444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Mexico Diabetes Drugs Market plays a pivotal role in addressing the rising prevalence of diabetes within the country. With diabetes becoming a significant public health concern, the market encompasses a wide range of pharmaceutical solutions aimed at managing the condition. As the healthcare landscape evolves and diabetes management gains prominence, the Mexico Diabetes Drugs Market’s growth aligns with the need for effective treatment options.

Meaning

The Mexico Diabetes Drugs Market revolves around the production, distribution, and utilization of pharmaceutical products designed to manage diabetes. These drugs encompass various categories, such as oral medications, injectables, and insulin therapies. Their primary function is to regulate blood glucose levels and prevent complications associated with diabetes.

Executive Summary

The significance of the Mexico Diabetes Drugs Market extends beyond its role as a pharmaceutical market; it addresses a critical health concern affecting millions of individuals. Effective diabetes management is essential to prevent complications, enhance quality of life, and reduce healthcare burden. As awareness about diabetes increases and healthcare systems adapt, the market’s growth is fueled by the demand for advanced treatment options.

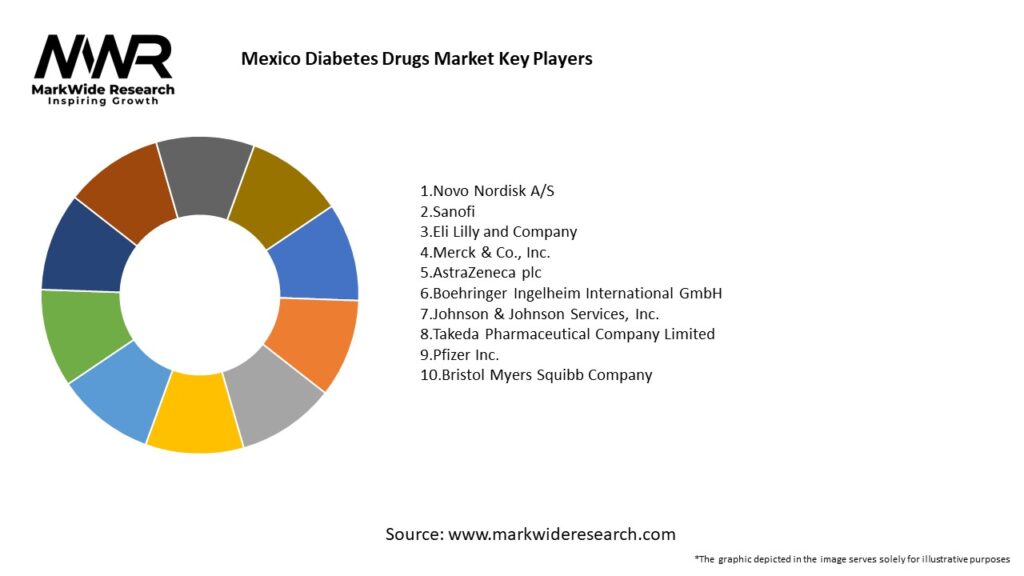

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Mexico has one of the highest diabetes prevalence rates among OECD countries, making demand relatively structural.

There is a shift from older generic therapies toward newer classes (SGLT‑2, GLP‑1) due to demonstrated cardiovascular and renal benefits.

Insulin costs and delivery infrastructure (e.g. cold chain) remain a challenge, especially in rural areas.

Government procurement and formulary inclusion strongly influence drug adoption and prices.

Patient adherence, education, and affordability remain critical barriers to optimal outcomes.

Market Drivers

Rising Diabetes Prevalence: Obesity, sedentary lifestyles, urbanization, and aging populations drive new cases.

Expanded Diagnosis & Health Coverage: Increased screening, public health programs, and expanded coverage enable more patients to access therapy.

Therapeutic Innovation: Introduction of advanced classes (GLP‑1, SGLT‑2) with organ-protective benefits encourages adoption.

Biosimilar Insulin Entry: Cost-lowering opportunities through biosimilars widen access among lower-income populations.

Telehealth & Digital Monitoring: Remote glucose monitoring, e-prescribing, and digital adherence tools support better drug utilization.

Market Restraints

Affordability and Out-of-Pocket Costs: Some patients lack coverage for newer agents, limiting uptake.

Supply Chain & Cold Storage Challenges: Insulin especially demands cold chain integrity; logistics gaps impair access in rural regions.

Regulatory & Pricing Hurdles: Approval timelines, price negotiations, and imposition of price controls may slow new drug entry.

Adherence Gaps: Non-adherence to therapy, dosage errors, or discontinuation are significant in the real-world setting.

Patent Barriers & IP Protection: Strong IP protections delay generic or biosimilar entry for some newer therapies.

Market Opportunities

Biosimilar & Generic Growth: Lower-cost insulin and biologics can expand access in price-sensitive segments.

