444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Micro-Investing Platform market has witnessed significant growth in recent years, driven by the increasing popularity of investment apps and the growing demand for accessible investment opportunities among individuals. Micro-investing refers to the practice of investing small amounts of money, typically in the range of a few dollars, into various investment options such as stocks, bonds, ETFs, or cryptocurrencies. This concept has gained traction due to its convenience, affordability, and ability to cater to a wider audience of potential investors.

Meaning

Micro-investing platforms are online platforms or mobile applications that enable users to invest small amounts of money in diversified portfolios. These platforms often utilize fractional investing, allowing users to own fractional shares of expensive stocks or invest in lower-cost funds. By lowering the barrier to entry and offering simplified investment options, micro-investing platforms aim to attract new investors who may not have significant capital or prior experience in traditional investing.

Executive Summary

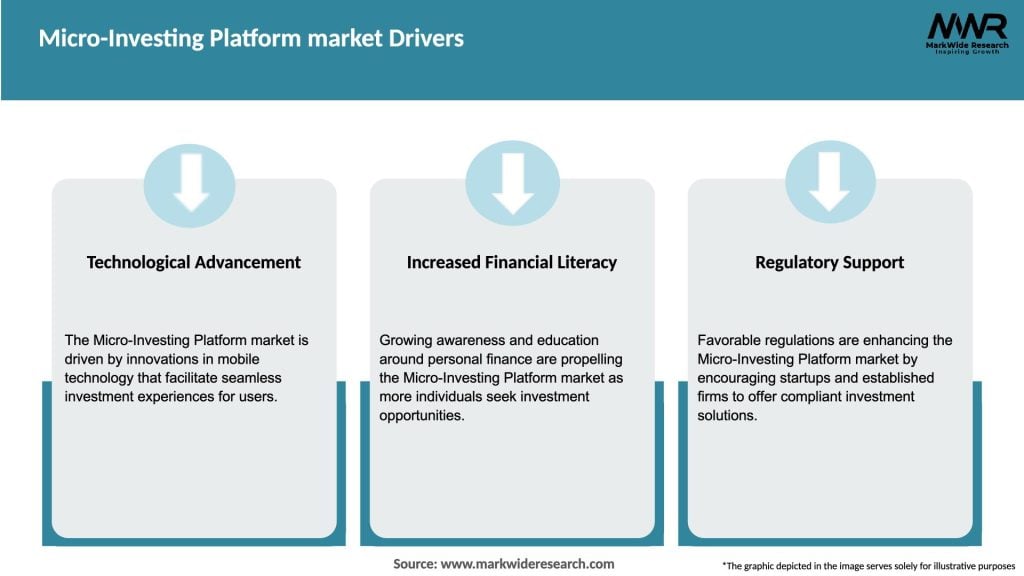

The Micro-Investing Platform market is experiencing robust growth, driven by factors such as increasing smartphone penetration, rising interest in financial literacy, and the desire for easy access to investment opportunities. These platforms have democratized investing, enabling individuals from diverse backgrounds to participate in the financial markets. With low minimum investment requirements and user-friendly interfaces, micro-investing platforms have become an attractive option for millennials and Gen Z investors seeking to grow their wealth over time.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Micro-Investing Platform market is characterized by intense competition and rapid technological advancements. Key players in the market are constantly innovating and expanding their product offerings to gain a competitive edge. The market dynamics are influenced by several factors, including user preferences, regulatory changes, and the overall economic environment. The industry’s growth trajectory is expected to be positive, driven by the increasing adoption of micro-investing platforms and the evolving needs of investors.

Regional Analysis

The Micro-Investing Platform market is experiencing growth across various regions, with North America and Europe leading in terms of market share. These regions have a high concentration of technologically advanced economies and a large population of digitally savvy individuals. However, emerging markets in Asia-Pacific and Latin America present significant growth opportunities due to the increasing smartphone penetration and rising interest in investment opportunities. Governments’ initiatives to promote financial inclusion and technological infrastructure development also contribute to the market’s growth in these regions.

Competitive Landscape

leading companies in the Micro-Investing Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

