444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Health Insurance Exchange market has experienced significant growth over the past few years, driven by factors such as increasing healthcare costs, rising awareness about the benefits of health insurance, and the growing popularity of online channels for insurance purchases. The concept of health insurance exchanges (HIX) emerged in the United States in 2010 with the implementation of the Affordable Care Act (ACA). Health insurance exchanges are online marketplaces that allow individuals and small businesses to compare and purchase health insurance plans. They serve as a platform for insurers to offer their products to consumers and help consumers navigate the complexities of the health insurance market.

In recent years, health insurance exchanges have gained significant momentum, not just in the US but in other countries as well. In this article, we will explore the Health Insurance Exchange market, its key drivers and challenges, and the opportunities and trends that are shaping its future.

Health Insurance Exchanges are online marketplaces that offer a range of health insurance plans from various insurers. These exchanges provide a platform for individuals and small businesses to compare and purchase health insurance plans that meet their needs and budgets. They offer a variety of plan types, including HMOs, PPOs, and POS plans, and are designed to provide consumers with transparency and choice when it comes to selecting their health insurance coverage.

Executive Summary

The Health Insurance Exchange market is growing at a rapid pace, driven by factors such as rising healthcare costs, increasing awareness about the benefits of health insurance, and the growing popularity of online channels for insurance purchases. The market is expected to continue its upward trajectory in the coming years, as more countries adopt health insurance exchanges as a means of improving healthcare access and reducing costs.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The health insurance exchange market is highly dynamic, with a range of factors influencing its growth and development. Key drivers of the market include rising healthcare costs, growing awareness about the benefits of health insurance, and increasing popularity of online channels for insurance purchases. However, the market is also subject to challenges such as limited provider networks, complex regulations, and limited consumer awareness.

Regional Analysis

North America is currently the largest market for health insurance exchanges, driven by the implementation of the Affordable Care Act in the US. However, Asia-Pacific is expected to grow at the highest CAGR during the forecast period, due to increasing healthcare spending and government initiatives to expand healthcare access. Other regions such as Europe and Latin America are also experiencing significant growth in the health insurance exchange market.

Competitive Landscape

Leading Companies in the Health Insurance Exchange Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

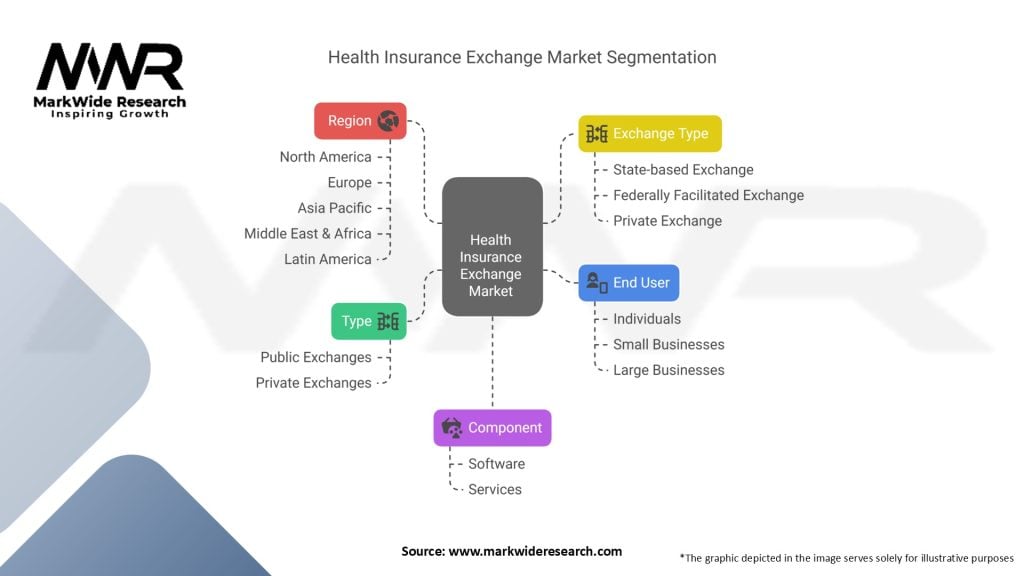

The health insurance exchange market can be segmented based on type, component, deployment model, end-user, and region.

