444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The lubricants for the cement industry play a vital role in ensuring the smooth functioning of machinery and equipment used in cement production. These lubricants not only minimize friction but also provide protection against wear and tear, corrosion, and excessive heat. In this comprehensive report, we delve into the lubricants for the cement industry market, examining its meaning, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits, SWOT analysis, key trends, Covid-19 impact, industry developments, analyst suggestions, future outlook, and conclusion.

Meaning

Lubricants for the cement industry refer to specialized oils, greases, and fluids used to reduce friction and enhance the performance of machinery and equipment in cement manufacturing processes. These lubricants are designed to withstand extreme operating conditions, including high temperatures, heavy loads, and abrasive environments, ensuring the efficient operation of various equipment such as crushers, mills, kilns, and conveyors.

Executive Summary

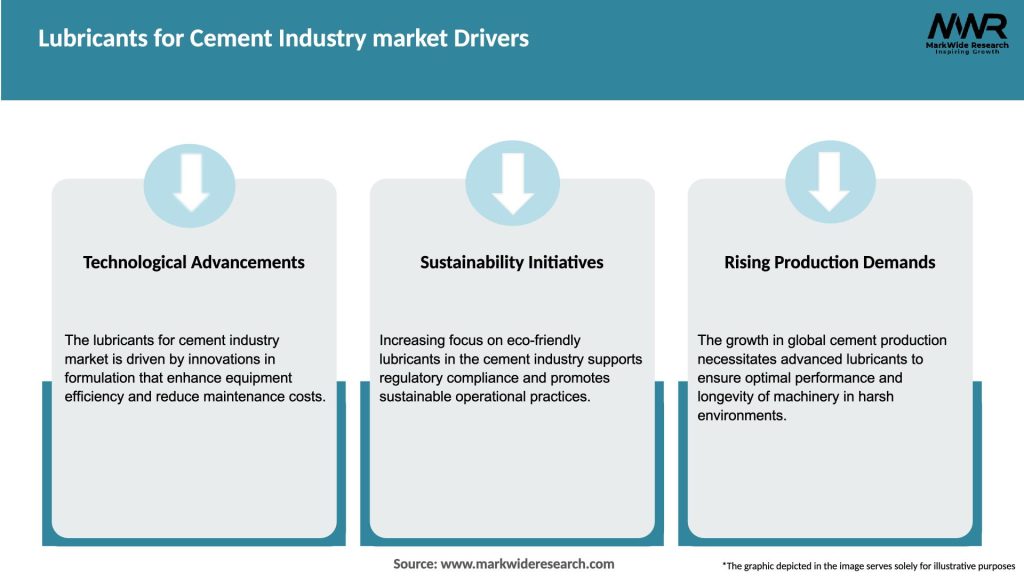

The lubricants for the cement industry market has witnessed significant growth in recent years, driven by the rising demand for cement across various sectors, including construction, infrastructure development, and industrial applications. The use of high-performance lubricants in cement production processes helps improve operational efficiency, extend equipment lifespan, and reduce maintenance costs. Additionally, increasing focus on sustainable and eco-friendly lubricants is creating new growth opportunities in the market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Regional Analysis

The lubricants for the cement industry market is segmented into key regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The Asia Pacific region dominates the market, driven by rapid urbanization, infrastructure development projects, and the presence of major cement manufacturers. Europe and North America also hold significant market shares due to the modernization and renovation of existing infrastructure.

Competitive Landscape

Leading Companies in the Lubricants for Cement Industry Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The market is segmented based on lubricant type, including oils, greases, and fluids, as well as by application areas such as crushers, mills, kilns, and conveyors. Furthermore, the market is categorized by product performance levels, ranging from general-purpose lubricants to high-performance specialty lubricants tailored for specific cement industry applications.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a temporary adverse impact on the lubricants for the cement industry market due to disruptions in construction activities and supply chains. However, as the construction sector recovers and infrastructure projects resume, the demand for lubricants is expected to rebound. Additionally, the industry’s focus on improving operational efficiency and reducing maintenance costs will drive the adoption of high-performance lubricants post-pandemic.

Key Industry Developments

Analyst Suggestions

Future Outlook

The lubricants for the cement industry market is poised for significant growth in the coming years, driven by increasing cement consumption, infrastructure development projects, and the adoption of advanced lubricant technologies. The market will witness new product launches, strategic collaborations, and a shift towards sustainable lubricant solutions to meet evolving industry demands.

