444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Automated material handling refers to the use of automated systems and technologies for the movement, storage, control, and protection of materials within a manufacturing or distribution facility. The United States automated material handling market has witnessed significant growth in recent years, driven by the increasing need for efficient and streamlined operations in various industries such as e-commerce, automotive, food and beverage, and pharmaceuticals.

Meaning

Automated material handling systems are designed to improve productivity, reduce labor costs, minimize errors, and enhance overall operational efficiency. These systems encompass a range of technologies, including robotics, conveyor systems, automated storage and retrieval systems (AS/RS), and warehouse management systems (WMS). By automating material handling processes, companies can optimize their supply chain, improve inventory management, and meet the growing demands of customers in a timely manner.

Executive Summary

The United States automated material handling market is witnessing steady growth, driven by the increasing adoption of automation technologies across industries. The market is characterized by the presence of several key players offering a wide range of automated material handling solutions. The demand for these solutions is primarily fueled by the need for cost reduction, improved productivity, and enhanced operational efficiency. The market is expected to continue its growth trajectory in the coming years, driven by advancements in technology and the rising trend of warehouse automation.

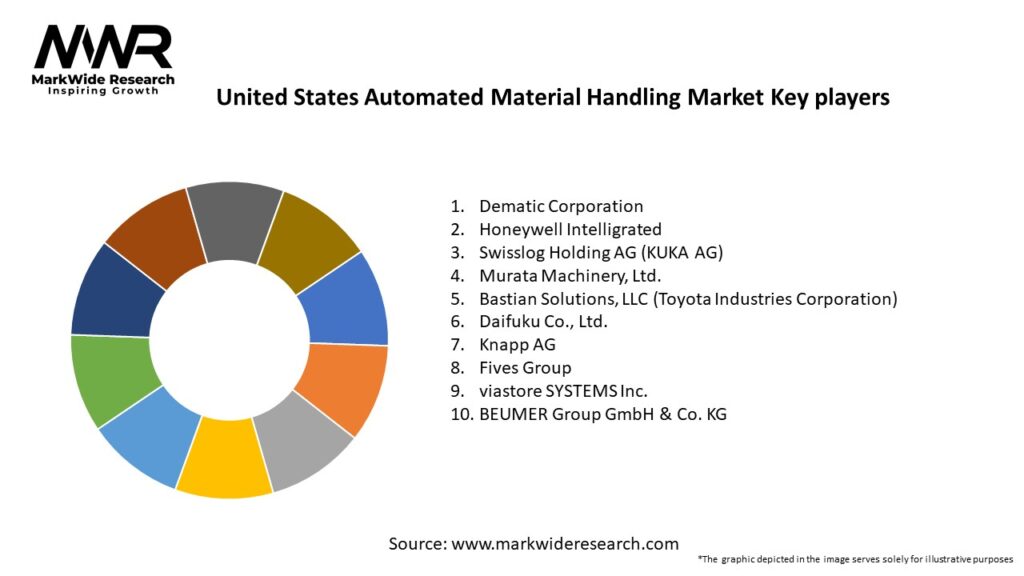

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The United States automated material handling market is driven by a combination of factors, including the need for operational efficiency, cost reduction, and improved productivity. The market is witnessing increasing adoption of advanced technologies, such as robotics, AI, and ML, to enhance the capabilities of material handling systems. The e-commerce sector, in particular, is driving significant demand for automated solutions to meet the growing expectations of customers for fast and accurate order fulfillment.

However, the market also faces challenges such as high initial investment costs, system integration complexities, and concerns over job displacement. To overcome these challenges, companies are focusing on providing scalable and customizable solutions, offering comprehensive support services, and educating end-users about the long-term benefits of automated material handling.

Regional Analysis

The United States automated material handling market can be segmented into various regions, including the Northeast, Midwest, South, and West. Each region has its own unique characteristics and industry landscape, influencing the adoption of automated material handling systems.

The Northeast region is home to several major metropolitan areas and has a strong presence of industries such as e-commerce, retail, and pharmaceuticals. The Midwest region is known for its manufacturing and automotive industries, which drive the demand for automated material handling solutions. The South region has a diverse industrial base, including industries such as food and beverage, logistics, and distribution. The West region, particularly California, is a hub for technology and innovation, fostering the adoption of advanced material handling technologies.

