444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Saudi Arabia Buy Now Pay Later (BNPL) Services market refers to the industry involved in providing convenient and flexible payment solutions to consumers. BNPL services allow customers to make purchases and pay for them in installments over a specified period, without the need for traditional credit cards or upfront payments. This market has gained significant traction in recent years, driven by the growing demand for convenient and accessible financing options, especially in the e-commerce sector.

Meaning

Buy Now Pay Later (BNPL) services are financial solutions that enable consumers to make purchases and defer payment until a later date. This payment model offers flexibility and convenience by allowing customers to split their payments into installments, typically interest-free or with minimal interest charges. In Saudi Arabia, BNPL services have gained popularity as an alternative to traditional credit cards, providing consumers with greater financial flexibility and control over their purchases.

Executive Summary

The Saudi Arabia Buy Now Pay Later Services market is experiencing rapid growth, fueled by the increasing popularity of online shopping and the demand for flexible payment options. The market offers convenience to consumers who prefer deferred payment options and provides merchants with opportunities to boost sales and customer loyalty. As technology advances and consumer behavior evolves, BNPL services are expected to continue expanding their presence in the Saudi Arabian market.

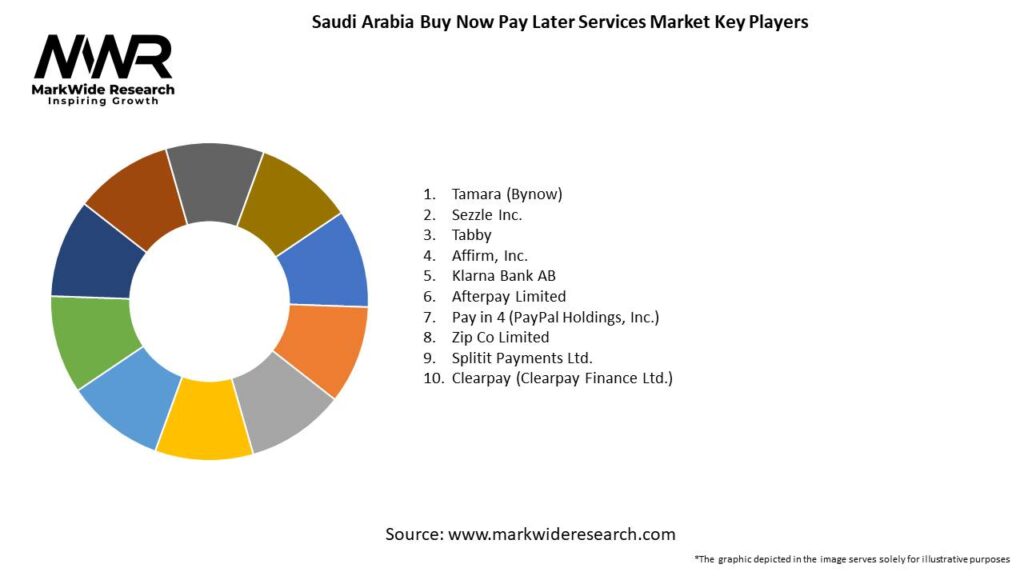

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

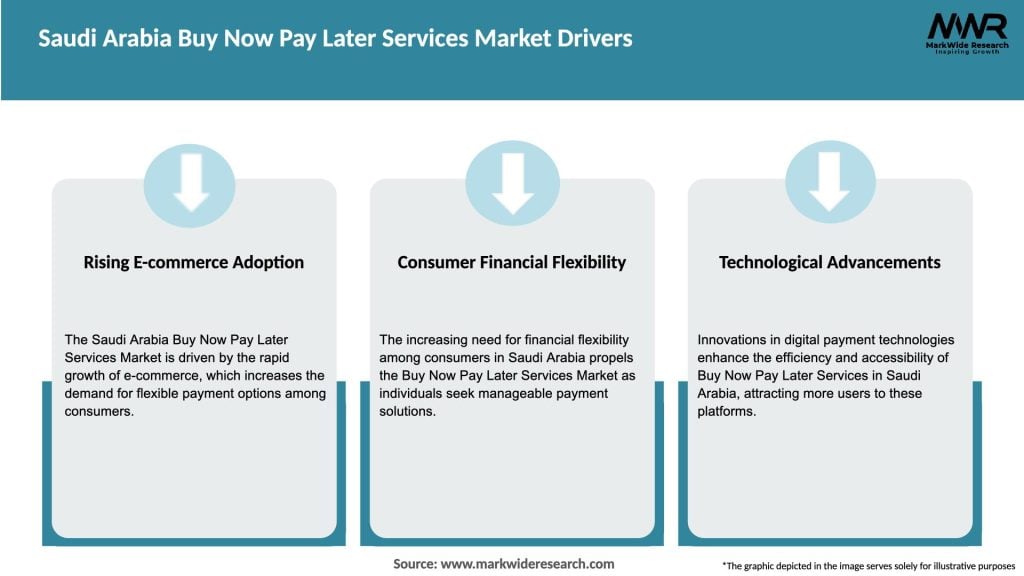

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Saudi Arabia BNPL Services market is driven by factors such as the convenience and flexibility offered to consumers, the growth of e-commerce, and the desire for enhanced shopping experiences. The market is characterized by intense competition among service providers, who differentiate themselves based on factors such as interest rates, repayment terms, and partnerships with merchants.

Regional Analysis

The demand for BNPL services in Saudi Arabia is spread across different regions, with major cities such as Riyadh, Jeddah, and Dammam being key markets. These regions experience significant e-commerce activity and have a growing population of tech-savvy consumers.

Competitive Landscape

Leading Companies in the Saudi Arabia Buy Now Pay Later Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Saudi Arabia Buy Now Pay Later Services Market can be segmented by:

By Application:

By Payment Plan Type:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated the adoption of BNPL services in Saudi Arabia. The shift towards online shopping and the need for flexible payment options during challenging economic times have further propelled the growth of BNPL services.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Saudi Arabia BNPL Services market is optimistic, with sustained growth expected. The market will continue to be driven by the increasing demand for flexible payment options, the growth of e-commerce, and technological advancements in the financial sector. However, market players should be mindful of regulatory developments and maintain a focus on responsible lending practices to ensure long-term success.

