444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The oral screening systems market is witnessing significant growth due to the increasing prevalence of oral diseases and the growing awareness about the importance of oral health. Oral screening systems play a crucial role in the early detection and diagnosis of various oral conditions, including oral cancer, gum diseases, and dental caries. These systems are designed to aid dental professionals in identifying abnormalities and potential risks, thus enabling timely intervention and treatment.

Advancements in technology, such as the development of portable and handheld oral screening devices, have revolutionized the field of oral healthcare. These innovative systems offer convenience, accuracy, and cost-effectiveness, thereby driving their adoption across dental clinics, hospitals, and diagnostic centers worldwide. Moreover, the integration of artificial intelligence (AI) and machine learning algorithms into oral screening systems has further enhanced their diagnostic capabilities, enabling faster and more precise detection of oral diseases.

Meaning

Oral screening systems refer to a range of devices and technologies that are used to assess and evaluate the oral cavity for signs of diseases, abnormalities, and oral health conditions. These systems are designed to aid dental professionals in conducting thorough oral examinations and identifying potential risks or abnormalities that may require further investigation or treatment.

The primary purpose of oral screening systems is to detect oral diseases at an early stage when they are more manageable and have better treatment outcomes. By facilitating early diagnosis, these systems can significantly improve patient outcomes, reduce treatment costs, and enhance overall oral health.

Executive Summary

The oral screening systems market is experiencing steady growth, driven by several factors such as the increasing prevalence of oral diseases, rising geriatric population, and growing awareness about oral health. Technological advancements in oral screening devices, such as the integration of AI and machine learning, have further propelled market growth. The market is highly competitive, with key players focusing on product innovation and strategic collaborations to gain a competitive edge. The COVID-19 pandemic has had a moderate impact on the market, with temporary disruptions in the supply chain and reduced dental visits. However, the market is expected to recover and witness significant growth in the coming years.

