444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Dental Biomaterials Market encompasses a wide range of materials used in dental procedures, restorations, and implantology. These materials are essential for repairing and preserving dental health, and they continue to evolve with advancements in dental technology.The Dental Biomaterials Market is a pivotal segment within the global dental industry, providing essential materials and technologies for dental procedures and restorative treatments. These biomaterials play a critical role in enhancing the quality and longevity of dental restorations, from fillings and crowns to implants.

Meaning

Dental Biomaterials refer to a diverse group of materials used in dentistry for restorations, repairs, and enhancements of teeth and oral structures. These materials include ceramics, composites, metals, and polymers, each designed for specific dental applications.

Executive Summary

The Dental Biomaterials Market is experiencing steady growth due to the increasing demand for aesthetic and functional dental restorations, the aging population, and technological advancements in dental materials. This executive summary provides an overview of key market trends and developments.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Implantology is a dominant application segment. Implants account for a major share of revenue, given the high cost and premium nature of implant metals, ceramics, and coatings.

Growing use of ceramics and composites. Aesthetic and biocompatible ceramic and composite materials (zirconia, lithium disilicate, nanocomposites) are gaining share relative to traditional metals.

Digital dentistry drives demand. As CAD/CAM milling, 3D printing, and intraoral scanning become more ubiquitous, biomaterials compatible with digital workflows see strong uptake.

Regenerative and bioactive materials are emerging. Scaffolds, membranes, bioactive glasses, and growth-factor‑infused materials are growing in importance in periodontal, bone, and soft tissue repair.

Premiumization & longevity matter. Manufacturers compete on longer lifespans, reduced failure, and warranties which influence willingness to pay by clinics and patients.

Geographic variance in adoption. Mature markets see stable demand, whereas emerging markets experience faster growth due to rising dental access and tourism.

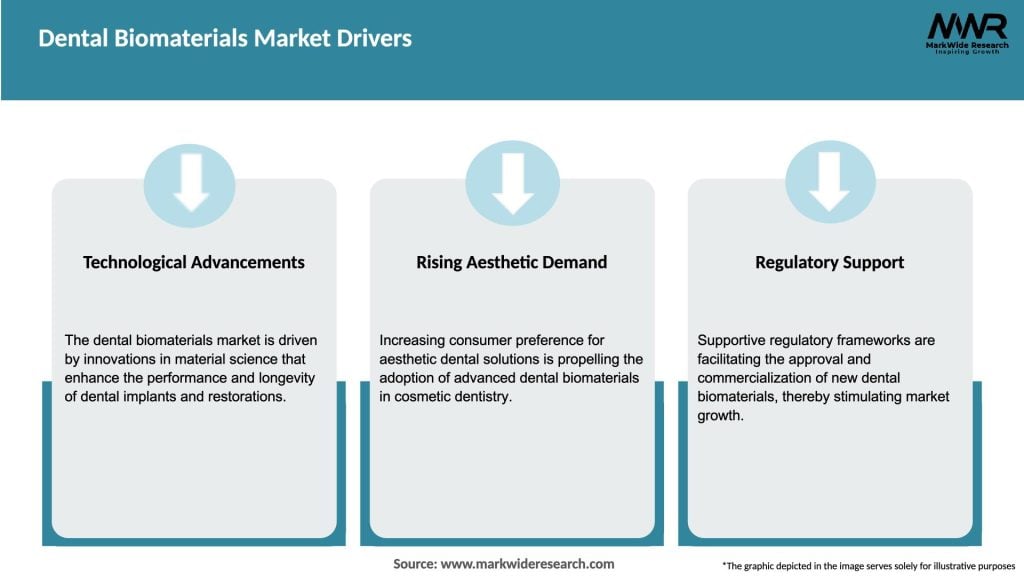

Market Drivers

Dental disease burden and unmet needs. Rising global prevalence of caries, periodontal disease, tooth loss, and trauma drives restorative and replacement needs.

Aging populations. Older adults retain natural teeth but require more restorations and replacements over time.

