444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The UAE Health Insurance Third Party Administrator (TPA) market has experienced significant growth in recent years. With the increasing demand for healthcare services and the growing complexity of insurance processes, TPAs have emerged as key players in the health insurance industry. TPAs act as intermediaries between insurance providers, policyholders, and healthcare service providers, offering a range of services to streamline claims processing and improve the overall efficiency of the insurance ecosystem.

Meaning

A Third Party Administrator (TPA) in the context of health insurance refers to an organization or entity that manages various administrative tasks on behalf of insurance companies. These tasks may include claims processing, policy administration, customer service, provider network management, and data management. TPAs play a crucial role in simplifying and expediting the insurance process, ensuring a smooth experience for both policyholders and healthcare service providers.

Executive Summary

The UAE Health Insurance TPA market is witnessing robust growth due to several factors, including the rising demand for healthcare services, the increasing complexity of insurance processes, and the need for improved efficiency in claims management. TPAs offer a wide range of services that contribute to enhanced customer experience, reduced administrative burden for insurance companies, and better coordination between insurers and healthcare providers. This report provides a comprehensive analysis of the market, including key insights, market drivers, restraints, opportunities, and future outlook.

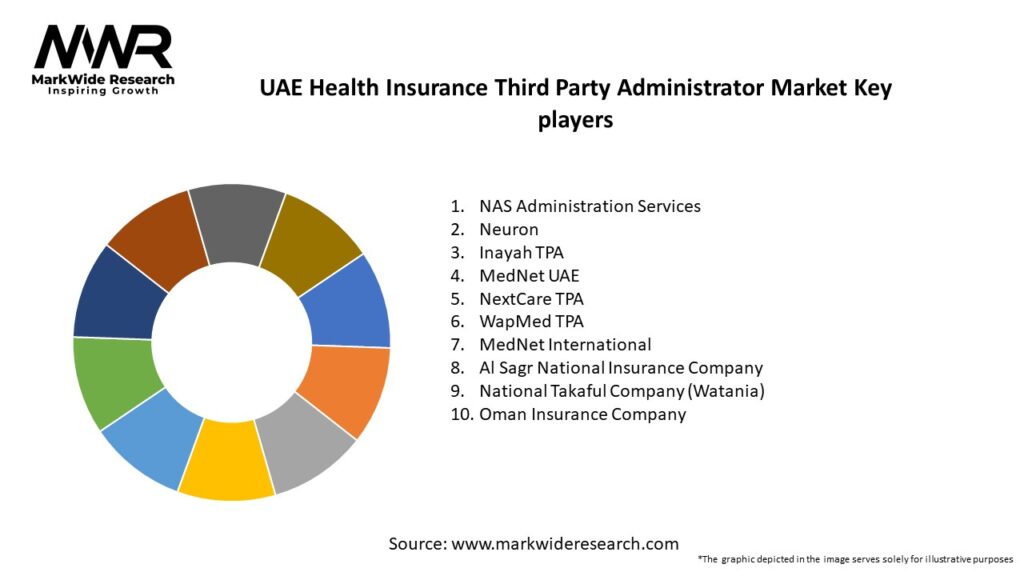

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The UAE Health Insurance TPA market is characterized by dynamic factors that shape its growth and development. These dynamics include market drivers, restraints, opportunities, and industry trends. Understanding and adapting to these dynamics is crucial for market players to stay competitive and capitalize on emerging opportunities.

Regional Analysis

The UAE Health Insurance TPA market exhibits regional variations in terms of market size, growth rate, and market dynamics. The major regions analyzed in this report include Dubai, Abu Dhabi, Sharjah, and other emirates. Each region has its unique characteristics, regulatory environment, and market players. Analyzing the regional landscape helps stakeholders identify growth opportunities, understand market trends, and tailor their strategies accordingly.