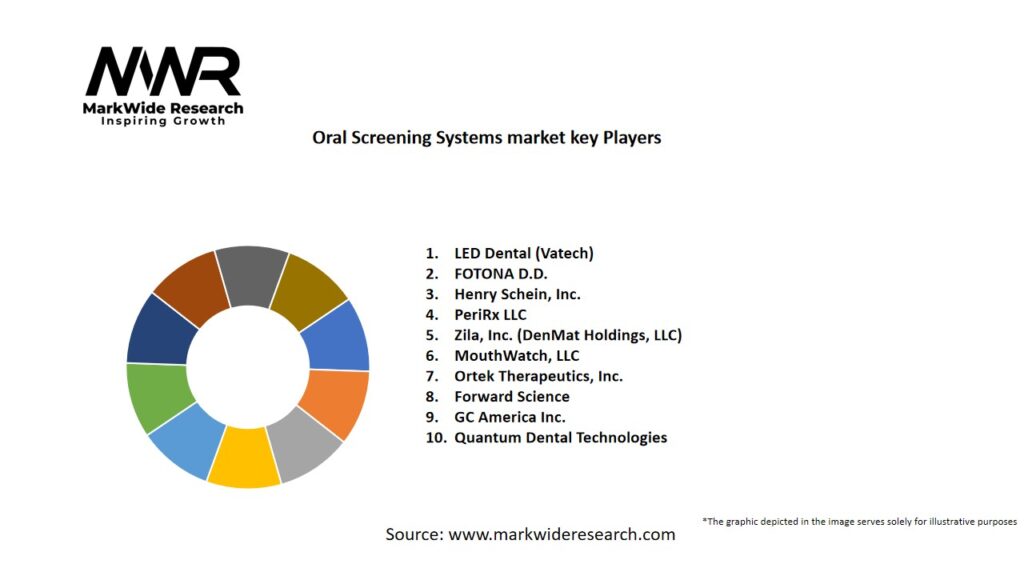

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

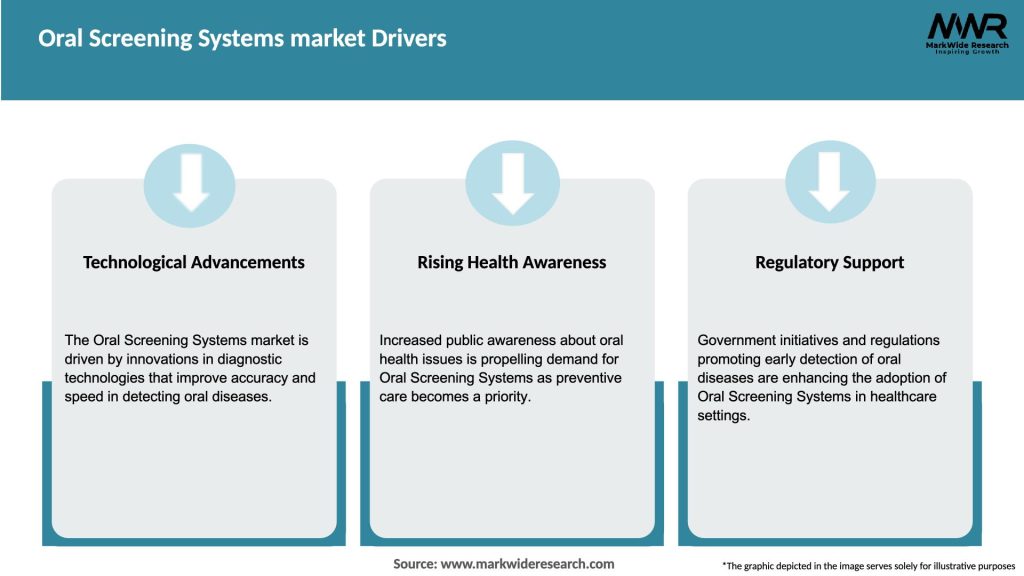

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The oral screening systems market is driven by several dynamic factors that shape its growth and development. These dynamics include market drivers, market restraints, market opportunities, and market trends. Understanding and analyzing these dynamics is crucial for stakeholders in the oral screening systems market to make informed decisions and formulate effective strategies.

The increasing prevalence of oral diseases, growing awareness about oral health, and technological advancements are the primary drivers of market growth. However, high costs, a shortage of skilled professionals, and limited access to oral healthcare act as restraints. Opportunities lie in emerging markets, product innovation, collaborations, dental tourism, and the integration of tele-dentistry. Additionally, market trends such as the impact of COVID-19 and the adoption of AI and machine learning in oral screening systems influence the market landscape.

Overall, the oral screeningsystems market is poised for significant growth, driven by the increasing demand for early detection and diagnosis of oral diseases, advancements in technology, and the growing emphasis on oral health. However, challenges such as high costs, limited access to oral healthcare, and the shortage of skilled professionals need to be addressed. By leveraging emerging opportunities, such as expanding into developing markets, fostering product innovation, and embracing tele-dentistry, stakeholders can capitalize on the market’s potential. It is important to stay updated with market trends, adapt to the impact of COVID-19, and collaborate with key industry players to maintain a competitive edge in this evolving landscape.

Regional Analysis

The oral screening systems market can be analyzed based on regional segmentation, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region exhibits unique characteristics and offers specific growth opportunities and challenges for market players.

North America

North America dominates the oral screening systems market due to its advanced healthcare infrastructure, high healthcare expenditure, and strong emphasis on oral health. The region has a well-established dental care system and a significant number of dental clinics and hospitals. The increasing prevalence of oral diseases, growing awareness about oral health, and technological advancements drive the demand for oral screening systems in this region.

Europe

Europe is another prominent market for oral screening systems, driven by factors such as the aging population, high healthcare expenditure, and strong dental care infrastructure. Countries like Germany, the UK, and France have a robust dental healthcare system and are early adopters of advanced oral screening technologies. The region also witnesses a high prevalence of oral diseases, including oral cancer and periodontal diseases, contributing to market growth.

Asia Pacific

Asia Pacific is expected to witness significant growth in the oral screening systems market due to the increasing focus on oral healthcare and rising disposable income in emerging economies such as China, India, and Japan. The region has a large population, which translates into a higher patient pool and a growing demand for oral screening systems. Government initiatives aimed at improving oral health awareness and expanding healthcare infrastructure further contribute to market growth.

