444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Welding Wires Market has experienced significant growth, driven by the increasing demand for welding applications across various industries, including automotive, construction, and manufacturing. Welding wires are crucial components in the welding process, providing the necessary filler material for joining metal parts. The market is characterized by advancements in technology and materials, enhancing the efficiency and quality of welding processes.

Meaning

Welding wires refer to the metallic wires used as filler material in welding applications. These wires are melted during the welding process to form a bond between the workpieces. They come in various compositions and sizes, suitable for different welding methods, including MIG (Metal Inert Gas), TIG (Tungsten Inert Gas), and others. The selection of welding wire depends on the base materials, the type of welding process, and the desired properties of the final weld.

Executive Summary

The global welding wires market is witnessing steady growth, driven by the increasing demand for welding applications in various industries. The market offers a wide range of welding wires, including solid wires, flux-cored wires, and metal-cored wires, catering to diverse welding needs. Factors such as the growing construction and infrastructure sector, rising automotive production, and the adoption of automated welding processes contribute to the market’s expansion. However, challenges like price volatility of raw materials and stringent regulations related to worker safety and environmental concerns pose restraints to the market’s growth. Despite these challenges, market players are focusing on innovation and product development to meet the evolving demands of end-users.

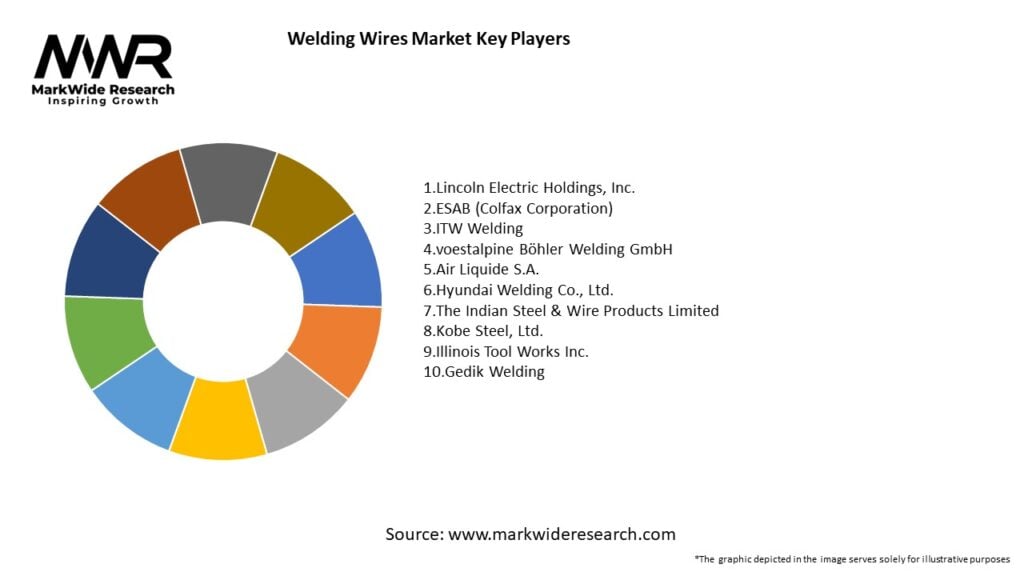

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Infrastructure Development: Global investment in bridges, tunnels, and pipelines stimulates demand for high-performance welding consumables.

Automotive Manufacturing: Lightweighting trends (aluminum and advanced high-strength steel) require specialized wires for consistent weld integrity.

Industrial Automation: Robotic welding lines prioritize reliable wire feedability, low-spatter formulations, and spooled packaging for continuous operation.

Energy Sector Expansion: Growth in oil & gas, LNG, and renewable energy installations calls for corrosion-resistant and cryogenic-capable wires.

Worker Safety & Environment: Regulations on fume emissions and chromates encourage development of low-fume, chromium-reduced wires.

Market Restraints

Raw Material Volatility: Fluctuations in steel, nickel, and alloying element prices impact wire production costs.

Skill Shortages: Skilled welders are required to optimize parameters for specialized wires—limiting adoption in some regions.

Equipment Compatibility: Certain flux-cored and metal-cored wires demand high-end power sources and precise parameter control.

Competition from Alternatives: Laser and friction stir welding technologies, although niche, compete in high-precision applications.

