444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Logging While Drilling (LWD) market is witnessing significant growth as the demand for efficient and accurate drilling operations continues to rise in the oil and gas industry. LWD technology allows real-time data acquisition and analysis during drilling operations, enabling operators to make informed decisions and optimize drilling processes. This comprehensive 4000-word article will delve into the various aspects of the LWD market, including its meaning, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and a conclusive summary.

Logging While Drilling (LWD) refers to a technique used in drilling operations, primarily in the oil and gas industry, to obtain valuable formation evaluation data in real-time. Unlike traditional wireline logging, where data is collected after drilling is completed, LWD involves placing logging instruments directly within the bottom-hole assembly (BHA) of the drill string. This allows for immediate data acquisition, which is crucial for optimizing drilling parameters and making accurate decisions while drilling. LWD technology enables continuous formation evaluation, including measurements of resistivity, porosity, gamma ray, and drilling dynamics, among others.

Executive Summary

The Logging While Drilling (LWD) market is experiencing substantial growth owing to the increasing need for real-time data acquisition during drilling operations. The demand for LWD technology is driven by its ability to enhance drilling efficiency, reduce costs, and improve wellbore placement accuracy. The market is witnessing a shift towards advanced LWD tools that offer improved measurements, data analysis capabilities, and compatibility with drilling systems. Key market players are investing in research and development activities to introduce innovative LWD solutions, driving market growth further.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Logging While Drilling (LWD) market is characterized by intense competition, technological advancements, and a growing emphasis on drilling efficiency. Key market players are investing in research and development activities to introduce innovative LWD tools and systems. The market is witnessing a trend towards the integration of LWD technology with drilling systems to enhance overall drilling performance. Moreover, the industry is focusing on the development of advanced sensors and data analysis algorithms to improve measurement accuracy and enable real-time decision-making. The market dynamics are influenced by factors such as oil prices, regulatory standards, environmental concerns, and the availability of skilled workforce.

Regional Analysis

The LWD market can be segmented into several regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America holds a significant market share due to the extensive shale gas exploration activities in the region, particularly in the United States and Canada. The Asia Pacific region is witnessing substantial growth, driven by the increasing demand for energy and the development of offshore oil and gas reserves. Europe and Latin America are also experiencing market growth, with the presence of mature oil and gas fields and offshore exploration activities. The Middle East and Africa region offer lucrative opportunities, given its vast hydrocarbon reserves and the continuous development of offshore fields.

Competitive Landscape

Leading Companies in the Logging While Drilling (LWD) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

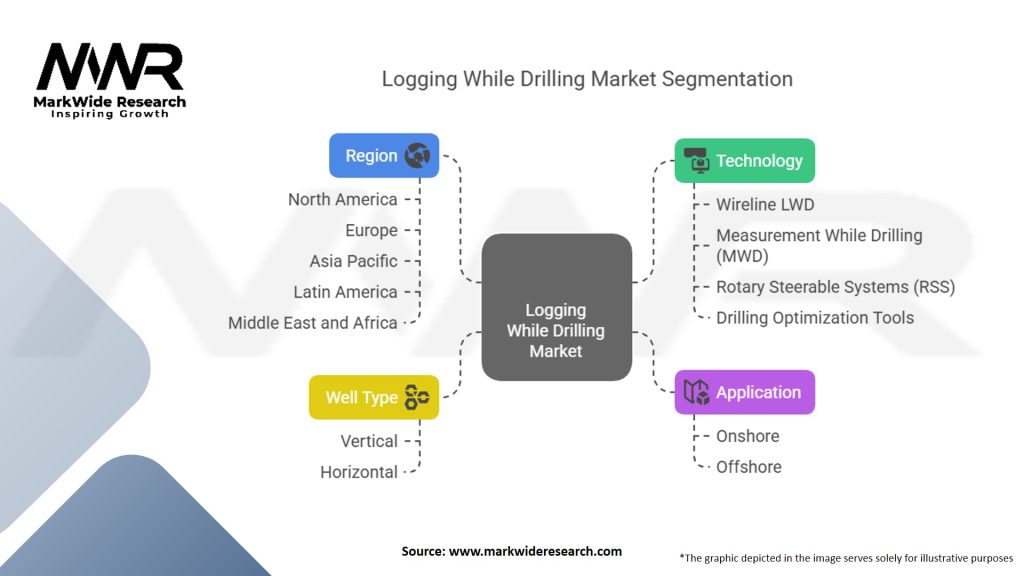

The LWD market can be segmented based on technology, application, and region.