Latin America

Latin America offers untapped opportunities for market players in the oral screening systems sector. The region has a growing middle-class population, rising healthcare expenditure, and increasing awareness about oral health. Countries such as Brazil and Mexico are witnessing advancements in dental care infrastructure and a rising demand for oral screening systems. Collaborations with local dental clinics and hospitals can help market players establish a strong presence in this region.

Middle East and Africa

The Middle East and Africa region present both opportunities and challenges for the oral screening systems market. Countries like the United Arab Emirates, Saudi Arabia, and South Africa have well-developed healthcare infrastructure and a high prevalence of oral diseases. However, access to oral healthcare services and facilities in certain areas remains limited, posing a challenge to market penetration. Nonetheless, with increasing healthcare investments and government initiatives to improve oral health, the market has growth potential in this region.

Competitive Landscape

Leading Companies in Oral Screening Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

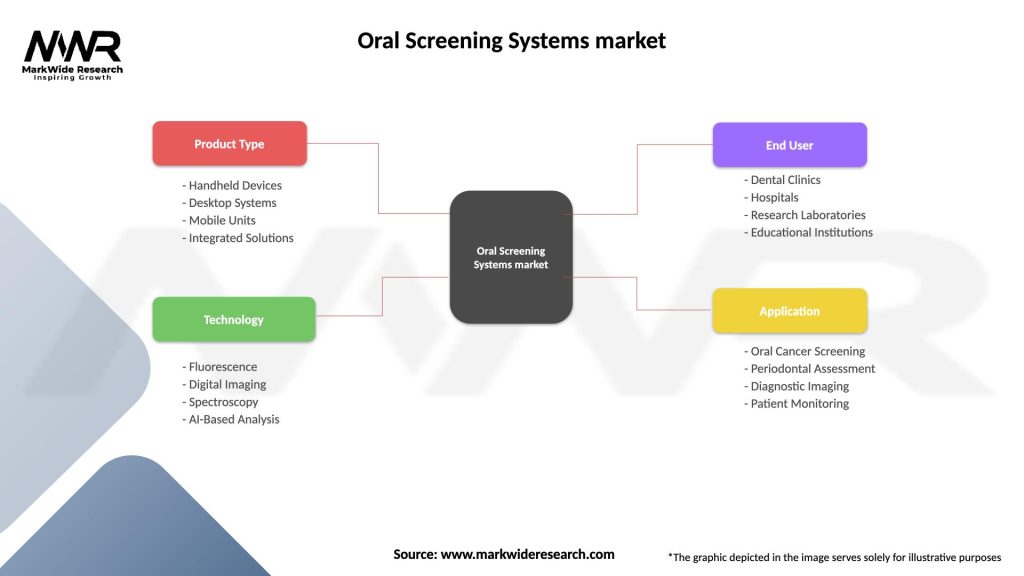

Segmentation

The oral screening systems market can be segmented based on various factors, including product type, end-user, and geography. Segmentation provides a structured approach to understanding the market and enables stakeholders to identify specific growth opportunities within each segment.

By Product Type:

By End-User:

By Geography:

Segmentation provides a comprehensive view of the market, enabling companies to target specific customer segments, tailor their marketing strategies, and develop customized solutions based on end-user requirements.

Category-wise Insights

To gain a deeper understanding of the oral screening systems market, let’s explore category-wise insights that highlight key aspects of each product category and end-user segment.

Handheld Devices:

Handheld devices are compact, portable, and user-friendly oral screening systems. These devices offer convenience and flexibility to dental professionals, allowing them to conduct oral examinations efficiently. Handheld devices typically feature imaging capabilities, including intraoral cameras, and are often integrated with AI algorithms for enhanced diagnostic accuracy. The growing demand for handheld devices is attributed to their ease of use, affordability, and effectiveness in identifying oral diseases at an early stage.

