444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview:

The US Anti Money Laundering Solution Market stands as a bulwark against illicit financial activities, ensuring the integrity of the financial ecosystem. In an era of complex financial transactions and evolving regulations, anti-money laundering (AML) solutions play a critical role in identifying and deterring money laundering, fraud, and other financial crimes. As the financial landscape becomes increasingly interconnected, this market is witnessing robust growth, driven by the imperative to protect financial institutions and maintain regulatory compliance.

Meaning:

Anti Money Laundering (AML) solutions are technological tools and processes designed to detect and prevent illegal activities involving money laundering, terrorism financing, and other financial crimes. These solutions employ advanced algorithms, data analysis, and pattern recognition to identify suspicious transactions and individuals, ensuring compliance with regulatory standards and safeguarding financial systems from abuse.

Executive Summary:

The US Anti Money Laundering Solution Market serves as a guardian of financial transparency and security. As financial transactions become increasingly complex, AML solutions emerge as a crucial defense against illicit activities. With regulatory scrutiny intensifying, financial institutions rely on these solutions to uphold their reputation, protect customer trust, and adhere to stringent compliance standards.

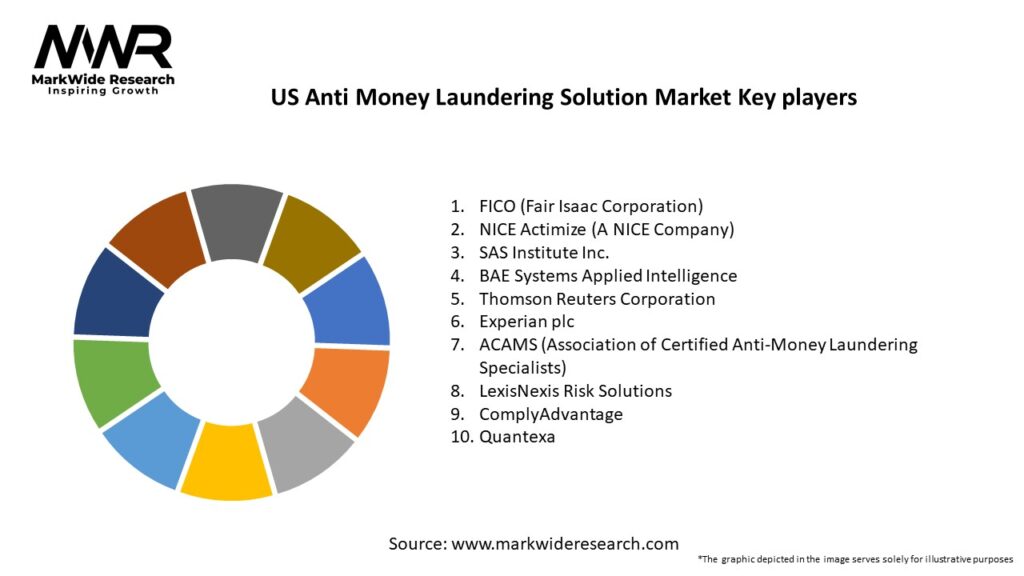

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

The growth of the US Anti Money Laundering Solution Market is driven by several factors:

Market Drivers:

Several drivers are propelling the US Anti Money Laundering Solution Market:

Market Restraints:

Despite its pivotal role, the US Anti Money Laundering Solution Market faces challenges such as:

Market Opportunities:

The US Anti Money Laundering Solution Market offers opportunities for growth:

Market Dynamics:

The dynamics of the US Anti Money Laundering Solution Market are characterized by a delicate equilibrium between technological advancements, regulatory requirements, and the evolving tactics of financial criminals. AML solution providers must strike this balance to offer effective tools that safeguard financial integrity.

Regional Analysis:

The adoption of AML solutions varies across states, influenced by factors such as the concentration of financial institutions, regulatory stringency, and the prevalence of financial crime. States with robust financial sectors are likely to lead in the adoption of advanced AML tools.

Competitive Landscape:

Leading Companies in US Anti Money Laundering Solution Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The US Anti Money Laundering Solution Market can be segmented based on solution types:

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

Industry participants and stakeholders reap multiple benefits from the US Anti Money Laundering Solution Market. Financial institutions safeguard their reputation by preventing money laundering and fraud, adhering to regulatory standards, and maintaining customer trust. Society benefits from a resilient financial system that thwarts criminal activities.

SWOT Analysis:

Market Key Trends:

Several key trends define the trajectory of the US Anti Money Laundering Solution Market:

Covid-19 Impact:

The Covid-19 pandemic emphasized the need for robust AML solutions as financial criminals sought to exploit the crisis. Financial institutions with advanced AML tools were better equipped to identify pandemic-related fraud and money laundering attempts.

Key Industry Developments:

Analyst Suggestions:

Industry analysts recommend the continuous evolution of AML solutions to counter ever-evolving financial crime tactics. Collaboration between technology providers, financial institutions, and regulatory bodies is key to ensuring the effectiveness of AML efforts.

Future Outlook:

The US Anti Money Laundering Solution Market is poised for sustained growth as financial institutions recognize the critical role of AML solutions in protecting their operations and reputation. With AI-driven innovations and collaborative approaches, the market’s trajectory is one of heightened financial resilience and unwavering commitment to combating financial crime.

Conclusion:

As the US Anti Money Laundering Solution Market evolves, it stands as a testament to the financial industry’s dedication to transparency, security, and ethical practices. With each transaction monitored, each suspicious activity flagged, and each criminal scheme thwarted, AML solutions play a pivotal role in fostering trust within the financial ecosystem. In a world of complex transactions and ever-evolving threats, these solutions stand strong as guardians of financial integrity.

US Anti Money Laundering Solution Market Segmentation:

| Segmentation | Details |

|---|---|

| Segment | Details |

| Component | Software, Services |

| Deployment | Cloud-based, On-premises |

| Region | United States |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in US Anti Money Laundering Solution Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at