444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Mexico Sodium Reduction Ingredients Market has been experiencing significant growth in recent years, driven by various factors such as the rising health concerns, increasing awareness about the adverse effects of excessive sodium consumption, and growing demand for healthier food options. Sodium reduction ingredients play a vital role in the food industry, helping manufacturers create products with lower sodium content without compromising taste and quality. This market overview will provide a comprehensive understanding of the sodium reduction ingredients market in Mexico, exploring its meaning, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, SWOT analysis, key trends, Covid-19 impact, key industry developments, analyst suggestions, future outlook, and a concluding summary.

Meaning

Sodium reduction ingredients refer to a range of substances used in food processing to reduce the sodium content in food products. High sodium intake is associated with various health issues, including hypertension, heart disease, and stroke. As a result, the food industry has been focusing on developing products with lower sodium levels to meet consumer demands for healthier options. Sodium reduction ingredients offer a solution to this challenge by enhancing the taste and flavor of low-sodium products, making them more palatable to consumers.

Executive Summary

The Mexico Sodium Reduction Ingredients Market has witnessed remarkable growth in recent times, driven by the growing health consciousness among consumers and their inclination towards healthier food choices. The report provides comprehensive insights into the market’s key aspects, including drivers, restraints, opportunities, and key trends. It also presents a detailed analysis of the competitive landscape, market segmentation, and regional outlook. Moreover, the report evaluates the impact of the Covid-19 pandemic on the market and offers valuable suggestions to industry participants and stakeholders for better decision-making. With a positive future outlook, the sodium reduction ingredients market in Mexico is poised for further expansion.

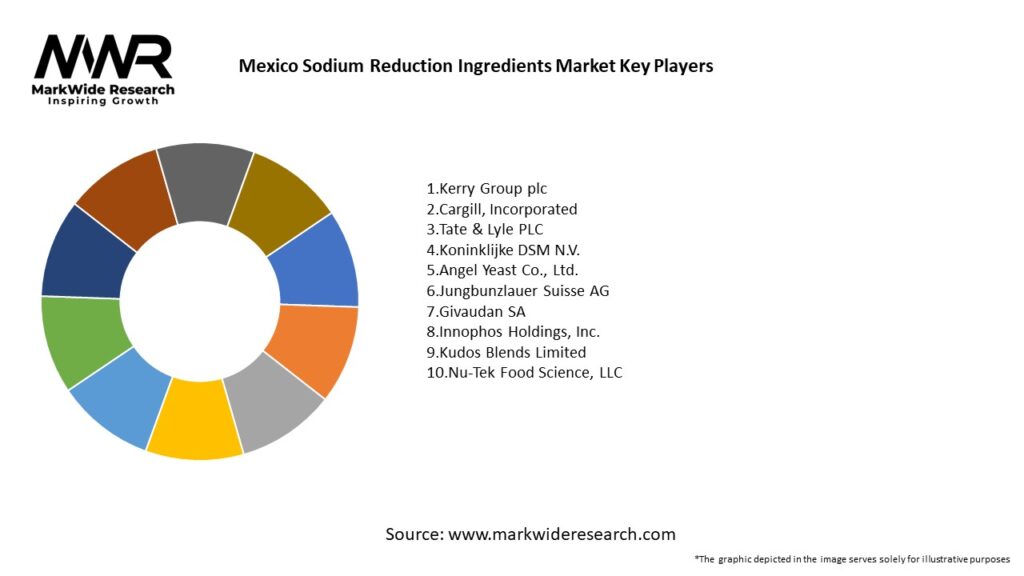

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Major food manufacturers in Mexico are increasingly launching “reduced-sodium” or “low-sodium” products, especially in snack, snack seasonings, canned goods, and sauces.

Reformulation is often gradual — incremental sodium cuts are easier to absorb in consumer palate than dramatic reductions.

The more advanced salt replacers or flavor enhancers (microspheres, peptides) are costlier but seen in premium product lines.

Ingredients combining multiple strategies (e.g. potassium salt + flavor enhancer) are gaining traction to balance taste and cost.

Regional variation matters—palates and salt preferences differ between northern, central, and southern Mexico, implying the need for localization of formula strategies.

Market Drivers

Public Health & Regulatory Pressure: Mexico’s government and health agencies emphasize hypertension and cardiovascular disease prevention, encouraging sodium reduction in packaged foods.

Consumer Health Awareness: Growing demand from consumers for “better-for-you” or “reduced-sodium” labels in processed, packaged, and restaurant foods.

Food Industry Reformulation Programs: Major food producers (snacks, sauces, canned goods) allocate R&D budgets for salt reduction efforts to meet both regulation and market demand.

Ingredient Innovation & Economies of Scale: Advances in salt replacers and flavor modules improve performance and reduce cost differentials.

Export Market Alignment: Manufacturers targeting export markets with strong sodium-reduction norms (e.g., North America, Europe) prefer preemptive reformulation.

Market Restraints

Taste & Palate Acceptance: Consumers frequently detect taste shifts; overreliance on certain replacers (e.g. potassium chloride) can cause bitterness or aftertaste.

