the forecast period. The key factors driving the growth of the market include the increasing adoption of smartphones, rising incidences of phone theft, accidental damage, and loss, and the growing demand for affordable insurance coverage and repair services. The market is highly competitive, with players focusing on strategic partnerships, mergers and acquisitions, and product innovation to gain a competitive edge.

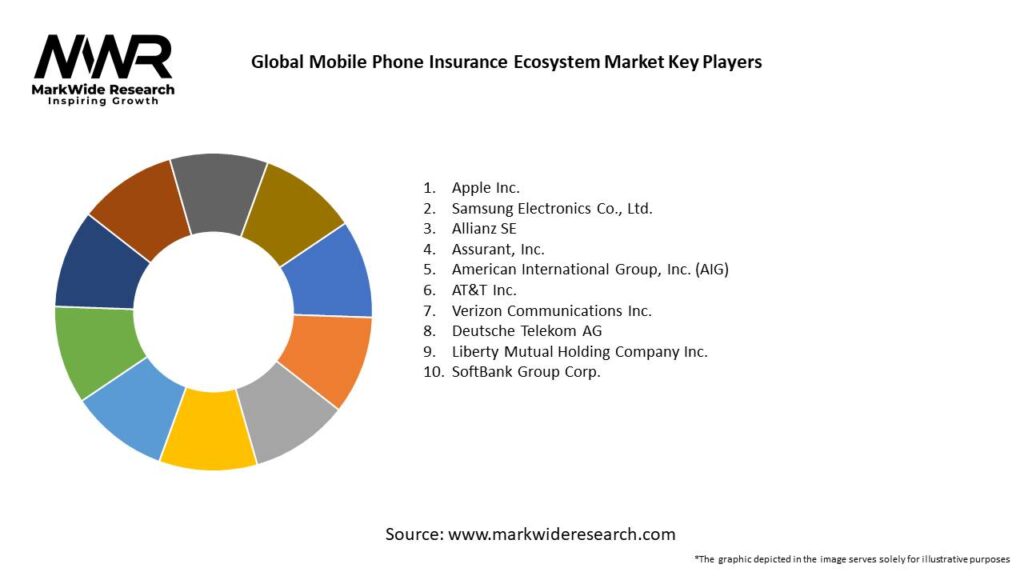

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Analysis

The global mobile phone insurance ecosystem market is expected to witness significant growth during the forecast period, driven by the increasing adoption of smartphones and rising incidences of phone theft, accidental damage, and loss. The market is highly competitive, with players focusing on strategic partnerships, mergers and acquisitions, and product innovation to gain a competitive edge.

Market Drivers

Market Restraints

Market Opportunities

The global mobile phone insurance ecosystem market is dynamic and evolving, with changing consumer preferences, technological advancements, and regulatory developments shaping the market landscape. The following are the key dynamics driving the market:

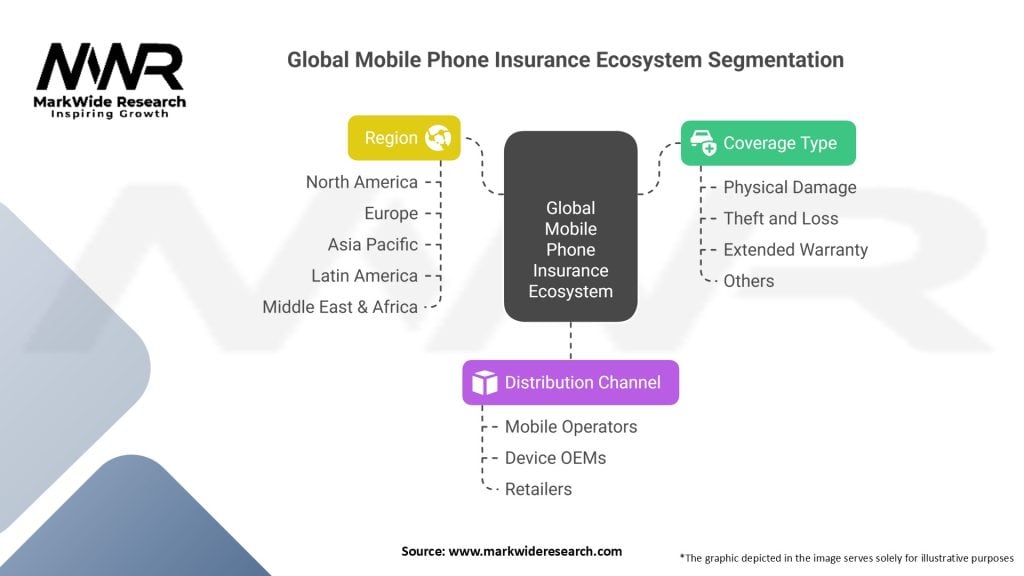

Regional Analysis

The global mobile phone insurance ecosystem market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America is expected to dominate the market, followed by Europe and Asia Pacific. The growth of the market in North America is driven by the high penetration of smartphones, rising incidences of phone theft and accidental damage, and the presence of key players in the region. Europe is also a significant market, driven by the increasing adoption of smartphones and the growing demand for affordable insurance coverage and repair services. Asia Pacific is expected to witness significant growth during the forecast period, driven by the increasing adoption of smartphones in the region and the emergence of new players offering insurance coverage and repair services.

