444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Peer-to-Peer (P2P) lending market has gained significant traction in recent years as a disruptive alternative to traditional lending institutions. P2P lending platforms connect borrowers directly with individual lenders, eliminating the need for intermediaries like banks. This market overview will delve into the meaning of P2P lending, provide an executive summary, highlight key market insights, explore market drivers, restraints, and opportunities, analyze the market dynamics, discuss regional analysis, evaluate the competitive landscape, provide segmentation insights, outline the benefits for industry participants and stakeholders, conduct a SWOT analysis, discuss key trends, assess the impact of COVID-19, highlight key industry developments, offer analyst suggestions, present a future outlook, and conclude with key takeaways.

Peer-to-peer lending, also known as P2P lending or marketplace lending, refers to the practice of lending money to individuals or businesses through online platforms that directly connect lenders and borrowers. These platforms act as intermediaries, facilitating loan transactions and providing credit assessment and risk management services. P2P lending enables individuals to lend money to others in need, earning interest on their investments, while borrowers can access funds outside of traditional banking channels.

Executive Summary

The P2P lending market has witnessed substantial growth in recent years, driven by technological advancements, changing consumer preferences, and increasing demand for alternative lending options. The market has opened up new avenues for both lenders and borrowers, offering competitive interest rates, quick loan approvals, and simplified loan application processes. However, challenges such as regulatory uncertainties and credit risk management remain. Despite these challenges, the P2P lending market holds immense potential, with opportunities for innovation and expansion.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The P2P lending market is driven by a combination of technological advancements, changing consumer behavior, regulatory factors, and market forces. It operates in a dynamic landscape where platform credibility, borrower creditworthiness, and lender confidence are critical factors for sustainable growth. Market dynamics are influenced by evolving regulatory frameworks, economic conditions, technological disruptions, and shifts in borrower and lender preferences.

Regional Analysis

The P2P lending market exhibits variations across different regions due to varying levels of internet penetration, regulatory environments, and access to traditional banking services. North America, Europe, and Asia Pacific have emerged as key regions in terms of P2P lending activity, driven by factors such as favorable regulatory frameworks, technological infrastructure, and market demand. However, the market is witnessing growth in other regions as well, driven by the need for alternative lending options and increasing internet penetration.

Competitive Landscape

Leading Companies in the Peer-to-peer Lending Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

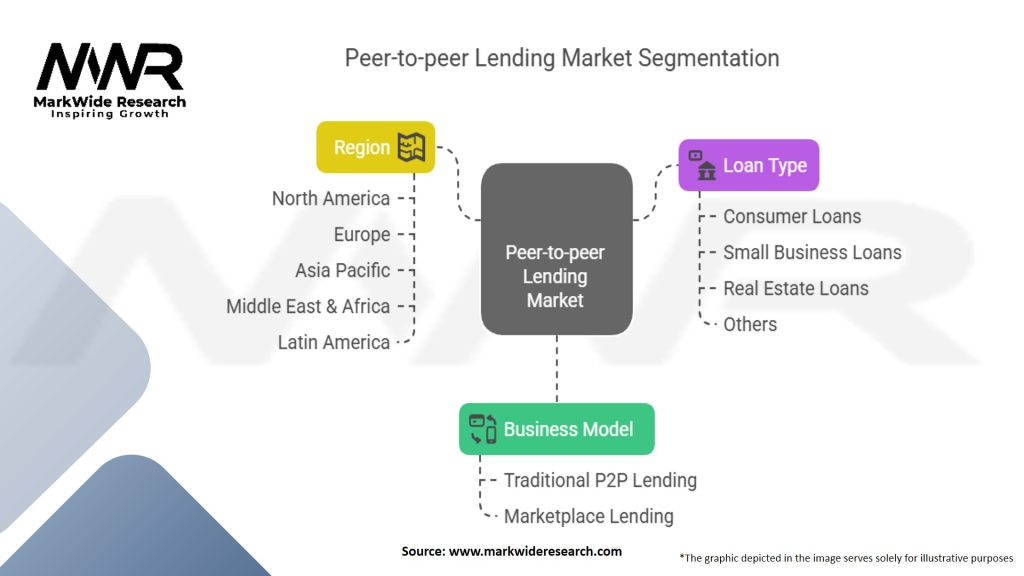

Segmentation

The P2P lending market can be segmented based on loan types, borrower profiles, and geographical regions. Loan types may include personal loans, business loans, student loans, and real estate financing. Borrower profiles may encompass individuals, small businesses, and underserved communities. Geographically, the market can be divided into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

