444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The UAE architectural paints and coatings market is a thriving industry that plays a crucial role in the country’s construction sector. Paints and coatings are essential for protecting and enhancing the appearance of buildings, both residential and commercial. The market offers a wide range of products, including interior and exterior paints, wood coatings, metal coatings, and special coatings for specific applications.

The UAE has witnessed significant growth in the construction and real estate sectors in recent years, driven by a booming economy and a rising population. This growth has fueled the demand for architectural paints and coatings, creating a favorable market environment for manufacturers, suppliers, and other industry participants.

Meaning

Architectural paints and coatings refer to a range of products specifically designed for application on various surfaces in buildings. They serve multiple purposes, including protection against weathering, UV radiation, corrosion, and other external factors. Additionally, architectural paints and coatings are used to enhance the aesthetic appeal of structures, offering a wide variety of colors, finishes, and textures.

These products are formulated with specific properties to suit different surfaces such as concrete, wood, metal, and plaster. They provide durability, resistance to abrasion, and ease of application. The market for architectural paints and coatings encompasses both residential and commercial construction projects, including homes, offices, hotels, retail spaces, and industrial facilities.

Executive Summary

The UAE architectural paints and coatings market has experienced robust growth over the years, driven by the country’s thriving construction sector. The market is characterized by intense competition among local and international manufacturers, who strive to offer innovative and high-quality products. Key factors influencing market growth include increasing construction activities, rising consumer demand for eco-friendly products, and the adoption of advanced coating technologies.

This report provides comprehensive insights into the UAE architectural paints and coatings market, including market trends, drivers, restraints, opportunities, and key industry developments. It also offers a regional analysis, competitive landscape assessment, and segmentation based on product categories. The report aims to assist industry participants and stakeholders in making informed decisions and capitalizing on the market’s growth potential.

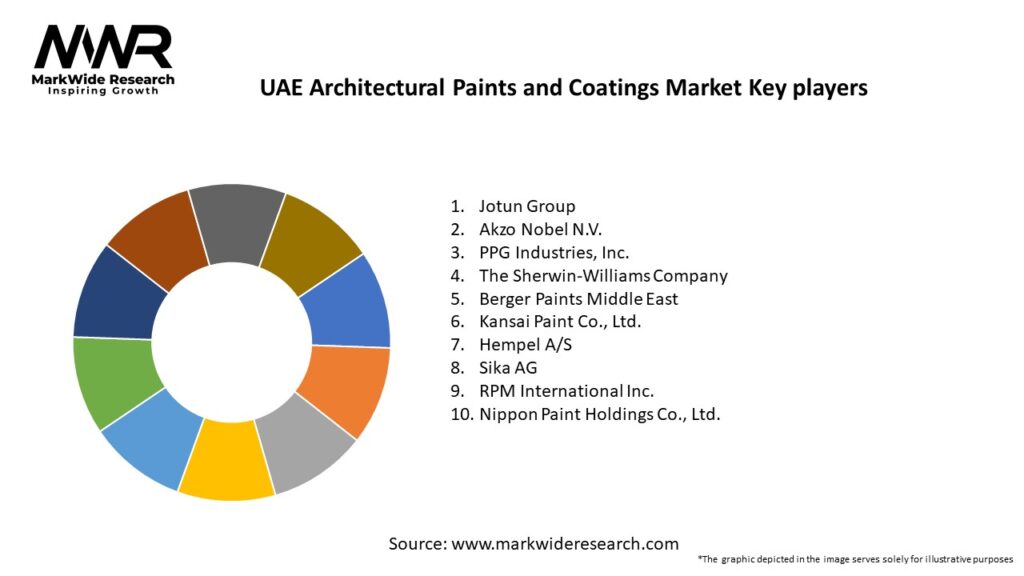

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The UAE architectural paints and coatings market is driven by several dynamic factors that shape its growth and development. Key dynamics include market drivers, such as construction activities and population growth, market restraints, such as raw material price volatility and stringent regulations, and market opportunities arising from green building initiatives and technological advancements.

The market is also influenced by consumer trends, including the increasing demand for eco-friendly and premium products, and industry developments, such as new product launches, partnerships, and mergers and acquisitions. Additionally, the market dynamics are impacted by macroeconomic factors, geopolitical factors, and emerging trends in the construction and real estate sectors.

Regional Analysis

The UAE architectural paints and coatings market can be analyzed regionally, considering key areas such as Abu Dhabi, Dubai, Sharjah, and other emirates. Each region has its own dynamics and factors influencing the demand for paints and coatings.

