444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The South America bunker fuel market has witnessed substantial growth in recent years, driven by increasing maritime trade and the region’s strategic location as a major transit route for global shipping. Bunker fuel, also known as marine fuel, is a type of fuel specifically designed for use in ships and other marine vessels. As the backbone of the shipping industry, the demand for bunker fuel is closely linked to the movement of goods and commodities across the world. This comprehensive analysis delves into the key aspects of the South America bunker fuel market, highlighting its meaning, executive summary, key market insights, market drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, SWOT analysis, key trends, Covid-19 impact, key industry developments, analyst suggestions, future outlook, and conclusion.

Meaning

Bunker fuel, in the context of the South America market, refers to the heavy fuel oil (HFO) or intermediate fuel oil (IFO) used to power marine vessels, including cargo ships, container ships, tankers, and cruise liners. It is stored in large on-board tanks, commonly known as bunkers, which is where the term “bunker fuel” originates. The grade and quality of bunker fuel vary, with different types suited for specific marine engines and operating conditions. As maritime trade continues to flourish, the demand for bunker fuel in South America is expected to experience significant growth.

Executive Summary

The executive summary provides a concise overview of the South America bunker fuel market, summarizing key findings and highlighting the main points covered in this analysis. It encapsulates the market’s current state, recent trends, and potential future developments, offering industry participants and stakeholders a quick grasp of the market’s opportunities and challenges.

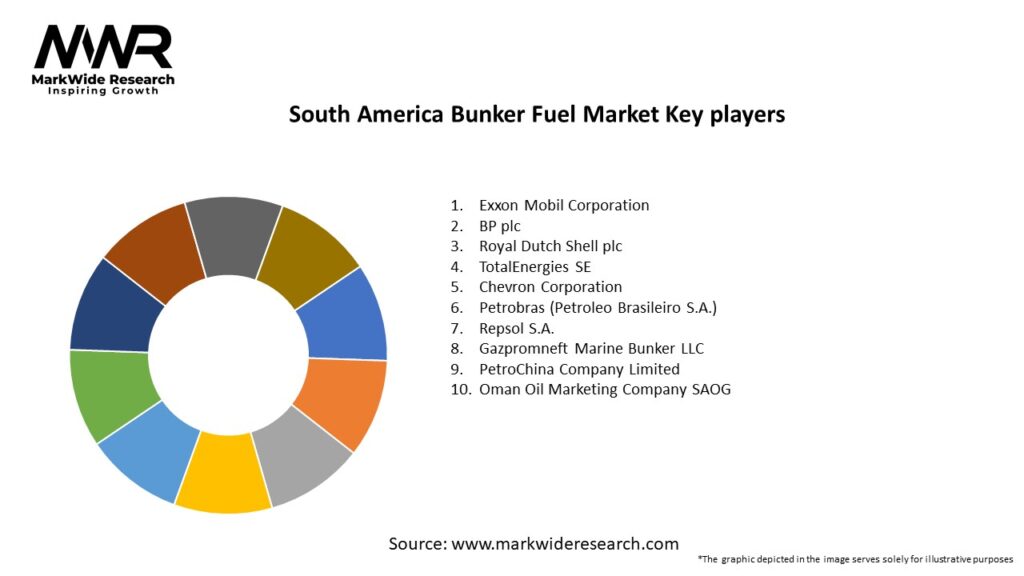

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

Regional Analysis

The South America bunker fuel market is experiencing varied growth patterns across different countries. Brazil is the dominant player in the region, owing to its large coastline, active shipping routes, and robust port infrastructure. Major ports like Santos and Rio de Janeiro handle significant volumes of both domestic and international cargo, driving bunker fuel demand.

Argentina and Chile also contribute to the market, with Buenos Aires and Valparaíso serving as key ports for trade. Argentina’s expansion in agricultural exports and Chile’s mining industry are significant contributors to bunker fuel demand in these countries.

However, while there is growth in fuel demand across the region, countries like Venezuela and Colombia face political and economic challenges that affect fuel consumption patterns.

Competitive Landscape

Leading Companies in the South America Bunker Fuel Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