Higher Ingredient Costs: Specialty sodium-reduction ingredients often cost significantly more than plain salt, compressing margins unless volumes scale.

Formulation Complexity: Preserving texture, microbial stability, moisture binding, and shelf life while reducing sodium demands sophisticated R&D.

Supply Chain Limitations: Some ingredients (e.g. specialty peptides or microsalt structures) may be imported or limited in local supply, increasing lead times and cost risk.

Labeling and Regulatory Constraints: Regulatory definitions of “reduced sodium” or “low sodium” must be met; any mislabeling risk is a deterrent.

Market Opportunities

Staple Food Categories: Reformulating everyday products—such as salsas, canned beans, soups, tortillas, seasoning mixes—presents high-volume opportunity.

Restaurant & Food Service Sector: Salt reduction in menu items (e.g. broths, sauces, condiments) drives demand for bulk sodium-reduction ingredients.

Regional Flavor Modules: Developing Mexico-specific flavor modules to mask sodium cuts while maintaining local taste profiles.

Private Label & Health-Focused Brands: Smaller brands catering to health-conscious consumers may adopt advanced sodium-reduction strategies.

Public-Private Partnerships: Collaboration between government health programs and ingredient firms to subsidize or support reformulation, especially for staple food sectors.

Market Dynamics

Supply-Side Factors:

Ingredient manufacturers invest in capacity and technology to produce microsalt particles, flavor modulators, and salt replacer blends.

Global suppliers partner with Mexican distributors and food technologists to localize offerings for Mexican food matrices.

Demand-Side Factors:

Food processors monitor consumer acceptance and regulatory trends, pushing gradual sodium reductions over time.

Regional palates and seasoning preferences cause variant formulations across states and product lines.

Economic & Policy Factors:

Government encouragement or indirect incentives (tax breaks, recognition) for “healthier” food reformulators support market growth.

Cost inflation on salt replacer imports or raw materials (minerals, peptides) impacts pricing dynamics.

Regional Analysis

Central Mexico (Mexico City & surrounding states): High consumption volumes and food processing hubs; strong testing grounds for new reduced-sodium products.

Northern Mexico: Closer to U.S. export corridors, alignment with U.S. sodium-reduction norms can influence reformulation efforts.

Yucatán / Southeast: Distinct flavor preferences (spice, regional condiments) require customized sodium-reduction strategies.

Bajío & Industrial Corridor (Querétaro, León, Guadalajara): Food and beverage manufacturing clusters provide concentrated demand.

Border Regions: Products may need to align with both Mexican and cross-border expectations; dual labeling and formulation adaptation matter.

Competitive Landscape

Leading Companies in the Mexico Sodium Reduction Ingredients Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Ingredient Type:

Potassium-based salts

Mineral salt blends

Flavor enhancers / yeast extracts / peptides

Microsalt / structural salt designs

Encapsulated salt / time-release technologies

By Application:

Snack Foods (chips, extruded products)

Seasonings, Condiments, Sauces

Canned & Processed Foods

Beverages & Broths

Food Service / Restaurant Batches

By Product Type:

Consumer Packaged Goods (CPG)

Food Service / Industrial Batches

By Region / State:

Mexico City / Central

Northern Border States

Yucatán / Southeast

Western & Bajío Manufacturing Corridors

Category-wise Insights

Snacks & Seasonings: Salt perception is critical, so microsalt, flavor enhancers, and potassium blends are heavily used.

Sauces & Condiments: Salt is key for preservation and taste; reduction strategies must maintain microbial safety while preserving flavor.

Canned / Processed Foods: Balanced reduction must account for water activity, osmosis, and shelf stability.

Beverages & Broths: Reduction is challenging due to liquid diffusion; use of peptides and flavor boosters aids in retention of savory notes.

Restaurant / Food Service: Bulk applications require scalable, cost-effective sodium-reduction modules without compromising batch consistency.

Key Benefits for Industry Participants and Stakeholders

Health Positioning: Brands can market reduced-sodium claims to appeal to hypertensive and health-conscious consumers.

Regulatory Preparedness: Early adoption prepares food companies for any future mandatory sodium reduction policies.

Cost Savings Over Time: Though replacers cost more, optimized formulations may allow salt usage decline and cost savings.

Innovation Differentiation: Specialty reduced-sodium products command premium margins and brand differentiation.

Partnership Leverage: Ingredient suppliers and food firms co-develop recipes and share benefits in healthier product segments.

SWOT Analysis

Strengths:

Strong food processing base and large domestic market.

Rising health awareness among Mexican consumers.

Ingredient innovation globally available to local formulators.

Weaknesses:

Incremental taste challenges and adaptation costs.

Dependence on imported specialty ingredients.

Limited local ingredient R&D capacity in advanced salt alternatives.

Opportunities:

Reformulation of staple food categories.

Expansion into restaurant and institutional food.

Government partnerships promoting public health.

Local development of flavor masking technology to lower import dependency.

Threats:

Consumer backlash against flavor change.

