444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The North America Mortgage/Loan Brokers Market is experiencing significant growth due to the rising demand for mortgage and loan services. Mortgage and loan brokers act as intermediaries between borrowers and lenders, facilitating the process of obtaining financing for various purposes, such as home purchases, business investments, and personal loans. The market in North America is driven by factors such as the increasing number of individuals seeking loans, the complexity of loan products, and the convenience offered by brokers in finding suitable loan options. The presence of a robust financial industry and the availability of diverse loan products contribute to the market’s growth in the region.

Meaning

Mortgage and loan brokers are financial intermediaries who connect borrowers with lenders. They assist individuals, businesses, and organizations in finding suitable loan options by assessing their financial needs, creditworthiness, and loan requirements. Mortgage brokers specifically focus on helping borrowers secure mortgage loans for purchasing real estate properties, while loan brokers cater to a broader range of loan types, including personal loans, business loans, and vehicle loans. These professionals play a crucial role in simplifying the loan application process and matching borrowers with lenders who offer competitive terms and rates.

Executive Summary

The North America Mortgage/Loan Brokers Market is witnessing substantial growth, driven by the increasing demand for loan services and the convenience offered by brokers. Mortgage and loan brokers act as intermediaries, connecting borrowers with lenders and facilitating the loan application process. The market is driven by factors such as the complexity of loan products, the rising number of individuals seeking financing, and the availability of diverse loan options. However, market growth is also influenced by challenges such as regulatory requirements and increasing competition. Despite these challenges, the market presents opportunities for brokers to expand their services and cater to evolving customer needs.