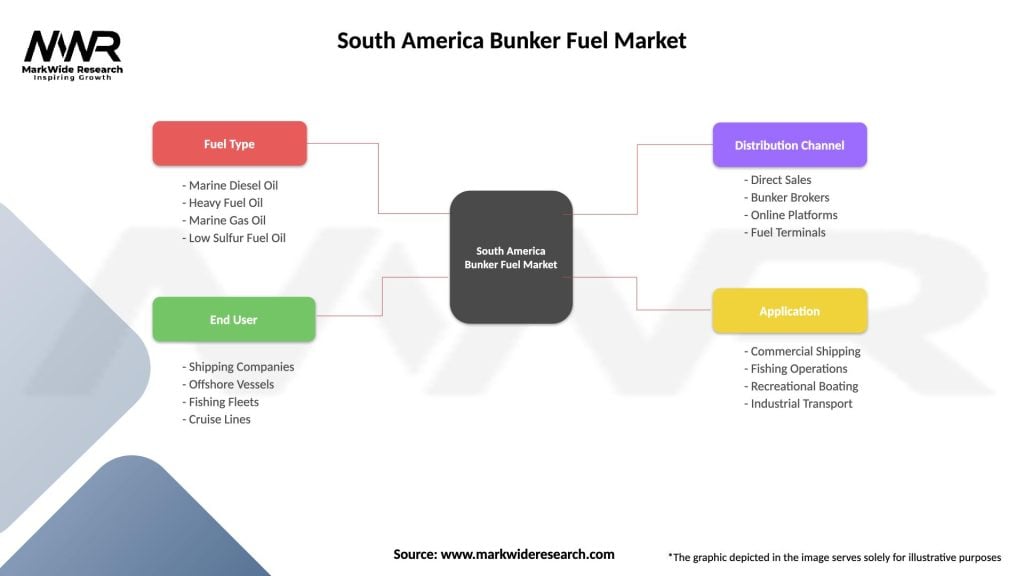

Segmentation

By Type of Fuel

By Application

By Country

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 impact section examines how the pandemic has affected the South America bunker fuel market. It analyzes disruptions in supply chains, changes in demand patterns, and the industry’s response to the crisis. The Covid-19 pandemic led to a temporary decline in shipping activities, affecting bunker fuel demand in the short term. However, as trade volumes recover, the market is expected to rebound, driven by increased global trade and the resumption of normal operations in key South American ports.

Key Industry Developments

Analyst Suggestions

Future Outlook

The South American bunker fuel market is poised for steady growth, driven by increasing international trade, investment in port infrastructure, and the shift toward cleaner fuels. The market’s future will largely depend on the regulatory landscape, fuel price trends, and the continued growth of maritime activities in the region. The future outlook offers an informed projection of the South America bunker fuel market’s potential trajectory. It considers upcoming trends, regulatory changes, and technological advancements that may shape the market’s growth in the coming years.

Conclusion

In conclusion, the South America bunker fuel market presents promising opportunities for industry players, driven by increasing maritime trade and strategic developments in the region. However, stakeholders must also address challenges such as stricter environmental regulations and the transition towards cleaner marine fuels. By understanding key market insights, regional variations, and competitive landscapes, participants can formulate effective strategies to thrive in this dynamic industry. Moreover, investing in sustainable and innovative solutions will play a pivotal role in ensuring the market’s long-term growth and resilience.

What is Bunker Fuel?

Bunker fuel refers to the fuel used aboard ships, primarily for propulsion and power generation. It is a crucial component in the maritime industry, particularly for commercial shipping and fishing vessels.

What are the key players in the South America Bunker Fuel Market?

Key players in the South America Bunker Fuel Market include Petrobras, Shell, and ExxonMobil, among others. These companies are involved in the production, distribution, and supply of bunker fuel across the region.

What are the main drivers of the South America Bunker Fuel Market?

The main drivers of the South America Bunker Fuel Market include the growth of international trade, increasing shipping activities, and the rising demand for energy-efficient marine fuels. Additionally, regulatory changes aimed at reducing emissions are influencing market dynamics.

What challenges does the South America Bunker Fuel Market face?

The South America Bunker Fuel Market faces challenges such as fluctuating oil prices, stringent environmental regulations, and competition from alternative fuels. These factors can impact profitability and operational efficiency for companies in the sector.

What opportunities exist in the South America Bunker Fuel Market?

Opportunities in the South America Bunker Fuel Market include the development of low-sulfur fuels and the adoption of cleaner technologies. Additionally, the expansion of shipping routes and increased investment in port infrastructure present growth potential.

What trends are shaping the South America Bunker Fuel Market?

Trends shaping the South America Bunker Fuel Market include a shift towards sustainable shipping practices, the implementation of stricter emissions regulations, and advancements in fuel technology. These trends are driving innovation and influencing purchasing decisions in the industry.

South America Bunker Fuel Market

| Segmentation Details | Description |

|---|---|

| Fuel Type | Marine Diesel Oil, Heavy Fuel Oil, Marine Gas Oil, Low Sulfur Fuel Oil |

| End User | Shipping Companies, Offshore Vessels, Fishing Fleets, Cruise Lines |

| Distribution Channel | Direct Sales, Bunker Brokers, Online Platforms, Fuel Terminals |

| Application | Commercial Shipping, Fishing Operations, Recreational Boating, Industrial Transport |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the South America Bunker Fuel Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at