444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The North America Wireline Logging Services Market is a thriving sector within the oil and gas industry. Wireline logging refers to the process of collecting data from wells using various tools and instruments lowered into the wellbore on a wireline. This data is crucial for assessing the subsurface conditions and evaluating the potential of hydrocarbon reservoirs. The market for wireline logging services in North America has experienced steady growth over the years, driven by the increasing demand for oil and gas exploration and production activities in the region.

Meaning

Wireline logging services involve the use of specialized tools and equipment to measure and record various parameters in oil and gas wells. These measurements help operators understand the characteristics of the reservoir, such as rock and fluid properties, formation pressure, and temperature. Wireline logging is performed by lowering a logging toolstring into the wellbore using a wireline cable. The toolstring is then used to collect data as it traverses the well, providing valuable insights for reservoir evaluation and production optimization.

Executive Summary

The North America Wireline Logging Services Market has witnessed significant growth in recent years, driven by the increasing demand for energy resources and the need for accurate subsurface data. The market is characterized by the presence of several key players offering a wide range of wireline logging services. The competitive landscape is intense, with companies focusing on technological advancements and strategic collaborations to gain a competitive edge. Despite the challenges posed by the COVID-19 pandemic, the market has shown resilience and is expected to continue its growth trajectory in the coming years.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The North America Wireline Logging Services Market is driven by a combination of factors, including the growing energy demand, technological advancements, and the need for reservoir optimization. The market is highly competitive, with key players focusing on innovation, strategic partnerships, and geographical expansion to gain a competitive advantage. However, the market faces challenges such as price volatility, regulatory constraints, and high initial investment requirements. Despite these challenges, the market is expected to grow steadily, driven by the increasing demand for oil and gas and the need for accurate subsurface data.

Regional Analysis

The North America Wireline Logging Services Market is segmented into several key regions, including the United States and Canada. The United States dominates the market due to its vast reserves of oil and gas and the presence of numerous exploration and production companies. The shale gas boom in the U.S. has significantly contributed to the demand for wireline logging services. Canada also presents substantial opportunities, particularly in Alberta’s oil sands and offshore exploration in the Atlantic region. The market in both countries is influenced by regulatory frameworks and environmental considerations.

Competitive Landscape

Leading Companies in North America Wireline Logging Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

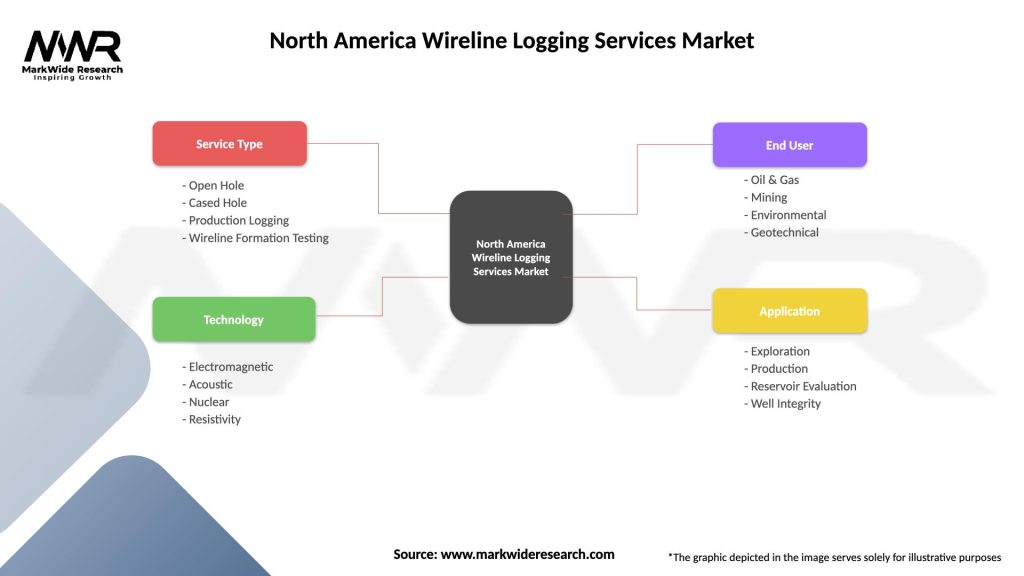

Segmentation

The market for wireline logging services in North America can be segmented based on the type of service, application, and location. By service type, the market can be divided into open hole and cased hole logging. Open hole logging involves data collection in an uncased wellbore, while cased hole logging is performed in wells that have been previously cased. By application, the market can be segmented into oil and gas exploration, production optimization, and well intervention. Geographically, the market can be segmented into the United States and Canada.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the North America Wireline Logging Services Market can benefit in several ways:

