444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Middle East Africa Early Production Facility (EPF) market is a rapidly growing sector that plays a vital role in the region’s oil and gas industry. EPFs are designed to facilitate the early production of oil and gas from offshore fields, enabling quick monetization and reducing time to market. These facilities are equipped with all the necessary infrastructure and equipment to process and treat hydrocarbons, allowing for efficient and cost-effective production.

Meaning

Early Production Facilities are temporary installations used to extract oil and gas from newly discovered reserves before the construction of permanent production infrastructure. These facilities are deployed in offshore areas where the distance to shore is relatively short and the reserves are economically viable for early production.

Executive Summary

The Middle East Africa Early Production Facility market is witnessing significant growth due to the region’s abundant oil and gas reserves. The demand for EPFs has increased as oil and gas companies aim to expedite the production and monetization of these reserves. The market is characterized by the presence of both established players and new entrants, creating a competitive landscape with numerous opportunities for growth.

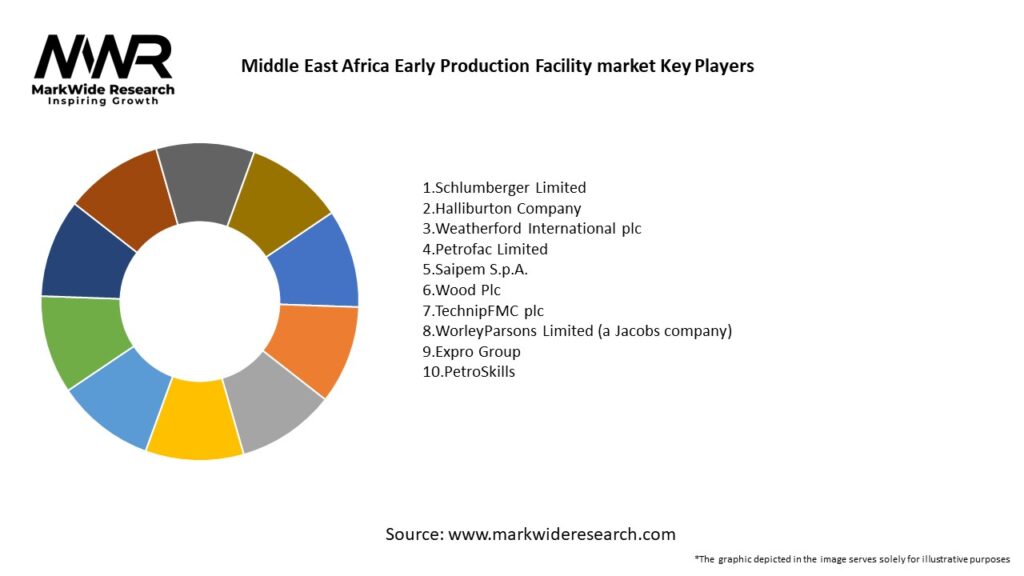

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Middle East Africa Early Production Facility market is characterized by dynamic trends and factors that shape its growth. The region’s abundant oil and gas reserves, coupled with increasing energy demand, drive the demand for EPFs. Technological advancements, government initiatives, and cost-effective solutions further contribute to market growth. However, environmental concerns, price volatility, infrastructure limitations, and geopolitical risks pose challenges to the market. The availability of untapped reserves, technological advancements, collaborations, and the focus on renewable energy present significant opportunities for industry participants.

Regional Analysis

The Middle East Africa region holds immense potential for the Early Production Facility market. The region is rich in oil and gas reserves, with countries like Saudi Arabia, the United Arab Emirates, Nigeria, and Angola playing significant roles in production. These countries have been at the forefront of offshore exploration and production activities, driving the demand for EPFs. The presence of established oil and gas companies, favorable government policies, and strategic geographical locations make the Middle East Africa region a hub for early production facilities.

Competitive Landscape

leading companies in the Middle East Africa Early Production Facility Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Early Production Facility market in the Middle East Africa region can be segmented based on various factors, including:

Segmenting the market helps in understanding specific trends, demands, and opportunities within each segment, enabling companies to tailor their strategies accordingly.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis of the Middle East Africa Early Production Facility market provides insights into its strengths, weaknesses, opportunities, and threats.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the Middle East Africa Early Production Facility market. The oil and gas industry faced multiple challenges, including a decline in global oil demand, supply chain disruptions, and reduced investments. Lockdowns, travel restrictions, and social distancing measures affected project timelines, operations, and workforce availability. However, the market showed resilience and adapted to the new normal by implementing safety protocols, adopting remote monitoring technologies, and focusing on cost optimization measures.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Middle East Africa Early Production Facility market is expected to continue its growth trajectory in the coming years. The region’s abundant oil and gas reserves, increasing energy demand, and technological advancements will drive market expansion. The integration of digital technologies, focus on sustainability, and collaborations for innovation will shape the future of the market. However, companies need to navigate geopolitical risks, price volatility, and environmental regulations to capitalize on opportunities and ensure sustainable growth.

Conclusion

The Middle East Africa Early Production Facility market presents significant opportunities for oil and gas companies to monetize reserves quickly and reduce time to market. The region’s abundant oil and gas reserves, technological advancements, and favorable government policies create a conducive environment for market growth. However, challenges such as environmental concerns, price volatility, infrastructure limitations, and geopolitical risks must be addressed. Embracing digital transformation, focusing on sustainability, and fostering collaborations are key strategies for industry participants to succeed in the evolving EPF market. With proper risk management and innovative approaches, the future outlook for the Middle East Africa Early Production Facility market remains promising.

What is Early Production Facility?

Early Production Facility refers to a temporary setup used in the oil and gas industry to extract and process hydrocarbons at the initial stages of a project. It allows for the early monetization of resources while permanent facilities are being constructed.

What are the key players in the Middle East Africa Early Production Facility market?

Key players in the Middle East Africa Early Production Facility market include Schlumberger, Halliburton, and Baker Hughes, among others. These companies provide various services and technologies essential for the efficient operation of early production facilities.

What are the growth factors driving the Middle East Africa Early Production Facility market?

The growth of the Middle East Africa Early Production Facility market is driven by increasing oil and gas exploration activities, the need for rapid production to meet energy demands, and advancements in technology that enhance operational efficiency.

What challenges does the Middle East Africa Early Production Facility market face?

The Middle East Africa Early Production Facility market faces challenges such as regulatory hurdles, environmental concerns, and the high costs associated with setting up temporary facilities. These factors can impact project timelines and profitability.

What opportunities exist in the Middle East Africa Early Production Facility market?

Opportunities in the Middle East Africa Early Production Facility market include the potential for partnerships with local governments, the adoption of innovative technologies for enhanced recovery, and the growing demand for energy in emerging economies.

What trends are shaping the Middle East Africa Early Production Facility market?

Trends shaping the Middle East Africa Early Production Facility market include the increasing focus on sustainability, the integration of digital technologies for monitoring and optimization, and the shift towards modular and flexible facility designs.

Middle East Africa Early Production Facility market

| Segmentation Details | Description |

|---|---|

| Technology | Gas Turbines, Steam Turbines, Reciprocating Engines, Solar Power |

| End User | Oil & Gas Companies, Mining Corporations, Power Utilities, Industrial Manufacturers |

| Installation Type | Onshore, Offshore, Modular, Fixed |

| Service Type | Maintenance, Consulting, Engineering, Project Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

leading companies in the Middle East Africa Early Production Facility Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at