444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The United Arab Emirates (UAE) lubricants market has witnessed significant growth in recent years. As a key player in the global lubricants industry, the UAE has emerged as a regional hub for lubricants production, distribution, and consumption. The market offers a wide range of lubricants, including automotive, industrial, and marine lubricants, catering to diverse industries such as automotive, manufacturing, construction, and marine sectors. The demand for lubricants in the UAE is primarily driven by the rapid growth of these industries, coupled with the country’s strategic geographic location and favorable business environment.

Meaning

Lubricants are substances used to reduce friction, heat, and wear between moving parts of machinery or equipment. They play a vital role in maintaining the efficiency and longevity of various mechanical systems, ensuring smooth operation and preventing damage caused by friction. Lubricants are formulated from base oils and additives, which impart specific properties such as viscosity, thermal stability, and corrosion resistance. These characteristics allow lubricants to withstand extreme operating conditions and provide optimal performance across a wide range of applications.

Executive Summary

The UAE lubricants market is experiencing steady growth, driven by several factors. The market offers a diverse range of lubricants, catering to various industries, including automotive, industrial, and marine sectors. The demand for lubricants in the UAE is fueled by the rapid expansion of these industries, coupled with the country’s favorable business environment. However, the market also faces challenges such as increasing competition, stringent regulations, and the impact of the COVID-19 pandemic. Despite these challenges, the UAE lubricants market is expected to witness promising growth in the coming years, driven by rising industrial activities and the government’s focus on infrastructure development.

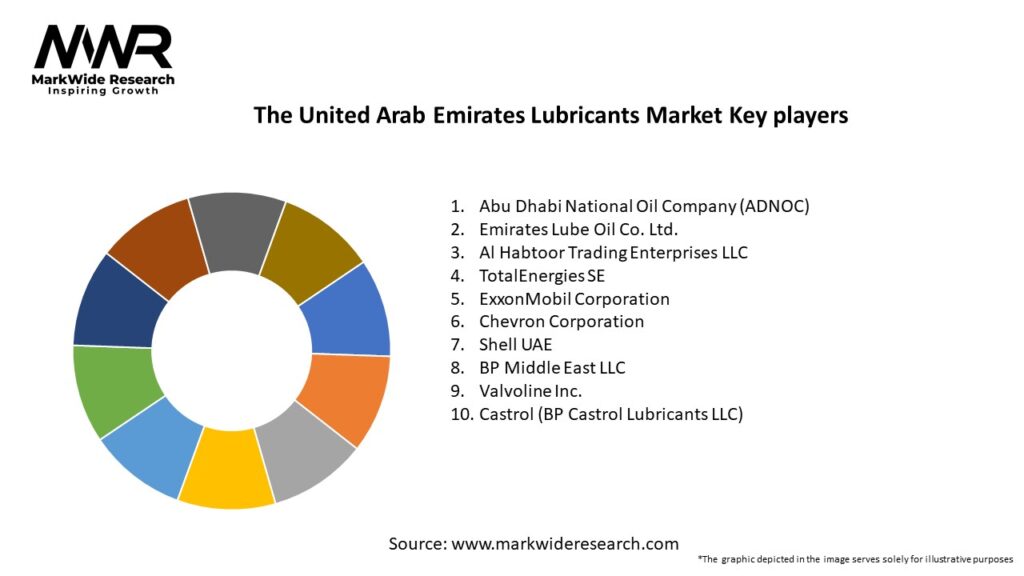

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the lubricants market in the UAE:

Market Restraints

Despite the favorable market conditions, the UAE lubricants market faces certain challenges that could hinder its growth:

Market Opportunities

The UAE lubricants market offers several opportunities for industry participants:

Market Dynamics

The UAE lubricants market is characterized by dynamic factors that influence its growth and development. Key market dynamics include:

Regional Analysis

The UAE lubricants market is geographically segmented into key regions, including Dubai, Abu Dhabi, Sharjah, and other emirates. Dubai and Abu Dhabi are the major regions contributing to the growth of the lubricants market due to their robust industrial and commercial activities. These regions are home to several manufacturing plants, logistics hubs, and distribution centers, attracting both global and regional lubricant manufacturers.

