444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United Kingdom Fintech Market has witnessed remarkable growth in recent years, becoming a dynamic and innovative sector within the financial industry. Fintech, a portmanteau of “financial technology,” refers to the use of cutting-edge technology to provide innovative financial products and services. The UK’s Fintech landscape boasts a thriving ecosystem of startups, established companies, and financial institutions working in collaboration to revolutionize the way financial services are delivered.

Meaning

Fintech encompasses a wide range of digital innovations aimed at enhancing financial processes, efficiency, and accessibility. It involves leveraging technologies like artificial intelligence, blockchain, big data, and mobile applications to create novel financial solutions. These innovations have democratized finance, empowering individuals and businesses with user-friendly tools for banking, payments, lending, investment, and more.

Executive Summary

The United Kingdom has emerged as a global leader in the Fintech space, driven by a supportive regulatory environment, a robust financial infrastructure, and a tech-savvy population. The sector’s growth has been fueled by increasing customer demand for convenient, secure, and personalized financial services. Additionally, government initiatives and investments have played a pivotal role in fostering the Fintech ecosystem.

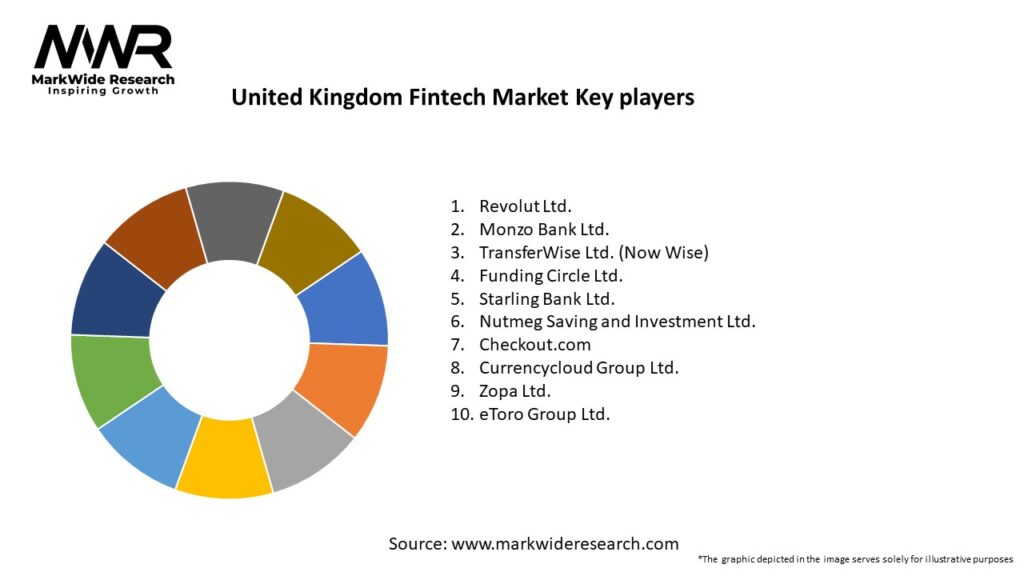

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The UK Fintech market is characterized by constant evolution, propelled by the interplay of innovation, regulation, and customer demand. Fintech companies continuously adapt to meet evolving market needs, resulting in disruptive solutions that challenge traditional financial practices. The ever-changing landscape fosters healthy competition, leading to a more efficient and customer-centric financial sector.

Regional Analysis

London, being the financial capital of the UK, remains the epicenter of Fintech activity in the country. However, other major cities like Manchester, Edinburgh, and Birmingham have also emerged as Fintech hubs, attracting startups and talent. The availability of skilled professionals, access to funding, and a supportive business environment contribute to the growth of regional Fintech ecosystems.

Competitive Landscape

Leading Companies in the United Kingdom Fintech Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The UK Fintech market can be segmented into various categories based on the type of services offered:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic significantly accelerated the adoption of digital financial services. Lockdowns and social distancing measures led to a surge in online transactions, contactless payments, and digital banking usage. Fintech companies played a crucial role in ensuring business continuity and facilitating financial transactions during the pandemic.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the UK Fintech market looks promising, driven by ongoing technological advancements, increasing adoption of digital finance, and the evolving regulatory landscape. As consumers embrace digital financial solutions, Fintech companies will continue to innovate, disrupting traditional financial services and shaping the future of finance.

Conclusion

The United Kingdom Fintech Market has blossomed into a powerhouse of innovation, combining cutting-edge technology with financial services. Fintech companies are reshaping the financial landscape, offering personalized, efficient, and accessible solutions to consumers and businesses alike. With a supportive ecosystem, talented workforce, and favorable regulatory environment, the UK Fintech sector is poised for sustained growth, making it a beacon of progress in the global financial arena. As the world evolves, Fintech will continue to play a pivotal role in transforming the way we manage our finances and access financial services.

United Kingdom Fintech Market

| Segmentation Details | Description |

|---|---|

| Service Type | Payment Processing, Digital Banking, Investment Management, Wealth Advisory |

| Customer Type | Retail Consumers, Small Businesses, Corporates, Startups |

| Technology | Blockchain, Artificial Intelligence, Machine Learning, Cloud Computing |

| End User | Financial Institutions, Insurance Companies, Payment Providers, Others |

Leading Companies in the United Kingdom Fintech Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at