Competitive Landscape

Leading Companies in the UAE Health Insurance Third Party Administrator Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The UAE Health Insurance TPA market can be segmented based on various factors such as service type, end-user, and geography. The segmentation allows for a deeper understanding of market dynamics and enables stakeholders to identify specific growth segments and target their efforts accordingly.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the UAE Health Insurance TPA market. The healthcare industry faced unprecedented challenges, with increased demand for medical services and a surge in insurance claims. TPAs played a crucial role in managing the influx of claims, ensuring timely reimbursement, and maintaining seamless coordination between insurers and healthcare providers. The pandemic accelerated the adoption of digital tools and telemedicine platforms, leading to a more digitized and efficient insurance ecosystem. However, it also highlighted the importance of data security and privacy in the healthcare sector, emphasizing the need for robust cybersecurity measures.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the UAE Health Insurance TPA market looks promising, with significant growth opportunities on the horizon. The market is expected to witness increased adoption of TPAs by insurance companies, driven by the need for cost containment, improved operational efficiency, and regulatory compliance. Technological advancements, including artificial intelligence, data analytics, and telemedicine, will play a vital role in shaping the future of TPAs, enabling them to deliver personalized, efficient, and seamless healthcare services. Collaborations, mergers, and acquisitions are anticipated to reshape the competitive landscape, with market players seeking strategic alliances to expand their market presence and diversify their service offerings.

Conclusion

The UAE Health Insurance TPA market is experiencing remarkable growth and transformation. TPAs have emerged as key intermediaries in the health insurance industry, streamlining administrative tasks, improving efficiency, and enhancing customer experience. The market is driven by factors such as the increasing demand for healthcare services, the complexity of insurance processes, and the need for cost containment strategies. TPAs have the opportunity to capitalize on emerging trends, such as digital transformation, telemedicine, and personalized healthcare, to stay competitive and meet evolving market demands. The future of the TPA market in the UAE looks promising, with a focus on advanced technologies, customer-centric strategies, and strategic collaborations.

What is Health Insurance Third Party Administrator?

Health Insurance Third Party Administrators (TPAs) are organizations that manage health insurance claims and provide administrative services on behalf of insurance companies. They play a crucial role in streamlining the claims process, ensuring compliance, and enhancing customer service in the health insurance sector.

What are the key players in the UAE Health Insurance Third Party Administrator Market?

Key players in the UAE Health Insurance Third Party Administrator Market include companies like Daman, Abu Dhabi National Insurance Company, and Oman Insurance Company, among others. These firms provide a range of services including claims processing, network management, and customer support.

What are the growth factors driving the UAE Health Insurance Third Party Administrator Market?

The growth of the UAE Health Insurance Third Party Administrator Market is driven by increasing healthcare costs, a growing population, and rising awareness of health insurance benefits. Additionally, regulatory changes and the expansion of health services contribute to market growth.

What challenges does the UAE Health Insurance Third Party Administrator Market face?

Challenges in the UAE Health Insurance Third Party Administrator Market include regulatory compliance issues, competition among TPAs, and the need for technological advancements. These factors can impact operational efficiency and service delivery.

What opportunities exist in the UAE Health Insurance Third Party Administrator Market?

Opportunities in the UAE Health Insurance Third Party Administrator Market include the adoption of digital health solutions, expansion into underserved regions, and partnerships with healthcare providers. These avenues can enhance service offerings and improve customer engagement.

What trends are shaping the UAE Health Insurance Third Party Administrator Market?

Trends shaping the UAE Health Insurance Third Party Administrator Market include the integration of artificial intelligence in claims processing, a shift towards value-based care, and an increased focus on customer experience. These trends are transforming how TPAs operate and interact with clients.

UAE Health Insurance Third Party Administrator Market

| Segmentation Details | Description |

|---|---|

| Service Type | Claims Management, Provider Network Management, Customer Support, Risk Management |

| End User | Insurance Companies, Corporates, Government Entities, Individuals |

| Technology | Cloud-Based Solutions, On-Premises Solutions, Mobile Applications, Data Analytics |

| Delivery Model | Direct Services, Outsourced Services, Hybrid Model, Subscription-Based |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the UAE Health Insurance Third Party Administrator Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at