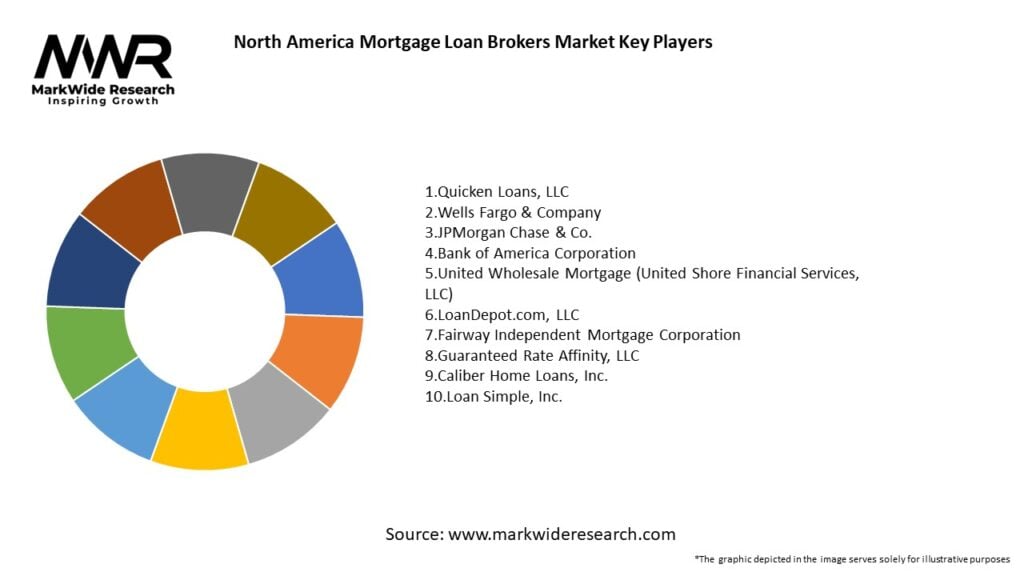

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

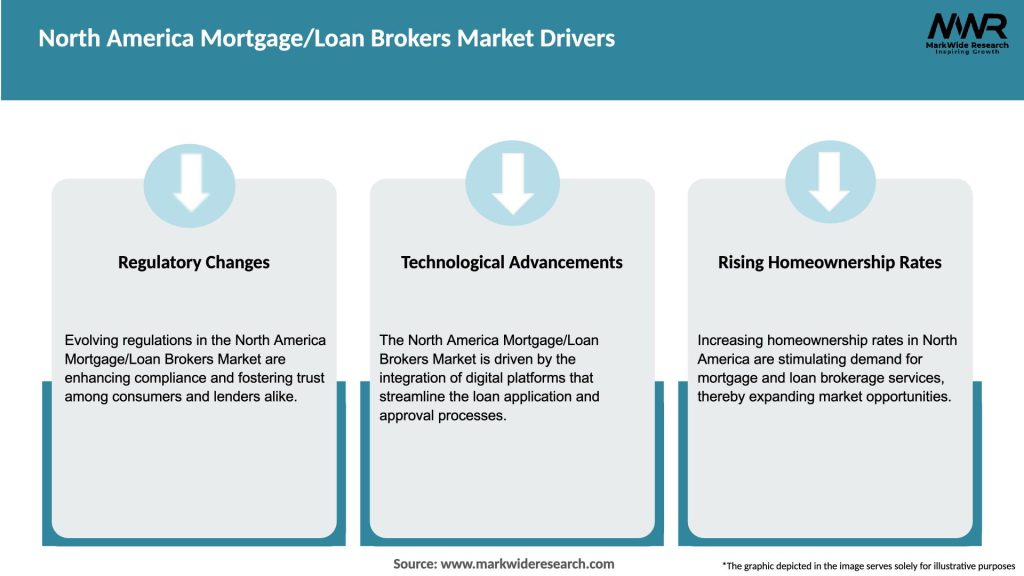

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The North America Mortgage/Loan Brokers Market is influenced by various dynamics, including market drivers, restraints, opportunities, and ongoing advancements in technology and regulatory landscape. The market’s growth is driven by the increasing demand for loan services, the complexity of loan products, and the convenience and expertise provided by brokers. Market participants need to adapt to changing customer preferences, leverage technology, and comply with regulatory requirements to thrive in the competitive landscape.

Regional Analysis

The North America Mortgage/Loan Brokers Market can be segmented into the United States, Canada, and Mexico. The United States dominates the market, accounting for a significant share due to its large population, strong financial industry, and high demand for mortgage and loan services. Canada and Mexico also contribute to market growth, driven by the increasing need for loan services in these countries.

Competitive Landscape

Leading Companies in North America Mortgage/Loan Brokers Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

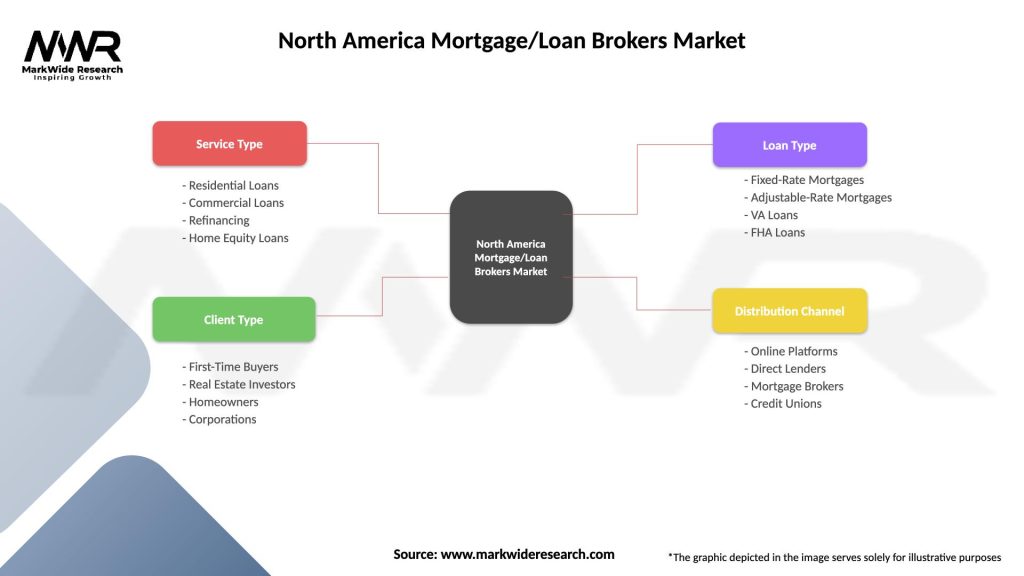

Segmentation

The North America Mortgage/Loan Brokers Market can be segmented based on the type of loan products and target customers.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

