444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Middle East and Africa (MEA) dairy alternatives market has been experiencing significant growth in recent years. Dairy alternatives are plant-based products that are used as substitutes for dairy milk and milk-based products. The market for dairy alternatives in the MEA region has witnessed substantial growth due to various factors such as increasing consumer awareness about the health benefits of plant-based products, the rise in vegan and lactose-intolerant population, and the growing demand for sustainable and ethical food options.

Meaning

Dairy alternatives, also known as plant-based milk or non-dairy milk, refer to beverages that are derived from plant sources such as soy, almond, coconut, rice, and oats. These products are designed to imitate the taste, texture, and nutritional profile of cow’s milk. Dairy alternatives are becoming increasingly popular among consumers who are seeking healthier and more environmentally friendly options. They are available in various flavors, including plain, vanilla, chocolate, and strawberry, catering to diverse consumer preferences.

Executive Summary

The MEA dairy alternatives market has witnessed significant growth in recent years, driven by factors such as increasing consumer awareness about health and wellness, changing dietary preferences, and the rise in lactose intolerance and milk allergies. The market offers a wide range of dairy alternative products, including plant-based milk, yogurt, cheese, and ice cream. Manufacturers are focusing on product innovation and expanding their product portfolios to cater to the evolving consumer demands. The market is highly competitive, with both global and regional players vying for market share.

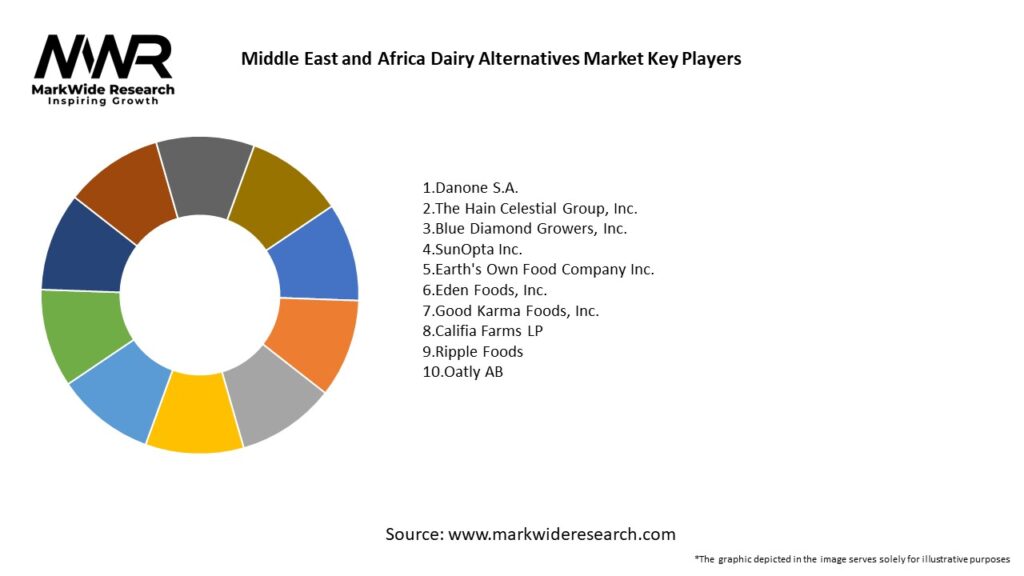

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The MEA dairy alternatives market is characterized by intense competition among players vying for market share. Manufacturers are investing in research and development to improve the taste, texture, and nutritional profile of dairy alternative products. Product innovation, marketing strategies, and collaborations are key strategies adopted by market players to gain a competitive edge. Additionally, regulatory bodies and industry associations are working together to establish guidelines and standards for dairy alternative products to ensure consumer safety and promote market growth.

Regional Analysis

The MEA dairy alternatives market can be divided into several regions, including the Middle East and Africa. Each region has its own unique market dynamics, influenced by factors such as consumer preferences, dietary habits, and cultural considerations. In the Middle East, the market for dairy alternatives is primarily driven by the growing health consciousness among consumers and the rise in lactose intolerance. In Africa, the demand for dairy alternatives is driven by factors such as the increasing vegan population, environmental concerns, and the availability of plant-based ingredients. Market players need to tailor their strategies according to the specific requirements of each region to succeed in the MEA market.

