444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview:

The Turkmenistan oil and gas market stands as a pivotal player in the global energy sector, characterized by its vast reserves and strategic geographical location. This Central Asian nation has long been recognized for its substantial hydrocarbon resources, contributing significantly to its economic growth and global energy supply. The market’s dynamics are influenced by various factors including geopolitical relationships, technological advancements, and evolving environmental concerns. This comprehensive exploration delves into the nuances of the Turkmenistan oil and gas market, shedding light on its significance, trends, challenges, and future prospects.

Meaning:

The Turkmenistan oil and gas market symbolizes the nation’s vital role in the global energy landscape. This sector encompasses the exploration, extraction, refinement, and distribution of petroleum and natural gas resources. Being one of the largest hydrocarbon reserves holders globally, Turkmenistan plays a pivotal role in shaping regional energy security and fostering economic growth. The country’s vast energy wealth has propelled it into the international arena, forging strategic partnerships and driving diplomatic relations.

Executive Summary:

The Turkmenistan oil and gas market’s executive summary offers a succinct overview of its multifaceted landscape. This summary encapsulates the market’s current standing, key trends, and potential challenges, providing a snapshot of what lies ahead. As an integral part of Central Asia’s energy powerhouse, Turkmenistan’s hydrocarbon industry influences global energy prices, geopolitical dynamics, and regional cooperation.

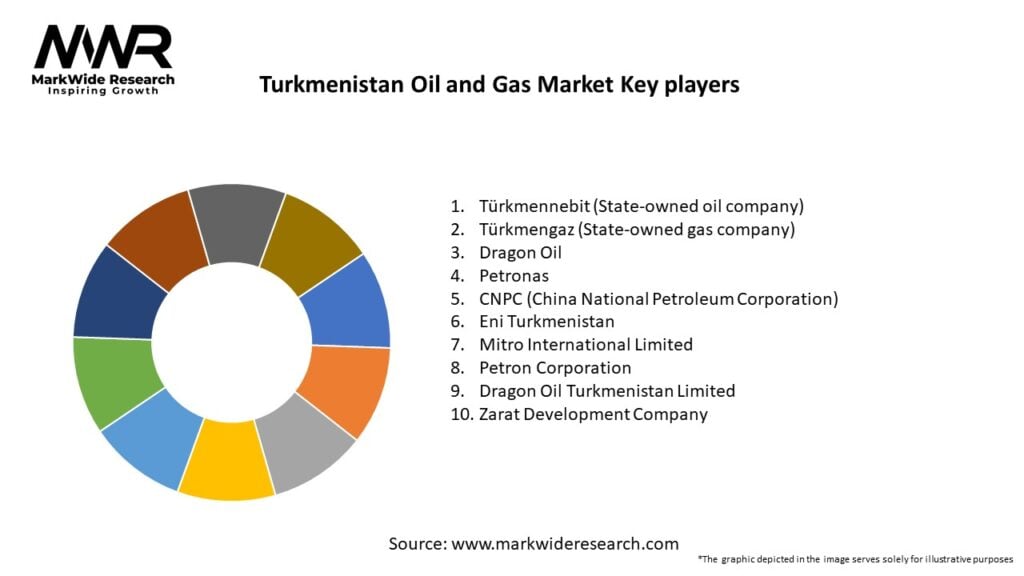

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The Turkmenistan Oil and Gas Market is driven by the following key factors:

Market Restraints

While the market presents significant growth opportunities, it also faces several challenges:

Market Opportunities

The Turkmenistan Oil and Gas Market offers several opportunities for growth:

Market Dynamics

Several factors are influencing the Turkmenistan Oil and Gas Market:

Regional Analysis

The Turkmenistan Oil and Gas Market is impacted by several regional factors:

Competitive Landscape

Leading Companies in the Turkmenistan Oil and Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Turkmenistan Oil and Gas Market can be segmented based on the following factors:

Resource Type

Application

Region

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact:

The COVID-19 pandemic has significantly impacted the Turkmenistan oil and gas market. Disruptions in global supply chains and reduced energy demand led to fluctuations in prices and production levels. The pandemic underscored the need for market resilience, spurring discussions on diversification and sustainable practices to mitigate future crises.

Key Industry Developments:

Turkmenistan’s oil and gas market is marked by key industry developments that shape its future trajectory. Infrastructure projects, including pipelines and transit routes, influence the nation’s role in regional energy dynamics. International collaborations and diplomatic engagements pave the way for cross-border energy initiatives, enhancing market access and stability.

Analyst Suggestions:

Industry analysts suggest several strategies to navigate the complexities of the Turkmenistan oil and gas market. Diversification of energy exports, investment in technological advancements, and sustainable practices emerge as critical imperatives. Strengthening regional partnerships and aligning market strategies with global trends ensure long-term resilience and growth.

Future Outlook:

The future outlook of Turkmenistan’s oil and gas market is one of cautious optimism. The nation’s hydrocarbon reserves will continue to play a pivotal role in energy markets, albeit with an increasing focus on sustainability. Technological innovations and evolving market dynamics will drive exploration, production, and distribution activities. Collaborative efforts regionally and internationally will define Turkmenistan’s standing in the global energy landscape.

Conclusion:

In conclusion, the Turkmenistan oil and gas market is a dynamic arena shaped by a multitude of factors. Its vast hydrocarbon reserves, strategic location, and evolving market trends position it as a key player in the global energy landscape. While challenges and uncertainties persist, the market’s potential for growth, innovation, and cooperation sets the stage for a promising future. As Turkmenistan charts its course forward, strategic decisions, technological investments, and sustainable practices will be instrumental in realizing its aspirations within the oil and gas sector.

What is Turkmenistan Oil and Gas?

Turkmenistan Oil and Gas refers to the exploration, extraction, and production of oil and natural gas resources in Turkmenistan, which is known for its significant reserves and strategic importance in the energy sector.

What are the key players in the Turkmenistan Oil and Gas Market?

Key players in the Turkmenistan Oil and Gas Market include Turkmennebit, Turkmen Gas, and Dragon Oil, among others. These companies are involved in various aspects of oil and gas production, from exploration to refining.

What are the growth factors driving the Turkmenistan Oil and Gas Market?

The growth of the Turkmenistan Oil and Gas Market is driven by factors such as increasing global energy demand, the country’s vast hydrocarbon reserves, and ongoing investments in infrastructure and technology.

What challenges does the Turkmenistan Oil and Gas Market face?

The Turkmenistan Oil and Gas Market faces challenges including geopolitical tensions, limited access to international markets, and the need for modernization of aging infrastructure.

What opportunities exist in the Turkmenistan Oil and Gas Market?

Opportunities in the Turkmenistan Oil and Gas Market include potential partnerships with foreign investors, the development of new gas export routes, and advancements in extraction technologies.

What trends are shaping the Turkmenistan Oil and Gas Market?

Trends in the Turkmenistan Oil and Gas Market include a focus on sustainable practices, increased exploration activities in untapped regions, and the adoption of digital technologies for enhanced operational efficiency.

Turkmenistan Oil and Gas Market

| Segmentation Details | Description |

|---|---|

| Type | Exploration, Production, Refining, Distribution |

| Service Type | Drilling, Maintenance, Engineering, Consulting |

| End User | Utilities, Industrial, Commercial, Residential |

| Technology | Offshore, Onshore, Enhanced Oil Recovery, Gas Processing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Turkmenistan Oil and Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at