444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Sweden mobile payments market has experienced significant growth in recent years, driven by the increasing adoption of smartphones and the growing popularity of digital payment solutions. Mobile payments refer to the use of mobile devices, such as smartphones and tablets, to make transactions or conduct financial activities. This market has witnessed a shift from traditional payment methods, such as cash and cards, towards mobile payment solutions, providing convenience, speed, and security to users.

Meaning

Mobile payments, also known as mobile money or mobile wallets, enable users to make payments, transfer funds, or conduct financial transactions using their mobile devices. These transactions can be made through various technologies, including Near Field Communication (NFC), Quick Response (QR) codes, mobile apps, or SMS-based systems. By leveraging the capabilities of smartphones, mobile payments offer a seamless and user-friendly way to manage financial transactions.

Executive Summary

The Sweden mobile payments market has experienced rapid growth in recent years, driven by factors such as the widespread adoption of smartphones, increasing digitalization, and changing consumer preferences. The market is characterized by the presence of several key players offering a wide range of mobile payment solutions. As the demand for convenient and secure payment methods continues to rise, the market is expected to witness further expansion in the coming years.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Sweden mobile payments market is characterized by intense competition among key players. Companies are continuously innovating and enhancing their mobile payment solutions to stay ahead in the market. Collaboration between banks, fintech firms, and mobile network operators is common, aiming to provide users with comprehensive and secure mobile payment experiences.

The market dynamics are also influenced by changing consumer preferences and technological advancements. As consumers become more comfortable with digital transactions and demand seamless payment experiences, mobile payment providers are focusing on improving user interfaces, adding new features, and enhancing security measures.

Additionally, partnerships with merchants, retailers, and e-commerce platforms play a crucial role in expanding the reach and acceptance of mobile payment solutions. By integrating mobile payment options into various points of sale, businesses can cater to the growing demand for cashless transactions and capture a larger customer base.

Furthermore, regulatory frameworks and government policies impact the mobile payments market. Regulatory bodies play a vital role in ensuring the security and reliability of mobile payment systems while addressing concerns related to data protection, privacy, and fraud prevention.

Regional Analysis

The mobile payments market in Sweden is geographically distributed across various regions, including major cities and rural areas. Urban regions, such as Stockholm, Gothenburg, and Malmö, have witnessed higher adoption rates due to greater smartphone penetration and access to advanced digital infrastructure. These regions are also home to a large number of businesses and retailers, making them ideal locations for the deployment of mobile payment solutions.

In contrast, rural areas may have lower mobile payment adoption rates due to limited access to smartphones, internet connectivity, and awareness about mobile payment solutions. However, with efforts to bridge the digital divide and improve connectivity in remote regions, the market is expected to witness growth across all geographies in the coming years.

Competitive Landscape

Leading Companies in the Sweden Mobile Payments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

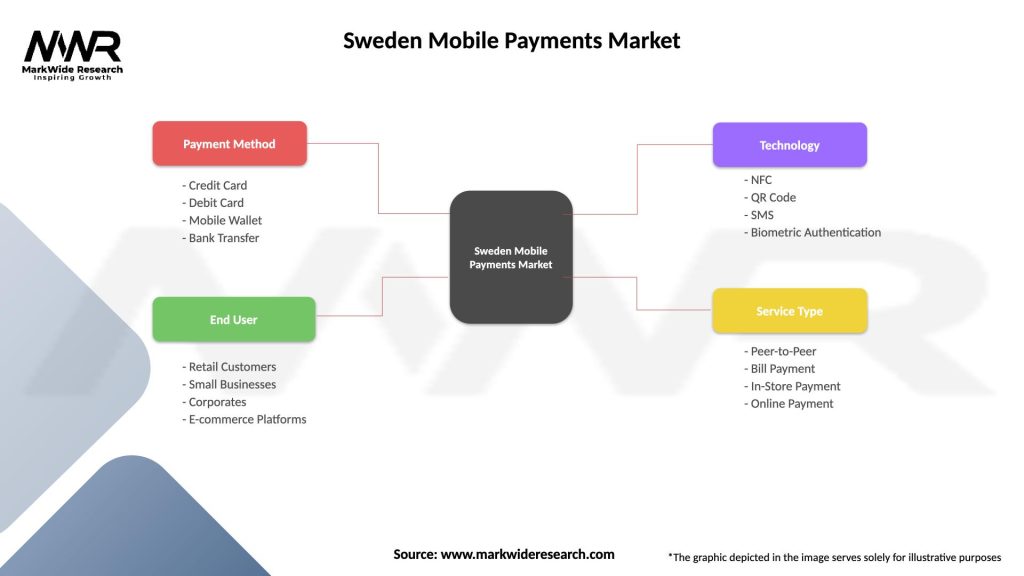

The Sweden mobile payments market can be segmented based on various factors, including technology, payment mode, and end-user industry.

