444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Mobile point of sale (POS) refers to the use of smartphones, tablets, and other mobile devices to process payments, manage inventory, and perform other essential business functions. Mobile POS solutions are becoming increasingly popular, particularly among small businesses and entrepreneurs who want to streamline their operations and offer their customers a more convenient and efficient payment option.

The global mobile POS market is expected to experience significant growth in the coming years, driven by factors such as the increasing adoption of mobile devices, the growing demand for contactless payment solutions, and the need for businesses to offer a more personalized customer experience.

In this article, we will provide an in-depth analysis of the mobile POS market, including its meaning, executive summary, key market insights, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, Covid-19 impact, key industry developments, analyst suggestions, future outlook, and conclusion.

Executive Summary

The global mobile POS market is expected to experience significant growth in the coming years, driven by factors such as the increasing adoption of mobile devices, the growing demand for contactless payment solutions, and the need for businesses to offer a more personalized customer experience.

In terms of market size, the global mobile POS market was valued at USD 15.13 billion in 2020 and is expected to grow at a CAGR of 17.1% from 2021 to 2028, reaching a market size of USD 58.42 billion by 2028.

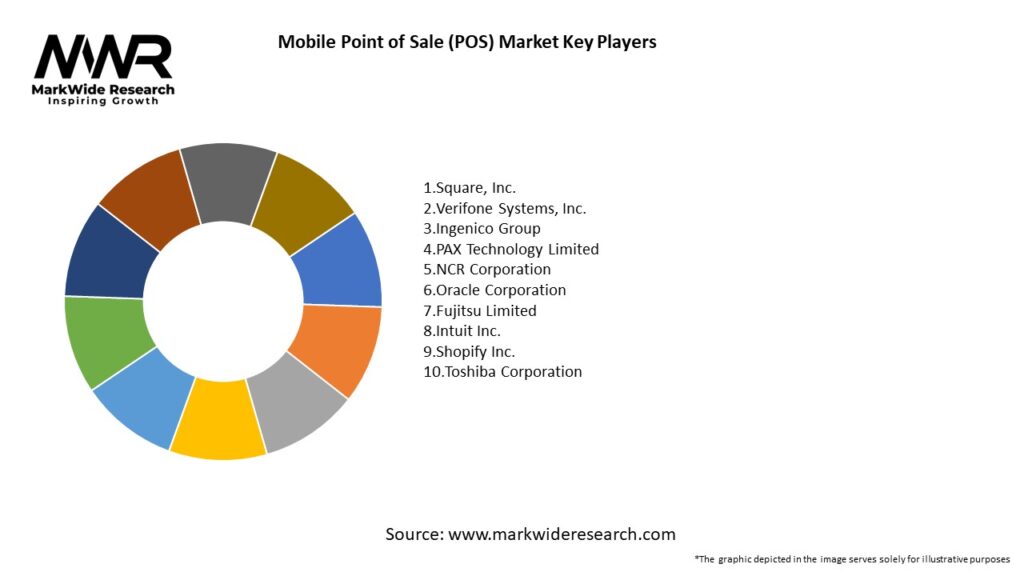

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Shift to Contactless Payments: Growing consumer preference for tap-to-pay and mobile wallets drives mobile POS adoption.

Hardware-Software Bundling: Integrated solutions (card reader + cloud POS app) simplify setup for small merchants.

SME Empowerment: Portable, low-cost systems enable micro and pop-up retailers to accept digital payments.

Omnichannel Integration: Mobile POS seamlessly connects in-store, online, and on-the-go sales channels.

Security & Compliance: EMV, PCI-DSS, and end-to-end encryption requirements shape solution design.

Market Drivers

E-commerce Growth Spillover: Brick-and-mortar retailers adopt mobile POS to provide digital-style flexibility.

Gig Economy Expansion: Food trucks, ride-share drivers, and home-service providers leverage portable POS for on-site check-out.

Fintech Partnerships: Banks and payment processors offer turnkey mobile POS to drive transaction volume.

Lower Entry Costs: Subscription and pay-as-you-go pricing reduce barriers for new merchants.

