444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Kuwait oil and gas market holds significant importance in the global energy landscape. Kuwait, a member of the Organization of the Petroleum Exporting Countries (OPEC), possesses abundant reserves of crude oil and natural gas. The country’s oil and gas sector plays a crucial role in its economy, contributing to a substantial portion of its revenue and supporting various industries. In this in-depth analysis, we will explore the key aspects of the Kuwait oil and gas market, including its meaning, executive summary, market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants and stakeholders, SWOT analysis, key trends, the impact of Covid-19, industry developments, analyst suggestions, future outlook, and a concluding remark.

Meaning

The Kuwait oil and gas market refers to the industry encompassing the exploration, production, refining, and distribution of oil and gas resources in Kuwait. It involves various companies, both domestic and international, engaged in upstream and downstream operations. The market’s significance lies in the vast reserves of oil and gas found in the region, making Kuwait a prominent player in the global energy market.

Executive Summary

The Kuwait Oil and Gas Market is expected to grow steadily, with a focus on maintaining high levels of oil production and expanding natural gas infrastructure. Kuwait’s oil industry, particularly crude oil production, remains central to its economic growth. In 2023, the market was valued at approximately USD 40 billion, with projections showing moderate growth in the coming years, driven by ongoing investments in exploration and production technologies, as well as downstream operations such as refining and petrochemical production.

The executive summary of the Kuwait oil and gas market provides a concise overview of the industry’s current state, highlighting the key trends, opportunities, challenges, and future prospects. It serves as a snapshot of the comprehensive analysis that follows, enabling readers to grasp the key points quickly.

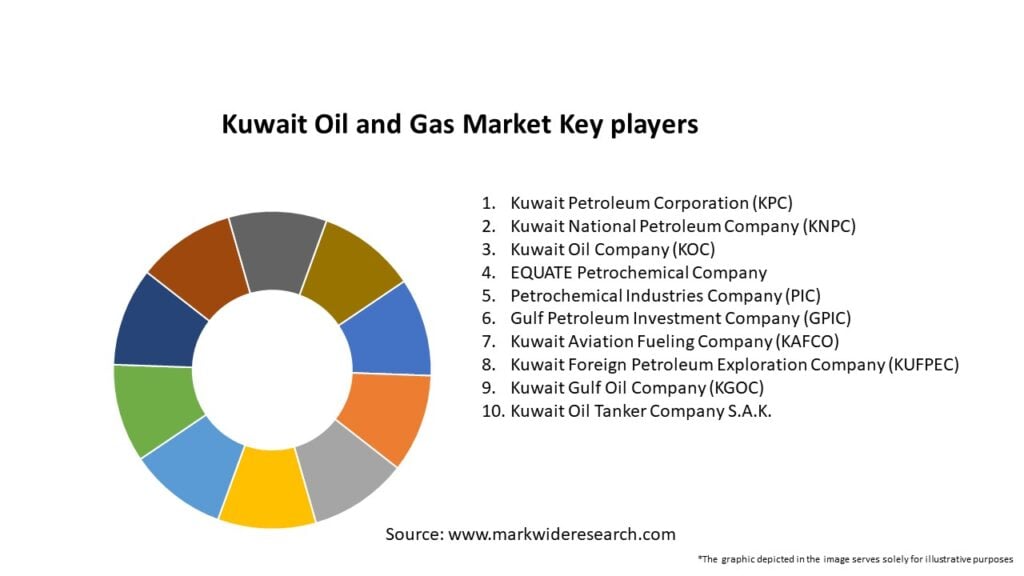

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The Kuwait Oil and Gas Market is characterized by several key factors influencing its growth trajectory:

Market Drivers

Several key drivers are contributing to the growth of the Kuwait Oil and Gas Market:

Market Restraints

Despite the growth prospects, the Kuwait Oil and Gas Market faces several challenges:

Market Opportunities

The Kuwait Oil and Gas Market presents numerous opportunities for growth and innovation:

Market Dynamics

The dynamics of the Kuwait Oil and Gas Market are shaped by a range of factors:

Regional Analysis

The Kuwait Oil and Gas Market plays a central role in the broader Middle East and North Africa (MENA) region:

Competitive Landscape

Leading Companies in the Kuwait Oil and Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Kuwait Oil and Gas Market can be segmented based on various criteria:

Category-wise Insights

Each category within the Kuwait Oil and Gas Market offers distinct growth opportunities:

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the global oil and gas industry, including Kuwait. This section examines the effects of the pandemic on production, consumption, investment, and market dynamics. It provides insights into the measures taken by industry players and governments to mitigate the impact and explores the outlook for recovery and resilience.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook section offers a glimpse into the Kuwait oil and gas market’s prospects, emphasizing potential growth areas, emerging trends, and investment opportunities. It considers factors such as technological advancements, regulatory frameworks, market demand, and geopolitical dynamics. The future outlook serves as a guide for industry participants and stakeholders in shaping their long-term strategies.

Conclusion

In conclusion, the Kuwait oil and gas market holds immense significance in the global energy landscape. Its vast reserves, strategic location, and favorable investment climate contribute to its prominence as a key player in the industry. By understanding the market dynamics, embracing technological advancements, and adapting to evolving trends, industry participants can unlock new opportunities, drive sustainable growth, and contribute to the development of Kuwait’s economy and energy sector.

What is Oil and Gas?

Oil and gas refer to natural resources that are extracted from the earth and used primarily for energy production, transportation, and various industrial applications. In Kuwait, these resources play a crucial role in the economy and energy sector.

What are the key players in the Kuwait Oil and Gas Market?

Key players in the Kuwait Oil and Gas Market include Kuwait Petroleum Corporation, Kuwait Oil Company, and Petrochemical Industries Company, among others. These companies are involved in exploration, production, and refining activities within the sector.

What are the growth factors driving the Kuwait Oil and Gas Market?

The growth of the Kuwait Oil and Gas Market is driven by factors such as increasing global energy demand, advancements in extraction technologies, and the country’s significant oil reserves. Additionally, investments in infrastructure and exploration activities contribute to market expansion.

What challenges does the Kuwait Oil and Gas Market face?

The Kuwait Oil and Gas Market faces challenges such as fluctuating oil prices, environmental regulations, and geopolitical tensions in the region. These factors can impact production levels and investment decisions.

What opportunities exist in the Kuwait Oil and Gas Market?

Opportunities in the Kuwait Oil and Gas Market include the potential for enhanced oil recovery techniques, the development of renewable energy projects, and partnerships with international firms for technology transfer. These avenues can help diversify the energy portfolio.

What trends are shaping the Kuwait Oil and Gas Market?

Trends in the Kuwait Oil and Gas Market include a shift towards digitalization and automation in operations, increased focus on sustainability practices, and the integration of renewable energy sources. These trends aim to improve efficiency and reduce environmental impact.

Kuwait Oil and Gas Market

| Segmentation Details | Description |

|---|---|

| Service Type | Exploration, Production, Refining, Distribution |

| Technology | Drilling, Hydraulic Fracturing, Enhanced Oil Recovery, Seismic Imaging |

| End User | Utilities, Industrial, Commercial, Residential |

| Application | Power Generation, Heating, Transportation, Petrochemicals |

Leading Companies in the Kuwait Oil and Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at