444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The military fuze market is a crucial component of the defense industry, providing essential technology for the activation and detonation of explosive devices. Fuzes play a vital role in ensuring the precision and effectiveness of military operations by controlling the timing and functioning of munitions. This comprehensive market analysis will delve into the various aspects of the military fuze market, including its meaning, executive summary, key market insights, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, Covid-19 impact, key industry developments, analyst suggestions, future outlook, and conclusion.

Meaning

Military fuzes are sophisticated devices designed to initiate the detonation of explosive materials in munitions such as artillery shells, bombs, rockets, and missiles. They provide the critical function of controlling the timing and sequence of events during the weapon’s deployment, ensuring accuracy, safety, and operational effectiveness. Military fuzes are typically equipped with various sensors, timers, and electronic components to enable precise activation under specific conditions.

Executive Summary

The executive summary of the military fuze market analysis provides a concise overview of the key findings and insights. It highlights the market’s size, growth rate, and major trends, as well as the key factors driving and restraining market growth. The executive summary also outlines the market opportunities and challenges, along with the regional analysis, competitive landscape, and future outlook.

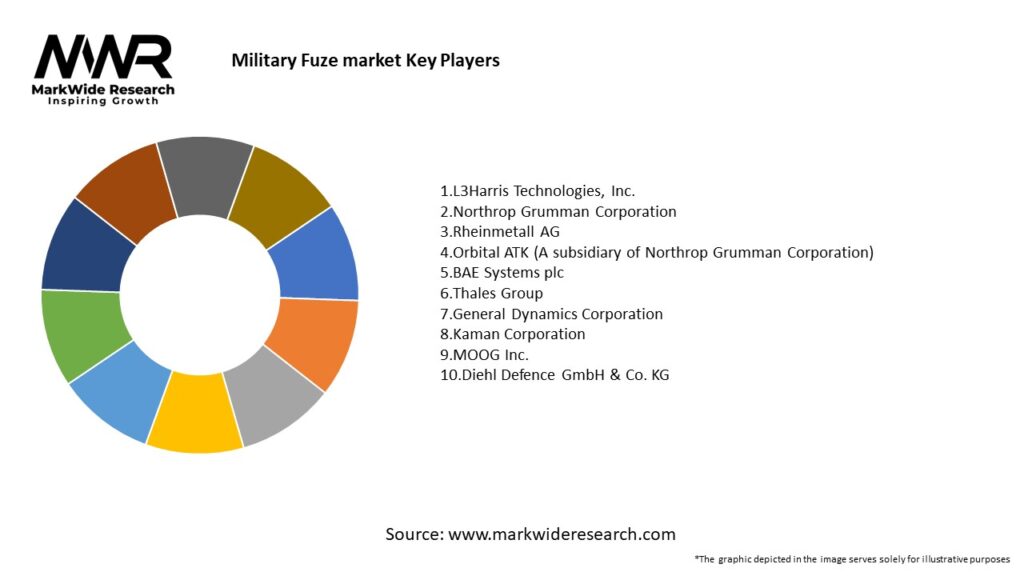

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Modernization Drives Replacement: Many existing artillery and mortar stockpiles are being retrofitted or replaced, renewing fuze procurement cycles.

Multipurpose Fuzes Preferred: Military users demand fuzes with multiple modes (airburst, delay, point detonate) rather than single-function items.

Domestic Capability Emphasis: Nations seek indigenous fuze development or manufacturing to control supply, security, and export restrictions.

Qualification Rigor: Fuze suppliers must meet stringent military testing (shock, temperature, vibrations, safety failures) over decades.

Cyber/Security Integration: Fuzes must resist electronic interference, tampering, or remote disabling; cybersecurity in fuze logic becomes critical.

Lifecycle Support Value: Providers offering spares, diagnostics, firmware updates, and safe disposal capture more value than one-off sales.