Regulatory Push for Financial Inclusion: Governments support digital payments to bring unbanked SMEs into the formal economy.

Market Restraints

Network Dependence: Unreliable connectivity can disrupt transactions in remote or high-traffic areas.

Device Fragmentation: Compatibility issues across various smartphones and tablet models complicate deployments.

Data Security Concerns: Small merchants may lack the expertise to manage encryption updates and compliance.

Transaction Fees: Per-transaction charges can deter price-sensitive businesses.

Integration Complexity: Linking mobile POS with existing ERP, inventory, or loyalty systems may require custom development.

Market Opportunities

5G Enablement: Low-latency, high-bandwidth networks will improve transaction speeds and reliability.

Value-Added Services: Lending, inventory management, and analytics bundled into mobile POS platforms.

Cross-Border Acceptance: Multi-currency and dynamic currency conversion features for traveling merchants.

AI-Driven Upselling: Embedded recommendation engines to boost average ticket size at checkout.

Ecosystem Partnerships: Alliances with delivery, CRM, and marketing platforms to create unified merchant solutions.

Market Dynamics

The mobile POS market is characterized by intense competition among vendors, with players vying for market share by offering innovative features and functionalities. In addition, the market is also seeing significant consolidation, with larger players acquiring smaller ones to expand their product portfolios and geographic reach.

The market is also seeing significant investment in research and development, with vendors investing in technologies such as biometrics, artificial intelligence, and machine learning to enhance the functionality and security of their mobile POS solutions.

Regional Analysis

In terms of regional analysis, North America dominated the global mobile POS market in 2020, accounting for a significant share of the market. This can be attributed to factors such as the high penetration of mobile devices and contactless payment solutions in the region, as well as the presence of a large number of key players in the market.

However, the Asia Pacific region is expected to witness the highest growth rate in the coming years, driven by factors such as the increasing adoption of mobile devices and growing demand for contactless payment solutions in countries such as China and India.

Competitive Landscape

Leading companies in the Mobile Point of Sale (POS) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

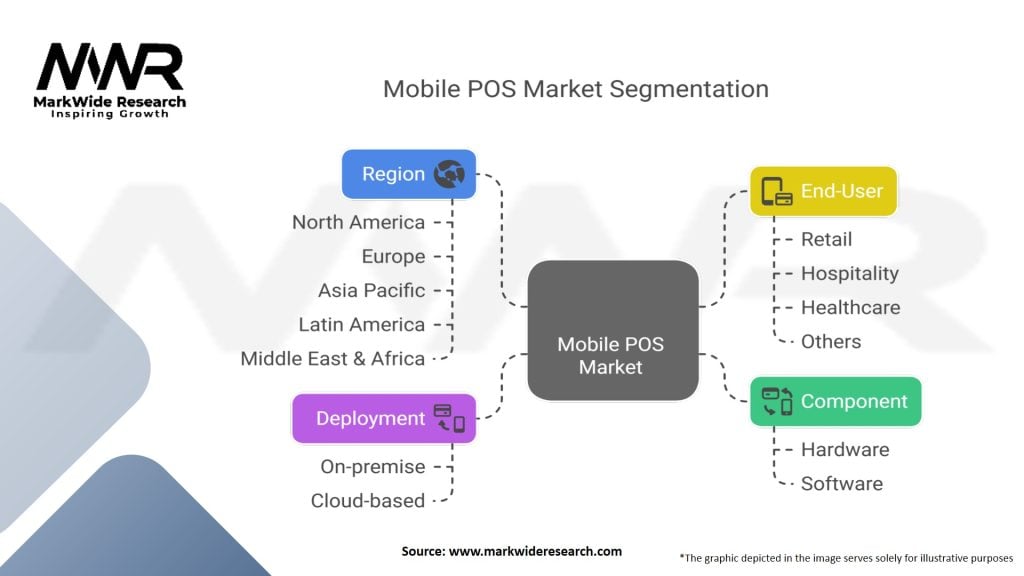

Segmentation

The global mobile POS market can be segmented on the basis of component, technology, deployment, application, and region.

By component, the market can be segmented into hardware, software, and services.

