444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The pipeline pigging equipment market refers to the industry involved in the manufacturing, distribution, and utilization of equipment used for pipeline pigging. Pipeline pigging is a process used to clean, inspect, and maintain pipelines in various industries such as oil and gas, chemical, and water utilities. The equipment used for pigging includes pigs (devices inserted into pipelines), launchers and receivers, cleaning tools, and inspection systems.

Meaning

Pipeline pigging equipment is designed to improve the operational efficiency and integrity of pipelines. The term “pig” refers to a device that is inserted into the pipeline and propelled by the fluid flow. These pigs are used for various purposes, including cleaning the pipelines of debris, inspecting the internal condition of the pipes, and separating different products being transported in multiproduct pipelines. The equipment used to launch and receive these pigs, as well as the associated cleaning and inspection tools, collectively make up the pipeline pigging equipment market.

Executive Summary

The pipeline pigging equipment market has experienced significant growth in recent years, driven by the increasing demand for energy and the need to maintain the efficiency of existing pipeline infrastructure. The market is characterized by the presence of both established players and new entrants offering a wide range of pigging equipment solutions. Key market trends include the adoption of advanced inspection technologies, the integration of automation and robotics in pigging operations, and the development of intelligent pigging systems for real-time monitoring and data analysis.

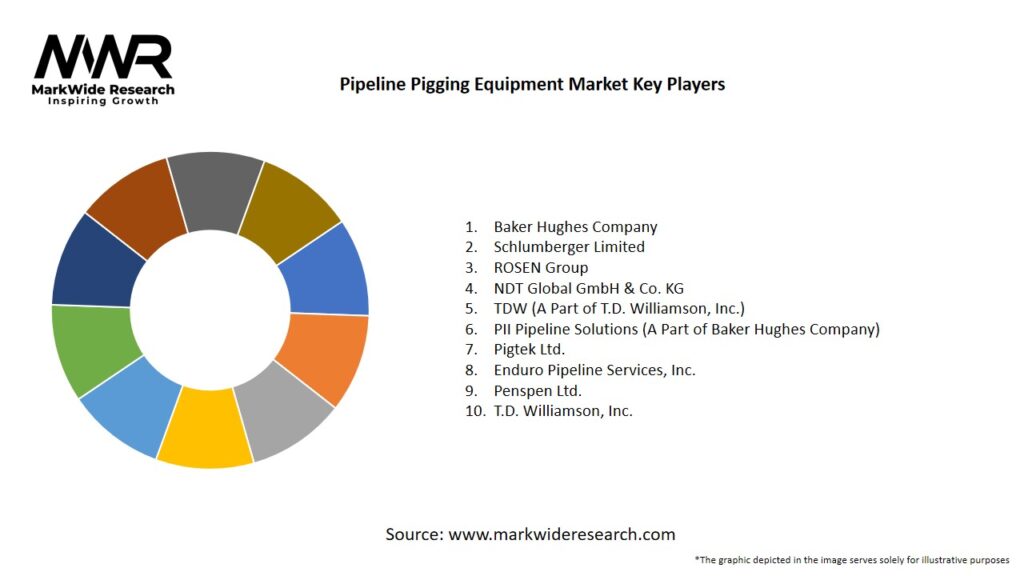

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The pipeline pigging equipment market is driven by various dynamics, including the demand for energy, safety and regulatory compliance, operational efficiency, and technological advancements. The market is highly competitive, with companies focusing on product development, partnerships, and acquisitions to strengthen their market position. The COVID-19 pandemic has had a mixed impact on the market, with temporary disruptions in the supply chain and project delays, but also increased focus on pipeline maintenance and integrity.

Regional Analysis

The pipeline pigging equipment market is analyzed based on different regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America and Europe dominate the market due to their extensive pipeline networks and stringent safety regulations. The Asia Pacific region is witnessing significant growth, driven by increasing energy demand and infrastructure development in countries like China and India.