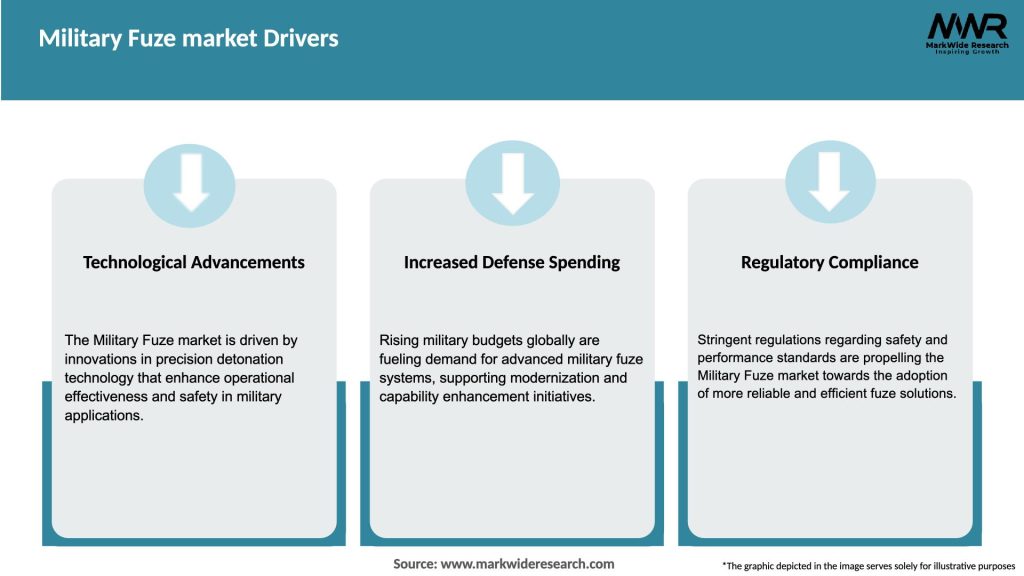

Market Drivers

Defense Modernization & Ammunition Refresh: Many armies are phasing out legacy munitions and acquiring precision-capable weapons needing advanced fuzes.

Precision Warfare & Urban Combat Needs: Fuzes with selective detonation minimize collateral damage and increase effectiveness in complex environments.

Cost Rationalization through Smart Fuzes: Replacing multiple specialized fuzes with a single modular multi-mode unit reduces logistic burden and costs.

Export Demand & Alliances: Friendlier export rules or regional arms modernization stimulate cross-border fuze procurement.

Dual-use and Civil Applications: Some advanced fuzes or sensor-based initiation technologies have applications in controlled demolitions, mining, or infrastructure clearing, broadening commercial viability.

Market Restraints

Certification Cost & Time: Qualification testing for military acceptance is expensive, time-consuming, and high risk.

Export Control & ITAR / EAR Restrictions: Many fuzes are subject to tight export controls, limiting global sales and inducing supply chain risk.

Reliability Pressure: A single fuze failure can result in errant detonation or dud; high safety margins are mandatory.

Niche Volumes: Compared to mass consumer markets, fuze volumes are limited, raising per-unit cost.

Obsolescence Risk: Fuze electronics must be designed for long product lifetimes (20–30 years), resisting electronics obsolescence.

Market Opportunities

Modular & Upgradeable Designs: Fuze architectures where sensors or electronics modules can be upgraded in the field extend life and reduce obsolescence.

Open Architecture Interfaces: Standardized electrical and command interfaces allow integration across multiple munition calibers.

Smart Fuzes for Autonomous Systems: Integration into loitering munitions, drones, and robot-delivered payloads.

Civil/Commercial Use Cases: Adaptation of initiation and sensor technology to demolition, mining, or controlled infrastructure interventions.

Secure & Resilient Supply Chains: Onshore or allied manufacturing to reduce reliance on fragile global supply networks under sanction risk.

Market Dynamics

Supply-Side Factors:

Few specialized companies dominate high-end fuze production due to technology and certification barriers.

Collaboration with military R&D and defense primes helps shape standards and requirements.

Geographic dispersion of manufacturing aids risk mitigation and export diversification.

Demand-Side Factors:

Militaries with large inventories and long procurement cycles drive stable demand.

Regional conflicts, deterrence postures, and arms renewal cycles cause procurement spikes.

Allies and procurement interoperability (NATO, alliances) push standardization and cost-effective scaling.

Policy & Budget Factors:

Defense budgets and capital spending cycles directly influence procurement windows.

Export policies and offset contracts influence flow of components and technologies.

Warranty, liability, and disposal regulation shape design constraints and pricing.

Regional Analysis

North America & Europe: Leading centers of fuze innovation and much of high-end procurement demand.

Asia-Pacific: Rapid modernization in Southeast Asia and South Asia fuels fuze demand, often under technology transfer or license.

Middle East & Africa: Demand driven by regional security needs, though constrained by import policy risk and local capacity.

Latin America: Smaller modernization programs present growth but often constrained by export regimes or local policy.

Russia / CIS States: Indigenous fuze development to reduce reliance on Western imports and manage strategic autonomy.

