444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Computer-Aided Manufacturing (CAM) is an advanced technology that has transformed the manufacturing industry by automating the manufacturing process. CAM software uses computer-generated models to control and manage the manufacturing process, improving efficiency, accuracy, and productivity. The CAM software has become an essential tool for manufacturers to stay competitive in the global market. The global Computer-Aided Manufacturing (CAM) market is expected to grow at a CAGR of 6.2% during the forecast period (2021-2026).

Computer-Aided Manufacturing (CAM) is the process of using computer software to control and automate manufacturing processes. It includes various software tools and techniques such as CAD (Computer-Aided Design), CAM (Computer-Aided Manufacturing), and CAE (Computer-Aided Engineering). CAM software is used to design, manufacture, and control industrial processes such as CNC (Computer Numerical Control) machines, robotics, and other automated equipment. The software can create 3D models of products, optimize manufacturing processes, and automate the production process.

Executive Summary

The Computer-Aided Manufacturing (CAM) market is expected to grow at a steady rate during the forecast period due to the increasing adoption of automation technologies in the manufacturing industry. The market is driven by factors such as the need for increased efficiency and productivity, the growing demand for customized products, and the rising trend of Industry 4.0. The Asia-Pacific region is expected to dominate the market due to the presence of major manufacturing hubs such as China, India, and Japan. Key players in the market are focusing on strategic partnerships and collaborations to expand their market presence and increase their product portfolio.

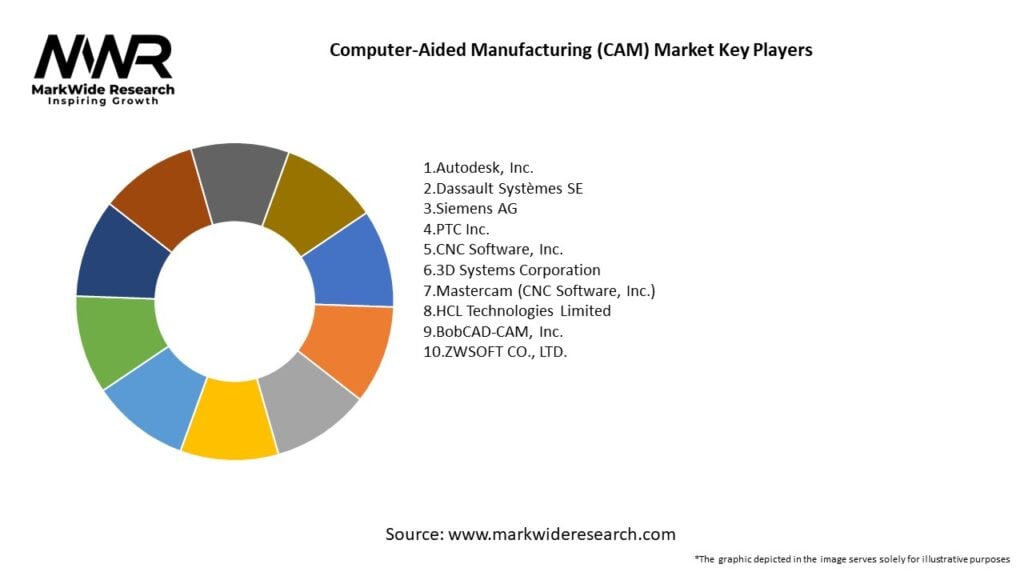

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The CAM market is growing at a CAGR of approximately 7–9%, outpacing general manufacturing IT software due to its direct impact on productivity and cost reduction.

Five-axis and multi-axis machining modules represent the fastest-growing segment, driven by demand for complex geometries in aerospace, medical implants, and mold making.

Cloud-based CAM platforms and remote collaboration features are gaining traction, facilitating distributed engineering teams and global shop-floor coordination.

Integration with digital twins and virtual commissioning tools enhances process validation before physical production, reducing startup scrap and ramp-up time.

Market Drivers

Industry 4.0 Adoption: As smart factories evolve, CAM systems play a central role in linking design data to shop-floor execution and gathering performance metrics for continuous improvement.

Complex Part Requirements: The need for intricate components with tight tolerances—common in aerospace, automotive, and medical sectors—fuels demand for advanced CAM functionalities such as adaptive clearing and high-speed machining.

Labor Shortages: Automation of programming tasks reduces reliance on skilled CNC programmers, enabling faster setup and lower training overhead.

Shorter Product Cycles: Rapid prototyping and small-batch production models require CAM software capable of quick toolpath generation and on-the-fly adjustments.

Sustainability Goals: CAM-driven optimization of toolpaths and machining strategies minimizes material waste, energy use, and carbon footprint.

Market Restraints

High Initial Investment: Enterprise-grade CAM solutions and their associated hardware can be costly, deterring smaller shops from full-scale adoption.

Integration Complexity: Seamless interoperability with existing CAD, PLM, and ERP systems requires careful customization and IT support.

Skill Gaps: While CAM automates much of the programming work, operators still need training to leverage advanced modules effectively.

