444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The market analysis is a crucial component of any business strategy. It provides valuable insights into the current state and future prospects of a particular market. In this comprehensive analysis of the Elements Market, we will explore its meaning, executive summary, key market insights, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, COVID-19 impact, key industry developments, analyst suggestions, future outlook, and a conclusive summary.

The Elements Market refers to the industry that revolves around the extraction, production, and distribution of elemental substances. These elements play a vital role in various sectors, including manufacturing, construction, electronics, energy, and more. The market analysis of the Elements Market aims to provide an in-depth understanding of the factors influencing its growth and the opportunities it presents.

Executive Summary

The executive summary provides a concise overview of the Elements Market analysis, highlighting the key findings and recommendations. It serves as a snapshot of the entire report, offering a quick understanding of the market’s current scenario and future prospects.

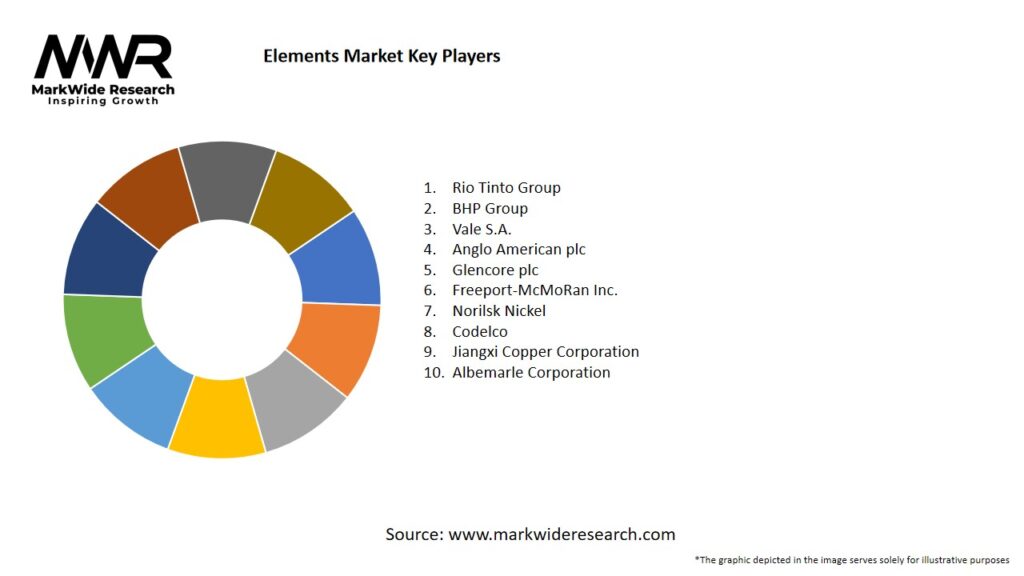

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the Elements Market:

Growth in Electric Vehicles: The rising adoption of electric vehicles is significantly boosting the demand for lithium, cobalt, and nickel, which are essential for lithium-ion batteries used in EVs.

Renewable Energy Expansion: The shift toward renewable energy sources such as wind and solar is driving the demand for specific elements, particularly rare earth metals used in wind turbine magnets and solar panel production.

Technological Innovations in Electronics: With the increasing use of advanced electronics, semiconductors, and other high-tech products, the demand for elements like silicon, copper, and rare earth metals is expanding.

Infrastructure Development: Urbanization and industrialization, particularly in emerging economies, are driving demand for construction materials like steel and aluminum, as well as other metals used in infrastructure development.

Battery Storage Solutions: The growing demand for energy storage solutions, such as batteries for grid storage and consumer electronics, is contributing to increased demand for lithium, cobalt, and nickel.

Market Restraints

Despite its growth potential, the Elements Market faces several challenges:

Geopolitical Risks: A significant portion of the world’s critical elements is sourced from a limited number of countries, creating supply chain risks. For instance, China dominates the rare earth element supply, leading to concerns over future supply disruptions.

Environmental Concerns: The extraction and mining of elements, particularly rare earths and metals like lithium and cobalt, can have significant environmental impacts, including habitat destruction and pollution from mining operations.

Price Volatility: The prices of elements can fluctuate significantly based on changes in global demand, production levels, and geopolitical events, making it difficult for industries to manage costs effectively.

Limited Recycling Infrastructure: While there is growing interest in recycling critical elements, the infrastructure for large-scale recycling of metals, batteries, and rare earth elements is still developing, limiting the ability to close the supply chain loop.

