444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The US investment banking market is a vital segment of the financial services industry, playing a crucial role in facilitating capital raising, mergers and acquisitions, and other financial transactions for businesses and institutions. Investment banks act as intermediaries between issuers of securities and investors, offering specialized services to help clients achieve their financial goals. With a sophisticated and robust financial ecosystem, the US investment banking market attracts both domestic and international players seeking growth opportunities and financial expertise.

Meaning

Investment banking refers to a range of financial services that assist corporations, governments, and other entities in raising capital through issuing securities, providing financial advice, and executing complex financial transactions. These services encompass underwriting, mergers and acquisitions (M&A) advisory, asset management, securities trading, and more. Investment banks serve as intermediaries between buyers and sellers, using their expertise to structure deals and optimize financial outcomes for their clients.

Executive Summary

The US investment banking market is a dynamic and fast-paced industry that continues to evolve in response to changing economic conditions, regulatory landscapes, and technological advancements. The market’s growth is influenced by various factors, including economic indicators, corporate performance, and global financial trends. This report provides a comprehensive analysis of the US investment banking market, offering key insights into market drivers, restraints, opportunities, and emerging trends.

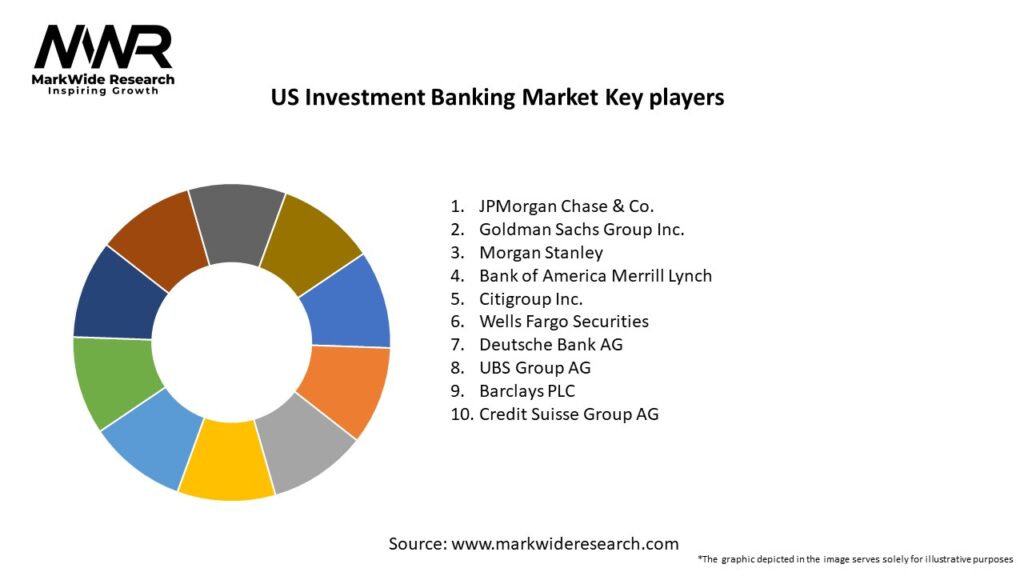

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The US investment banking market boasts a highly competitive landscape with both global and domestic players vying for market share. Investment banks offer a wide array of services, including capital raising, advisory, risk management, and financial restructuring. In recent years, technological innovation has played a significant role in transforming the industry, with the rise of digital platforms and algorithmic trading impacting traditional business models.

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The US investment banking market operates within a dynamic ecosystem influenced by a combination of internal and external factors. Market dynamics are driven by economic conditions, regulatory changes, technological disruptions, and global financial trends. Investment banks must be adaptable and agile to seize opportunities and navigate challenges in this ever-evolving landscape.

Regional Analysis

The US investment banking market exhibits regional variations, with major financial hubs like New York City, Chicago, and San Francisco playing a pivotal role in driving industry growth. These cities attract top talent, foster innovation, and serve as centers for financial transactions. The regional analysis also considers factors such as economic performance, industry concentration, and regulatory environments affecting market dynamics in different regions.

Competitive Landscape

Leading Companies in US Investment Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The US investment banking market can be segmented based on the types of services offered, including capital raising, M&A advisory, asset management, securities trading, and risk management. Additionally, segmentation based on client type, such as corporations, governments, institutions, and high-net-worth individuals, provides insights into the market’s diverse clientele.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the US investment banking market. The outbreak led to market volatility, disrupted deal-making activities, and necessitated remote work arrangements. However, investment banks demonstrated resilience by adapting to the challenges and leveraging digital solutions to continue operations.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the US investment banking market is promising, with continued growth expected in line with economic expansion and evolving financial needs. Technological advancements, sustainable finance initiatives, and emerging market trends will shape the industry’s trajectory, presenting both opportunities and challenges for market participants.

Conclusion

The US investment banking market serves as a cornerstone of the global financial industry, facilitating capital raising, M&A transactions, and financial advisory services. This comprehensive analysis explored the market’s dynamics, key insights, drivers, and restraints. As the financial landscape evolves, investment banks must embrace innovation, foster sustainable practices, and adapt to regulatory changes to thrive in this dynamic and competitive sector. By staying attuned to market trends and leveraging technological advancements, investment banks can navigate challenges and capitalize on emerging opportunities to achieve long-term success.

What is Investment Banking?

Investment banking refers to a segment of the financial services industry that assists individuals, corporations, and governments in raising capital by underwriting or acting as an agent in the issuance of securities. It also provides advisory services for mergers and acquisitions, restructurings, and other financial transactions.

What are the key players in the US Investment Banking Market?

Key players in the US Investment Banking Market include major firms such as Goldman Sachs, Morgan Stanley, and JPMorgan Chase. These companies are known for their extensive services in capital markets, advisory roles, and asset management, among others.

What are the growth factors driving the US Investment Banking Market?

The US Investment Banking Market is driven by factors such as increased corporate mergers and acquisitions, a rise in initial public offerings, and the growing demand for financial advisory services. Additionally, economic recovery and market volatility can lead to increased activity in investment banking.

What challenges does the US Investment Banking Market face?

The US Investment Banking Market faces challenges such as regulatory scrutiny, market competition, and economic uncertainties. Compliance with evolving regulations can increase operational costs and impact profitability for investment banks.

What opportunities exist in the US Investment Banking Market?

Opportunities in the US Investment Banking Market include the expansion of fintech solutions, increased focus on sustainable investments, and the potential for growth in emerging markets. Investment banks can leverage technology to enhance service delivery and client engagement.

What trends are shaping the US Investment Banking Market?

Trends shaping the US Investment Banking Market include the rise of digital transformation, increased emphasis on environmental, social, and governance (ESG) criteria, and the growing importance of data analytics in decision-making. These trends are influencing how investment banks operate and engage with clients.

US Investment Banking Market

| Segmentation Details | Description |

|---|---|

| Investment Strategy | Equity, Debt, Mergers & Acquisitions, Restructuring |

| Client Type | Corporations, Governments, Institutions, High-Net-Worth Individuals |

| Transaction Size | Small Cap, Mid Cap, Large Cap, Mega Cap |

| Service Type | Advisory, Underwriting, Asset Management, Research |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in US Investment Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at