Competitive Landscape

Leading companies in the Global Mobile Phone Insurance Ecosystem Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The global mobile phone insurance ecosystem market is segmented based on type of coverage, distribution channel, and end user. The following are the key segments in the market:

Category-wise Insights

The mobile phone insurance ecosystem market can be categorized based on the type of coverage, distribution channel, and end user.

Key Benefits for Industry Participants and Stakeholders

The key benefits for industry participants and stakeholders in the mobile phone insurance ecosystem market include:

SWOT Analysis

The following is a SWOT analysis of the global mobile phone insurance ecosystem market:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The following are the key trends shaping the global mobile phone insurance ecosystem market:

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the global mobile phone insurance ecosystem market. The pandemic has led to an increase in remote work and virtual communication, which has driven the demand for mobile devices. However, the economic uncertainty and financial constraints caused by the pandemic have also led to a reduction in consumer spending, which has impacted the growth of the market. The pandemic has also disrupted supply chains and manufacturing operations, which has affected the availability of mobile devices and repair services.

Key Industry Developments

The following are the key industry developments in the global mobile phone insurance ecosystem market:

Analyst Suggestions

The following are the key suggestions for industry participants and stakeholders

Future Outlook

The global mobile phone insurance ecosystem market is expected to witness significant growth in the coming years, driven by the increasing adoption of smartphones and rising incidences of phone theft, accidental damage, and loss. The market is highly competitive, with players focusing on strategic partnerships, mergers and acquisitions, and product innovation to gain a competitive edge. The emergence of device manufacturers and retailers as key players in the market presents a significant opportunity for industry participants. However, regulatory developments and economic uncertainty could pose challenges to the growth of the market.

Conclusion

The global mobile phone insurance ecosystem market is dynamic and evolving, driven by changing consumer preferences, technological advancements, and regulatory developments. The market is highly competitive, with players focusing on strategic partnerships, mergers and acquisitions, and product innovation to gain a competitive edge. The emergence of device manufacturers and retailers as key players in the market presents a significant opportunity for industry participants. To stay competitive and meet consumer needs, industry participants should focus on innovation, address consumer concerns, leverage technology, and strengthen partnerships. The future outlook for the market is positive, but challenges such as regulatory developments and economic uncertainty could impact the growth of the market.

What is the Global Mobile Phone Insurance Ecosystem?

The Global Mobile Phone Insurance Ecosystem refers to the network of services and products designed to protect mobile phone users against loss, theft, damage, and other risks. This ecosystem includes insurance providers, mobile carriers, and repair services that work together to offer comprehensive coverage options.

Who are the key players in the Global Mobile Phone Insurance Ecosystem Market?

Key players in the Global Mobile Phone Insurance Ecosystem Market include companies like Asurion, SquareTrade, and Allianz, which provide various insurance products and services for mobile devices. These companies compete to offer innovative solutions and customer-centric policies, among others.

What are the main drivers of growth in the Global Mobile Phone Insurance Ecosystem Market?

The main drivers of growth in the Global Mobile Phone Insurance Ecosystem Market include the increasing reliance on mobile devices, rising consumer awareness about insurance options, and the growing incidence of device theft and damage. Additionally, advancements in technology are enabling more tailored insurance solutions.

What challenges does the Global Mobile Phone Insurance Ecosystem Market face?

Challenges in the Global Mobile Phone Insurance Ecosystem Market include high competition among providers, consumer skepticism regarding the value of insurance, and the complexity of claims processes. These factors can hinder market growth and customer satisfaction.

What opportunities exist in the Global Mobile Phone Insurance Ecosystem Market?

Opportunities in the Global Mobile Phone Insurance Ecosystem Market include the potential for partnerships with mobile manufacturers and retailers, the introduction of customizable insurance plans, and the expansion into emerging markets where mobile device usage is rapidly increasing.

What trends are shaping the Global Mobile Phone Insurance Ecosystem Market?

Trends shaping the Global Mobile Phone Insurance Ecosystem Market include the rise of on-demand insurance services, the integration of artificial intelligence in claims processing, and the growing demand for coverage that includes accidental damage and loss. These trends reflect changing consumer preferences and technological advancements.

Global Mobile Phone Insurance Ecosystem Market:

| Segmentation Details | Description |

|---|---|

| Coverage Type | Physical Damage, Theft and Loss, Extended Warranty, Others |

| Distribution Channel | Mobile Operators, Device OEMs, Retailers |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Global Mobile Phone Insurance Ecosystem Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at