444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United States Less than Truckload (LTL) Road Freight Transport Market is a vital component of the country’s logistics and transportation industry. LTL refers to the transportation of relatively small freight shipments that do not require the use of an entire truck trailer. This method of freight transport is cost-effective for businesses, as it allows them to share the shipping costs with other companies, leading to reduced expenses.

Meaning

The concept of Less than Truckload (LTL) shipping has gained significant importance in the United States due to its ability to efficiently handle small to medium-sized shipments. Unlike Full Truckload (FTL) shipping, where an entire truck is dedicated to a single shipment, LTL shipping optimizes truck capacity by combining multiple shipments from different customers, resulting in reduced costs and increased operational efficiency.

Executive Summary

The United States LTL Road Freight Transport Market has experienced substantial growth over the past decade, driven by factors such as increasing e-commerce activities, globalization of supply chains, and the growing need for just-in-time deliveries. The market is highly competitive, with several established players and regional carriers vying for market share. As technology continues to evolve, the industry is witnessing significant advancements in logistics management, route optimization, and tracking systems.

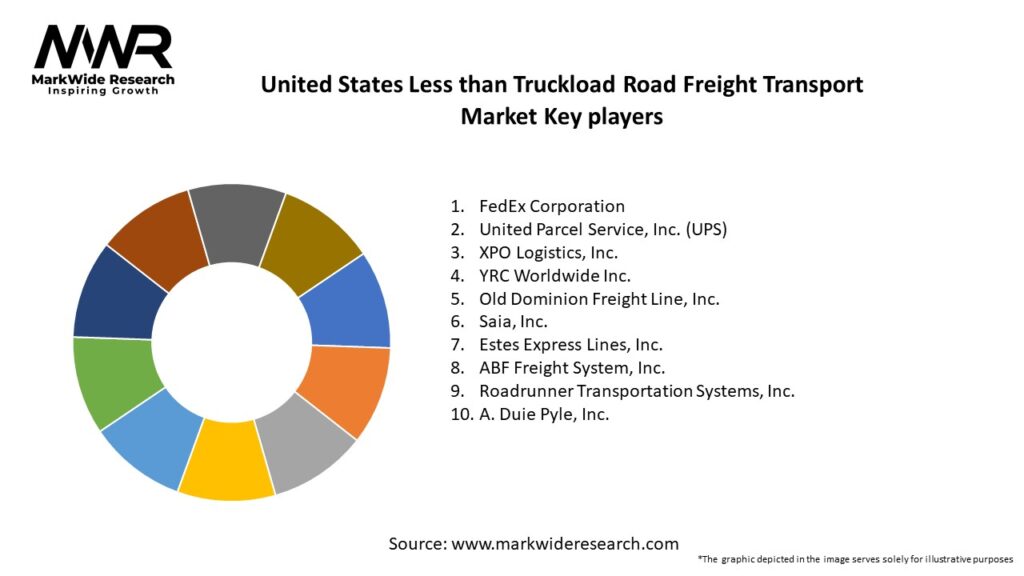

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The United States LTL Road Freight Transport Market is dynamic and influenced by various factors, including economic trends, technological advancements, and changing consumer behavior. To remain competitive, industry players must continuously adapt and innovate to meet the evolving needs of customers.

Regional Analysis

The LTL Road Freight Transport Market in the United States exhibits regional variations in terms of demand, industry focus, and infrastructure. Major metropolitan areas with high commercial activities often witness increased LTL shipment volumes compared to rural regions.

Competitive Landscape

Leading Companies in the United States Less than Truckload Road Freight Transport Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The United States LTL Road Freight Transport Market can be segmented based on service type, end-user industry, and geography. Service types may include standard LTL, expedited LTL, and guaranteed LTL services. End-user industries encompass retail, manufacturing, pharmaceuticals, automotive, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the LTL Road Freight Transport Market. While initial disruptions in supply chains were observed, the industry demonstrated resilience and adaptability to changing market conditions. E-commerce surged during the pandemic, leading to increased demand for LTL services to fulfill online orders.

Key Industry Developments

Analyst Suggestions

Future Outlook

The United States LTL Road Freight Transport Market is poised for continued growth in the coming years. As e-commerce continues to flourish, the demand for efficient LTL services will remain robust. Advancements in technology, sustainability efforts, and strategic partnerships will shape the future landscape of the industry.

Conclusion

The United States LTL Road Freight Transport Market plays a crucial role in the country’s logistics ecosystem. With the rise of e-commerce and evolving supply chain dynamics, LTL shipping has become a preferred choice for businesses seeking cost-effective and sustainable transportation solutions. As the industry continues to embrace technology and adapt to changing market demands, it is poised for a promising future with ample opportunities for growth and innovation.

What is Less than Truckload Road Freight Transport?

Less than Truckload (LTL) Road Freight Transport refers to the shipping of relatively small freight shipments that do not require a full truckload. This service is commonly used by businesses to transport goods efficiently while minimizing costs, making it a vital component of the logistics and supply chain industry.

What are the key players in the United States Less than Truckload Road Freight Transport Market?

Key players in the United States Less than Truckload Road Freight Transport Market include companies like XPO Logistics, YRC Worldwide, and Old Dominion Freight Line, which provide comprehensive LTL services across various sectors, including retail and manufacturing, among others.

What are the growth factors driving the United States Less than Truckload Road Freight Transport Market?

The growth of the United States Less than Truckload Road Freight Transport Market is driven by the increasing demand for e-commerce, the need for efficient supply chain solutions, and the rise in small and medium-sized enterprises requiring flexible shipping options.

What challenges does the United States Less than Truckload Road Freight Transport Market face?

Challenges in the United States Less than Truckload Road Freight Transport Market include rising fuel costs, capacity constraints, and regulatory compliance issues that can impact service efficiency and pricing.

What opportunities exist in the United States Less than Truckload Road Freight Transport Market?

Opportunities in the United States Less than Truckload Road Freight Transport Market include advancements in technology for tracking and logistics management, the potential for increased automation in freight handling, and the expansion of e-commerce which requires more LTL services.

What trends are shaping the United States Less than Truckload Road Freight Transport Market?

Trends shaping the United States Less than Truckload Road Freight Transport Market include the growing emphasis on sustainability in logistics, the adoption of digital platforms for freight booking, and the increasing use of data analytics to optimize routes and reduce costs.

United States Less than Truckload Road Freight Transport Market

| Segmentation Details | Description |

|---|---|

| Service Type | Standard, Expedited, Guaranteed, Intermodal |

| End User | Retail, Manufacturing, E-commerce, Construction |

| Vehicle Type | Box Truck, Flatbed, Refrigerated Truck, Cargo Van |

| Delivery Model | Direct Delivery, Hub-and-Spoke, Cross-Docking, Last Mile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the United States Less than Truckload Road Freight Transport Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at