The SWOT analysis for the North America Mortgage/Loan Brokers Market is as follows:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the North America Mortgage/Loan Brokers Market. The outbreak led to economic uncertainties, affecting the demand for loans and mortgage services. However, the low-interest-rate environment and government initiatives to support lending and economic recovery mitigated some of the negative impacts. The market adapted to remote work arrangements, digital loan processing, and virtual consultations to ensure continuity of services. As the economy recovers and business activities regain momentum, the market is expected to rebound.

Key Industry Developments

Analyst Suggestions

Future Outlook

The North America Mortgage/Loan Brokers Market is expected to witness steady growth in the coming years. The increasing demand for loan services, the complexity of loan products, and the convenience offered by brokers drive market growth. Brokers need to adapt to changing customer preferences, integrate technology, and comply with regulatory requirements to thrive in the competitive landscape. Expanding service offerings, leveraging digital platforms, and enhancing customer experience will be crucial for sustained success in the market.

Conclusion

The North America Mortgage/Loan Brokers Market is experiencing significant growth, driven by the increasing demand for loan services and the convenience provided by brokers. Mortgage and loan brokers act as intermediaries, connecting borrowers with lenders and simplifying the loan application process. The market is driven by factors such as the complexity of loan products, the rising number of individuals seeking financing, and the availability of diverse loan options. While challenges exist in terms of regulatory compliance and increasing competition, there are opportunities for brokers to expand their services and cater to evolving customer needs. By embracing technology, providing personalized experiences, and staying abreast of regulatory changes, mortgage and loan brokers can position themselves for success in the market.

What is Mortgage/Loan Brokers?

Mortgage/Loan Brokers are professionals who act as intermediaries between borrowers and lenders, helping clients secure financing for real estate purchases or refinancing existing loans. They provide expertise in navigating the mortgage process, including loan options, rates, and terms.

What are the key players in the North America Mortgage/Loan Brokers Market?

Key players in the North America Mortgage/Loan Brokers Market include Quicken Loans, LoanDepot, and Guaranteed Rate, among others. These companies offer a range of mortgage products and services to meet diverse consumer needs.

What are the main drivers of growth in the North America Mortgage/Loan Brokers Market?

The main drivers of growth in the North America Mortgage/Loan Brokers Market include low interest rates, increasing homeownership rates, and a growing demand for refinancing options. Additionally, technological advancements in online mortgage applications are enhancing accessibility for consumers.

What challenges does the North America Mortgage/Loan Brokers Market face?

Challenges in the North America Mortgage/Loan Brokers Market include regulatory compliance, fluctuating interest rates, and competition from direct lenders. These factors can impact brokers’ ability to attract clients and close deals effectively.

What opportunities exist in the North America Mortgage/Loan Brokers Market?

Opportunities in the North America Mortgage/Loan Brokers Market include the expansion of digital platforms for mortgage services and the potential for growth in underserved markets. Additionally, increasing consumer awareness of alternative financing options presents new avenues for brokers.

What trends are shaping the North America Mortgage/Loan Brokers Market?

Trends shaping the North America Mortgage/Loan Brokers Market include the rise of online mortgage brokers, the integration of artificial intelligence in loan processing, and a focus on personalized customer service. These trends are transforming how brokers operate and engage with clients.

North America Mortgage/Loan Brokers Market

| Segmentation Details | Description |

|---|---|

| Service Type | Residential Loans, Commercial Loans, Refinancing, Home Equity Loans |

| Client Type | First-Time Buyers, Real Estate Investors, Homeowners, Corporations |

| Loan Type | Fixed-Rate Mortgages, Adjustable-Rate Mortgages, VA Loans, FHA Loans |

| Distribution Channel | Online Platforms, Direct Lenders, Mortgage Brokers, Credit Unions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in North America Mortgage/Loan Brokers Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at