Public-Private Partnerships: Collaborations between government health agencies and private pharma can subsidize access to novel therapies.

Digital Health Integration: Combining therapeutics with glucose monitors, mobile apps, and telemedicine can improve adherence and outcomes.

Rural Outreach Programs: Targeted distribution strategies and mobile clinics can penetrate underserved areas.

Expansion of Combination Products: Fixed-dose combos that reduce pill burden offer patient convenience.

Market Dynamics

Supply-Side Factors:

Multinational and domestic pharma firms invest in clinical trials, regulatory filings, and local manufacturing or authorized generics.

Cold chain logistics, import infrastructure, and regulatory compliance are critical enablers.

Pharmaceutical alliances with device makers for combination pen/monitor products are evolving.

Demand-Side Factors:

Physicians increasingly prescribe newer agents based on guideline updates and organ protection benefits.

Patients demand better safety profiles, lower side effects, and simpler regimens.

Public health policies and national diabetes strategies allocate budgets for drugs and education.

Policy & Economic Factors:

Government reimbursement decisions, price caps, and inclusion in institutional formularies dictate market access.

Currency fluctuations and import tariffs affect cost of branded products.

Health insurance expansion and social program funding impact patient co-pay levels.

Regional Analysis

Mexico City / Central Region: High concentration of specialty endocrine clinics, hospitals, and market demand for premium therapies.

Northern States (Nuevo León, Baja California): Closer proximity to U.S. borders and logistics corridors facilitate greater availability.

Southern and Rural States (Chiapas, Oaxaca, Veracruz): Under-resourced and lower formulary penetration; opportunity for regional outreach.

Coastal & Tourism Zones: Private sector clinics serving tourists and expatriates often demand high-end therapies.

Border Regions: Cross-border pharmacies and pricing arbitrage influence drug flows and demand dynamics.

Competitive Landscape

Leading Companies in the Mexico Diabetes Drugs Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Drug Class:

Insulin (human, analog, biosimilar)

Oral antidiabetics (metformin, sulfonylureas, etc.)

DPP‑4 Inhibitors

SGLT‑2 Inhibitors

GLP‑1 Receptor Agonists

Fixed-Dose Combinations

By Mode of Delivery:

Injectable (insulin, GLP‑1)

Oral Tablets / Pills

Fixed-Combination Tablets / Pens

By Market Channel:

Public Health System (IMSS, ISSSTE, Seguro)

Private Insurance / Pharmacies

Specialty Clinics and Hospitals

Telemedicine / e-Pharmacy Channels

By Region:

Central / Mexico City

Northern States

Southern & Rural States

Border Areas

Private Vs Public Market Segmentation

Category-wise Insights

Insulin: Still essential for many patients; analogs and biosimilars drive differentiation by smoother action profiles and lower hypoglycemia risk.

Oral Antidiabetics: Metformin remains backbone; newer classes (SGLT‑2, DPP‑4) gain share due to safety and cardiovascular benefits.

GLP‑1 Agents: Growing adoption for weight benefit and organ protection, albeit at higher cost tiers.

Fixed Combinations: Aid adherence by reducing pill burden—especially in multi-drug regimens.

Biosimilars: Offer opportunity to reduce cost and expand access, particularly among underserved populations.

Key Benefits for Industry Participants and Stakeholders

Improved Patient Outcomes: Greater access to advanced therapies helps reduce complications and hospitalizations.

Healthcare Cost Savings: Prevention of complications (renal disease, cardiovascular events) reduces long-term health expenditures.

Market Growth Potential: High unmet treatment need and evolving therapy landscape present growth for innovators and generics alike.

Brand Trust & Loyalty: Effective patient support programs and stable supply chains strengthen provider and patient relationships.

Scalable Technology Integration: Combining drugs with monitoring systems, digital adherence, and telehealth creates differentiated offerings.

SWOT Analysis

Strengths:

Established pharmaceutical ecosystem and regulatory capability.

High disease prevalence ensures stable base demand.

Public sector procurement supports volume markets.

Weaknesses:

Price sensitivity among public payer segments.

Inconsistent cold chain or rural access for injectable products.

Adherence issues and health literacy gaps hindering optimal drug use.

Opportunities:

Biosimilar insulin and generic expansion.

Combining therapeutics with digital health tools to improve adherence.

Penetrating underserved rural markets via outreach.

Public-private initiatives to subsidize access to newer therapies.

Threats:

Price controls or reimbursement cuts undermining margins.

Regulatory delays in biosimilar or novel drug approvals.

Currency depreciation increasing imported drug costs.

Competition from alternative care models or non-pharmaceutical interventions.

Market Key Trends

Biosimilar Insulin Growth: Lower-cost analogs entering market post-patent expirations.