Cost escalations eroding margins.

Competing health narratives (e.g., sugar reduction) overshadow sodium initiatives.

Regulation or labeling requirements that constrain marketing claims.

Market Key Trends

Gradual “Salt Step-Downs”: Many manufacturers reduce sodium gradually (e.g. 5–10% every cycle) to retain consumer acceptance.

Peptide & Umami Boosters: Growing use of savory peptides and amino acid blends to raise salt perception.

Digital Taste Modelling: Formulation labs using modeling tools and AI to predict consumer acceptance before pilot production.

Public Awareness Campaigns: Health authorities and NGOs promoting reduced sodium diets influence brand positioning.

Collaboration Alliances: Ingredient firms working with local food industry associations to share best practices in sodium reduction.

Key Industry Developments

Pilot Reformulations: Leading snack and sauce brands in Mexico trial reduced-sodium versions in select regional markets.

Ingredient Launches: Some global specialty ingredient suppliers have introduced localized sodium-replacer blends tailored to Mexican cuisine.

Regulation Proposals: Health agencies exploring voluntary or mandatory sodium targets for processed food categories.

R&D Partnerships: Joint initiatives between universities, food institutes, and ingredient firms to study sodium reduction strategies applicable in Mexican food matrices.

Public Health Collaborations: Some voluntary labeling or awareness programs list low-sodium guidelines and encourage food companies to participate.

Analyst Suggestions

Start with Easy-Win Categories: Reformulate snack seasonings or condiments where salt margin is high and technical risk is moderate.

Use Incremental Pathway: Reduce sodium gradually across launches to maintain consumer acceptance.

Invest in Local Flavor Masking: Build R&D to tailor masking solutions suited to Mexican spices and salsa-rich cuisines.

Partner with Health Authorities: Align reformulation with public health goals and gain consumer credibility.

Scale Ingredient Supply Locally: Encourage development of regional distribution or even localized manufacturing of sodium-reduction blends to reduce cost and lead time.

Future Outlook

The Mexico Sodium Reduction Ingredients Market is well-positioned for sustained growth as regulatory, health, and market forces converge. Incremental reformulation will remain the dominant strategy in the near term, while more advanced solutions gain ground in premium or export-oriented product lines.

As ingredient costs fall with scale and innovation, more food categories will adopt sodium reduction approaches. Local R&D and supply chain development will reduce dependence on expensive imports. Collaboration between public health agencies, ingredient suppliers, and food manufacturers will accelerate adoption and consumer acceptance.

Conclusion

The Mexico Sodium Reduction Ingredients Market is evolving from niche to mainstream as food producers, health agencies, and consumers align around lower-sodium choices. The path is complex—taste, cost, formulation stability all require carefully balanced solutions—but the opportunity is substantial. Companies that combine innovation, local adaptation, cost-efficiency, and health positioning will lead in this emerging healthier-food era in Mexico.

What is Sodium Reduction Ingredients?

Sodium Reduction Ingredients are substances used in food products to lower sodium content while maintaining flavor and quality. These ingredients are essential in addressing health concerns related to high sodium intake, particularly in processed foods.

What are the key players in the Mexico Sodium Reduction Ingredients Market?

Key players in the Mexico Sodium Reduction Ingredients Market include companies like Cargill, Inc., Ingredion Incorporated, and Tate & Lyle, among others. These companies are involved in developing innovative sodium reduction solutions for various food applications.

What are the growth factors driving the Mexico Sodium Reduction Ingredients Market?

The Mexico Sodium Reduction Ingredients Market is driven by increasing health awareness among consumers, rising prevalence of hypertension, and regulatory pressures to reduce sodium levels in food products. These factors are pushing manufacturers to seek effective sodium reduction solutions.

What challenges does the Mexico Sodium Reduction Ingredients Market face?

Challenges in the Mexico Sodium Reduction Ingredients Market include consumer resistance to taste changes, the complexity of reformulating existing products, and the potential for higher costs associated with sodium reduction ingredients. These factors can hinder market growth.

What opportunities exist in the Mexico Sodium Reduction Ingredients Market?

Opportunities in the Mexico Sodium Reduction Ingredients Market include the growing demand for healthier food options, innovations in flavor enhancement technologies, and the potential for new product development targeting health-conscious consumers. These trends can lead to market expansion.

What trends are shaping the Mexico Sodium Reduction Ingredients Market?

Trends in the Mexico Sodium Reduction Ingredients Market include the increasing use of natural and plant-based sodium reduction ingredients, advancements in food technology, and a shift towards clean label products. These trends reflect changing consumer preferences and regulatory demands.

Mexico Sodium Reduction Ingredients Market

| Segmentation Details | Description |

|---|---|

| Product Type | Salt Substitutes, Flavor Enhancers, Preservatives, Seasoning Blends |

| End User | Food Manufacturers, Beverage Producers, Snack Companies, Catering Services |

| Application | Processed Foods, Sauces, Dairy Products, Meat Products |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Food Service Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Mexico Sodium Reduction Ingredients Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at