444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Occupancy sensors have become an essential component in modern building automation systems, revolutionizing the way commercial, industrial, and residential spaces are managed. These sensors play a pivotal role in energy efficiency, security, and overall comfort by detecting human presence within a designated area and controlling lighting, HVAC, and other systems accordingly. The US Occupancy Sensors Market has witnessed significant growth in recent years, driven by the increasing adoption of smart building technologies, stringent energy efficiency regulations, and a growing focus on sustainability.

Meaning

Occupancy sensors, also known as presence or motion sensors, are electronic devices that detect the presence or absence of people in a specific area. These sensors employ various technologies such as passive infrared (PIR), ultrasonic, microwave, and dual-technology to identify human motion or heat signatures. By intelligently managing lighting, heating, and cooling systems, occupancy sensors offer a cost-effective and eco-friendly solution for reducing energy consumption and carbon footprint.

Executive Summary

The US Occupancy Sensors Market is experiencing robust growth owing to the rising demand for energy-efficient solutions and the need to comply with strict energy codes and standards. The market is witnessing a surge in commercial applications, with office spaces, retail outlets, and educational institutions adopting occupancy sensors to optimize energy usage and enhance occupant comfort. Additionally, technological advancements, such as wireless connectivity and integration with building automation systems, are further propelling the market’s expansion.

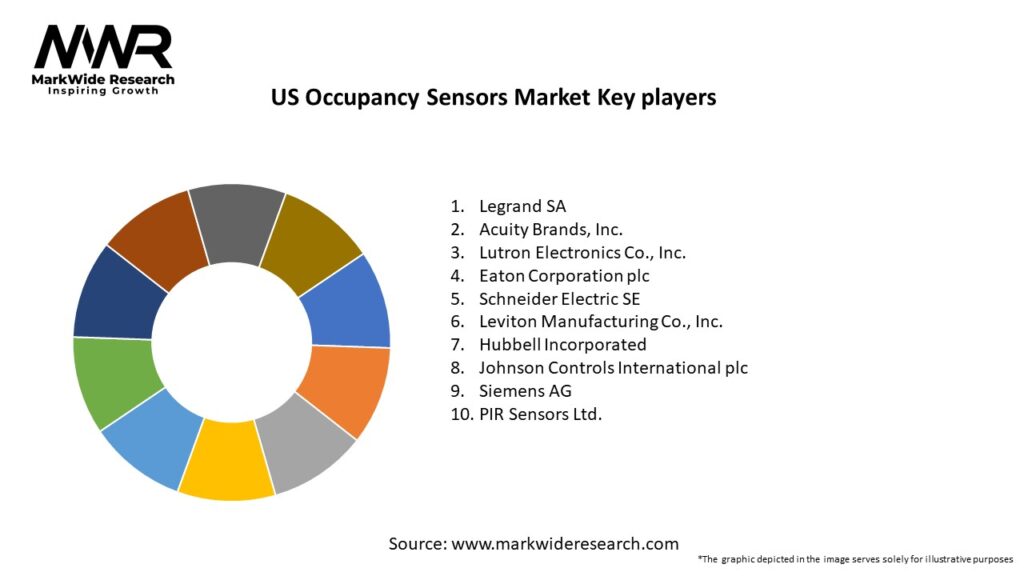

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The US Occupancy Sensors Market is highly dynamic, influenced by technological advancements, changing consumer preferences, and regulatory developments. The market’s growth is characterized by a constant influx of innovative products and solutions, catering to diverse end-user requirements. Additionally, the collaboration between sensor manufacturers and building automation companies is contributing to a seamless integration of occupancy sensors into comprehensive building management systems.

Regional Analysis

The US Occupancy Sensors Market exhibits varying trends across different regions. The major metropolitan areas are witnessing a higher adoption rate due to the concentration of commercial and industrial establishments. However, the demand for occupancy sensors is steadily spreading to suburban and rural regions as awareness about energy efficiency gains momentum.

Competitive Landscape

Leading Companies in the US Occupancy Sensors Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