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the North America Wireline Logging Services Market. The oil and gas industry witnessed a sharp decline in demand due to reduced economic activity and travel restrictions imposed to curb the spread of the virus. This led to a decline in exploration and production activities, thereby affecting the demand for wireline logging services.

Furthermore, the pandemic disrupted supply chains, causing delays in equipment procurement and logistical challenges. Travel restrictions and social distancing measures also impacted field operations and personnel availability, affecting the execution of wireline logging services.

However, as the industry gradually recovers from the pandemic, the demand for wireline logging services is expected to rebound. The increasing energy demand and the resumption of exploration and production activities will drive the market’s recovery.

Key Industry Developments

Analyst Suggestions

Based on the market analysis and trends, analysts suggest the following strategies for industry participants:

Future Outlook

The North America Wireline Logging Services Market is expected to witness steady growth in the coming years. The increasing energy demand, focus on reservoir optimization, and technological advancements will drive market expansion. The exploration and production activities in unconventional resources, such as shale gas and tight oil, present significant opportunities for wireline logging services. The industry will continue to evolve with digitalization, automation, and the integration of data analytics. However, market participants should remain vigilant of price volatility, regulatory challenges, and the evolving energy landscape to sustain growth.

Conclusion

The North America Wireline Logging Services Market is a vital component of the oil and gas industry, providing essential data for reservoir evaluation, production optimization, and well intervention. The market is driven by the increasing energy demand, technological advancements, and the focus on reservoir optimization. Despite challenges such as price volatility and regulatory constraints, the market offers significant opportunities, particularly in unconventional resource exploration and offshore activities. Industry participants should focus on innovation, collaboration, and environmental sustainability to thrive in the competitive market. With the recovery from the COVID-19 pandemic, the market is expected to rebound and witness steady growth in the future.

What is Wireline Logging Services?

Wireline Logging Services refer to the techniques used to gather data from boreholes in the oil and gas industry. These services include various methods such as electrical, nuclear, and acoustic logging to assess the geological formations and fluid properties.

What are the key players in the North America Wireline Logging Services Market?

Key players in the North America Wireline Logging Services Market include Schlumberger, Halliburton, and Baker Hughes, among others. These companies provide a range of logging services and technologies to enhance oil and gas exploration and production.

What are the growth factors driving the North America Wireline Logging Services Market?

The growth of the North America Wireline Logging Services Market is driven by increasing oil and gas exploration activities, advancements in logging technologies, and the need for efficient resource management. Additionally, the rising demand for energy fuels the market’s expansion.

What challenges does the North America Wireline Logging Services Market face?

The North America Wireline Logging Services Market faces challenges such as fluctuating oil prices, regulatory hurdles, and the high cost of advanced logging technologies. These factors can impact the profitability and investment in wireline services.

What opportunities exist in the North America Wireline Logging Services Market?

Opportunities in the North America Wireline Logging Services Market include the increasing adoption of digital technologies, the expansion of unconventional oil and gas resources, and the growing focus on environmental sustainability. These trends can lead to innovative service offerings.

What trends are shaping the North America Wireline Logging Services Market?

Trends shaping the North America Wireline Logging Services Market include the integration of automation and data analytics in logging operations, the rise of real-time data acquisition, and the development of eco-friendly logging techniques. These innovations aim to improve efficiency and reduce environmental impact.

North America Wireline Logging Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Open Hole, Cased Hole, Production Logging, Wireline Formation Testing |

| Technology | Electromagnetic, Acoustic, Nuclear, Resistivity |

| End User | Oil & Gas, Mining, Environmental, Geotechnical |

| Application | Exploration, Production, Reservoir Evaluation, Well Integrity |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in North America Wireline Logging Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at