Cosmetics & aesthetic demand. Patients increasingly demand natural-looking restorations, fueling ceramic, translucent, and color-matching materials.

Implant adoption growth. As implant surgery becomes more accessible, demand for implant biomaterials rises.

Digital dentistry proliferation. Compatibility with digital manufacturing (milling, printing) encourages adoption of specialized biomaterials.

Dental tourism in emerging regions. Cross-border patients from higher-cost regions stimulate demand in lower-cost countries.

Regenerative dentistry advancements. Investment in biomaterial scaffolds, stem-cell integration, and guided regeneration pushes R&D and market expansion.

Market Restraints

High regulatory and clinical validation requirements. Long approval cycles, material certification, and clinical trials slow product rollout.

High R&D and production costs. Advanced biomaterials often require costly fabrication, testing, and quality control.

Competition from non‑biomaterial alternatives. In some cases, conventional restoratives or minimally invasive techniques may substitute.

Material failure risk and liability concerns. Implant failure, fatigue, wear, or biodegradation can lead to reputational and financial risks for manufacturers.

Cost sensitivity in certain markets. In price-sensitive regions, clinicians may prefer lower-cost, conventional materials.

Market Opportunities

Smart and bioresponsive materials. Materials that respond to pH, temperature, or release therapeutics can improve performance and lifespan.

Regenerative & tissue engineering integration. Combining scaffolds, growth factors, and stem-cell carriers into dental biomaterial systems.

Customized restorations & 3D printing materials. Patient‑specific implants, crowns, and scaffolds produced on-demand.

Material hybrids & composites. Blends combining strength, esthetics, and functionality—for example, ceramic‑polymer hybrids.

Emerging market expansion. Growing dental infrastructure in Asia, Latin America, Africa opens new demand fronts.

Sustainable and biocompatible materials. Eco‑friendly, non-toxic, and longer-lasting formulations that appeal to regulatory and patient concerns.

Market Dynamics

Supply-Side Factors:

Major dental biomaterials firms invest in R&D, material science, and quality systems

Vertical integration: companies bundling materials with instrument platforms

Strategic acquisitions of niche biomaterial startups to access novel IP

Demand-Side Factors:

Clinics and labs selecting materials not only on cost but long-term performance and warranty

Increasing preference for seamless digital workflows pushes materials suited for CAD/CAM and printing

Patient awareness and aesthetic expectations push investment in premium materials

Economic & Policy Factors:

Reimbursement policies (public or private) influence material cost thresholds

Patent expirations and generics may pressure pricing in standard biomaterial segments

Regulatory frameworks (FDA, CE, ISO) drive adoption timelines and safety standards

Regional Analysis

North America: Mature, high-value market with extensive adoption of advanced biomaterials, high regulatory standards, and dominant share of R&D and innovation.

Europe: Strong acceptance, especially in Western Europe, with growing emphasis on esthetics, biocompatibility, and sustainability.

Asia-Pacific: Fastest growth region, particularly in China, India, South Korea, and Japan, driven by increasing dental access, tourism, and rising incomes.

Latin America: Emerging market with demand for implants and restorative dentistry; cost sensitivity is a key factor.

Middle East & Africa: Growth potential as dental infrastructure expands; adoption driven by expatriate populations and rising cosmetic demand.

Competitive Landscape

Leading Companies in the Dental Biomaterials Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

