444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The KSA (Kingdom of Saudi Arabia) private K12 education market has witnessed significant growth in recent years. With a focus on providing quality education, the market has become a key player in the region’s educational landscape. This article provides an in-depth analysis of the market, including its meaning, executive summary, key market insights, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, Covid-19 impact, key industry developments, analyst suggestions, future outlook, and a comprehensive conclusion.

Meaning

The KSA private K12 education market refers to the segment of the education industry that encompasses private schools catering to students from kindergarten to grade 12. These schools operate independently or are affiliated with international educational systems. They offer a wide range of curricula, including national, international, and bilingual programs, to meet the diverse needs of students and parents in Saudi Arabia.

Executive Summary

The KSA private K12 education market has experienced significant growth due to several factors such as increasing population, rising disposable income, changing cultural dynamics, and a growing emphasis on quality education. The market is highly competitive, with both local and international players vying for a larger market share. This executive summary provides a snapshot of the market, highlighting the key aspects and trends driving its growth.

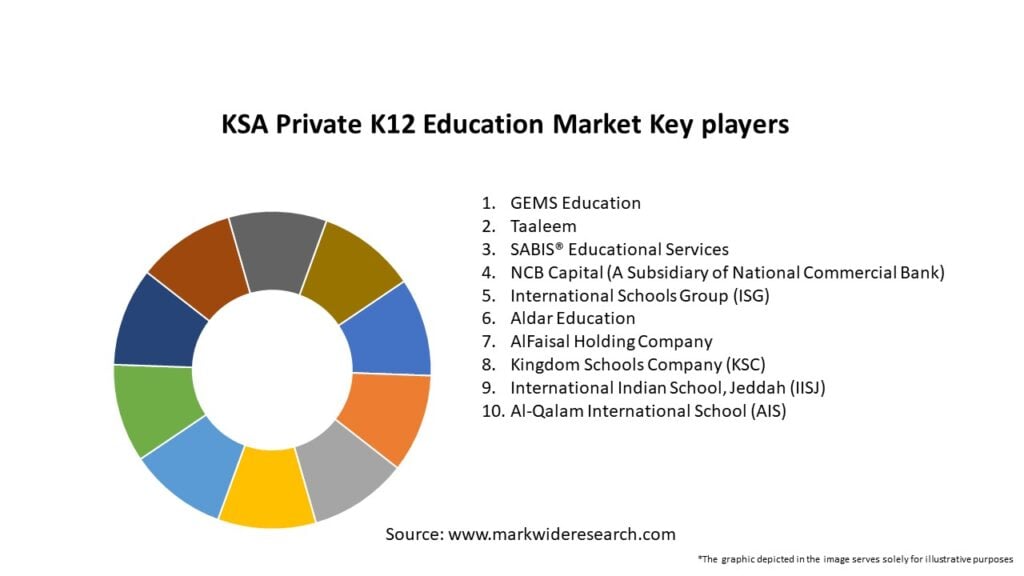

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The KSA private K12 education market is characterized by intense competition, with players striving to differentiate themselves through curriculum offerings, facilities, teaching quality, and extracurricular activities. The market dynamics are influenced by factors such as changing demographics, regulatory reforms, economic conditions, and advancements in educational technology. Moreover, parents’ increasing awareness of the importance of quality education and the growing emphasis on holistic development contribute to the evolving dynamics of the market.

Regional Analysis

The KSA private K12 education market exhibits regional variations in terms of demand, market saturation, and regulatory frameworks. Major cities such as Riyadh, Jeddah, and Dammam have a higher concentration of private schools, driven by the urban population’s preferences and higher disposable incomes. However, opportunities exist in less-developed regions where the demand for private education is growing, but the supply is relatively limited.