Based on technology, the market can be categorized into:

Based on payment mode, the market can be divided into:

Based on end-user industry, the market can be segmented into:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Sweden mobile payments market offers several benefits for industry participants and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a profound impact on the Sweden mobile payments market. The lockdowns and social distancing measures implemented to curb the spread of the virus accelerated the adoption of mobile payment solutions. The fear of transmitting the virus through physical cash and the need for contactless transactions led to a surge in mobile payment usage.

During the pandemic, consumers and businesses turned to mobile payments as a safe and hygienic payment option. Mobile payment apps gained traction as people avoided physical contact with payment terminals or cashiers. Additionally, the closure of physical retail stores and the shift towards online shopping further boosted the usage of mobile payments for e-commerce transactions.

The pandemic also highlighted the importance of digital payments and the need for a robust and resilient payment infrastructure. As a result, both consumers and businesses became more comfortable with mobile payment solutions, paving the way for sustained growth in the market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Sweden mobile payments market looks promising, with sustained growth expected in the coming years. The increasing adoption of smartphones, the ongoing digitalization of the economy, and changing consumer preferences will be key drivers of market expansion.

Mobile payment providers will continue to innovate and differentiate their offerings to stay competitive. The integration of mobile payments with other services and the development of value-added features will further enhance user experiences. Additionally, advancements in technologies such as biometric authentication and open banking APIs will contribute to the evolution of mobile payment solutions.

Regulatory frameworks will play a vital role in shaping the market landscape. Continued collaboration between industry stakeholders and regulatory bodies will be essential to ensure the security, privacy, and interoperability of mobile payment systems.

Conclusion

The Sweden mobile payments market has witnessed significant growth driven by the increasing adoption of smartphones, growing digitalization, and changing consumer preferences. Mobile payments provide a convenient and secure way to make transactions, transfer funds, and manage finances using mobile devices.

The market is characterized by intense competition among key players, who continuously innovate to provide user-friendly and feature-rich mobile payment solutions. Collaboration between banks, fintech companies, and technology giants has been instrumental in driving market growth.

While the market offers numerous opportunities for expansion, challenges such as limited acceptance infrastructure, security concerns, and resistance to change remain. Overcoming these challenges will require concerted efforts from industry participants, regulators, and stakeholders.

What is Mobile Payments?

Mobile payments refer to transactions made through mobile devices, allowing users to pay for goods and services using their smartphones or tablets. This includes various methods such as mobile wallets, contactless payments, and in-app purchases.

What are the key players in the Sweden Mobile Payments Market?

Key players in the Sweden Mobile Payments Market include Swish, Klarna, and iZettle, which provide various mobile payment solutions and services. These companies are known for their innovative approaches to enhancing user experience and security in mobile transactions, among others.

What are the main drivers of growth in the Sweden Mobile Payments Market?

The growth of the Sweden Mobile Payments Market is driven by increasing smartphone penetration, the rise of e-commerce, and consumer demand for convenient payment solutions. Additionally, advancements in technology and security measures are encouraging more users to adopt mobile payment methods.

What challenges does the Sweden Mobile Payments Market face?

The Sweden Mobile Payments Market faces challenges such as security concerns, regulatory compliance, and competition from traditional banking methods. These factors can hinder the adoption of mobile payments among certain consumer segments.

What opportunities exist in the Sweden Mobile Payments Market?

Opportunities in the Sweden Mobile Payments Market include the expansion of digital wallets, integration with loyalty programs, and the potential for partnerships with retailers. As consumer preferences shift towards cashless transactions, there is significant potential for growth in this sector.

What trends are shaping the Sweden Mobile Payments Market?

Trends in the Sweden Mobile Payments Market include the increasing use of biometric authentication, the rise of peer-to-peer payment platforms, and the integration of mobile payments with emerging technologies like blockchain. These trends are transforming how consumers engage with payment systems.

Sweden Mobile Payments Market

| Segmentation Details | Description |

|---|---|

| Payment Method | Credit Card, Debit Card, Mobile Wallet, Bank Transfer |

| End User | Retail Customers, Small Businesses, Corporates, E-commerce Platforms |

| Technology | NFC, QR Code, SMS, Biometric Authentication |

| Service Type | Peer-to-Peer, Bill Payment, In-Store Payment, Online Payment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at