Imaging Systems:

Imaging systems play a crucial role in oral screening by providing detailed visual representations of the oral cavity. These systems utilize technologies such as X-rays, 3D imaging, and digital imaging to capture high-resolution images. Imaging systems enable dental professionals to assess the condition of teeth, gums, and surrounding structures, aiding in the detection of dental caries, periodontal diseases, and abnormalities. Continuous advancements in imaging technologies, such as the integration of AI for image analysis, are driving the adoption of imaging systems in oral screening.

Diagnostic Tools:

Diagnostic tools encompass a wide range of devices and instruments used for comprehensive oral examinations. These tools include tongue depressors, probes, mirrors, and explorers, among others. Dental professionals utilize diagnostic tools to visually inspect the oral cavity, assess tissue health, and identify any abnormalities or signs of oral diseases. Diagnostic tools are essential for conducting a thorough examination and are often combined with other screening systems to enhance diagnostic accuracy.

Fluorescence Imaging Devices:

Fluorescence imaging devices are specialized oral screening systems that utilize fluorescent agents to identify early-stage lesions and abnormalities in the oral cavity. These devices emit a specific wavelength of light, causing the targeted tissues to emit fluorescence, which can be captured and analyzed. Fluorescence imaging devices are particularly useful for detecting oral cancer, as they can identify precancerous and cancerous lesions that may not be visible under normal light. The growing emphasis on early detection of oral cancer has fueled the demand for fluorescence imaging devices.

Dental Clinics:

Dental clinics are the primary end-users of oral screening systems. These clinics provide comprehensive oral healthcare services, including routine check-ups, oral examinations, and treatment of various oral diseases. Oral screening systems play a crucial role in dental clinics, enabling dental professionals to identify and diagnose oral conditions at an early stage. The integration of oral screening systems in dental clinics improves workflow efficiency, enhances diagnostic accuracy, and enhances patient satisfaction.

Hospitals:

Hospitals also utilize oral screening systems to complement their dental departments and provide comprehensive oral healthcare services. Hospitals typically have a broader range of healthcare facilities and specialists, allowing for more advanced diagnostic capabilities and treatment options. Oral screening systems in hospitals are often integrated with other medical imaging and diagnostic technologies, facilitating a multidisciplinary approach to oral healthcare.

Diagnostic Centers:

Diagnostic centers specialize in conducting various medical and dental diagnostic procedures, including oral examinations. These centers offer advanced imaging technologies, such as X-rays and 3D imaging, to assess oral health conditions. Oral screening systems in diagnostic centers aid in the early detection of oral diseases and provide detailed diagnostic reports for further treatment planning. Diagnostic centers play a crucial role in catering to individuals seeking specialized oral examinations and assessments.

Dental Laboratories:

Dental laboratories are involved in fabricating dental prosthetics, such as crowns, bridges, and dentures. Oral screening systems in dental laboratories are used for quality control purposes, ensuring the accuracy of dental prosthetics and their compatibility with the patient’s oral cavity. These systems enable dental technicians to assess the fit, occlusion, and aesthetics of the prosthetics, ensuring optimal patient outcomes. Oral screening systems in dental laboratories contribute to the overall quality of dental restorations.

Each category and end-user segment within the oral screening systems market has its unique requirements and preferences. Understanding these insights enables market players to develop tailored solutions, target specific customer segments, and meet the diverse needs of dental professionals and patients.

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the oral screening systems market can expect various benefits from their involvement in this rapidly growing sector. These benefits include:

Industry participants and stakeholders should leverage these key benefits to strengthen their position in the oral screening systems market. By understanding the market dynamics, addressing customer needs, and focusing on product innovation, companies can maximize their opportunities and create a positive impact on oral healthcare.

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis provides a comprehensive assessment of the internal and external factors that influence the oral screening systems market. Understanding the strengths, weaknesses, opportunities, and threats enables industry participants to develop effective strategies and make informed decisions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Understanding the strengths, weaknesses, opportunities, and threats enables industry participants to devise strategies that capitalize on their strengths, address weaknesses, leverage opportunities, and mitigate threats. By focusing on product innovation, expanding into emerging markets, establishing strategic collaborations, and staying agile in response to market dynamics, companies can thrive in the oral screening systems market.

