444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United Arab Emirates (UAE) chocolate market is experiencing significant growth, driven by the rising disposable income of consumers and their changing preferences. Chocolate, a widely consumed confectionery product, is gaining popularity among all age groups in the UAE. It is not only considered a delightful treat but also a luxurious indulgence. The market is witnessing a surge in demand for premium and artisanal chocolates, reflecting the evolving taste preferences of consumers.

Meaning

The UAE chocolate market refers to the industry that encompasses the production, distribution, and consumption of chocolate products within the United Arab Emirates. This market includes various types of chocolates, such as milk chocolate, dark chocolate, white chocolate, and flavored chocolates. It also covers different formats like bars, truffles, pralines, and chocolate-coated confections. The market includes both domestic chocolate manufacturers and international brands catering to the UAE market.

Executive Summary

The UAE chocolate market is witnessing robust growth, driven by factors such as increasing disposable income, urbanization, and a growing young population. The market is highly competitive, with a mix of international chocolate brands and local players. Premium and artisanal chocolates are gaining popularity, with consumers seeking unique flavors and high-quality products. The COVID-19 pandemic has impacted the market, leading to changes in consumer behavior and a shift towards online purchasing. Despite challenges, the future outlook for the UAE chocolate market remains positive, with opportunities for innovation and expansion.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The UAE chocolate market is dynamic, driven by various factors shaping consumer behavior and industry trends. Factors such as rising disposable income, shifting consumer preferences towards premium and artisanal chocolates, and the influence of social media and promotional campaigns impact market growth. The market is also influenced by challenges, including intense competition, fluctuating raw material prices, health concerns, and seasonal demand fluctuations. To thrive in this dynamic market, chocolate manufacturers need to adapt, innovate, and meet consumer expectations.

Regional Analysis

The UAE chocolate market is concentrated in urban areas, especially in major cities like Dubai and Abu Dhabi. These regions offer a favorable consumer base due to higher income levels and a diverse population. The market penetration in other emirates is also increasing, driven by the growth of modern retail channels and rising consumer awareness. Each region has its preferences and cultural influences, leading to variations in flavor preferences, packaging, and marketing strategies employed by chocolate manufacturers.

Competitive Landscape

Leading Companies in the UAE Chocolate Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