Logistics Costs: Bulk shipments of heavy wire spools incur high freight expenses, especially for remote manufacturing sites.

Market Opportunities

Advanced Alloy Wires: Development of wires for new materials—such as duplex stainless steels, superalloys, and aluminum-lithium—opens niche high-value markets.

Consumables-as-a-Service: Subscription models for just-in-time wire delivery and inventory management in automated welding facilities.

Digital Integration: Wire performance data—tracked via RFID tags on spools—enabling traceability, usage analytics, and predictive replenishment.

Sustainable Packaging: Biodegradable inner liners and reusable wire feeder containers reduce waste and environmental footprint.

Training & Certification: Partnering with welding schools and awarding bodies to upskill operators in specialized wire processes.

Market Dynamics

Process Innovation: Synergic pulsed MIG and cold-wire tandem processes require wires with consistent chemistry and feed properties.

Regulatory Evolution: Stricter occupational exposure limits for manganese and chromium fumes drive low-fume wire R&D.

Customization Demand: End users request tailor-made alloy blends and flux formulations to meet exact application requirements.

Consolidation Trend: M&A among consumable suppliers expands product portfolios and global distribution reach.

Emerging Market Growth: Southeast Asia and Latin America’s growing fabrication industries present high-volume opportunities.

Regional Analysis

Asia-Pacific: Largest volume market—driven by China, India, and Southeast Asia’s infrastructure and automotive growth.

North America: Premium market with high adoption of flux-cored and metal-cored wires in heavy-duty fabrication and energy projects.

Europe: Demand for low-fume, stainless steel, and specialty alloy wires in automotive, maritime, and nuclear sectors.

Latin America: Developing market with rising welding education and growing fabrication workshops in Brazil and Mexico.

Middle East & Africa: Infrastructure and energy projects spur demand for corrosion-resistant and high-strength wires.

Competitive Landscape

Leading Companies in the Welding Wires Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

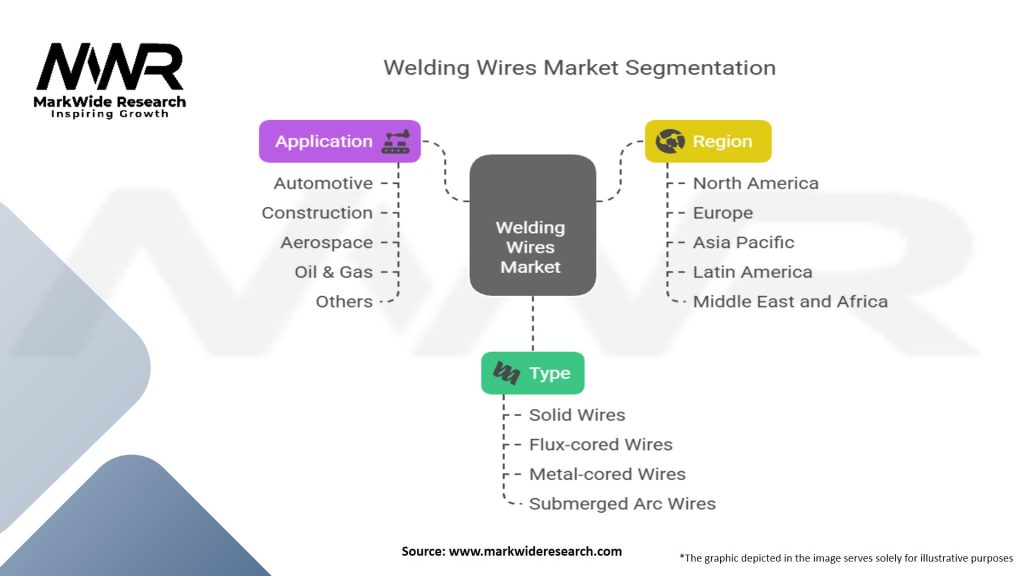

Segmentation

The welding wires market can be segmented based on wire type, application, end-use industry, and region.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Diverse wire technologies tailored to specific welding processes and materials.

Synergistic partnerships with equipment manufacturers ensure optimized performance.

Global distribution networks support just-in-time delivery for high-volume users.

Weaknesses:

Price sensitivity in commodity steel wire segments can pressure margins.

Dependence on skilled welders for optimal parameter selection in flux-cored and metal-cored processes.