Legacy Equipment Constraints: Older CNC machines may lack the connectivity or processing power to support modern CAM workflows and real-time data exchange.

Security Concerns: Cloud-hosted CAM platforms introduce data-security and IP-protection challenges, especially for sensitive defense or medical applications.

Market Opportunities

Subscription & SaaS Models: Offering modular, cloud-based CAM on a subscription basis lowers entry barriers for SMEs and encourages adoption of premium features as needed.

AI-Enabled Optimization: Embedding machine learning algorithms to suggest optimal toolpaths, feeds, and speeds based on historical performance data can accelerate programming cycles.

Hybrid Manufacturing Support: Extending CAM capabilities to plan both additive and subtractive sequences in a unified environment addresses growing demand for combined processes.

Augmented Reality (AR) Integration: AR-driven guidance for machine setup and real-time error detection can further reduce downtime and training requirements.

Localized Ecosystems: Partnerships between CAM vendors and regional machine-tool suppliers can deliver turnkey solutions tailored to local manufacturing needs.

Market Dynamics

The global Computer-Aided Manufacturing (CAM) market is highly competitive and dynamic, with numerous players operating in the market. The market is driven by several factors such as the need for increased efficiency and productivity, the growing demand for customized products, and the rising trend of Industry 4.0.

The market is also influenced by the increasing adoption of automation technologies in the manufacturing industry. CAM software has become an essential tool for manufacturers to stay competitive in the global market. The growing trend of Industry 4.0, which emphasizes the use of automation, data exchange, and artificial intelligence, is also driving the adoption of CAM software.

The market is characterized by the presence of major players such as Autodesk, Inc., Dassault Systèmes SE, Siemens AG, and PTC Inc. These players are focusing on strategic partnerships and collaborations to expand their market presence and increase their product portfolio. For instance, in December 2020, Siemens AG announced a collaboration with Nexa3D to develop ultra-fast additive manufacturing solutions.

Regional Analysis

The Asia-Pacific region is expected to dominate the Computer-Aided Manufacturing (CAM) market during the forecast period. The region is home to major manufacturing hubs such as China, India, and Japan. The region is also witnessing significant growth due to the increasing adoption of advanced manufacturing technologies in the region.

North America and Europe are also expected to witness significant growth during the forecast period due to the increasing adoption of automation technologies in the manufacturing industry. The regions are also witnessing a growing trend of Industry 4.0, which is driving the adoption of CAM software.

Competitive Landscape

Leading Companies in the Computer-Aided Manufacturing (CAM) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The global Computer-Aided Manufacturing (CAM) market is segmented based on component, deployment type, application, and end-use industry.

By component, the market is segmented into software and services. The software segment is further sub-segmented into standalone and integrated.

By deployment type, the market is segmented into on-premise and cloud-based.

By application, the market is segmented into aerospace and defense, automotive, industrial machinery, healthcare, and others.

By end-use industry, the market is segmented into automotive, aerospace and defense, healthcare, and others.

Category-wise Insights

2.5- to 3-Axis Milling Modules: Core functionality for basic part machining; highest penetration across small job shops.

5-Axis and Above: Essential for complex geometry and undercuts in aerospace, automotive, and medical implants; fastest growth due to performance demands.

Multitasking (Mill-Turn): Combines milling and turning operations in a single setup, reducing cycle times and improving part accuracy for high-volume production.

EDM & Wire EDM: Critical for hard-to-machine materials and precision components, occupying a specialized but high-value niche.

CAM Simulation & Verification: Collision detection and virtual machining reduce scrap and protect expensive tooling and machine assets.

Key Benefits for Industry Participants and Stakeholders

Reduced Programming Time: Automated feature recognition and generative toolpath strategies accelerate CAM programming by up to 60%.

Improved Part Quality: Advanced simulation and optimization minimize machining marks, tool deflection, and dimensional errors.

Lower Operating Costs: Optimized feed rates, tool engagements, and cycle times extend tool life and reduce energy consumption.

Enhanced Collaboration: Cloud-enabled CAM platforms allow design, engineering, and shop-floor teams to work concurrently on part programs.

Scalability: Modular architectures and subscription licenses enable manufacturers to expand CAM capabilities as projects and workforce needs evolve.

SWOT Analysis

Strengths:

Direct impact on manufacturing throughput, quality, and cost.

Broad applicability across multiple industries and machine types.

Continuous innovation in toolpath algorithms and usability features.

Weaknesses:

Steep learning curve for advanced multi-axis and hybrid machining modules.

Dependence on machine-tool compatibility and robust post-processors.

Upfront software and infrastructure investment can be substantial.

Opportunities:

Integration with AI for predictive toolpath optimization and anomaly detection.

Expansion into emerging markets with growing manufacturing bases (e.g., Eastern Europe, Mexico).

Development of low-code/no-code CAM interfaces to democratize programming.

Threats:

Competition from open-source or lower-cost CAM alternatives.

Rapid changes in manufacturing technology (e.g., direct digital manufacturing) that may shift the CAM value proposition.