Conclusion

The lubricants for the cement industry market plays a crucial role in ensuring the smooth operation and longevity of machinery and equipment in cement production processes. As the industry continues to expand globally, lubricant manufacturers need to focus on developing high-performance, sustainable lubricants, while cement industry players should prioritize the adoption of advanced lubrication solutions to improve efficiency, reduce maintenance costs, and achieve environmental compliance. With the right lubricants and strategic partnerships, stakeholders in the cement industry can unlock new opportunities and drive future growth.

What is Lubricants for Cement Industry?

Lubricants for Cement Industry refer to specialized formulations designed to reduce friction and wear in machinery used in cement production. These lubricants enhance the efficiency and longevity of equipment such as crushers, mills, and conveyors.

What are the key companies in the Lubricants for Cement Industry market?

Key companies in the Lubricants for Cement Industry market include ExxonMobil, Shell, and TotalEnergies, among others. These companies provide a range of lubricants tailored for the demanding conditions of cement manufacturing.

What are the growth factors driving the Lubricants for Cement Industry market?

The growth of the Lubricants for Cement Industry market is driven by increasing cement production globally, the need for equipment efficiency, and advancements in lubricant formulations that enhance performance and reduce maintenance costs.

What challenges does the Lubricants for Cement Industry market face?

Challenges in the Lubricants for Cement Industry market include fluctuating raw material prices, stringent environmental regulations, and the need for continuous innovation to meet the evolving demands of cement production.

What opportunities exist in the Lubricants for Cement Industry market?

Opportunities in the Lubricants for Cement Industry market include the development of bio-based lubricants, increasing demand for high-performance lubricants, and the expansion of cement production in emerging markets.

What trends are shaping the Lubricants for Cement Industry market?

Trends in the Lubricants for Cement Industry market include the shift towards synthetic lubricants, the integration of smart lubrication systems, and a growing focus on sustainability and eco-friendly products.

Lubricants for Cement Industry market

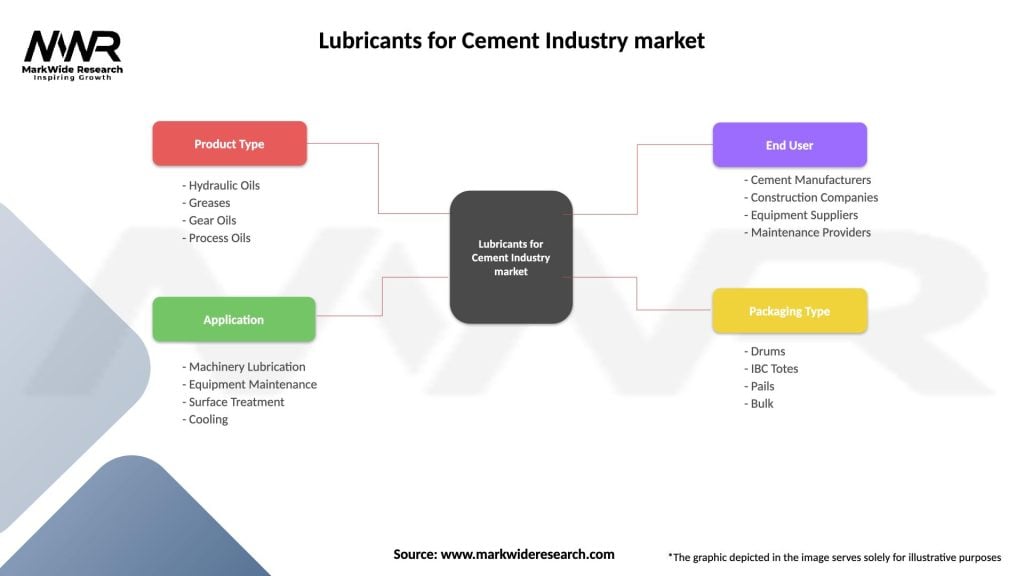

| Segmentation Details | Description |

|---|---|

| Product Type | Hydraulic Oils, Greases, Gear Oils, Process Oils |

| Application | Machinery Lubrication, Equipment Maintenance, Surface Treatment, Cooling |

| End User | Cement Manufacturers, Construction Companies, Equipment Suppliers, Maintenance Providers |

| Packaging Type | Drums, IBC Totes, Pails, Bulk |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Lubricants for Cement Industry Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at