Based on type, the market can be segmented into individual and group.

Based on component, the market can be segmented into software, services, and hardware.

Based on deployment model, the market can be segmented into on-premise and cloud.

Based on end-user, the market can be segmented into individuals, small businesses, and large businesses.

Category-wise Insights

Individuals are the largest category of end-users in the health insurance exchange market, driven by the growing number of individuals who are self-employed or work for small businesses that do not offer health insurance benefits. The web-based segment is the largest segment in the health insurance exchange market, driven by the growing popularity of online channels for insurance purchases.

Key Benefits for Industry Participants and Stakeholders

Health insurance exchanges offer a range of benefits for industry participants and stakeholders, including:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the health insurance exchange market. The pandemic has highlighted the importance of health insurance coverage, and has accelerated the shift towards online channels for insurance purchases. Consumers have become increasingly comfortable with telemedicine and other remote healthcare services, which has created new opportunities for health insurance exchanges to expand their offerings.

However, the pandemic has also created challenges for health insurance exchanges, particularly with regards to provider networks and regulatory oversight. The pandemic has disrupted healthcare systems around the world, leading to changes in provider availability and healthcare costs.

Key Industry Developments

Analyst Suggestions

Industry analysts suggest that health insurance exchanges will continue to grow in popularity and importance in the coming years. They recommend that industry participants focus on:

Future Outlook

The future of the health insurance exchange market looks promising, with continued growth expected in the coming years. Increasing healthcare costs, growing awareness about the benefits of health insurance, and the popularity of online channels for insurance purchases are expected to drive the growth of the market.

However, the market is also subject to challenges such as limited provider networks, complex regulations, and limited consumer awareness. Industry participants will need to address these challenges and leverage new technologies and opportunities to remain competitive in the market.

Conclusion

The health insurance exchange market is a dynamic and rapidly evolving industry, driven by a range of factors including rising healthcare costs, increasing awareness about the benefits of health insurance, and the growing popularity of online channels for insurance purchases. While the market is subject to challenges such as limited provider networks and complex regulations, it offers significant opportunities for industry participants to expand their offerings and improve access to healthcare. By focusing on personalized health insurance, consumer engagement, and technological advancements, health insurance exchanges can position themselves for continued growth and success in the years to come.

What is a Health Insurance Exchange?

A Health Insurance Exchange is a marketplace where individuals and businesses can compare and purchase health insurance plans. These exchanges facilitate access to various insurance options, often with subsidies for eligible consumers to make coverage more affordable.

Who are the key players in the Health Insurance Exchange Market?

Key players in the Health Insurance Exchange Market include companies like Anthem, UnitedHealthcare, and Blue Cross Blue Shield, which offer a range of health insurance products. Additionally, technology firms that provide platforms for these exchanges play a significant role, among others.

What are the main drivers of growth in the Health Insurance Exchange Market?

The main drivers of growth in the Health Insurance Exchange Market include increasing healthcare costs, a rising number of uninsured individuals seeking coverage, and government initiatives aimed at expanding access to health insurance. Additionally, consumer demand for more transparent and competitive pricing is influencing market dynamics.

What challenges does the Health Insurance Exchange Market face?

The Health Insurance Exchange Market faces challenges such as regulatory changes, market volatility, and the complexity of insurance products that can confuse consumers. Additionally, competition among insurers can lead to pricing pressures that affect profitability.

What opportunities exist in the Health Insurance Exchange Market?

Opportunities in the Health Insurance Exchange Market include the potential for technological advancements to improve user experience and streamline enrollment processes. There is also a growing trend towards personalized health plans that cater to specific consumer needs, which can enhance market engagement.

What trends are shaping the Health Insurance Exchange Market?

Trends shaping the Health Insurance Exchange Market include the increasing use of telehealth services, a shift towards value-based care, and the integration of artificial intelligence in customer service. These trends are transforming how consumers interact with health insurance providers and access care.

Health Insurance Exchange Market

| Segmentation | Details |

|---|---|

| Type | Public Exchanges, Private Exchanges |

| Component | Software, Services |

| Exchange Type | State-based Exchange, Federally Facilitated Exchange, Private Exchange |

| End User | Individuals, Small Businesses, Large Businesses |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Health Insurance Exchange Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at