444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Natural gas is a type of fossil fuel that is formed from the remains of plants and animals. It is a colorless and odorless gas that is primarily composed of methane. Natural gas is widely used as a source of energy in the residential, commercial, and industrial sectors. It is also used as a feedstock for the production of various chemicals.

The global natural gas market is expected to grow at a significant rate in the coming years. The market is driven by the increasing demand for natural gas as a cleaner alternative to coal and oil. The growing adoption of natural gas in the transportation sector is also contributing to the growth of the market.

In this article, we will provide a comprehensive analysis of the natural gas market, including market trends, drivers, restraints, opportunities, and regional analysis.

Natural gas is a type of fossil fuel that is primarily composed of methane. It is formed from the remains of plants and animals that lived millions of years ago. The gas is extracted from underground reservoirs using drilling techniques. Natural gas is widely used as a source of energy in the residential, commercial, and industrial sectors. It is also used as a feedstock for the production of various chemicals.

Executive Summary:

The global natural gas market is expected to grow at a significant rate in the coming years. The market is driven by the increasing demand for natural gas as a cleaner alternative to coal and oil. The growing adoption of natural gas in the transportation sector is also contributing to the growth of the market.

The market is characterized by the presence of several key players such as Exxon Mobil Corporation, Royal Dutch Shell plc, and BP plc. The market is also highly fragmented, with several small and medium-sized players operating in the market.

The Asia Pacific region is expected to be the fastest-growing market for natural gas during the forecast period. The region is witnessing significant investments in the natural gas sector, particularly in countries such as China and India.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Bridge Fuel Status: Natural gas is positioned as a transition energy source between coal and renewable generation.

Liquefied Natural Gas (LNG) Expansion: Infrastructure growth lowers geographic supply constraints and enables global trade.

Price Volatility: Spot pricing and linkage to oil indices create revenue uncertainty for producers and consumers.

Regulatory & Environmental Pressures: Methane emissions controls and decarbonization targets influence market dynamics.

Infrastructure Bottlenecks: Pipeline capacity constraints and regasification terminal backlogs limit supply flexibility.

Market Drivers

Power Generation Demand: Gas-fired plants offer flexible, dispatchable capacity to complement intermittent renewables.

Industrial Heat Use: Chemicals, metals, and manufacturing sectors rely on natural gas for high-temperature processes.

Residential & Commercial Heating: Urbanization and improved living standards drive steady gas consumption.

LNG Trade Growth: New export terminals in North America and Australia expand supply to Asia and Europe.

Policy Incentives: Subsidies and carbon pricing mechanisms favor natural gas over coal.

Market Restraints

Methane Leakage Concerns: Environmental and reputational risks from upstream and midstream emissions.

Renewable Competition: Falling costs of wind, solar, and storage challenge gas-based generation economics.

Geopolitical Risks: Supply disruptions from transit country disputes or production region instability.

Infrastructure Costs: High capital requirements for pipelines, LNG liquefaction, and storage facilities.

Regulatory Uncertainty: Shifting energy policies and climate targets can rapidly alter market forecasts.

Market Opportunities

Small-Scale LNG: Mobile and distributed liquefaction/regasification units to serve remote or niche markets.

Gas-to-Power in Emerging Economies: New grid connections in Africa and Southeast Asia increase demand.

Carbon Capture Integration: Coupling gas plants with CCUS to reduce lifecycle emissions.

Renewable Gas Blends: Introduction of biomethane or hydrogen admixtures into existing pipelines.

Digital Pipeline Management: IoT sensors and AI for leak detection, flow optimization, and maintenance scheduling.

Market Dynamics:

The natural gas market is characterized by several trends, drivers, restraints, and opportunities. The market is driven by the increasing demand for natural gas as a cleaner alternative to coal and oil. The growing adoption of natural gas in the transportation sector is also contributing to the growth of the market.

The market is also witnessing significant investments in the natural gas sector, particularly in countries such as China and India. Technological advancements in natural gas exploration and production are also driving the growth of the market.

However, the market is also restrained by fluctuations in natural gas prices, limited infrastructure for natural gas distribution and transportation, and stringent regulations on natural gas exploration and production.