Market Opportunities

The Elements Market presents several opportunities for growth:

Recycling of Critical Elements: As demand for specific elements increases, so does the opportunity for the development of efficient recycling technologies that can reduce reliance on mining and mitigate environmental impacts.

Exploration of Alternative Sources: Mining companies are investing in the exploration of new deposits of critical elements, including untapped regions and seabed mining, to ensure a stable supply of essential materials.

Substitution and Innovation: Researchers are working on finding alternative materials or processes that can reduce reliance on specific elements, particularly rare earth elements, in applications such as electronics and energy storage.

Supply Chain Diversification: With the risks associated with geopolitical supply chains, many countries and companies are looking to diversify their supply chains for critical materials. This opens up opportunities for new suppliers to enter the market.

Government Initiatives: Governments are increasing their focus on securing supplies of critical materials through strategic partnerships, stockpiling, and policies that promote domestic production and recycling of elements.

Market Dynamics

The Elements Market is shaped by several dynamic factors:

Technological Advancements: Innovations in extraction methods, such as more efficient mining technologies and methods for processing and recycling critical elements, are making the supply of these elements more sustainable and cost-effective.

Demand for Electric Vehicles: The rise in electric vehicle adoption continues to boost the demand for lithium, cobalt, and other elements used in batteries, which are a core component of EVs.

Geopolitical and Trade Issues: The concentration of element production in certain regions, particularly China’s dominance in the rare earth element market, creates geopolitical risks and trade uncertainties, impacting global supply chains.

Sustainability and Regulation: Increased focus on environmental sustainability and stricter regulations on mining activities are pushing industries to explore alternative supply sources, including recycling and ethical mining practices.

Regional Analysis

The Elements Market can be segmented by region, with each region presenting unique opportunities and challenges:

North America: North America is a significant player in the market, with a growing demand for critical elements in electric vehicle production and renewable energy projects. The U.S. is also investing in securing domestic supplies of rare earth elements and lithium.

Europe: Europe is seeing increasing demand for elements for the production of renewable energy technologies, including wind and solar, and electric vehicles. The region is also focusing on developing recycling capabilities for critical materials.

Asia-Pacific: Asia-Pacific, led by China, remains the largest producer and consumer of rare earth elements. The region is also experiencing rapid growth in electric vehicle adoption, further driving demand for lithium and cobalt.

Latin America: Latin America is rich in natural resources and is a key supplier of lithium, copper, and other essential metals. Countries like Chile, Argentina, and Bolivia are playing a crucial role in the supply of lithium for global markets.

Middle East & Africa: The Middle East and Africa are emerging markets for elements such as metals used in construction and energy applications. The region is also exploring the development of local mining operations.

Competitive Landscape

Leading Companies in the Elements Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

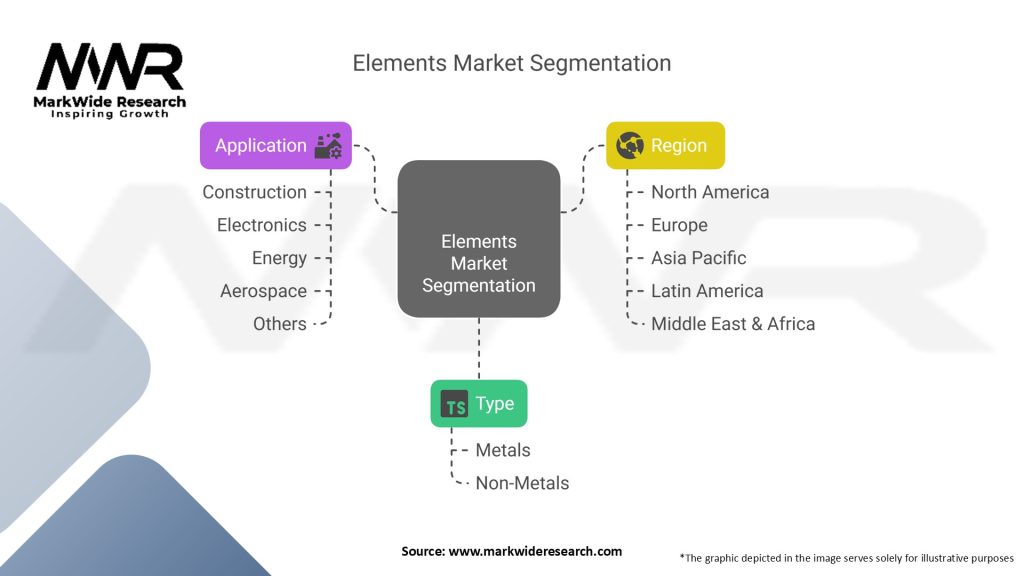

Segmentation

The Elements Market can be segmented based on various factors:

By Element Type: Rare Earth Elements, Base Metals, Precious Metals, and Others.

