444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Kuwait gas hobs market has witnessed significant growth in recent years, driven by the increasing demand for efficient and convenient cooking solutions. Gas hobs, also known as gas cooktops, are kitchen appliances that provide a reliable and responsive heat source for cooking. They offer precise temperature control and quick heating, making them a popular choice among households and professional kitchens alike.

Meaning

A gas hob is a type of cooking appliance that uses natural gas or liquefied petroleum gas (LPG) as a fuel source. It consists of multiple burners mounted on a stove or countertop, each with a control knob to adjust the flame intensity. Gas hobs are known for their versatility, allowing users to cook various dishes simultaneously on different burners.

Executive Summary

The Kuwait gas hobs market has experienced steady growth in recent years, driven by factors such as the increasing urbanization, rising disposable incomes, and a growing preference for efficient cooking appliances. Consumers are seeking innovative solutions that offer convenience, energy efficiency, and advanced features to enhance their culinary experiences. Gas hobs have emerged as a popular choice due to their precise control, fast heating, and ease of use.

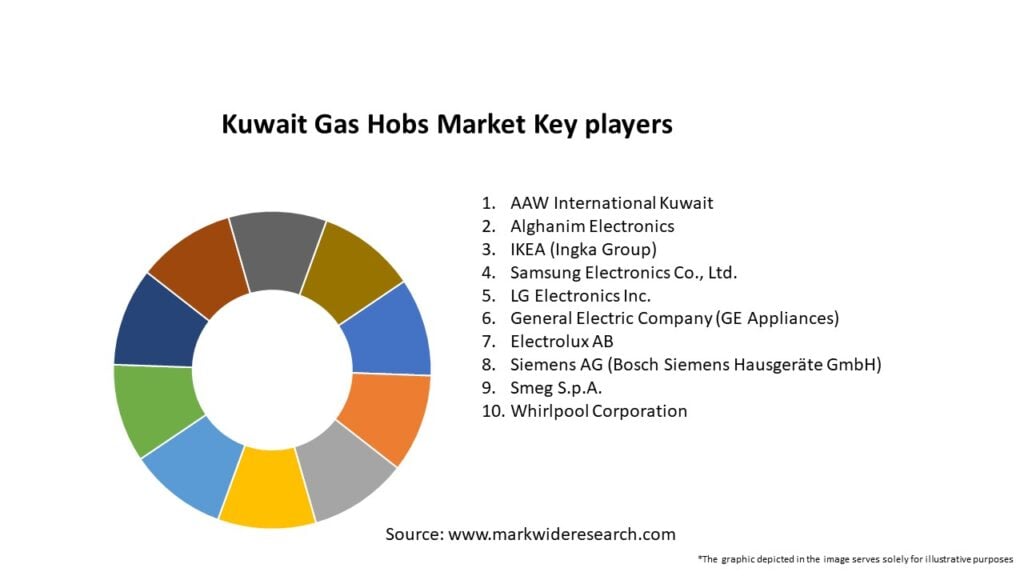

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

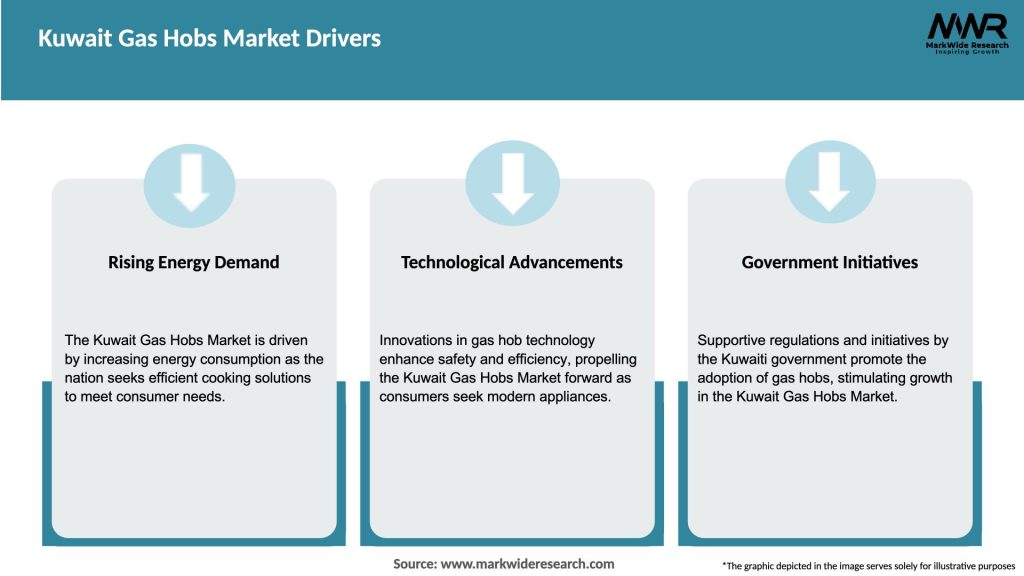

Market Drivers

The Kuwait gas hobs market is driven by several key factors, including:

Market Restraints

Despite the positive growth trajectory, the Kuwait gas hobs market faces certain challenges, including:

Market Opportunities

The Kuwait gas hobs market presents promising opportunities for growth, including:

Market Dynamics

The Kuwait gas hobs market operates in a dynamic environment influenced by various factors, including consumer preferences, technological advancements, government regulations, and economic conditions. It is essential for manufacturers and industry participants to stay abreast of these dynamics to make informed decisions and adapt their strategies accordingly.