Despite these challenges, the market presents several opportunities for growth. The increasing demand for natural gas in emerging economies, development of new natural gas reserves, and growing demand for liquefied natural gas (LNG) are some of the key opportunities in the market.

Regional Analysis:

The natural gas market is analyzed based on key regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The Asia Pacific region is expected to be the fastest-growing market for natural gas during the forecast period.

The region is witnessing significant investments in the natural gas sector, particularly in countries such as China and India. The increasing demand for natural gas in the region is driven by the growing population, urbanization, and industrialization.

North America and Europe are mature markets for natural gas, with a well-established infrastructure for distribution and transportation. However, these regions are also witnessing significant investments in the natural gas sector, particularly in the development of new reserves.

Competitive Landscape:

Leading companies in the Natural Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

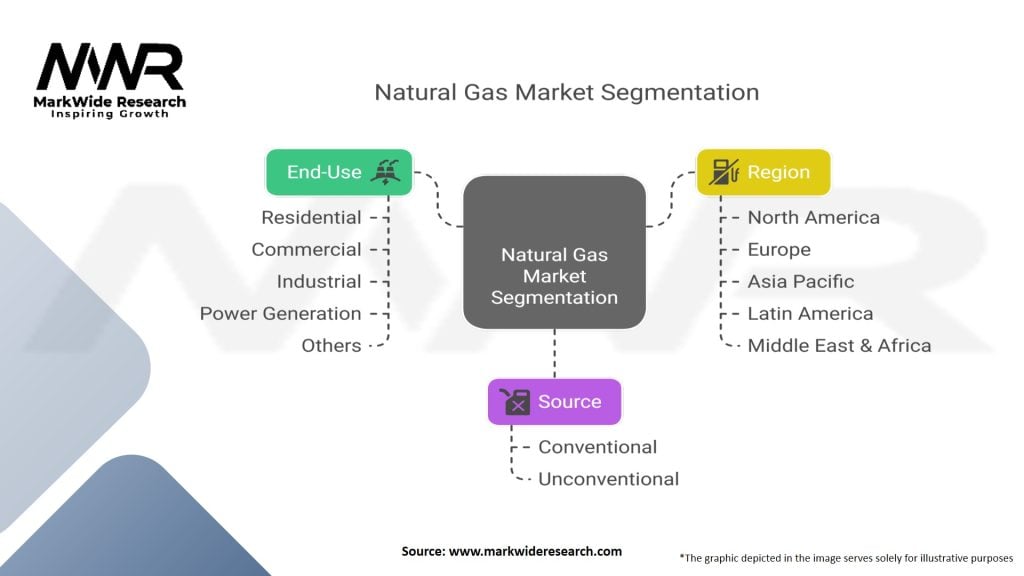

Segmentation:

The natural gas market is segmented based on type, application, and region. Based on type, the market is segmented into conventional and unconventional natural gas. Based on application, the market is segmented into residential, commercial, industrial, and transportation.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic has had a significant impact on the natural gas market. The pandemic has led to a decline in demand for natural gas due to the slowdown in economic activity.

However, the market is expected to recover in the coming years as the global economy recovers from the pandemic.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The global natural gas market is expected to grow at a significant rate in the coming years. The market is driven by the increasing demand for natural gas as a cleaner alternative to coal and oil.

The growing adoption of natural gas in the transportation sector is also contributing to the growth of the market. The market is also witnessing significant investments in the natural gas sector, particularly in emerging economies such as China and India.

Conclusion:

The global natural gas market presents several opportunities for growth, driven by the increasing demand for natural gas as a cleaner alternative to coal and oil. Despite the challenges, the market is expected to grow at a significant rate in the coming years.

Industry players should focus on investing in technological advancements and expanding their natural gas production capacity to meet the growing demand for natural gas. The future outlook for the natural gas market is positive, and the market presents several opportunities for industry participants and stakeholders.

Natural Gas Market

| Segmentation | Details |

|---|---|

| End-Use | Residential, Commercial, Industrial, Power Generation, Others |

| Source | Conventional, Unconventional |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Natural Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at