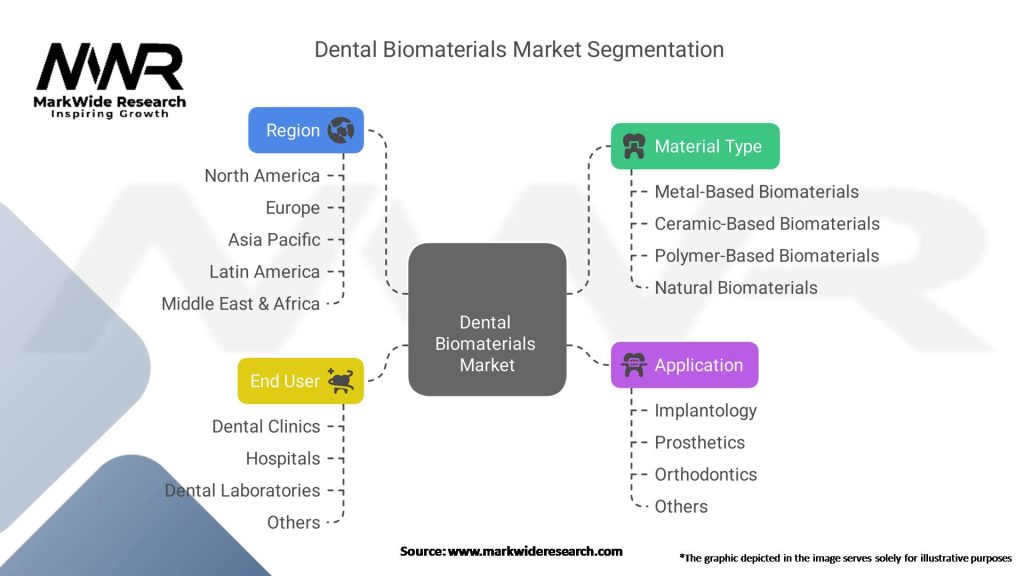

Segmentation

By Material Type:

Metallic Biomaterials (e.g. titanium, alloys)

Ceramic Biomaterials (e.g. zirconia, alumina)

Polymeric / Composite Biomaterials

Metal-Ceramic Hybrids

Natural Biomaterials (bone grafts, collagen, membranes)

By Application:

Implantology

Prosthodontics (crowns, bridges)

Restorative Dentistry (fillings, inlays)

Orthodontics

Regenerative Dentistry / Tissue Engineering

By End User:

Dental Clinics / Practices

Dental Laboratories

Research Institutes / Universities

Dental Product Manufacturers

By Geography / Region:

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

Category-wise Insights

Metal Biomaterials: Strong in implants and frameworks; favored for strength and bone integration.

Ceramic Biomaterials: Rapidly growing due to esthetics, biocompatibility, and improved toughness (e.g. zirconia).

Polymers & Composites: Widely used in restorations, adhesives, and bonding agents—flexible, cost-effective, and evolving.

Metal-Ceramic Hybrids: Offer balance between strength and appearance; used in prosthodontic applications.

Natural Biomaterials: Bone grafts, membranes, collagen matrices mainly in regenerative and periodontal procedures; often premium niches.

Key Benefits for Industry Participants and Stakeholders

Clinics & Dentists: Access to high-performance, long-lasting materials improves patient outcomes and reputation

Patients: Better aesthetics, biocompatibility, and durability with fewer repeat interventions

Manufacturers: Premium margins and differentiation through material innovation

Researchers: Opportunity to advance next-gen biomaterials, biomimetics, and tissue engineering

Healthcare Systems: Reduced long-term costs via durable restorations and fewer failures

SWOT Analysis

Strengths:

Strong innovation pipeline in biomaterials science

Existing adoption of digital dentistry drives incremental upgrades

High demand base in established dental markets

Weaknesses:

Long development and regulatory cycles

High cost of novel materials inhibiting price-sensitive adoption

Risk of material failures and liability concerns

Opportunities:

Regenerative and growth‑factor integrated materials

Custom 3D-printed restorations and scaffolds

Expansion into underserved and emerging markets

Eco-friendly and biodegradable materials attracting regulatory preference

Threats:

Disruptive alternative technologies (e.g. tissue regeneration replacing certain prosthetics)

Material patent expiration and commoditization

Economic downturns reducing elective dentistry spending

Regulatory changes tightening approval burdens

Market Key Trends

3D Printing & Additive Manufacturing: Biomaterials that are printable (e.g. resins, ceramics) gaining momentum for patient‑specific restorations.

Bioactive & Smart Materials: Materials that release ion, antibacterial agents, or stimulate tissue growth are in rising demand.