Conclusion

The Saudi Arabia Buy Now Pay Later Services market is witnessing significant growth driven by the demand for convenient and flexible payment options, especially in the e-commerce sector. BNPL services provide consumers with the ability to make purchases and pay in installments, enhancing their shopping experience and boosting sales for businesses. While the market offers immense opportunities, responsible lending practices, consumer education, and regulatory compliance are crucial for its sustainable growth. The future outlook is promising, with continued innovation, partnerships, and market expansion anticipated in the coming years.

What is Buy Now Pay Later Services?

Buy Now Pay Later Services refer to financial solutions that allow consumers to purchase goods and services immediately while deferring payment over a specified period. This model is increasingly popular in retail and e-commerce, providing flexibility to consumers in managing their finances.

What are the key players in the Saudi Arabia Buy Now Pay Later Services Market?

Key players in the Saudi Arabia Buy Now Pay Later Services Market include Tamara, Tabby, and PayFort, among others. These companies offer various payment solutions that cater to different consumer needs and preferences.

What are the growth factors driving the Saudi Arabia Buy Now Pay Later Services Market?

The growth of the Saudi Arabia Buy Now Pay Later Services Market is driven by increasing consumer demand for flexible payment options, the rise of e-commerce, and a growing acceptance of digital payment solutions. Additionally, the younger demographic’s preference for online shopping contributes to this trend.

What challenges does the Saudi Arabia Buy Now Pay Later Services Market face?

Challenges in the Saudi Arabia Buy Now Pay Later Services Market include regulatory scrutiny, potential consumer debt issues, and competition from traditional credit providers. These factors can impact the sustainability and growth of BNPL services.

What opportunities exist in the Saudi Arabia Buy Now Pay Later Services Market?

Opportunities in the Saudi Arabia Buy Now Pay Later Services Market include expanding partnerships with retailers, enhancing technology for better user experience, and targeting underserved consumer segments. The increasing digitalization of financial services also presents significant growth potential.

What trends are shaping the Saudi Arabia Buy Now Pay Later Services Market?

Trends in the Saudi Arabia Buy Now Pay Later Services Market include the integration of artificial intelligence for credit assessments, the rise of mobile payment solutions, and a focus on customer loyalty programs. These innovations are enhancing the overall consumer experience and driving market growth.

Saudi Arabia Buy Now Pay Later Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Retail, E-commerce, Travel, Healthcare |

| Customer Type | Millennials, Gen Z, Professionals, Families |

| Payment Method | Credit Card, Debit Card, Bank Transfer, Digital Wallet |

| Transaction Size | Small, Medium, Large, High-Value |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Saudi Arabia Buy Now Pay Later Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at