444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview:

In the vast landscape of the energy sector, the United States Oil and Gas Upstream Market stands as a critical player, driving the nation’s economic growth and energy security. This comprehensive analysis delves into the nuances of this market, highlighting its key components, trends, challenges, and future prospects. From its meaning to the impact of Covid-19, and from regional dynamics to a SWOT analysis, this document provides valuable insights for industry participants, stakeholders, and enthusiasts alike.

The United States Oil and Gas Upstream Market refers to the initial phase of the industry’s value chain, encompassing exploration, drilling, production, and well operations. This segment plays a pivotal role in extracting crude oil and natural gas from the earth’s crust. As an integral part of the energy sector, the upstream market’s activities directly influence supply, demand, and prices. It’s a complex and capital-intensive arena, where technology, geopolitics, and environmental concerns intersect.

Meaning:

The term “upstream” originates from the metaphor of a river: the activities take place “upstream” from the end consumers. It involves locating oil and gas reserves, drilling exploratory wells, and subsequently extracting hydrocarbons. The process demands sophisticated technology, significant investments, and skilled human resources. The upstream market is akin to the backbone of the energy sector, providing the essential raw materials that power economies and industries.

Executive Summary:

The United States Oil and Gas Upstream Market is a critical driver of the nation’s energy security and economic prosperity. This market overview provides a glimpse into the complexities and opportunities within the upstream segment. From exploration to production, every stage demands substantial investments and expertise. While the sector has witnessed fluctuations due to various factors, advancements in technology continue to reshape its landscape.

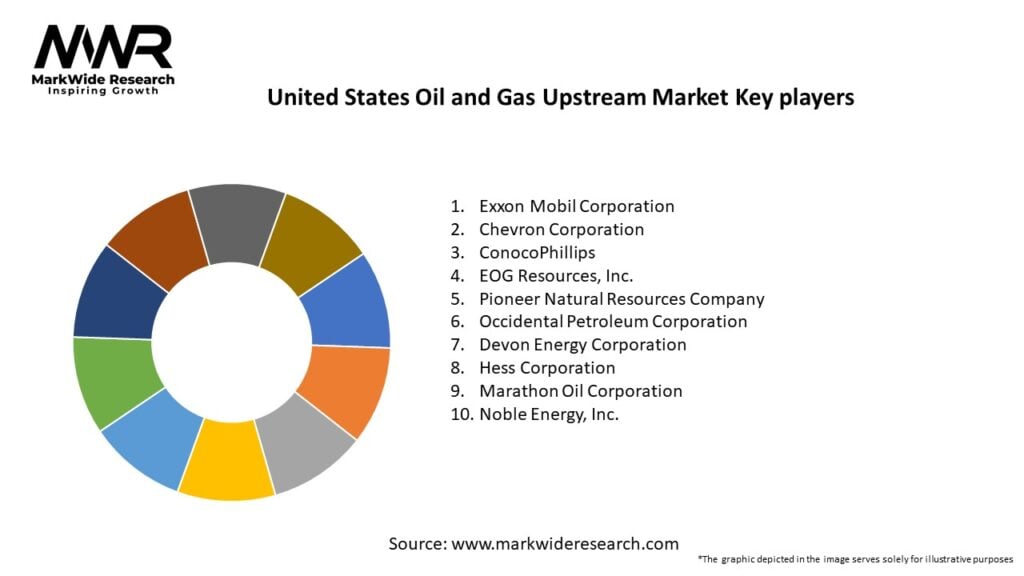

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several key factors are driving the growth of the United States Oil and Gas Upstream Market:

Market Restraints

Despite its potential, the United States Oil and Gas Upstream Market faces several challenges:

Market Opportunities

The United States Oil and Gas Upstream Market offers several opportunities:

Market Dynamics

The dynamics of the United States Oil and Gas Upstream Market are shaped by several factors:

Regional Analysis

The United States Oil and Gas Upstream Market is highly regionalized, with specific areas of the country contributing significantly to overall production:

Competitive Landscape

Leading Companies in the United States Oil and Gas Upstream Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