Competitive Landscape

Leading Companies in the Military Fuze Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Munition Type:

Artillery & Mortar Fuzes

Bomb and Glide Bomb Fuzes

Rocket and Guided Rocket Fuzes

Missile Fuzes

Grenade and Small-Caliber Fuzes

By Mode/Operation:

Point-Detonate (Impact)

Delay / Timed Fuzes

Proximity / Airburst

Multi-Mode / Programmable Fuzes

By Electronics Complexity:

Mechanical / Electromechanical Fuzes

Simple Electronic Fuzes

Smart / Sensor‑Enhanced Fuzes

MEMS / Micro-sensor Based Fuzes

By Region / Customer Base:

North America / NATO-aligned

Asia-Pacific Modernizing Forces

Middle East / Near East

Emerging Markets

Category-wise Insights

Artillery & Mortar Fuzes: Among the highest volume uses; modernization focuses on replacing mechanical fuzes with programmable sensor fuzes.

Bomb & Glide Bomb Fuzes: Precision munitions demand more complex logic, altitude sensing, and fail-safe features.

Rocket Fuzes: Must handle high acceleration, spin, and often require modular electronics to detect forward flight and control modes.

Missile Fuzes: Highest complexity, needing redundant sensors, anti-jamming, and strict safety and initiation logic.

Grenade / Small-Caliber Fuzes: Miniaturization trends dominate, balancing cost, safety, and sensor logic in compact form.

Key Benefits for Industry Participants and Stakeholders

Enhanced Operational Effect: Accurate fuzing increases lethality while controlling collateral risk.

Reduced Logistic Complexity: Multipurpose fuzes reduce inventory burden by replacing multiple single-mode fuzes.

Strategic Autonomy: Domestic fuze production reduces dependency on foreign supply chains.

Upgrade Path: Modular designs allow incremental electronics or sensor improvements without redesigning entire munition.

Lifecycle Value: Support contracts, firmware updates, diagnostics, and spares provide recurring revenue beyond initial sale.

SWOT Analysis

Strengths:

High barrier to entry protects incumbents; qualified pedigree is a strong asset.

Deep integration with defense primes ensures demand capture.

Capability in safety, redundancy, and rugged design is rare and valued.

Weaknesses:

Long development cycles and high qualification costs.

Low volumes relative to mass consumer markets.

Strict export control constraints limit global expansion flexibility.

Opportunities:

Adoption of smart, upgradeable fuzes across many munitions platforms.

Transfer to dual-use, civil demolition, or mining initiation niches.

Customization for new domains like drone or loitering munitions fuze modules.

Alliances to localize production in emerging defense markets.

Threats:

Export denial regimes or embargoes.

Rapid obsolescence of electronics requiring redesign cycles.

Countermeasures or jamming tactics evolving faster than fuze sensors.

Liability and safety regulation tightening in some jurisdictions.

Market Key Trends

Modularity & Plug-and-Play Fuzes: Designs that let users upgrade sensors or logic modules without replacing entire unit.

Sensor Fusion in Fuzes: Combining radar, laser, IR, and inertial sensors to improve accuracy and discriminate environments.

Software-Defined Fuzing Logic: Firmware-based logic allows in-field adjustment of fuze behavior.

Countermeasure Resistance: Shielding, signal processing, and adaptive logic to resist electronic warfare interference.

Qualification as a Service: Some firms offering testing and validation service packages to reduce barrier for smaller clients.

Key Industry Developments

Next-Generation Programmed Fuze Programs: Defense procurements increasingly specify multi-mode, programmable fuze components.

Regional Production Expansion: Countries investing in local fuze manufacture to bypass restrictions or improve supply assurance.

Integrating with Smart Ammunition Ecosystems: Fuzes with datalinks to fire-control networks enabling mission-tailored behavior.

Qualification Laboratories Upgrades: Labs expanding shock, temperature, EMI test capacity to speed design cycles.

Cross-Domain Miniaturization: Mini fuze modules suited for small drones or loitering weapons being developed.

Analyst Suggestions

Invest in Modular Architecture: Use plug-in sensor modules to simplify upgrades and manage obsolescence risk.

Build Secure Supply Chains: Localize critical components, maintain redundancy, and adhere to export compliance frameworks.

Offer Lifecycle Services: Support firmware updates, diagnostics, and maintenance contracts to extend revenue.

Collaborate on Dual-Use Applications: Explore civil demolition, mining, and infrastructure uses to widen market.

Maintain Certification Capability: In-house test, qualification, safety certification and compliance capacity are strategic differentiators.