Regional Analysis

The Kuwait gas hobs market is primarily concentrated in urban areas with high residential and commercial development. Major cities such as Kuwait City, Hawalli, and Al Ahmadi represent key regional markets. The demand for gas hobs is driven by the growing population, rising disposable incomes, and changing lifestyle patterns in these urban centers.

Competitive Landscape

Leading Companies in the Kuwait Gas Hobs Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

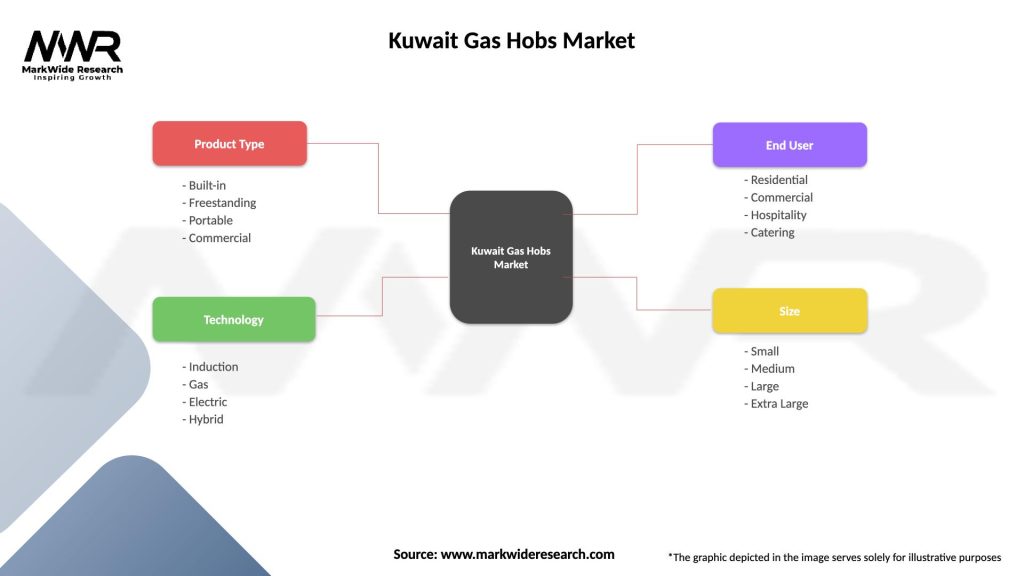

Segmentation

The Kuwait gas hobs market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had both positive and negative impacts on the Kuwait gas hobs market. While the initial lockdowns and restrictions temporarily affected the market due to disrupted supply chains and reduced consumer spending, the subsequent shift towards home cooking and the renewed focus on hygiene and safety have driven the demand for gas hobs. Homebound consumers sought reliable and efficient cooking appliances, leading to increased sales and market growth.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Kuwait gas hobs market looks promising, driven by factors such as urbanization, rising disposable incomes, and a growing emphasis on convenience and efficiency in cooking. The market is expected to witness further growth with the introduction of technologically advanced gas hobs, increased focus on sustainability, and the expanding adoption of smart home systems.

Conclusion

The Kuwait gas hobs market is experiencing steady growth, driven by the demand for efficient and convenient cooking appliances. Gas hobs offer precise temperature control, fast heating, and flexibility, making them a popular choice among households and professional kitchens. Despite the competition from electric and induction cooktops, the market presents opportunities for innovation, expansion, and differentiation. By staying attuned to market dynamics, focusing on product quality and customer satisfaction, and leveraging emerging trends, industry participants can thrive in the Kuwait gas hobs market.

What is Gas Hobs?

Gas hobs are cooking appliances that use gas as a fuel source for heating and cooking food. They are popular for their quick heating capabilities and precise temperature control, making them a preferred choice in many kitchens.

What are the key players in the Kuwait Gas Hobs Market?

Key players in the Kuwait Gas Hobs Market include companies like Miele, Bosch, and Electrolux, which offer a range of gas hobs with various features and designs. These companies compete on innovation, quality, and customer service, among others.

What are the growth factors driving the Kuwait Gas Hobs Market?

The growth of the Kuwait Gas Hobs Market is driven by increasing consumer preference for gas cooking due to its efficiency and cost-effectiveness. Additionally, the rise in modern kitchen designs and renovations contributes to the demand for advanced gas hobs.

What challenges does the Kuwait Gas Hobs Market face?

The Kuwait Gas Hobs Market faces challenges such as safety concerns related to gas leaks and the competition from electric cooking appliances. Regulatory compliance and the need for regular maintenance also pose challenges for manufacturers and consumers.

What opportunities exist in the Kuwait Gas Hobs Market?

Opportunities in the Kuwait Gas Hobs Market include the introduction of smart gas hobs that integrate with home automation systems. Additionally, the growing trend of gourmet cooking at home presents a chance for manufacturers to innovate and cater to culinary enthusiasts.

What trends are shaping the Kuwait Gas Hobs Market?

Trends in the Kuwait Gas Hobs Market include the increasing popularity of multi-functional hobs that combine gas and induction cooking. There is also a rising demand for energy-efficient models that reduce gas consumption while maintaining performance.

Kuwait Gas Hobs Market

| Segmentation Details | Description |

|---|---|

| Product Type | Built-in, Freestanding, Portable, Commercial |

| Technology | Induction, Gas, Electric, Hybrid |

| End User | Residential, Commercial, Hospitality, Catering |

| Size | Small, Medium, Large, Extra Large |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Kuwait Gas Hobs Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at