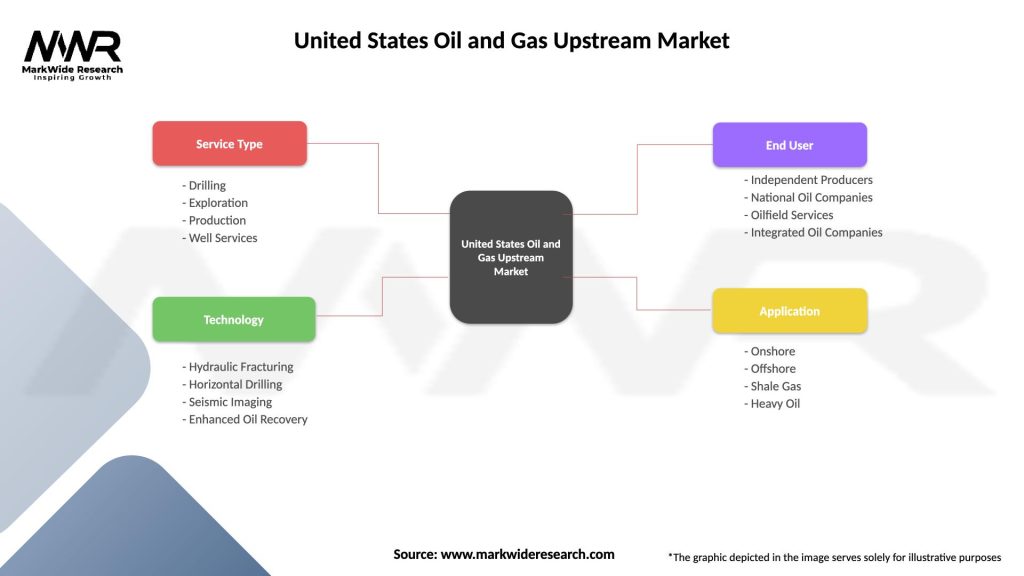

The United States Oil and Gas Upstream Market can be segmented by the following factors:

Type of Resource

Technology

End-User

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact:

The Covid-19 pandemic reverberated through the United States Oil and Gas Upstream Market, triggering demand shocks and supply chain disruptions. Lockdowns and reduced mobility led to decreased fuel consumption. However, the crisis also accelerated digital transformation and remote operations adoption. The experience highlighted the industry’s resilience and adaptability in challenging times.

Key Industry Developments:

Key developments within the United States Oil and Gas Upstream Market have shaped its evolution. The rise of shale production, particularly in the Permian Basin, marked a transformative phase, altering global energy dynamics. Advancements in drilling techniques unlocked previously untapped resources. The industry’s focus on sustainability and emissions reduction signifies a paradigm shift towards responsible practices.

Analyst Suggestions:

Industry analysts offer valuable suggestions for stakeholders in the United States Oil and Gas Upstream Market. Embracing technology-driven solutions, diversifying energy portfolios, and collaborating for innovation are emphasized. Balancing short-term profitability with long-term sustainability remains crucial. Additionally, staying attuned to geopolitical developments aids in strategic decision-making.

Future Outlook:

The future outlook of the United States Oil and Gas Upstream Market is multifaceted. As the world transitions towards renewable energy, the upstream sector will witness transformational changes. The industry’s ability to adapt and innovate will determine its resilience. Technological integration, sustainable practices, and strategic collaborations will shape the sector’s evolution, ensuring its continued significance in the energy landscape.

Conclusion:

The United States Oil and Gas Upstream Market, a dynamic and complex realm, is pivotal to the nation’s energy security and economic growth. From its foundation in exploration to the challenges of price volatility and environmental responsibility, this market encapsulates a myriad of influences. As technology advances and energy demands evolve, the sector’s journey continues, marked by innovation, sustainability, and an unwavering commitment to powering the nation and beyond.

What is Oil and Gas Upstream?

Oil and Gas Upstream refers to the exploration and production segment of the oil and gas industry, focusing on the extraction of crude oil and natural gas from the earth. This includes activities such as drilling, well completion, and production operations.

What are the key players in the United States Oil and Gas Upstream Market?

Key players in the United States Oil and Gas Upstream Market include companies like ExxonMobil, Chevron, and ConocoPhillips, which are involved in exploration and production activities. Other notable companies include EOG Resources and Pioneer Natural Resources, among others.

What are the main drivers of the United States Oil and Gas Upstream Market?

The main drivers of the United States Oil and Gas Upstream Market include the increasing demand for energy, advancements in drilling technologies, and the discovery of new oil and gas reserves. Additionally, geopolitical factors and regulatory changes can also influence market dynamics.

What challenges does the United States Oil and Gas Upstream Market face?

The United States Oil and Gas Upstream Market faces challenges such as fluctuating oil prices, environmental regulations, and the need for significant capital investment. Additionally, competition from renewable energy sources is becoming a growing concern.

What opportunities exist in the United States Oil and Gas Upstream Market?

Opportunities in the United States Oil and Gas Upstream Market include the potential for technological innovations in extraction methods, increased investment in shale oil production, and the expansion of offshore drilling activities. These factors can lead to enhanced production efficiency and resource recovery.

What trends are shaping the United States Oil and Gas Upstream Market?

Trends shaping the United States Oil and Gas Upstream Market include the adoption of digital technologies for operational efficiency, a focus on sustainability practices, and the integration of artificial intelligence in exploration processes. Additionally, there is a growing emphasis on reducing carbon emissions in upstream operations.

United States Oil and Gas Upstream Market

| Segmentation Details | Description |

|---|---|

| Service Type | Drilling, Exploration, Production, Well Services |

| Technology | Hydraulic Fracturing, Horizontal Drilling, Seismic Imaging, Enhanced Oil Recovery |

| End User | Independent Producers, National Oil Companies, Oilfield Services, Integrated Oil Companies |

| Application | Onshore, Offshore, Shale Gas, Heavy Oil |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United States Oil and Gas Upstream Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at