Nanotechnology & Surface Engineering: Nanostructured surfaces improve osseointegration, wear resistance, and antibacterial function.

Hybrid & Multi‑Material Solutions: Combining materials (e.g. ceramic + polymer) to balance mechanical and aesthetic properties.

Sustainability & Biocompatibility: Growing emphasis on non-toxic, recyclable, and long-lifespan materials.

Digital Workflow Integration: Biomaterials optimized for scanning, milling, or printing shorten chair time and enhance precision.

Key Industry Developments

Major suppliers launching new ceramic, composite, and bioactive lines

Partnerships between biomaterial firms and dental 3D printing companies

Regulatory approvals of advanced biomaterials in key markets

Acquisitions and consolidation in the biomaterials niche by larger dental or medical firms

Clinical studies validating long-term success of novel materials

Analyst Suggestions

Focus R&D on bioactivity and regenerative integration

Ensure materials are compatible with digital manufacturing methods

Collaborate with clinics and labs to validate products in real-world settings

Target emerging markets with scalable, cost-efficient biomaterial variants

Prioritize regulatory readiness (ISO, FDA, CE) early in product development

Future Outlook

The Dental Biomaterials Market is poised for sustained, dynamic growth over the next decade. As technologies such as digital dentistry, 3D printing, tissue engineering, and advanced materials converge, biomaterials will become more intelligent, adaptive, and customizable. The market is expected to transition gradually from purely mechanical replacements toward materials that not only restore but regenerate.

Emerging regions will contribute significantly to volume growth, while advanced markets will demand premium, high-performance solutions. The next frontier may lie in personalized biomaterials (tailored to patient biology), hybrid regenerative/implant systems, and closed-loop platforms combining biofeedback with material response.

Conclusion

The Dental Biomaterials Market plays a pivotal role in modern dentistry, enabling restorative, prosthetic, aesthetic, and regenerative therapies. As patient expectations, regulatory standards, and digital workflows evolve, biomaterials must keep pace through innovation, biocompatibility, and integration. Manufacturers, clinicians, and researchers that align material science, digital compatibility, and clinical performance will lead the next era of dental care—delivering durable, beautiful, and biologically integrated solutions for patients worldwide.

What are dental biomaterials?

Dental biomaterials are substances used in dental applications to restore or replace damaged teeth and tissues. They include materials like dental ceramics, composites, and metals that are designed to be biocompatible and durable.

Who are the key players in the Dental Biomaterials Market?

Key players in the Dental Biomaterials Market include companies such as Dentsply Sirona, Straumann, and Henry Schein, which are known for their innovative products and solutions in dental restoration and implantology, among others.

What are the main drivers of growth in the Dental Biomaterials Market?

The growth of the Dental Biomaterials Market is driven by increasing dental procedures, rising awareness of oral health, and advancements in dental technology. Additionally, the demand for aesthetic dental solutions is contributing to market expansion.

What challenges does the Dental Biomaterials Market face?

The Dental Biomaterials Market faces challenges such as high costs of advanced materials and stringent regulatory requirements. Additionally, the variability in patient responses to biomaterials can complicate treatment outcomes.

What opportunities exist in the Dental Biomaterials Market?

Opportunities in the Dental Biomaterials Market include the development of new materials with enhanced properties and the expansion of dental services in emerging markets. Innovations in regenerative dentistry also present significant growth potential.

What trends are shaping the Dental Biomaterials Market?

Trends in the Dental Biomaterials Market include the increasing use of digital dentistry and 3D printing technologies. There is also a growing focus on sustainable materials and eco-friendly practices in dental product development.

Dental Biomaterials Market

| Segmentation | Details |

|---|---|

| Material Type | Metal-Based Biomaterials, Ceramic-Based Biomaterials, Polymer-Based Biomaterials, Natural Biomaterials |

| Application | Implantology, Prosthetics, Orthodontics, Others |

| End User | Dental Clinics, Hospitals, Dental Laboratories, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Dental Biomaterials Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at