Abu Dhabi, as the capital city of the UAE, witnesses significant construction activities, driven by government initiatives and infrastructure development projects. The demand for architectural paints and coatings is high in this region, catering to commercial and residential projects.

Dubai, known for its iconic skyline and ambitious real estate projects, offers immense opportunities for manufacturers and suppliers of architectural paints and coatings. The city’s vibrant construction sector, driven by tourism and business growth, fuels the demand for high-quality coatings.

Sharjah, another prominent emirate in the UAE, experiences a steady demand for architectural paints and coatings due to residential and commercial construction projects. The region’s focus on cultural development and heritage preservation also creates opportunities for specialized coatings.

Other emirates in the UAE, such as Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain, contribute to the overall demand for architectural paints and coatings through various construction and development activities. These regions present opportunities for market expansion and penetration.

Competitive Landscape

Leading Companies in the UAE Architectural Paints and Coatings Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

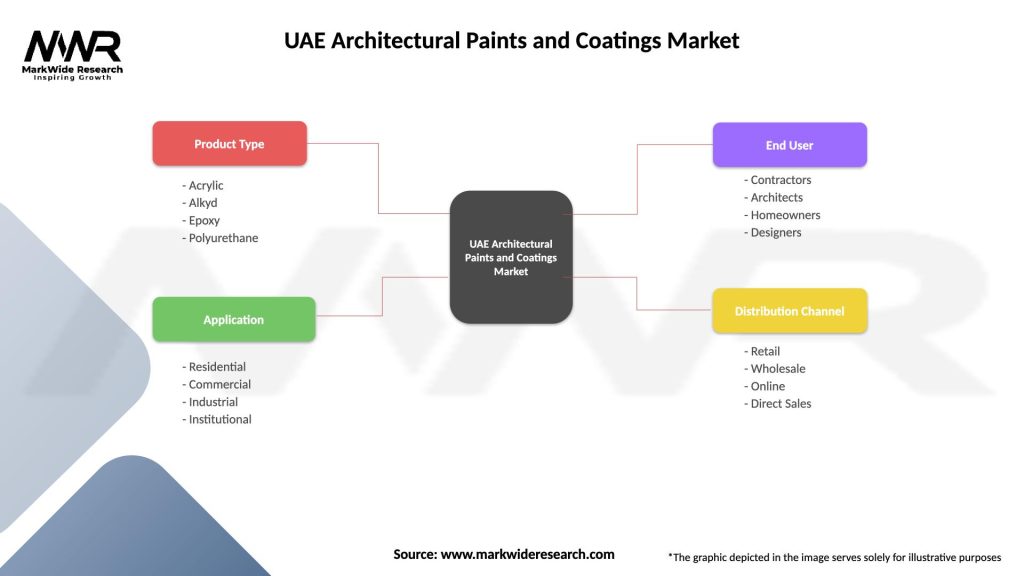

Segmentation

The UAE architectural paints and coatings market can be segmented based on various categories, including product type, application, and end-user. The segmentation provides a deeper understanding of the market dynamics and helps industry participants target specific market segments.

Segmentation enables manufacturers and suppliers to tailor their product offerings and marketing strategies according to the specific requirements and preferences of different customer segments. It also helps identify growth opportunities and areas of focus for industry participants.

Category-wise Insights

Each category of architectural paints and coatings serves distinct purposes and addresses specific challenges encountered in construction projects. Manufacturers focus on product development and innovation to offer a diverse range of coatings that meet customer demands.

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders can leverage these benefits to establish a strong presence in the UAE architectural paints and coatings market and capitalize on the opportunities it offers.

SWOT Analysis

A SWOT analysis provides an assessment of the strengths, weaknesses, opportunities, and threats within the UAE architectural paints and coatings market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Analyzing the strengths, weaknesses, opportunities, and threats helps industry participants and stakeholders in formulating strategies to capitalize on market opportunities, mitigate risks, and maintain a competitive edge.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has significantly impacted the UAE architectural paints and coatings market, as it did with the overall construction industry. The pandemic led to disruptions in construction activities, including project delays, reduced investments, and labor shortages.

During the lockdowns and movement restrictions, construction projects were put on hold, resulting in a decline in demand for architectural paints and coatings. The supply chain was also disrupted, causing delays in raw material procurement and manufacturing operations.