Dubai, in particular, serves as a key trading hub for lubricants, with its strategic location, world-class infrastructure, and well-established free zones. The emirate’s connectivity to major ports and airports facilitates the import and export of lubricants, making it an attractive destination for international players.

Abu Dhabi, on the other hand, is home to significant manufacturing industries, including oil and gas, petrochemicals, and automotive. The presence of these industries drives the demand for lubricants, creating growth opportunities for market participants.

Sharjah and other emirates also contribute to the lubricants market, with their focus on industrial development, construction projects, and transportation infrastructure.

Competitive Landscape

Leading Companies in The United Arab Emirates Lubricants Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The UAE lubricants market can be segmented based on product type and end-use industry:

The automotive lubricants segment dominates the market, driven by the growing automotive industry and increasing vehicle ownership. Industrial lubricants also hold a significant market share, with rising manufacturing activities in the UAE. The marine lubricants segment is witnessing steady growth due to the country’s thriving maritime industry.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The UAE lubricants market offers several benefits for industry participants and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the UAE lubricants market, causing disruptions across the supply chain and affecting market dynamics. The lockdown measures, reduced industrial activities, and travel restrictions imposed to curb the spread of the virus led to a decline in demand for lubricants. The automotive and aviation sectors were particularly affected, as mobility restrictions resulted in reduced vehicle usage and a decline in air travel.

However, as the UAE gradually eased restrictions and initiated economic recovery measures, the lubricants market started to rebound. The resumption of industrial activities, construction projects, and increased mobility contributed to the recovery of the market. The growing emphasis on hygiene and safety protocols also led to increased demand for industrial lubricants for maintenance and equipment sanitization.

Moving forward, the vaccination campaigns, economic stimulus packages, and the gradual reopening of international borders are expected to drive the market’s recovery and growth. However, uncertainties regarding future waves of the virus and potential changes in consumer behavior continue to pose challenges for market participants.

Key Industry Developments

Analyst Suggestions

Based on the analysis of the UAE lubricants market, analysts suggest the following strategies for industry participants:

Future Outlook

The future outlook for the UAE lubricants market is positive, with several factors expected to drive market growth. The continued industrialization, infrastructure development, and favorable business environment in the UAE are likely to fuel the demand for lubricants across various sectors. The automotive lubricants segment is expected to witness steady growth due to the rising automotive industry and increasing vehicle ownership. The transition towards electric vehicles and the development of new mobility solutions will also create opportunities for lubricant manufacturers to cater to evolving market needs. The industrial lubricants segment is anticipated to grow, driven by increasing manufacturing activities, expansion in the construction sector, and the country’s focus on diversifying its economy. The marine lubricants segment will continue to be supported by the UAE’s thriving maritime industry, which includes ports, shipping, and offshore activities.

However, market participants should remain vigilant and adaptable to changing market dynamics, including evolving customer preferences, technological advancements, and regulatory requirements. Continuous investments in research and development, sustainability initiatives, and strategic collaborations will be crucial to stay ahead in the competitive landscape.

Conclusion

The United Arab Emirates lubricants market is witnessing steady growth, driven by rapid industrialization, a growing automotive sector, and infrastructure development. The market offers a diverse range of lubricants catering to various industries, including automotive, manufacturing, construction, and marine sectors. While the market faces challenges such as intense competition and stringent regulations, there are ample opportunities for industry participants to expand their market presence. Customization, technological advancements, sustainability, and export potential are key areas for growth and differentiation.

The COVID-19 pandemic had a significant impact on the market, but with the gradual recovery and vaccination efforts, the market is expected to rebound. Future prospects remain positive, with the UAE’s favorable business environment, strategic location, and emphasis on sustainable practices driving market growth. By focusing on product differentiation, collaboration, sustainability, and digital transformation, industry participants can navigate the evolving landscape and capitalize on the opportunities presented by the UAE lubricants market.

The United Arab Emirates Lubricants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Engine Oil, Transmission Fluid, Hydraulic Oil, Grease |

| End User | Automotive, Industrial, Marine, Aviation |

| Application | Passenger Vehicles, Commercial Vehicles, Heavy Machinery, Equipment |

| Distribution Channel | Retail, Wholesale, Online, Direct Sales |

Leading Companies in The United Arab Emirates Lubricants Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at