P2P lending offers several benefits for industry participants and stakeholders:

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the P2P lending market. The economic slowdown and increased uncertainty have led to higher loan default rates, impacting lender returns. However, the crisis has also highlighted the need for alternative lending options, and P2P lending platforms have adapted by implementing stricter credit assessments and risk management measures. Despite short-term challenges, the P2P lending market is expected to recover and grow as the economy stabilizes.

Key Industry Developments

Analyst Suggestions

Future Outlook

The P2P lending market is expected to witness sustained growth in the coming years. Factors such as increasing internet penetration, changing borrower preferences, and evolving regulatory frameworks will drive market expansion. Technological advancements, including blockchain, artificial intelligence, and machine learning, will continue to reshape the industry, improving transparency, efficiency, and risk management. Collaborations with traditional financial institutions will further strengthen the market’s credibility and stability. However, challenges related to regulatory uncertainties and borrower creditworthiness assessments will require ongoing attention. Overall, the future outlook for the P2P lending market remains positive, with ample opportunities for innovation and market penetration.

Conclusion

The Peer-to-Peer (P2P) lending market has emerged as a disruptive force, providing an alternative financing option for borrowers and attractive investment opportunities for lenders. The market’s convenience, competitive interest rates, and quick loan disbursals have propelled its growth, attracting individuals and businesses alike. However, challenges such as regulatory uncertainties, credit risk management, and economic downturns pose risks to the market’s stability. By focusing on borrower creditworthiness assessments, risk mitigation strategies, technological innovations, and collaborations with traditional financial institutions, the P2P lending market can overcome these challenges and thrive. The future outlook for the market remains optimistic, with opportunities for expansion into underserved markets, integration of advanced technologies, and the promotion of sustainable lending practices.

What is peer-to-peer lending?

Peer-to-peer lending is a method of borrowing and lending money directly between individuals, bypassing traditional financial institutions. This model allows borrowers to access funds from multiple lenders, often resulting in lower interest rates and more flexible terms.

What are the major companies in the peer-to-peer lending market?

Major companies in the peer-to-peer lending market include LendingClub, Prosper, and Upstart, which provide platforms for individuals to lend and borrow money directly. These companies have significantly influenced the lending landscape, offering innovative solutions and competitive rates among others.

What are the key drivers of growth in the peer-to-peer lending market?

Key drivers of growth in the peer-to-peer lending market include the increasing demand for alternative financing options, the rise of digital platforms facilitating transactions, and the growing acceptance of peer-to-peer lending among consumers seeking lower interest rates and faster access to funds.

What challenges does the peer-to-peer lending market face?

The peer-to-peer lending market faces challenges such as regulatory scrutiny, concerns over borrower creditworthiness, and competition from traditional financial institutions. These factors can impact the growth and sustainability of peer-to-peer lending platforms.

What opportunities exist for the future of the peer-to-peer lending market?

Opportunities for the future of the peer-to-peer lending market include expanding into new geographic regions, integrating advanced technologies like artificial intelligence for better risk assessment, and developing niche lending segments such as green loans or small business financing.

What trends are shaping the peer-to-peer lending market?

Trends shaping the peer-to-peer lending market include the increasing use of blockchain technology for secure transactions, the rise of social lending platforms that connect borrowers and lenders based on shared interests, and a growing focus on ethical lending practices.

Peer-to-peer Lending Market

| Segmentation | Details |

|---|---|

| Business Model | Traditional P2P Lending, Marketplace Lending |

| Loan Type | Consumer Loans, Small Business Loans, Real Estate Loans, Others |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Peer-to-peer Lending Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at