444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The oil storage terminal market plays a critical role in the global energy infrastructure, providing a crucial link between oil production and distribution. Oil storage terminals serve as essential facilities for storing and maintaining the strategic reserves of crude oil and petroleum products. These terminals enable the industry to address fluctuations in demand and supply, ensuring a steady flow of oil to meet consumer needs. In this comprehensive report, we will delve into the meaning of oil storage terminals, analyze key market insights, examine market drivers, restraints, and opportunities, explore market dynamics, conduct a regional analysis, discuss the competitive landscape, provide segmentation insights, highlight the benefits for industry participants and stakeholders, conduct a SWOT analysis, analyze key trends and the impact of Covid-19, review key industry developments, offer analyst suggestions, present a future outlook, and conclude with a summary of findings.

Oil storage terminals, also known as oil terminals or oil depots, are facilities designed for the storage and distribution of various petroleum products, including crude oil, gasoline, diesel, jet fuel, and other refined products. These terminals are typically situated near oil refineries, production fields, or major transportation hubs, such as ports or pipelines. The primary function of an oil storage terminal is to receive, store, and dispatch oil and petroleum products efficiently, ensuring a continuous supply to end-users.

Executive Summary

The global oil storage terminal market has experienced significant growth in recent years, driven by rising energy consumption, increasing oil production, and growing demand for secure storage facilities. The market is characterized by a diverse range of participants, including major oil companies, independent terminal operators, and governments. The competition is intense, with players striving to enhance their infrastructure, improve operational efficiency, and expand their storage capacities. The market is expected to witness further growth in the coming years, driven by factors such as expanding refining capacities, growing demand for petroleum products, strategic inventory management, and the need to address geopolitical uncertainties.

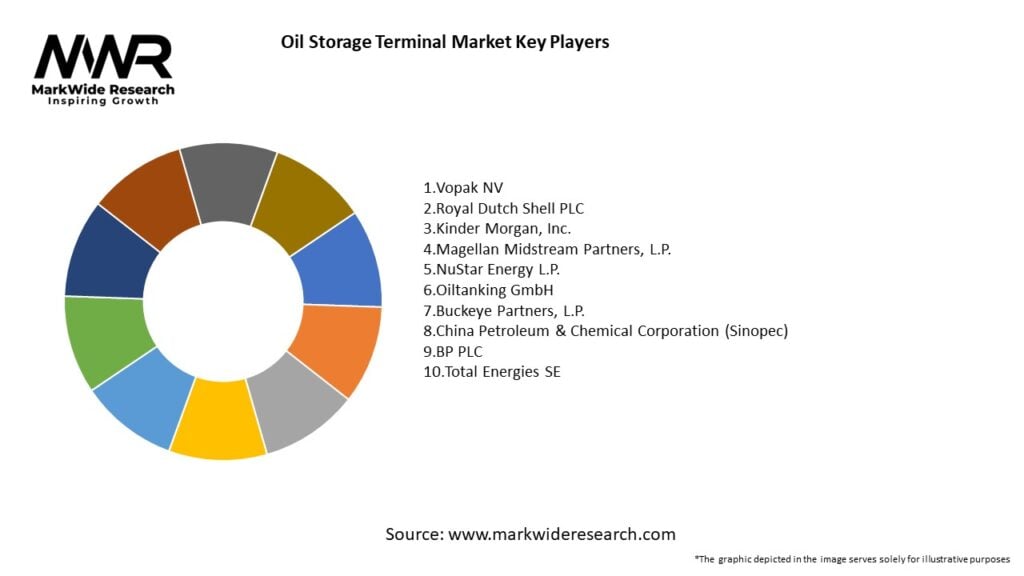

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The oil storage terminal market operates within a dynamic environment influenced by various factors, including geopolitical tensions, macroeconomic conditions, energy policies, and technological advancements. These dynamics shape the market landscape, driving the need for strategic investments, infrastructure expansions, and operational optimizations. The industry players must stay abreast of these dynamics and adapt their strategies to remain competitive.

Regional Analysis

The oil storage terminal market exhibits regional variations due to factors such as geographical location, energy demand, production capabilities, and regulatory frameworks. The market is dominated by key regions, including North America, Europe, Asia Pacific, and the Middle East. Each region presents distinct opportunities and challenges, influenced by local market conditions, government policies, and industry dynamics.