Competitive Landscape

Leading Companies in Middle East and Africa Dairy Alternatives Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The MEA dairy alternatives market can be segmented based on product type, distribution channel, and geography.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had both positive and negative impacts on the MEA dairy alternatives market. On the positive side, the pandemic heightened consumer focus on health and wellness, leading to increased demand for dairy alternative products perceived as healthier options. Consumers also turned to online shopping during lockdowns, boosting the online retailing of dairy alternatives. However, the pandemic also disrupted supply chains, causing temporary shortages of dairy alternative products in certain regions. The economic impact of the pandemic and reduced consumer spending power also affected the market growth to some extent.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the MEA dairy alternatives market looks promising, with sustained growth expected in the coming years. Factors such as increasing consumer awareness about health and sustainability, the rise in lactose intolerance and milk allergies, and the growing vegan population will continue to drive market growth. Product innovation, expanding distribution networks, and strategic collaborations will be crucial for industry players to capture market share and meet the evolving consumer demands. Regulatory support and favorable government policies promoting plant-based diets can further propel the growth of the MEA dairy alternatives market.

Conclusion

The Middle East and Africa dairy alternatives market is witnessing significant growth driven by factors such as increasing consumer awareness about health and wellness, rising lactose intolerance, and the growing vegan population. The market offers a wide range of dairy alternative products, including plant-based milk, yogurt, cheese, and ice cream. Manufacturers are focusing on product innovation, expanding their distribution networks, and collaborating with retailers to meet consumer demands and enhance market presence. The future outlook for the MEA dairy alternatives market is positive, with ample opportunities for industry participants to capitalize on the growing consumer interest in healthier and sustainable food options.

What is Dairy Alternatives?

Dairy alternatives refer to plant-based products that serve as substitutes for traditional dairy products. These include items like almond milk, soy yogurt, and coconut cheese, catering to consumers seeking lactose-free or vegan options.

What are the key players in the Middle East and Africa Dairy Alternatives Market?

Key players in the Middle East and Africa Dairy Alternatives Market include Alpro, Oatly, and Danone, which offer a range of plant-based dairy products. These companies are focusing on expanding their product lines and enhancing distribution channels, among others.

What are the growth factors driving the Middle East and Africa Dairy Alternatives Market?

The growth of the Middle East and Africa Dairy Alternatives Market is driven by increasing health consciousness among consumers, rising lactose intolerance rates, and a growing trend towards veganism. Additionally, innovations in product formulations are attracting more consumers.

What challenges does the Middle East and Africa Dairy Alternatives Market face?

The Middle East and Africa Dairy Alternatives Market faces challenges such as limited consumer awareness and acceptance of plant-based products. Additionally, competition from traditional dairy products and regulatory hurdles can hinder market growth.

What opportunities exist in the Middle East and Africa Dairy Alternatives Market?

Opportunities in the Middle East and Africa Dairy Alternatives Market include the potential for product diversification and the introduction of new flavors and formulations. There is also a growing demand for organic and non-GMO options among health-conscious consumers.

What trends are shaping the Middle East and Africa Dairy Alternatives Market?

Trends shaping the Middle East and Africa Dairy Alternatives Market include the rise of clean label products, increased investment in sustainable sourcing, and the popularity of fortified dairy alternatives. These trends reflect changing consumer preferences towards healthier and more environmentally friendly options.

Middle East and Africa Dairy Alternatives Market

| Segmentation Details | Description |

|---|---|

| Product Type | Almond Milk, Soy Milk, Oat Milk, Coconut Milk |

| End User | Households, Food Service, Retail, Beverage Manufacturers |

| Distribution Channel | Supermarkets, Online Retail, Health Stores, Convenience Stores |

| Packaging Type | Cartons, Bottles, Pouches, Tetra Packs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Middle East and Africa Dairy Alternatives Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at