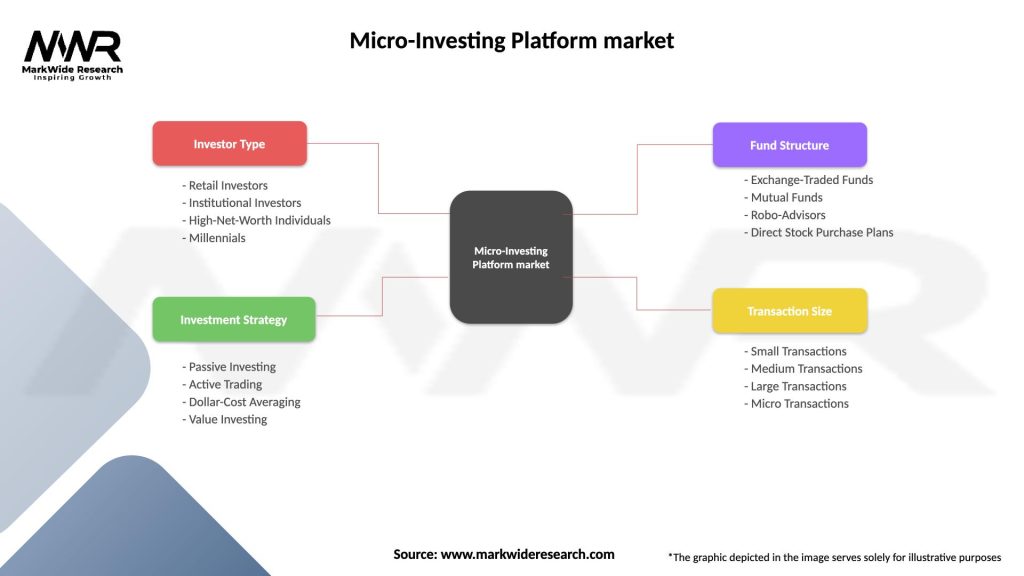

Segmentation

The Micro-Investing Platform market can be segmented based on the type of investment options offered, target demographic, and geographical regions. In terms of investment options, the market includes platforms focusing on stocks, bonds, ETFs, cryptocurrencies, or a combination of these. Demographic segmentation can be based on age groups, income levels, or specific interests. Geographically, the market can be segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had both positive and negative impacts on the Micro-Investing Platform market. On one hand, the increased volatility in financial markets and the economic uncertainty caused by the pandemic have made individuals more interested in investing and seeking opportunities to grow their wealth. This has driven the demand for micro-investing platforms as people look for accessible ways to invest and manage their finances.

On the other hand, the pandemic has also created challenges for the market. The economic downturn and job losses have affected individuals’ disposable income and their ability to invest. Additionally, the market volatility caused by the pandemic has increased risk perception among potential investors, making them more cautious about investing.

Despite these challenges, micro-investing platforms have adapted to the new normal by enhancing their digital offerings, providing educational resources to help users navigate uncertain markets, and offering investment options that align with changing market trends.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Micro-Investing Platform market is expected to witness substantial growth in the coming years. The increasing adoption of mobile technology, rising interest in financial literacy, and the growing demand for accessible investment opportunities are key drivers of this growth. With continued innovation, expanded investment options, and strategic partnerships, micro-investing platforms can capture a larger market share and cater to the evolving needs of investors worldwide. Additionally, the integration of advanced technologies such as artificial intelligence and blockchain can further enhance the user experience and open up new possibilities for the industry. As the market matures, regulatory frameworks will play a crucial role in shaping the industry landscape and ensuring investor protection. Overall, the future looks promising for micro-investing platforms as they continue to revolutionize the investment landscape and empower individuals to participate in the financial markets.

In the future, micro-investing platforms are likely to focus on enhancing user engagement and personalization. The integration of advanced technologies such as machine learning and data analytics will enable platforms to offer more tailored investment recommendations based on users’ preferences, risk profiles, and financial goals. This personalized approach will not only enhance the user experience but also improve investment outcomes.

Conclusion

In conclusion, the Micro-Investing Platform market is poised for significant growth and innovation in the coming years. These platforms have democratized investing, allowing individuals with minimal capital to participate in the financial markets and build wealth over time. With technological advancements, personalized recommendations, and expanded investment options, micro-investing platforms will continue to attract a wider audience of investors, including millennials and Gen Z who are seeking accessible and user-friendly investment solutions. However, addressing security concerns, regulatory challenges, and risk perception will be crucial for sustained growth and user trust. By staying at the forefront of technological advancements, fostering financial education, and embracing collaboration, micro-investing platforms can shape the future of investing and empower individuals to achieve their financial goals.

What is Micro-Investing Platform?

Micro-Investing Platforms are financial services that allow individuals to invest small amounts of money, often through mobile applications. These platforms typically focus on making investing accessible to a broader audience by enabling users to invest spare change or small sums into various assets.

What are the key players in the Micro-Investing Platform market?

Key players in the Micro-Investing Platform market include Acorns, Stash, and Robinhood, which offer unique features such as automated investing, educational resources, and commission-free trading, among others.

What are the growth factors driving the Micro-Investing Platform market?

The growth of the Micro-Investing Platform market is driven by increasing smartphone penetration, a growing interest in personal finance among younger generations, and the rise of digital banking solutions that facilitate easy investment.

What challenges does the Micro-Investing Platform market face?

Challenges in the Micro-Investing Platform market include regulatory scrutiny, competition from traditional investment firms, and the need to educate users about investment risks and strategies.

What opportunities exist in the Micro-Investing Platform market?

Opportunities in the Micro-Investing Platform market include expanding into emerging markets, integrating advanced technologies like AI for personalized investment advice, and developing partnerships with financial institutions to enhance service offerings.

What trends are shaping the Micro-Investing Platform market?

Trends in the Micro-Investing Platform market include the rise of socially responsible investing, gamification of investment processes to engage users, and the increasing use of robo-advisors to automate investment decisions.

Micro-Investing Platform market

| Segmentation Details | Description |

|---|---|

| Investor Type | Retail Investors, Institutional Investors, High-Net-Worth Individuals, Millennials |

| Investment Strategy | Passive Investing, Active Trading, Dollar-Cost Averaging, Value Investing |

| Fund Structure | Exchange-Traded Funds, Mutual Funds, Robo-Advisors, Direct Stock Purchase Plans |

| Transaction Size | Small Transactions, Medium Transactions, Large Transactions, Micro Transactions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

leading companies in the Micro-Investing Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at