However, as the situation improved and restrictions were eased, construction activities gradually resumed, leading to a recovery in the market. The market witnessed a shift in consumer preferences towards products with antimicrobial properties and coatings that contribute to improved hygiene and cleanliness.

The pandemic also accelerated the adoption of digital platforms and e-commerce channels for product selection and purchases. Online platforms provided a means for customers to explore and purchase architectural paints and coatings while adhering to social distancing measures.

Overall, while the COVID-19 pandemic presented significant challenges to the UAE architectural paints and coatings market, the industry has shown resilience and adapted to the changing market dynamics.

Key Industry Developments

Analyst Suggestions

Based on the analysis of the UAE architectural paints and coatings market, industry analysts make the following suggestions:

Future Outlook

The future outlook for the UAE architectural paints and coatings market is positive, with several factors indicating sustained growth. The country’s construction sector is expected to continue expanding, driven by infrastructure development, urbanization, and population growth.

The demand for eco-friendly and sustainable coatings is expected to rise as consumers become more conscious of the environmental impact of products. Manufacturers are likely to invest in research and development to develop innovative coatings that meet sustainability requirements and offer enhanced performance characteristics.

Technological advancements will play a crucial role in shaping the market’s future, with the adoption of advanced coating technologies and the development of smart coatings. Nanotechnology, self-cleaning coatings, and antimicrobial coatings are expected to witness increased adoption.

The UAE government’s focus on sustainability and green building initiatives will drive the demand for coatings that comply with environmental standards and green building certifications. Manufacturers should align their strategies with these initiatives and seek certification for their products.

While the market presents growth opportunities, industry participants should also remain vigilant about challenges such as raw material price volatility, regulatory compliance, and intense competition. Adapting to changing market dynamics, investing in innovation, and building strong customer relationships will be crucial for long-term success.

Conclusion

The UAE architectural paints and coatings market is a thriving industry driven by the country’s robust construction sector. The market offers a wide range of products catering to various applications and surfaces. The demand for architectural paints and coatings is fueled by factors such as increasing construction activities, rising consumer awareness of eco-friendly products, technological advancements, and the emphasis on sustainability.

While the market presents significant opportunities, industry participants should be mindful of challenges such as raw material price volatility, regulatory compliance, and intense competition. Adapting to changing market dynamics, investing in research and development, and building strong customer relationships will be essential for success.

The future outlook for the market is positive, with sustained growth expected in the coming years. Technological advancements, increasing demand for sustainable coatings, and the government’s focus on green building initiatives will shape the market’s future. Manufacturers and suppliers who align their strategies with market trends and customer preferences are likely to thrive in this dynamic industry.

What is Architectural Paints and Coatings?

Architectural paints and coatings are products used for protecting and decorating buildings and structures. They include a variety of finishes and formulations designed for different surfaces and environments.

What are the key players in the UAE Architectural Paints and Coatings Market?

Key players in the UAE Architectural Paints and Coatings Market include Jotun, AkzoNobel, and National Paints, among others. These companies are known for their innovative products and extensive distribution networks.

What are the main drivers of the UAE Architectural Paints and Coatings Market?

The main drivers of the UAE Architectural Paints and Coatings Market include rapid urbanization, increasing construction activities, and a growing demand for eco-friendly and durable coatings. Additionally, the rise in infrastructure projects contributes to market growth.

What challenges does the UAE Architectural Paints and Coatings Market face?

The UAE Architectural Paints and Coatings Market faces challenges such as fluctuating raw material prices and stringent environmental regulations. These factors can impact production costs and product availability.

What opportunities exist in the UAE Architectural Paints and Coatings Market?

Opportunities in the UAE Architectural Paints and Coatings Market include the increasing demand for smart coatings and sustainable products. Additionally, the growth of the hospitality and real estate sectors presents new avenues for expansion.

What trends are shaping the UAE Architectural Paints and Coatings Market?

Trends shaping the UAE Architectural Paints and Coatings Market include the rise of eco-friendly formulations and the integration of technology in coatings. Innovations such as self-cleaning and anti-microbial paints are gaining popularity among consumers.

UAE Architectural Paints and Coatings Market

| Segmentation Details | Description |

|---|---|

| Product Type | Acrylic, Alkyd, Epoxy, Polyurethane |

| Application | Residential, Commercial, Industrial, Institutional |

| End User | Contractors, Architects, Homeowners, Designers |

| Distribution Channel | Retail, Wholesale, Online, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the UAE Architectural Paints and Coatings Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at