Competitive Landscape

Leading Companies in the United States Automated Material Handling Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The United States automated material handling market can be segmented based on technology, industry vertical, and application.

By technology:

By industry vertical:

By application:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a mixed impact on the United States automated material handling market. While some industries experienced disruptions and reduced demand, others, such as e-commerce and logistics, witnessed accelerated growth. The pandemic highlighted the need for resilient and efficient supply chains, driving the adoption of automated material handling systems.

The e-commerce sector experienced a surge in demand during the pandemic, leading to increased investments in warehouse automation to cope with the growing order volumes. Companies in the food and beverage industry also turned to automation to ensure continuous production and supply chain resilience.

However, the initial phases of the pandemic resulted in supply chain disruptions and delays in project implementations. The uncertainty caused by the pandemic also led some companies to delay or reconsider investments in automation. Additionally, the pandemic highlighted the importance of flexibility and adaptability in automated systems to quickly respond to changing market conditions.

Key Industry Developments

Rise of AI-Powered Automation – Companies are integrating Artificial Intelligence (AI) and Machine Learning (ML) into AMH systems to optimize warehouse operations, improve predictive maintenance, and enhance decision-making.

Adoption of Robotics & AGVs – Increased use of Autonomous Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), and robotic arms in warehouses and distribution centers to boost efficiency and reduce reliance on human labor.

Expansion of E-commerce Warehousing – Major retailers and logistics providers are investing in automated storage and retrieval systems (AS/RS) to meet the rising demand for fast and accurate order fulfillment.

IoT-Enabled Smart Warehouses – The integration of Internet of Things (IoT) and real-time data analytics is enhancing supply chain visibility, improving inventory management, and reducing operational costs.

Sustainability Initiatives – Companies are focusing on energy-efficient automation solutions, such as eco-friendly conveyor systems and AI-driven optimization techniques, to reduce carbon footprints in logistics operations.

Analyst Suggestions

Future Outlook

The United States automated material handling market is poised for continued growth in the coming years. The increasing adoption of automation across industries, advancements in technology, and the growing demand for streamlined operations and improved productivity are key factors driving the market. The e-commerce sector is expected to remain a significant driver for the adoption of automated material handling systems, as companies strive to meet the ever-increasing customer expectations for fast and accurate order fulfillment. The automotive industry is also expected to witness significant growth, driven by the need for efficient logistics and assembly line operations.

Furthermore, the integration of AI, ML, and IoT technologies will continue to enhance the capabilities of automated material handling systems. Real-time data analytics, predictive maintenance, and autonomous decision-making will become increasingly important in optimizing material flow and overall operational efficiency. Despite the challenges of high initial investment costs and system integration complexities, companies are expected to overcome these hurdles through scalable and customizable solutions. The market will likely witness increased collaboration among industry players, leading to the development of innovative and comprehensive automated material handling solutions.

Conclusion

The United States automated material handling market is experiencing steady growth, driven by the need for efficient and streamlined operations across industries. The adoption of automation technologies, such as robotics, conveyor systems, AS/RS, and WMS, enables companies to improve productivity, reduce labor costs, and enhance overall operational efficiency. While the market faces challenges such as high initial investment costs and system integration complexities, the benefits of automated material handling systems outweigh these concerns. Improved accuracy, optimized inventory management, and enhanced customer satisfaction are key advantages that drive the adoption of automation.

Looking ahead, the market is expected to witness continued growth, fueled by advancements in technology, the increasing demand for warehouse automation, and the integration of AI, ML, and IoT in material handling systems. Companies that embrace these trends, foster strategic partnerships, and prioritize sustainability will be well-positioned to capitalize on the opportunities in the United States automated material handling market.

United States Automated Material Handling Market

| Segmentation Details | Description |

|---|---|

| Product Type | Automated Guided Vehicles, Robotic Arms, Conveyor Systems, Sortation Systems |

| Technology | IoT, AI, Machine Learning, Robotics |

| End User | Manufacturing, E-commerce, Retail, Pharmaceuticals |

| Application | Warehouse Management, Order Fulfillment, Inventory Control, Packaging |

Leading Companies in the United States Automated Material Handling Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at