By technology, the market can be segmented into NFC, Bluetooth, and others.

By deployment, the market can be segmented into on-premise and cloud-based.

By application, the market can be segmented into retail, hospitality, healthcare, entertainment, and others.

Category-wise Insights

In terms of category-wise insights, the hardware segment is expected to dominate the global mobile POS market in the coming years, driven by factors such as the increasing adoption of mobile devices and growing demand for contactless payment solutions.

The retail segment is expected to hold the largest share of the market in terms of application, driven by factors such as the growing need for businesses to offer a more personalized customer experience and the increasing adoption of mobile POS solutions by small and medium-sized retailers.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the mobile POS market, driving increased demand for contactless payment solutions as consumers looked to minimize their risk of exposure to the virus. In addition, the pandemic also accelerated the adoption of mobile POS solutions, particularly among small and medium-sized businesses that were forced to adapt to changing consumer behavior and social distancing guidelines.

Key Industry Developments

Analyst Suggestions

Analysts suggest that vendors in the mobile POS market should focus on developing solutions that offer advanced security features, such as biometric authentication and encryption, to address concerns around mobile payments. In addition, vendors should also focus on integrating their solutions with other business applications such as inventory management and accounting software to offer a more comprehensive solution to customers.

Future Outlook

The global mobile POS market is expected to continue to grow in the coming years, driven by factors such as the increasing adoption of mobile devices, the growing demand for contactless payment solutions, and the need for businesses to offer a more personalized customer experience. In addition, the market is also expected to see significant consolidation, with larger players acquiring smaller ones to expand their product portfolios and geographic reach.

Conclusion

The mobile POS market is a rapidly growing industry, driven by factors such as the increasing adoption of mobile devices, the growing demand for contactless payment solutions, and the need for businesses to offer a more personalized customer experience. While the market faces challenges such as security concerns and limited functionality compared to traditional POS systems, it also offers significant opportunities for vendors who can offer innovative solutions that meet the needs of businesses and consumers. With the market expected to continue to grow in the coming years, the mobile POS industry presents significant opportunities for investors, businesses, and other stakeholders.

What is a Mobile Point of Sale (POS)?

A Mobile Point of Sale (POS) is a portable payment processing system that allows businesses to conduct transactions using mobile devices such as smartphones or tablets. This technology enables merchants to accept payments anywhere, enhancing customer convenience and streamlining sales processes.

Who are the key players in the Mobile Point of Sale (POS) Market?

Key players in the Mobile Point of Sale (POS) Market include Square, PayPal, and Shopify, which provide various solutions for businesses to manage transactions and inventory. Other notable companies include Verifone and Ingenico, among others.

What are the main drivers of growth in the Mobile Point of Sale (POS) Market?

The growth of the Mobile Point of Sale (POS) Market is driven by the increasing adoption of smartphones, the demand for contactless payment solutions, and the need for businesses to enhance customer experiences. Additionally, the rise of e-commerce and mobile shopping is contributing to this trend.

What challenges does the Mobile Point of Sale (POS) Market face?

Challenges in the Mobile Point of Sale (POS) Market include security concerns related to data breaches and fraud, as well as the need for reliable internet connectivity. Furthermore, competition from traditional POS systems can hinder market penetration.

What opportunities exist in the Mobile Point of Sale (POS) Market?

Opportunities in the Mobile Point of Sale (POS) Market include the expansion of services into emerging markets, the integration of advanced technologies like AI and machine learning, and the growing trend of mobile wallets. These factors can enhance functionality and attract new customers.

What trends are shaping the Mobile Point of Sale (POS) Market?

Trends in the Mobile Point of Sale (POS) Market include the increasing use of cloud-based solutions, the rise of subscription-based pricing models, and the integration of loyalty programs into POS systems. These trends are helping businesses to improve customer engagement and streamline operations.

Mobile Point of Sale (POS) Market

| Segmentation | Details |

|---|---|

| Component | Hardware, Software |

| Deployment | On-premise, Cloud-based |

| End-User | Retail, Hospitality, Healthcare, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mobile Point of Sale (POS) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at