Inventory complexity for stocking multiple alloy grades and wire types.

Opportunities:

Growth in robotic and hybrid welding applications requiring premium wires.

Development of wires for new materials—such as high-strength aluminum and advanced steels—for lightweighting.

Expansion of digital services—wire usage analytics and parameter recall—for large-scale welding operations.

Threats:

Emerging solid-state welding techniques (laser, friction stir) may reduce reliance on consumable wires in niche segments.

Volatility in alloying element prices (nickel, chromium) affecting specialty wire costs.

Regulatory changes on fume emissions pushing R&D for new flux chemistries and wire alloys.

Market Key Trends

Synergic Pulse Technology: Wires and power sources communicating to automatically optimize pulse parameters for minimal heat input and spatter.

Low-Fume Formulations: New flux blends reducing manganese and chromium dioxide fume emissions for improved shop air quality.

Reel Automation: High-capacity wire reels (up to 25 kg) and robotic feeder integration for multi-shift, unattended welding.

Alloy Optimization: Nano-grain-refined wire chemistries offering superior toughness and crack resistance in extreme temperatures.

Subscription Consumables: Consumable management platforms tracking wire usage rates and triggering automated replenishment orders.

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the welding wires market. The initial outbreak and subsequent lockdown measures disrupted manufacturing activities and led to supply chain disruptions. However, as industries gradually resumed operations and governments implemented stimulus packages for infrastructure development, the market witnessed a recovery. The construction sector’s rebound and the increased focus on infrastructure projects, particularly in regions like Asia Pacific, drove the demand for welding wires. Despite the challenges posed by the pandemic, the market showcased resilience and adapted to the changing market dynamics.

Key Industry Developments

Analyst Suggestions

Future Outlook

The welding wires market is poised for steady growth in the coming years. The increasing adoption of automation in welding processes, the growth of the construction and infrastructure sector, and the rising demand for welding wires in automotive and aerospace applications will drive market expansion. Technological advancements, including the development of high-strength and eco-friendly welding wires, will continue to shape the market. Companies that focus on innovation, market diversification, and strategic partnerships are likely to thrive in this competitive landscape.

Conclusion

The welding wires market is experiencing significant growth, driven by the increasing demand for welding applications across various industries. The market offers a wide range of welding wires, including solid wires, flux-cored wires, and metal-cored wires, catering to diverse welding needs. The adoption of automation in welding processes, the growth of the construction and infrastructure sector, and the rising automotive production are key drivers of the market. However, challenges such as the price volatility of raw materials and stringent regulations related to worker safety and environmental concerns pose restraints. Despite these challenges, market players can leverage opportunities such as market expansion in emerging regions, product innovation, and collaboration with end-users to achieve success in the welding wires market.

What are welding wires?

Welding wires are consumable materials used in various welding processes to join metals together. They are available in different types, such as solid, flux-cored, and metal-cored wires, each suited for specific applications and welding techniques.

Who are the key players in the Welding Wires Market?

Key players in the Welding Wires Market include companies like Lincoln Electric, ESAB, and Miller Electric, which are known for their innovative welding solutions and extensive product ranges, among others.

What are the main drivers of the Welding Wires Market?

The Welding Wires Market is driven by the increasing demand for welding in construction, automotive, and manufacturing industries. Additionally, advancements in welding technology and the growing trend of automation in welding processes contribute to market growth.

What challenges does the Welding Wires Market face?

The Welding Wires Market faces challenges such as fluctuating raw material prices and the need for skilled labor. Additionally, stringent regulations regarding emissions and safety standards can impact production and operational costs.

What opportunities exist in the Welding Wires Market?

Opportunities in the Welding Wires Market include the development of eco-friendly welding wires and the expansion of applications in renewable energy sectors. The rise of additive manufacturing also presents new avenues for growth.

What trends are shaping the Welding Wires Market?

Trends in the Welding Wires Market include the increasing adoption of automation and robotics in welding processes, as well as the growing preference for high-performance and specialized welding wires. Additionally, there is a shift towards sustainable practices and materials.

Welding Wires Market

| Segmentation | Details |

|---|---|

| Type | Solid Wires, Flux-cored Wires, Metal-cored Wires, Submerged Arc Wires |

| Application | Automotive, Construction, Aerospace, Oil & Gas, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Welding Wires Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at