Market Key Trends

The oral screening systems market is influenced by various key trends that shape its growth trajectory and impact the industry landscape. These trends reflect the evolving needs and preferences of dental professionals, patients, and healthcare systems. Understanding these trends is crucial for industry participants to stay ahead and proactively respond to market demands.

1. Integration of Artificial Intelligence (AI) and Machine Learning (ML):

The integration of AI and ML technologies is a significant trend in the oral screening systems market. AI algorithms enable intelligent image analysis, pattern recognition, and risk assessment, enhancing the diagnostic capabilities of oral screening systems. Machine learning algorithms enable systems to learn from data, improving accuracy and diagnostic efficiency over time. The integration of AI and ML facilitates faster and more precise detection of oral diseases, improving patient outcomes and optimizing treatment planning.

2. Portable and Handheld Devices:

The market is witnessing a shift towards portable and handheld oral screening devices. These devices offer convenience, ease of use, and portability, enabling dental professionals to conduct oral examinations with flexibility and efficiency. Portable devices are particularly beneficial in remote or underserved areas where access to comprehensive oral healthcare services is limited. The demand for portable and handheld oral screening systems is expected to increase as they provide flexibility and cost-effectiveness without compromising diagnostic accuracy.

3. Imaging Technologies and 3D Visualization:

Advancements in imaging technologies, such as X-rays, 3D imaging, and intraoral cameras, are transforming the oral screening systems market. High-resolution imaging provides detailed visualization of the oral cavity, aiding in the detection of dental caries, periodontal diseases, and abnormalities. 3D visualization allows dental professionals to assess the oral structures more comprehensively, enabling precise treatment planning and improved patient outcomes.

4. Tele-dentistry and Remote Monitoring:

The adoption of tele-dentistry and remote monitoring technologies has gained momentum, driven by the COVID-19 pandemic and the need for virtual healthcare solutions. Oral screening systems integrated with tele-dentistry platforms enable remote consultations, oral examinations, and monitoring of oral health conditions. Tele-dentistry facilitates access to oral healthcare services, especially in underserved areas, and improves patient convenience and engagement.

5. Focus on Preventive Dentistry:

The shift towards preventive dentistry is a growing trend in oral healthcare. Dental professionals and patients alike recognize the importance of early detection and intervention to prevent the progression of oral diseases. Oral screening systems play a crucial role in preventive dentistry by facilitating early diagnosis and promoting regular oral examinations. The emphasis on preventive dentistry is expected to drive the demand for oral screening systems.

6. Integration with Electronic Health Records (EHRs):

Integration of oral screening systems with electronic health records (EHRs) enables seamless data management, storage, and retrieval. EHR integration enhances the efficiency of oral examinations, enables accurate record-keeping, and supports collaborative care among dental professionals and other healthcare providers. Integration with EHRs streamlines the workflow, reduces administrative burdens, and enhances patient care coordination.

Covid-19 Impact

The COVID-19 pandemic has had a moderate impact on the oral screening systems market. The outbreak and subsequent containment measures, including lockdowns and social distancing, disrupted dental care services worldwide. Key impacts of COVID-19 on the oral screening systems market include:

While the pandemic has presented challenges, it has also accelerated the adoption of tele-dentistry, created opportunities for innovation, and emphasized the importance of infection control in dental practices. The market is expected to rebound and witness renewed growth in the post-pandemic era.

Key Industry Developments

The oral screening systems market has witnessed several key industry developments in recent years. These developments reflect the evolving landscape and market dynamics, shaping the future of oral healthcare and the adoption of oral screening systems. Some notable industry developments include:

These key industry developments demonstrate the ongoing efforts to improve the diagnostic accuracy, usability, and patient experience of oral screening systems. By staying at the forefront of these developments, industry participants can position themselves as leaders in the evolving oral healthcare landscape.

Analyst Suggestions

Based on market trends and industry insights, analysts provide the following suggestions to industry participants in the oral screening systems market:

By implementing these suggestions, industry participants can position themselves for success in the competitive oral screening systems market. Adaptability, innovation, strategic collaborations, and a customer-centric approach are key to capturing market opportunities and driving sustainable growth.