Competitive Landscape

Leading companies in the Oil Storage Terminal Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

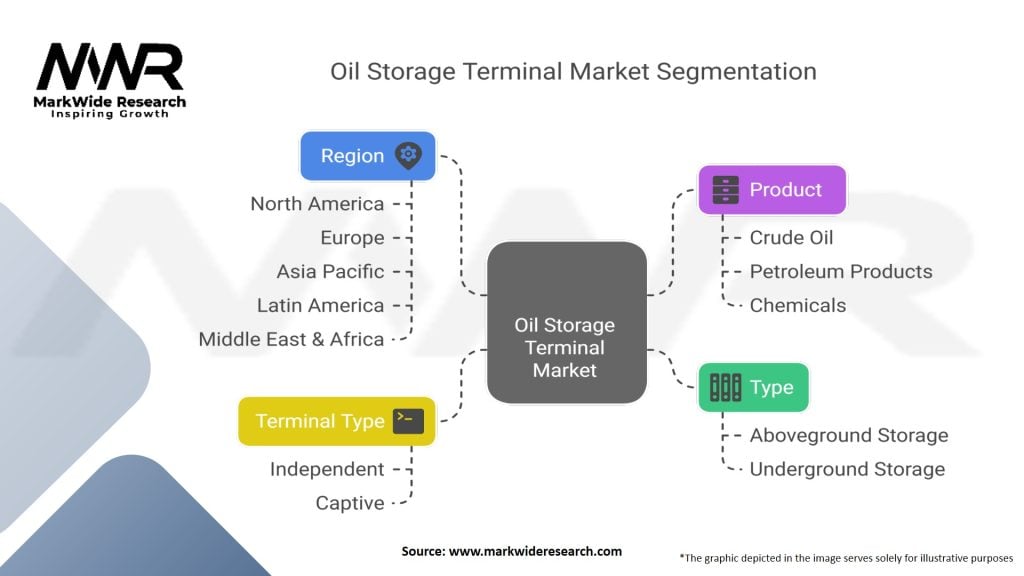

The oil storage terminal market can be segmented based on various factors, including terminal type, product type, and end-user industry. The segmentation enables a deeper understanding of market dynamics, customer preferences, and growth opportunities. The common segmentation categories include:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The oil storage terminal market offers several benefits for industry participants and stakeholders, including:

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis of the oil storage terminal market provides valuable insights into the market’s internal and external factors, shaping its current and future trajectory.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the oil storage terminal market. The unprecedented decrease in oil demand, caused by travel restrictions, economic slowdown, and lockdown measures, led to a surplus in oil production. This surplus strained existing storage capacities, resulting in temporary storage shortages and volatile oil prices. However, as the global economy recovers and oil demand rebounds, the market is expected to regain momentum, driven by the need to replenish strategic reserves and ensure energy security.

Key Industry Developments

Analyst Suggestions

Based on the analysis of the oil storage terminal market, analysts suggest the following strategies:

Future Outlook

The oil storage terminal market is expected to witness continued growth in the coming years. Factors such as increasing energy demand, expanding refining capacities, strategic inventory management, and the need for energy security will drive market growth. The adoption of advanced technologies, sustainable practices, and strategic partnerships will further enhance the market’s potential. However, challenges related to environmental regulations, infrastructure limitations, and geopolitical uncertainties will need to be addressed for sustained market expansion.

Conclusion

The oil storage terminal market plays a vital role in ensuring a steady supply of oil and petroleum products to meet global energy demands. The market is characterized by growing energy consumption, increasing oil production, and the need for strategic inventory management. While market drivers include expanding refining capacities and the growing demand for energy, restraints such as environmental concerns and volatile oil prices pose challenges. However, opportunities exist in strategic partnerships, technological advancements, and emerging markets. The market is dynamic and influenced by regional factors, competitive landscapes, and industry trends. Looking ahead, the market is poised for growth, driven by operational advancements, sustainable practices, and the recovery from the Covid-19 pandemic.

What is an oil storage terminal?

An oil storage terminal is a facility designed for the storage of crude oil and refined petroleum products. These terminals play a crucial role in the oil supply chain, enabling the safe and efficient management of oil inventories for distribution and transportation.

Who are the key players in the Oil Storage Terminal Market?

Key players in the Oil Storage Terminal Market include companies such as Vopak, Magellan Midstream Partners, and Kinder Morgan, among others. These companies are involved in the development and operation of storage facilities that cater to various oil and gas needs.

What are the main drivers of growth in the Oil Storage Terminal Market?

The growth of the Oil Storage Terminal Market is driven by increasing global oil demand, the expansion of refining capacities, and the need for strategic reserves. Additionally, geopolitical factors and fluctuations in oil prices also contribute to the market’s expansion.

What challenges does the Oil Storage Terminal Market face?

The Oil Storage Terminal Market faces challenges such as regulatory compliance, environmental concerns, and the high costs associated with infrastructure development. Additionally, market volatility and competition from alternative energy sources pose significant hurdles.

What opportunities exist in the Oil Storage Terminal Market?

Opportunities in the Oil Storage Terminal Market include the development of advanced storage technologies and the expansion into emerging markets. The increasing focus on sustainability and the integration of renewable energy sources also present new avenues for growth.

What trends are shaping the Oil Storage Terminal Market?

Trends in the Oil Storage Terminal Market include the adoption of digital technologies for monitoring and management, the shift towards more sustainable practices, and the consolidation of storage facilities. These trends are influencing how companies operate and invest in storage solutions.

Oil Storage Terminal Market:

| Segmentation Details | Description |

|---|---|

| Type | Aboveground Storage, Underground Storage |

| Product | Crude Oil, Petroleum Products, Chemicals |

| Terminal Type | Independent, Captive |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Oil Storage Terminal Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at