By End-Use Industry: Automotive (Electric Vehicles), Electronics, Renewable Energy, Manufacturing, and Others.

By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Category-wise Insights

Rare Earth Elements: These elements, including neodymium, dysprosium, and lanthanum, are critical for manufacturing magnets used in electric vehicles, wind turbines, and electronics.

Metals for Energy Storage: Lithium, cobalt, and nickel are essential for the production of lithium-ion batteries, which are used in energy storage systems and electric vehicles.

Key Benefits for Industry Participants and Stakeholders

Strategic Positioning: Companies focusing on securing reliable supplies of critical elements can position themselves as key players in the global energy transition and electric vehicle markets.

Sustainability Initiatives: Emphasizing sustainable mining practices and developing recycling capabilities will help companies meet increasing regulatory pressures and consumer demand for ethical sourcing.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends shaping the Elements Market include:

Sustainable Practices: Increased focus on developing ethical mining practices and sustainable sourcing.

Growth in Electric Vehicles: Continuous demand for lithium, cobalt, and nickel as the electric vehicle market expands.

COVID-19 Impact

The COVID-19 pandemic has significantly impacted global markets, including the Elements Market. This section examines the effects of the pandemic on the market, such as supply chain disruptions, shifts in demand patterns, and changes in consumer behavior. It also explores the resilience and recovery strategies adopted by industry players in response to the crisis.

Key Industry Developments

Key industry developments highlight significant milestones, innovations, and events within the Elements Market. It includes product launches, mergers and acquisitions, partnerships, and collaborations that have shaped the market landscape. Understanding these developments provides insights into the market’s progress and offers ideas for potential business opportunities.

Analyst Suggestions

In this section, industry analysts provide suggestions and recommendations based on their market analysis. These suggestions may include strategies for market entry, product differentiation, customer engagement, and risk management. Businesses can leverage these expert insights to optimize their operations and enhance their competitive advantage.

Future Outlook

The future outlook section presents a forward-looking perspective on the Elements Market. It forecasts market trends, growth opportunities, challenges, and technological advancements expected in the coming years. This information assists businesses in formulating long-term strategies and investment plans to position themselves for success in the evolving market.

Conclusion

The Elements Market represents a dynamic and crucial sector in the global economy. As the demand for essential materials grows, particularly in the context of the energy transition and technological advancements, companies that focus on sustainability, innovation, and securing supply chains will be well-positioned to thrive in this expanding market.

The Elements Market analysis provides a comprehensive understanding of the market’s current landscape, key trends, opportunities, and challenges. By leveraging these insights, industry participants and stakeholders can make informed decisions and formulate strategies to thrive in the dynamic market.

What are elements in the context of the Elements Market?

Elements refer to the fundamental substances that cannot be broken down into simpler substances. In the context of the Elements Market, they include metals, nonmetals, and metalloids that are essential for various industrial applications.

Who are the key players in the Elements Market?

Key players in the Elements Market include companies like BASF, Albemarle Corporation, and Rio Tinto, which are involved in the extraction and production of various elements used in electronics, batteries, and construction, among others.

What are the main drivers of growth in the Elements Market?

The main drivers of growth in the Elements Market include the increasing demand for renewable energy technologies, advancements in electronics, and the rising need for lightweight materials in the automotive industry.

What challenges does the Elements Market face?

The Elements Market faces challenges such as fluctuating raw material prices, environmental regulations, and the complexities of supply chain management, which can impact production and availability.

What opportunities exist in the Elements Market for future growth?

Opportunities in the Elements Market include the development of new materials for energy storage solutions, innovations in recycling technologies, and the expansion of applications in the aerospace and automotive sectors.

What trends are currently shaping the Elements Market?

Current trends in the Elements Market include a shift towards sustainable sourcing practices, increased investment in research and development for new element applications, and the growing importance of circular economy principles in material usage.

Elements Market:

| Segmentation | Details |

|---|---|

| Type | Metals, Non-Metals |

| Application | Construction, Electronics, Energy, Aerospace, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Elements Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at