Competitive Landscape

Leading Companies in the Pipeline Pigging Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The pipeline pigging equipment market can be segmented based on the type of equipment, application, and end-user industry. Equipment types include pigs (conventional pigs, intelligent pigs, cleaning pigs, etc.), launchers and receivers, cleaning tools (brush pigs, foam pigs, etc.), and inspection systems (ultrasonic, magnetic, etc.). Applications of pigging equipment include cleaning, inspection, and product separation. End-user industries include oil and gas, chemical, water utilities, food processing, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a mixed impact on the pipeline pigging equipment market. The temporary disruptions in the global supply chain and project delays affected the market in the short term. However, the pandemic also highlighted the importance of pipeline maintenance and integrity, leading to increased investments in pipeline infrastructure and pigging operations. The market is expected to recover and grow as the global economy rebounds and energy demand increases.

Key Industry Developments

Analyst Suggestions

Future Outlook

The pipeline pigging equipment market is expected to witness steady growth in the coming years, driven by the increasing demand for energy, the expansion of pipeline infrastructure, and the need for pipeline maintenance and integrity management. Technological advancements, such as intelligent pigging systems and robotics, will play a significant role in shaping the future of the market. The focus on sustainability, data analysis, and predictive maintenance will also be key trends in the industry.

Conclusion

The pipeline pigging equipment market plays a crucial role in maintaining the integrity and efficiency of pipelines in various industries. The market is driven by factors such as the increasing demand for energy, the need for pipeline maintenance and inspection, and the emphasis on safety and regulatory compliance. Technological advancements, collaboration between industry stakeholders, and the exploration of emerging markets present significant opportunities for market players. Despite challenges such as high initial investment and operational complexities, the market is expected to grow steadily, supported by the expansion of pipeline infrastructure and the adoption of innovative pigging solutions.

What is Pipeline Pigging Equipment?

Pipeline Pigging Equipment refers to tools and devices used in the maintenance and cleaning of pipelines, ensuring efficient flow and reducing downtime. These tools are essential for removing debris, wax, and other build-up from the interior of pipelines.

What are the key players in the Pipeline Pigging Equipment Market?

Key players in the Pipeline Pigging Equipment Market include companies like Baker Hughes, TDW, and CIRCOR International, which provide a range of pigging solutions for various applications, including oil and gas, water, and chemical industries, among others.

What are the main drivers of the Pipeline Pigging Equipment Market?

The main drivers of the Pipeline Pigging Equipment Market include the increasing demand for efficient pipeline maintenance, the growth of the oil and gas sector, and the need for compliance with safety regulations. Additionally, advancements in technology are enhancing the effectiveness of pigging operations.

What challenges does the Pipeline Pigging Equipment Market face?

The Pipeline Pigging Equipment Market faces challenges such as high operational costs and the complexity of pigging operations in certain pipeline configurations. Additionally, the need for skilled personnel to operate and maintain these systems can be a barrier to widespread adoption.

What opportunities exist in the Pipeline Pigging Equipment Market?

Opportunities in the Pipeline Pigging Equipment Market include the expansion of pipeline networks in emerging economies and the increasing focus on pipeline integrity management. Furthermore, the integration of smart technologies and automation presents new avenues for growth.

What trends are shaping the Pipeline Pigging Equipment Market?

Trends shaping the Pipeline Pigging Equipment Market include the adoption of environmentally friendly pigging solutions and the use of advanced materials for pigging tools. Additionally, there is a growing emphasis on digitalization and data analytics to optimize pigging operations.

Pipeline Pigging Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Batch Pig, Intelligent Pig, Foam Pig, Magnetic Pig |

| End User | Oil & Gas, Water Utilities, Chemical Processing, Food & Beverage |

| Technology | Ultrasonic, Electromagnetic, Mechanical, Hydraulic |

| Application | Pipeline Maintenance, Inspection, Cleaning, Flow Assurance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Pipeline Pigging Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at