Data security and IP-protection concerns in cloud deployments.

Market Key Trends

Generative Toolpath Strategies: AI-driven toolpaths that adaptively refine machining motions for minimal cycle times and optimal surface finishes.

Augmented Programming: Use of AR/VR tools for immersive toolpath review, tooling setup, and virtual commissioning.

Collaborative Platforms: Shared cloud workspaces enabling version control, change management, and cross-site standardization of CAM templates.

Edge Computing: On-machine CAM offloading for real-time toolpath adjustments based on spindle load and vibration feedback.

Sustainability Metrics: CAM suites incorporating energy-use calculators to guide eco-friendly machining practices.

Covid-19 Impact

The pandemic underscored the need for remote connectivity and digital resilience. Manufacturers accelerated adoption of cloud-based CAM to enable distributed programming and off-site technical support. Virtual training modules and digital-twin simulations replaced on-site courses, widening accessibility for global engineering teams. As supply-chain disruptions prompted near-shoring, localized CAM capabilities became critical for rapid production ramp-up.

Key Industry Developments

Siemens’ NX X CAM Release: Introduced generative CAM powered by AI, enabling automated feature detection and process planning in seconds.

Autodesk’s Netfabb Integration: Merged CAM and additive workflows, allowing hybrid machining and 3D printing sequences within a single platform.

Hexagon’s Edge Pro for Cloud: Launched a SaaS version of its flagship CAM software, offering on-demand compute resources and collaborative workspaces.

Analyst Suggestions

Prioritize Interoperability: Select CAM solutions with robust API ecosystems and support for open-data standards to future-proof investments.

Invest in Training & Change Management: Ensure workforce readiness through blended learning—combining virtual labs, peer coaching, and on-site mentorship—to maximize software ROI.

Leverage Outcome-Based Licensing: Negotiate flexible license models tied to production volumes or feature usage to align costs with business performance.

Pilot AI-Driven Modules: Test generative CAM and simulation-based verification in controlled projects to assess productivity gains before wider rollout.

Future Outlook

The CAM market in North America and Europe will continue to evolve alongside manufacturing’s digital transformation. Advances in AI, edge computing, and hybrid machining will raise the bar for part complexity and production agility. Demand for subscription and cloud-based delivery will grow, especially among SMEs seeking scalable solutions. As machine tools and CAM software become more tightly integrated, manufacturers that embrace data-driven, adaptive machining workflows will achieve significant competitive advantage in cost, quality, and time to market.

Conclusion

In conclusion, Computer-Aided Manufacturing software has become a cornerstone of modern production, driving efficiency, precision, and innovation across industries. Stakeholders who invest in advanced CAM capabilities—supported by robust training, interoperability strategies, and outcome-based licensing—will be best positioned to navigate evolving market demands and capitalize on opportunities presented by Industry 4.0 and sustainable manufacturing initiatives.

What is Computer-Aided Manufacturing (CAM)?

Computer-Aided Manufacturing (CAM) refers to the use of software and computer-controlled machinery to automate manufacturing processes. It encompasses various applications such as CNC machining, additive manufacturing, and robotics to enhance production efficiency and precision.

Who are the key players in the Computer-Aided Manufacturing (CAM) Market?

Key players in the Computer-Aided Manufacturing (CAM) Market include Siemens, Autodesk, Hexagon, and Dassault Systèmes, among others. These companies are known for their innovative software solutions and technologies that drive efficiency in manufacturing processes.

What are the main drivers of growth in the Computer-Aided Manufacturing (CAM) Market?

The growth of the Computer-Aided Manufacturing (CAM) Market is driven by the increasing demand for automation in manufacturing, the need for precision in production processes, and the rising adoption of Industry Four-point-oh technologies. Additionally, the expansion of the aerospace and automotive sectors significantly contributes to market growth.

What challenges does the Computer-Aided Manufacturing (CAM) Market face?

The Computer-Aided Manufacturing (CAM) Market faces challenges such as high initial investment costs, the complexity of software integration, and the need for skilled personnel to operate advanced CAM systems. These factors can hinder the adoption of CAM technologies in smaller manufacturing firms.

What opportunities exist in the Computer-Aided Manufacturing (CAM) Market?

Opportunities in the Computer-Aided Manufacturing (CAM) Market include the development of advanced technologies like artificial intelligence and machine learning, which can enhance automation and decision-making in manufacturing. Additionally, the growing trend of customization in production offers new avenues for CAM applications.

What trends are shaping the Computer-Aided Manufacturing (CAM) Market?

Current trends in the Computer-Aided Manufacturing (CAM) Market include the integration of IoT devices for real-time monitoring, the rise of cloud-based CAM solutions, and the increasing focus on sustainable manufacturing practices. These trends are transforming how manufacturers approach production and efficiency.

Computer-Aided Manufacturing (CAM) Market

| Segmentation Details | Details |

|---|---|

| Component | Solution, Services |

| Application | Aerospace & Defense, Automotive, Industrial Equipment, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Computer-Aided Manufacturing (CAM) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at