Future Outlook

The future outlook for the oral screening systems market is promising, driven by various factors such as the increasing prevalence of oral diseases, technological advancements, and growing awareness about oral health. The market is expected to witness significant growth in the coming years, propelled by factors such as the integration of AI and machine learning, the focus on preventive dentistry, and the adoption of tele-dentistry solutions.

The increasing geriatric population, which is more prone to oral health issues, presents a substantial market opportunity. Additionally, emerging markets in Asia Pacific and Latin America offer significant growth potential due to the rising disposable income, increasing healthcare expenditure, and improving healthcare infrastructure in these regions.

Product innovation will continue to be a crucial driver of market growth. Companies will focus on developing advanced, user-friendly oral screening systems that offer improved diagnostic accuracy and patient comfort. The integration of AI and machine learning will play a key role in enhancing the diagnostic capabilities of these systems.

Tele-dentistry and remote monitoring will continue to gain traction, even beyond the COVID-19 pandemic. The adoption of tele-dentistry platforms integrated with oral screening systems will enable convenient access to oral healthcare services, particularly in remote or underserved areas.

Regulatory compliance will remain a key consideration for industry participants. Companies should stay updated with evolving regulatory standards and invest in obtaining necessary certifications to ensure their products meet the required quality and safety standards.

Overall, the future outlook for the oral screening systems market is optimistic, with significant growth opportunities on the horizon. Industry participants that focus on innovation, collaboration, and market expansion strategies will be well-positioned to capitalize on these opportunities and contribute to improving oral healthcare worldwide.

Conclusion

In conclusion, the oral screening systems market holds immense potential for growth. With advancements in technology, a growing emphasis on preventive dentistry, and the integration of tele-dentistry solutions, the market is poised for significant expansion. Industry participants should focus on product innovation, strategic collaborations, and market expansion strategies to capitalize on these opportunities. By addressing challenges and staying abreast of market trends, stakeholders can contribute to improving oral healthcare outcomes and meet the evolving needs of dental professionals and patients.

What is Oral Screening Systems?

Oral Screening Systems refer to diagnostic tools and technologies used to detect oral diseases, including oral cancer and other conditions. These systems often utilize advanced imaging techniques and software to enhance the accuracy of screenings.

What are the key players in the Oral Screening Systems market?

Key players in the Oral Screening Systems market include companies like VELscope, OralID, and Identafi, which specialize in innovative screening technologies. These companies focus on improving early detection methods for oral health issues, among others.

What are the growth factors driving the Oral Screening Systems market?

The growth of the Oral Screening Systems market is driven by increasing awareness of oral health, rising incidences of oral cancer, and advancements in screening technologies. Additionally, the growing emphasis on preventive healthcare is contributing to market expansion.

What challenges does the Oral Screening Systems market face?

The Oral Screening Systems market faces challenges such as high costs associated with advanced screening technologies and a lack of trained professionals to operate these systems. Furthermore, varying regulations across regions can hinder market growth.

What opportunities exist in the Oral Screening Systems market?

Opportunities in the Oral Screening Systems market include the development of portable screening devices and integration of artificial intelligence for enhanced diagnostic accuracy. Additionally, increasing collaborations between healthcare providers and technology firms present significant growth potential.

What trends are shaping the Oral Screening Systems market?

Trends in the Oral Screening Systems market include the adoption of telehealth solutions for remote screenings and the use of digital platforms for patient management. Moreover, there is a growing focus on personalized medicine, which is influencing the design of screening systems.

Oral Screening Systems market

| Segmentation Details | Description |

|---|---|

| Product Type | Handheld Devices, Desktop Systems, Mobile Units, Integrated Solutions |

| Technology | Fluorescence, Digital Imaging, Spectroscopy, AI-Based Analysis |

| End User | Dental Clinics, Hospitals, Research Laboratories, Educational Institutions |

| Application | Oral Cancer Screening, Periodontal Assessment, Diagnostic Imaging, Patient Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Oral Screening Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at