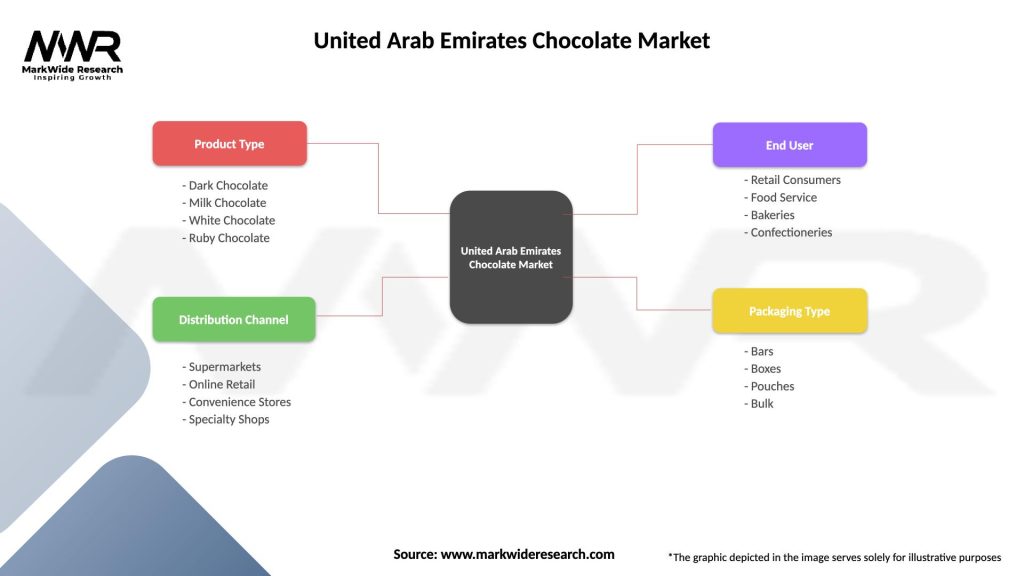

Segmentation

The UAE chocolate market can be segmented based on various factors, including type, distribution channel, and consumer segment.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the UAE chocolate market. During the lockdowns and movement restrictions, the market experienced a temporary decline due to the closure of non-essential retail outlets. However, the market quickly adapted to the changing circumstances, with a surge in online sales and home deliveries. Consumers turned to chocolates as a source of comfort and indulgence during challenging times. The pandemic also highlighted the importance of e-commerce and contactless retail experiences, accelerating the digital transformation of the market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the UAE chocolate market is positive, driven by factors such as increasing disposable income, evolving consumer preferences, and the growing popularity of premium and artisanal chocolates. The market is expected to witness further innovation, with a focus on sustainable practices, healthier alternatives, and unique flavor combinations. Digital transformation and e-commerce will continue to play a crucial role in expanding the market reach and meeting consumer demands. Despite challenges, the UAE chocolate market presents opportunities for both domestic and international chocolate manufacturers to thrive and capture a larger market share.

Conclusion

The United Arab Emirates chocolate market is witnessing robust growth, fueled by rising disposable income, shifting consumer preferences, and the demand for premium and artisanal chocolates. The market is highly competitive, with a mix of international and local players vying for market share. Although challenges such as intense competition, fluctuating raw material prices, and health concerns exist, there are several opportunities for growth, including the artisanal and premium chocolate segment, e-commerce expansion, and export potential. To succeed in this dynamic market, chocolate manufacturers need to innovate, cater to evolving consumer demands, and embrace sustainable practices. The future outlook for the UAE chocolate market remains positive, driven by changing consumer preferences, digital transformation, and a growing population.

What is Chocolate?

Chocolate is a sweet food product made from cocoa beans, often enjoyed in various forms such as bars, drinks, and desserts. It is a popular treat in many cultures, including the United Arab Emirates, where it is often used in confections and gifts.

What are the key players in the United Arab Emirates Chocolate Market?

Key players in the United Arab Emirates Chocolate Market include companies like Al Nassma, Patchi, and Mars, among others. These companies offer a range of chocolate products, from luxury chocolates to mass-market options, catering to diverse consumer preferences.

What are the growth factors driving the United Arab Emirates Chocolate Market?

The growth of the United Arab Emirates Chocolate Market is driven by increasing consumer demand for premium and artisanal chocolates, the rise of gifting culture, and the expansion of retail channels. Additionally, the influence of social media on consumer preferences plays a significant role.

What challenges does the United Arab Emirates Chocolate Market face?

The United Arab Emirates Chocolate Market faces challenges such as fluctuating cocoa prices, competition from alternative snacks, and changing consumer health trends. These factors can impact production costs and consumer purchasing decisions.

What opportunities exist in the United Arab Emirates Chocolate Market?

Opportunities in the United Arab Emirates Chocolate Market include the potential for product innovation, such as healthier chocolate options and unique flavor combinations. Additionally, expanding e-commerce platforms can help reach a broader audience.

What trends are shaping the United Arab Emirates Chocolate Market?

Trends in the United Arab Emirates Chocolate Market include a growing interest in sustainable and ethically sourced chocolates, as well as the popularity of personalized and customized chocolate gifts. These trends reflect changing consumer values and preferences.

United Arab Emirates Chocolate Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dark Chocolate, Milk Chocolate, White Chocolate, Ruby Chocolate |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Specialty Shops |

| End User | Retail Consumers, Food Service, Bakeries, Confectioneries |

| Packaging Type | Bars, Boxes, Pouches, Bulk |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the UAE Chocolate Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at