444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The digital wallet market is a rapidly growing industry that is revolutionizing the way we pay for goods and services. Digital wallets are electronic payment systems that allow users to store and manage their payment information securely and conveniently. These payment systems eliminate the need for physical payment methods such as cash or credit cards.

Digital wallets are widely used for e-commerce transactions and are becoming increasingly popular for in-store purchases. According to a report by Statista, the global digital wallet market size is projected to reach $3.1 trillion by 2025, growing at a CAGR of 28.2% from 2020 to 2025.

A digital wallet is a mobile application that allows users to store payment information such as credit and debit card details, bank account information, and cryptocurrency. The payment information is securely stored and can be used to make purchases both online and in-store. Digital wallets use a combination of encryption and tokenization to protect user information from unauthorized access. These payment systems are typically linked to a user’s smartphone, making them easily accessible and convenient.

Executive Summary

The digital wallet market is experiencing rapid growth, driven by factors such as the increasing use of mobile devices, the rise of e-commerce, and the need for more secure payment methods. The market is projected to reach $3.1 trillion by 2025, growing at a CAGR of 28.2% from 2020 to 2025.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Some of the key market insights include:

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The digital wallet market is driven by a variety of factors, including increasing use of mobile devices, rising demand for secure payment methods, and growing adoption of e-commerce. However, the market also faces challenges such as concerns over security and privacy, limited acceptance by merchants, and low awareness among consumers.

Regional Analysis

The digital wallet market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific is the largest market for digital wallets, followed by North America and Europe. The market in Asia-Pacific is driven by factors such as the high adoption of mobile devices and the rise of e-commerce.

Competitive Landscape

Leading Companies in the Digital Wallet Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

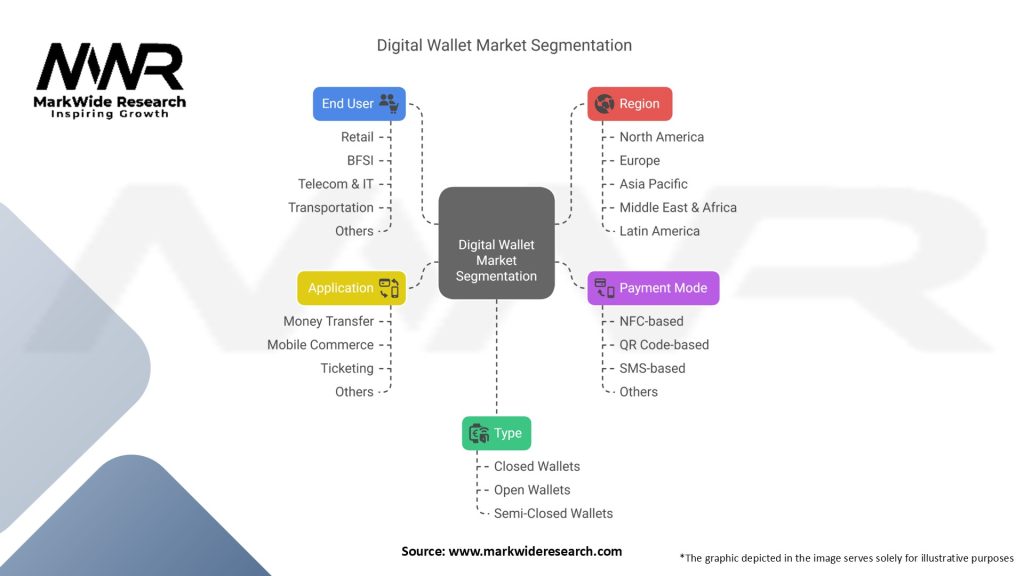

Segmentation

The Digital Wallet Market is diverse and rapidly evolving, making segmentation essential for effective market strategies:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated the adoption of digital wallets as consumers seek contactless payment options to reduce the risk of transmission. The pandemic has also led to an increase in e-commerce, further driving the demand for digital wallets.

Key Industry Developments

Analyst Suggestions

Future Outlook

The digital wallet market is expected to continue growing at a rapid pace, driven by factors such as the increasing use of mobile devices, the rise of e-commerce, and the need for more secure payment methods. The market is also expected to see increased adoption of blockchain technology and expansion into emerging markets.

Conclusion

The digital wallet market is a dynamic and rapidly growing industry that is changing the way we pay for goods and services. Digital wallets provide a convenient, secure, and fast payment option for consumers and offer significant benefits for merchants and vendors.

While the market faces challenges such as limited acceptance by merchants and low awareness among consumers, it also presents opportunities for growth through expansion into emerging markets and the adoption of blockchain technology. Overall, the future outlook for the digital wallet market is positive, and the industry is expected to continue to thrive in the coming years.

What is a digital wallet?

A digital wallet is a software-based system that securely stores users’ payment information and passwords for numerous payment methods and websites. It allows users to make electronic transactions easily and efficiently, often through mobile devices or computers.

Who are the key players in the digital wallet market?

Key players in the digital wallet market include PayPal, Apple Pay, Google Pay, and Samsung Pay, among others. These companies offer various features and services that cater to different consumer needs and preferences.

What are the main drivers of growth in the digital wallet market?

The growth of the digital wallet market is driven by increasing smartphone penetration, the rise of e-commerce, and the demand for contactless payment solutions. Additionally, consumer preferences for convenience and security in transactions are significant factors.

What challenges does the digital wallet market face?

The digital wallet market faces challenges such as security concerns, regulatory compliance issues, and competition from traditional banking systems. These factors can hinder user adoption and trust in digital wallet solutions.

What opportunities exist for the future of the digital wallet market?

Opportunities in the digital wallet market include the integration of advanced technologies like blockchain and AI, expansion into emerging markets, and partnerships with retailers to enhance user experience. These developments can lead to increased adoption and innovation.

What trends are shaping the digital wallet market?

Trends in the digital wallet market include the growing popularity of peer-to-peer payment systems, the incorporation of loyalty programs, and the rise of cryptocurrency transactions. These trends reflect changing consumer behaviors and preferences in digital finance.

Digital Wallet Market

| Segmentation | Details |

|---|---|

| Type | Closed Wallets, Open Wallets, Semi-Closed Wallets |

| Payment Mode | NFC-based, QR Code-based, SMS-based, Others |

| Application | Money Transfer, Mobile Commerce, Ticketing, Others |

| End User | Retail, BFSI, Telecom & IT, Transportation, Others |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Digital Wallet Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at