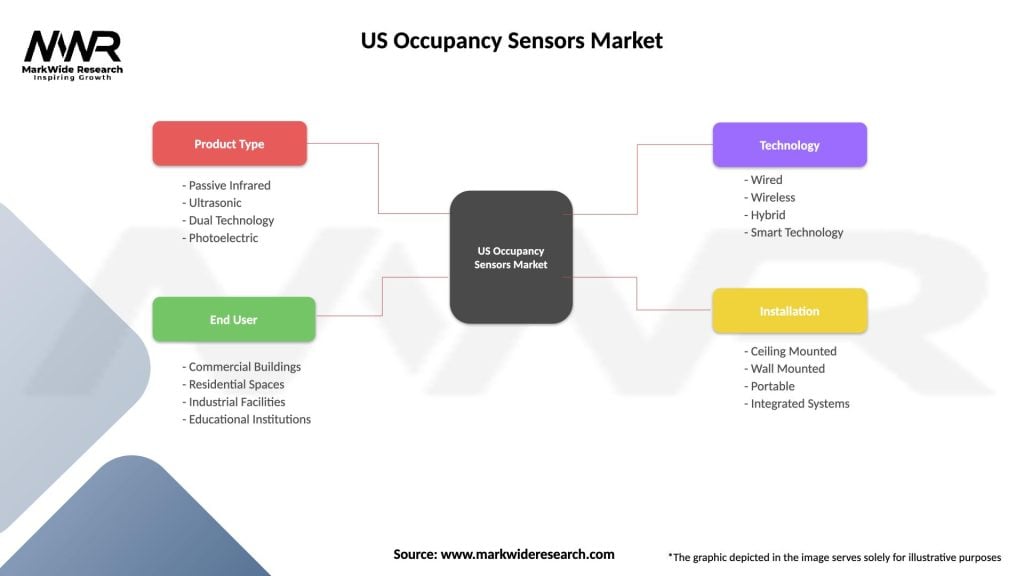

Segmentation

The US Occupancy Sensors Market can be segmented based on technology, application, end-user, and region. The technology segment includes PIR, ultrasonic, microwave, and dual-technology sensors. Applications range from lighting control to HVAC optimization, while end-users encompass commercial, industrial, and residential sectors.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic significantly impacted the US Occupancy Sensors Market. With widespread lockdowns and remote work arrangements, many commercial spaces experienced reduced occupancy. However, as businesses adapted to changing circumstances, the demand for occupancy sensors increased as they became a vital tool in managing spaces efficiently while adhering to social distancing norms and minimizing energy usage.

Key Industry Developments

Analyst Suggestions

Future Outlook

The US Occupancy Sensors Market is poised for steady growth in the coming years. As sustainability and energy efficiency remain top priorities for businesses and consumers, occupancy sensors will continue to be embraced across various sectors. Further advancements in IoT, AI, and data analytics will enhance the capabilities of occupancy sensors, driving their adoption in a wider array of applications.

Conclusion

The US Occupancy Sensors Market is witnessing a transformative phase as businesses and individuals recognize the importance of energy efficiency and sustainability. Occupancy sensors, with their ability to optimize energy consumption and enhance occupant comfort, have emerged as a key solution in this endeavor. Despite initial challenges, the market is primed for growth, and manufacturers, stakeholders, and policymakers must collaborate to capitalize on the vast potential of occupancy sensors in shaping the future of smart, energy-efficient buildings.

What is Occupancy Sensors?

Occupancy sensors are devices that detect the presence of people in a space and automatically control lighting, heating, or cooling systems. They are commonly used in commercial buildings, residential homes, and public spaces to enhance energy efficiency and improve user comfort.

What are the key players in the US Occupancy Sensors Market?

Key players in the US Occupancy Sensors Market include companies like Lutron Electronics, Legrand, and Honeywell. These companies are known for their innovative solutions and extensive product offerings in the occupancy sensor space, among others.

What are the main drivers of growth in the US Occupancy Sensors Market?

The main drivers of growth in the US Occupancy Sensors Market include increasing energy efficiency regulations, rising demand for smart building technologies, and the growing awareness of energy conservation among consumers. These factors are pushing more businesses and homeowners to adopt occupancy sensors.

What challenges does the US Occupancy Sensors Market face?

The US Occupancy Sensors Market faces challenges such as high installation costs and the complexity of integrating these sensors with existing building management systems. Additionally, there may be resistance from users unfamiliar with the technology.

What opportunities exist in the US Occupancy Sensors Market?

Opportunities in the US Occupancy Sensors Market include the expansion of smart home technologies and the increasing adoption of Internet of Things (IoT) solutions. As more consumers seek automated and energy-efficient solutions, the demand for advanced occupancy sensors is expected to rise.

What trends are shaping the US Occupancy Sensors Market?

Trends shaping the US Occupancy Sensors Market include the integration of artificial intelligence for improved accuracy and functionality, as well as the development of wireless and mobile-enabled sensors. These innovations are enhancing user experience and expanding application areas.

US Occupancy Sensors Market

| Segmentation Details | Description |

|---|---|

| Product Type | Passive Infrared, Ultrasonic, Dual Technology, Photoelectric |

| End User | Commercial Buildings, Residential Spaces, Industrial Facilities, Educational Institutions |

| Technology | Wired, Wireless, Hybrid, Smart Technology |

| Installation | Ceiling Mounted, Wall Mounted, Portable, Integrated Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the US Occupancy Sensors Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at