Future Outlook

The Military Fuze Market will grow along with modernization of ammunition fleets, demand for precision effects, and integration with smart supply chains. Modular, sensor-fused, software-defined fuzes will become the baseline over the next decade. Markets in Asia, the Middle East, and Latin America will increasingly demand localized or allied fuze supply. Defense firms that can design resilient, upgradeable, and certified fuzes with global delivery capability and compliance will dominate the sector’s future. The interface between munitions, electronics, and networked fire control ensures that fuze technology remains a strategic enabler in modern warfare.

Conclusion

The Military Fuze Market represents a vital intersection of munitions lethality, safety, and modern electronics. With rising demand for multifunctionality, programmability, sensor integration, and upgradeability, the fuze segment is evolving from mechanical triggers into sophisticated embedded systems. Firms that master regulatory compliance, resilience, supply security, modular architecture, and lifecycle support will command leadership in this high-leverage niche.

What is Military Fuze?

Military fuze refers to a device that initiates the detonation of a munition, such as bombs or artillery shells, upon impact or at a predetermined time. These devices are critical for ensuring the effectiveness and safety of military operations.

What are the key players in the Military Fuze market?

Key players in the Military Fuze market include companies like Northrop Grumman, Raytheon Technologies, and BAE Systems, which are known for their advanced fuze technologies and military applications, among others.

What are the growth factors driving the Military Fuze market?

The Military Fuze market is driven by factors such as increasing defense budgets, advancements in technology, and the rising demand for precision-guided munitions. Additionally, geopolitical tensions contribute to the growth of this market.

What challenges does the Military Fuze market face?

Challenges in the Military Fuze market include stringent regulations regarding safety and reliability, high development costs, and the need for continuous innovation to keep up with evolving military requirements.

What opportunities exist in the Military Fuze market?

Opportunities in the Military Fuze market include the development of smart fuzes that enhance targeting accuracy and the integration of fuze technology with unmanned systems. Additionally, emerging markets present new avenues for growth.

What trends are shaping the Military Fuze market?

Trends in the Military Fuze market include the increasing use of digital technology for enhanced performance, the shift towards modular fuze designs, and the growing emphasis on safety features to prevent accidental detonations.

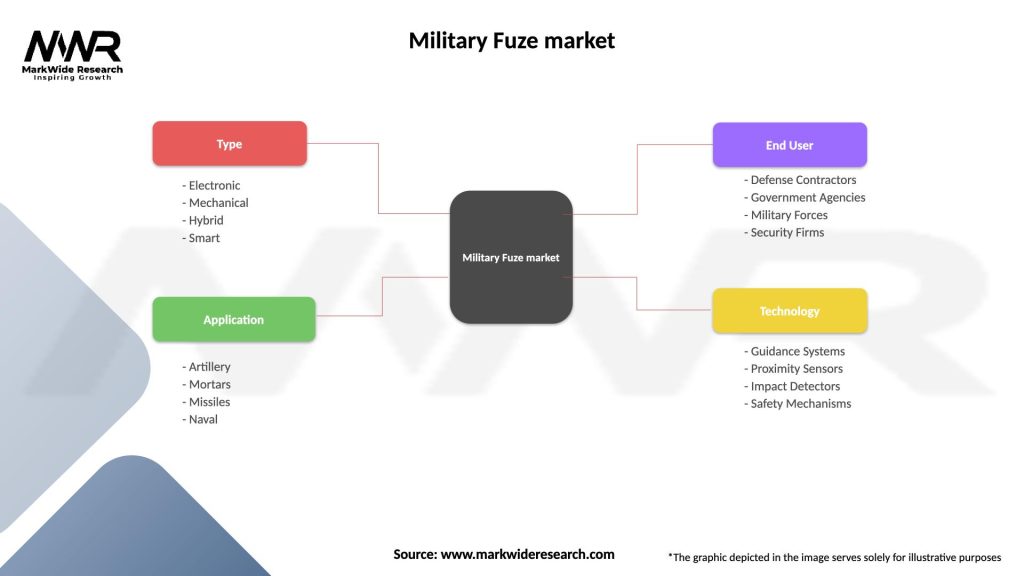

Military Fuze market

| Segmentation Details | Description |

|---|---|

| Type | Electronic, Mechanical, Hybrid, Smart |

| Application | Artillery, Mortars, Missiles, Naval |

| End User | Defense Contractors, Government Agencies, Military Forces, Security Firms |

| Technology | Guidance Systems, Proximity Sensors, Impact Detectors, Safety Mechanisms |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Military Fuze Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at