Cardio-Renal Protective Agents: SGLT‑2 and GLP‑1 adoption rising due to demonstrated benefits beyond glucose control.

Digital Therapeutics & Telemedicine: Remote monitoring platforms and e-prescribing help address adherence gaps.

Fixed-Dose Combinations: Increasing usage to simplify treatment regimens and improve adherence.

Public Program Expansion: Government diabetes initiatives and subsidies broadening drug access in lower-income populations.

Key Industry Developments

Biosimilar Launches: Local or regional biosimilar insulin products introduced under cost-competitive models.

Government Procurement Contracts: New tenders for combination therapy and newer agents in public health programs.

Integrated Care Models: Diabetes care centers combining drug supply, monitoring and education under one roof.

Digital Prescription Platforms: E-pharmacies working with clinics to deliver diabetes medications to remote users.

Patient Support Programs: Pharmaceutical firms expanding adherence, education, and follow-up initiatives to support therapy retention.

Analyst Suggestions

Promote Biosimilar Ecosystem: Invest in local manufacturing or partnerships to supply affordable insulin analogs.

Bundle Drug + Digital Tools: Offer drug packages inclusive of glucose monitors, apps, and adherence support.

Enhance Rural Distribution: Strengthen cold-chain and delivery networks in underserved states.

Advocate Policy Support: Work with government to include newer therapies in public programs or subsidy schemes.

Educate Clinicians and Patients: Focus on training and awareness to encourage rational use of novel agents.

Future Outlook

The Mexico Diabetes Drugs Market is poised for consistent growth, driven by unmet clinical need, evolving therapies, and digital health integration. Biosimilars and generics will expand access in cost-sensitive segments. Use of SGLT‑2, GLP‑1, and fixed combinations will gain share, especially as diabetes guidelines integrate cardiovascular and renal outcomes.

Telemedicine, remote monitoring, and adherence support will strengthen therapy outcomes. Public health expansion and inclusion of advanced therapies in national programs will bridge coverage gaps. Ultimately, the market will evolve into a more integrated ecosystem—combining drugs, devices, services, and data—to improve patient care and disease management across Mexico.

Conclusion

The Mexico Diabetes Drugs Market sits at the intersection of high disease burden, evolving therapeutic innovation, and public health challenge. Stakeholders who invest in biosimilar access, digital health integration, clinician and patient education, and robust distribution will capture growth and deliver improved outcomes. As Mexico continues to confront the diabetes epidemic, a more connected, accessible, and patient-centric market for diabetes therapies will be key to reducing long-term complications and improving national health resilience.

In conclusion, the Mexico Diabetes Drugs market stands at a critical juncture, marked by dynamic growth and transformative advancements in diabetes management. With the escalating prevalence of diabetes in the country, the market’s expansion is inevitable, driven by increasing healthcare awareness and a growing aging population.

What is Diabetes Drugs?

Diabetes drugs are medications used to manage blood sugar levels in individuals with diabetes. They include various classes of drugs such as insulin, sulfonylureas, and GLP-1 receptor agonists, which help control glucose levels and prevent complications associated with diabetes.

What are the key players in the Mexico Diabetes Drugs Market?

Key players in the Mexico Diabetes Drugs Market include Sanofi, Novo Nordisk, and AstraZeneca, which offer a range of diabetes medications. These companies are known for their innovative products and extensive distribution networks, among others.

What are the growth factors driving the Mexico Diabetes Drugs Market?

The Mexico Diabetes Drugs Market is driven by increasing diabetes prevalence, rising awareness about diabetes management, and advancements in drug formulations. Additionally, the growing aging population and lifestyle changes contribute to the market’s expansion.

What challenges does the Mexico Diabetes Drugs Market face?

The Mexico Diabetes Drugs Market faces challenges such as high medication costs, regulatory hurdles, and competition from generic drugs. Additionally, patient adherence to treatment regimens can be a significant barrier to effective diabetes management.

What opportunities exist in the Mexico Diabetes Drugs Market?

Opportunities in the Mexico Diabetes Drugs Market include the development of new drug formulations and personalized medicine approaches. There is also potential for growth in telemedicine and digital health solutions that support diabetes management.

What trends are shaping the Mexico Diabetes Drugs Market?

Trends in the Mexico Diabetes Drugs Market include the increasing use of combination therapies and the rise of continuous glucose monitoring systems. Additionally, there is a growing focus on patient-centric approaches and lifestyle interventions to complement drug therapies.

Mexico Diabetes Drugs Market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin, GLP-1 Agonists, DPP-4 Inhibitors, SGLT2 Inhibitors |

| Delivery Mode | Injectable, Oral, Inhalable, Transdermal |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Therapy Area | Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes, Prediabetes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Mexico Diabetes Drugs Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at