By Technology:

By Application:

By Region:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Logging While Drilling (LWD) technology offers several key benefits for industry participants and stakeholders, including:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the Logging While Drilling (LWD) market, primarily due to the decline in oil prices and reduced drilling activities. The pandemic-induced lockdowns and travel restrictions led to a decrease in global oil demand, resulting in a decline in drilling operations. Many oil and gas companies reduced their capital expenditures and postponed drilling projects, affecting the adoption of LWD technology. However, the market is expected to recover as the global economy rebounds and oil prices stabilize. The emphasis on cost reduction and operational efficiency post-pandemic is likely to drive the demand for LWD technology.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Logging While Drilling (LWD) market is poised for significant growth in the coming years. The demand for LWD technology is expected to increase as the oil and gas industry focuses on drilling efficiency, reservoir optimization, and cost reduction. Technological advancements, such as high-resolution measurements, integration with drilling systems, and compatibility with data analytics, will drive market growth. Additionally, the exploration of unconventional reservoirs and the development of offshore fields present substantial opportunities for the LWD market. Collaboration, strategic partnerships, and a customer-centric approach will be key factors for success in this evolving market.

Conclusion

The Logging While Drilling (LWD) market is witnessing robust growth, driven by the need for real-time data acquisition and analysis during drilling operations. LWD technology enhances drilling efficiency, reduces costs, and improves wellbore placement accuracy. The market is characterized by technological advancements, integration with drilling systems, and a focus on high-resolution measurements. Despite challenges such as high initial investment costs and technological limitations, the market presents significant opportunities in unconventional reservoir development, emerging regions, and digitalization trends. Collaboration, training, and environmental responsibility are crucial for industry participants and stakeholders. The future outlook for the LWD market is promising, with a strong emphasis on innovation, efficiency, and sustainable drilling practices.

What is Logging While Drilling (LWD)?

Logging While Drilling (LWD) refers to the process of collecting geological and formation data during the drilling of a well. This technique allows for real-time analysis of the subsurface conditions, which is crucial for optimizing drilling operations and making informed decisions.

What are the key companies in the Logging While Drilling (LWD) market?

Key companies in the Logging While Drilling (LWD) market include Schlumberger, Halliburton, Baker Hughes, and Weatherford, among others.

What are the main drivers of growth in the Logging While Drilling (LWD) market?

The growth of the Logging While Drilling (LWD) market is driven by the increasing demand for efficient drilling techniques, the need for real-time data to enhance decision-making, and the rising exploration activities in oil and gas sectors.

What challenges does the Logging While Drilling (LWD) market face?

The Logging While Drilling (LWD) market faces challenges such as high operational costs, the complexity of data interpretation, and the need for skilled personnel to operate advanced LWD technologies.

What opportunities exist in the Logging While Drilling (LWD) market?

Opportunities in the Logging While Drilling (LWD) market include advancements in sensor technologies, the integration of artificial intelligence for data analysis, and the growing trend of automation in drilling operations.

What are the current trends in the Logging While Drilling (LWD) market?

Current trends in the Logging While Drilling (LWD) market include the increasing adoption of digital technologies, the focus on sustainable drilling practices, and the development of hybrid LWD systems that combine various logging techniques.

Logging While Drilling (LWD) Market

| Segmentation | Details |

|---|---|

| Technology | Wireline LWD, Measurement While Drilling (MWD), Rotary Steerable Systems (RSS), Drilling Optimization Tools |

| Application | Onshore, Offshore |

| Well Type | Vertical, Horizontal |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Logging While Drilling (LWD) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at