Competitive Landscape

Leading Companies in the KSA Private K12 Education Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

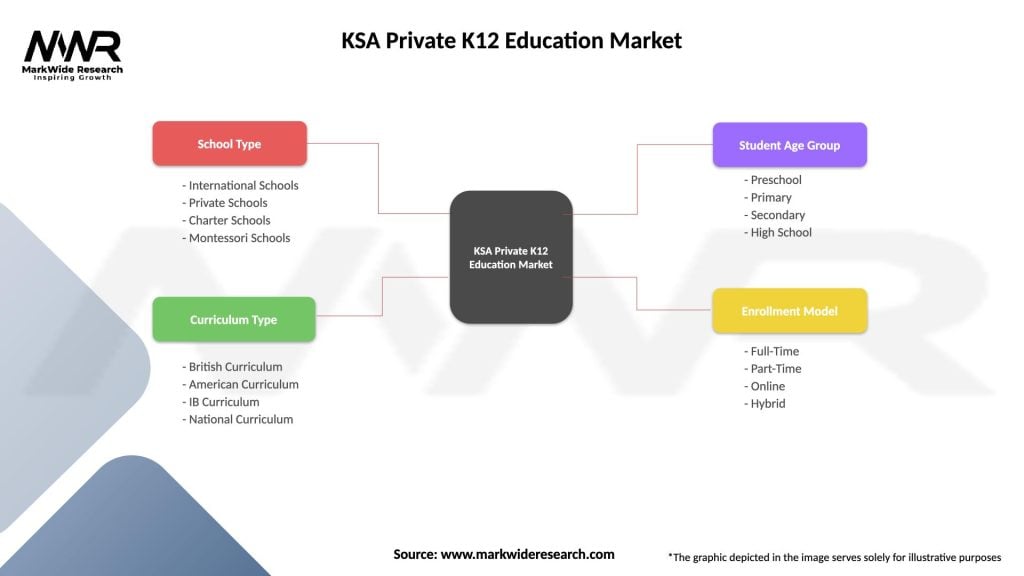

Segmentation

The KSA private K12 education market can be segmented based on curriculum type, school ownership, and geographical regions. Curriculum types may include international programs (e.g., IB, American, British), national curricula, and bilingual programs. School ownership can range from privately-owned schools to schools managed by educational groups or international franchises. Geographically, the market can be segmented into major cities, suburban areas, and rural regions, each with its unique characteristics and demand patterns.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has significantly impacted the KSA private K12 education market. Schools had to adapt rapidly to remote learning models during lockdowns, relying on technology to deliver education. The pandemic accelerated the adoption of online platforms and highlighted the importance of digital readiness in the education sector. Additionally, health and safety protocols, including social distancing measures and hygiene practices, have become integral parts of school operations.

Key Industry Developments

Analyst Suggestions

Future Outlook

The KSA private K12 education market is poised for continued growth, driven by factors such as population expansion, increasing disposable incomes, and the government’s commitment to educational reforms. The market is likely to witness further advancements in educational technology, a shift towards personalized learning, and an increased emphasis on 21st-century skills. Collaboration between schools, industry stakeholders, and government entities will play a crucial role in shaping the future of private K12 education in Saudi Arabia.

Conclusion

The KSA private K12 education market has experienced remarkable growth, driven by increasing demand for quality education, evolving demographics, and government initiatives. Despite challenges, the market offers significant opportunities for schools, stakeholders, and the overall development of human capital in Saudi Arabia. By embracing innovative practices, leveraging technology, and focusing on student-centered education, private K12 schools can navigate the market dynamics and contribute to the advancement of education in the Kingdom.

What is Private K12 Education?

Private K12 Education refers to the educational institutions that provide primary and secondary education funded through tuition fees rather than government funding. These schools often offer diverse curricula and specialized programs tailored to student needs.

What are the key players in the KSA Private K12 Education Market?

Key players in the KSA Private K12 Education Market include international schools like British International School, local institutions such as Al-Falah International School, and educational groups like Taaleem, among others.

What are the growth factors driving the KSA Private K12 Education Market?

The KSA Private K12 Education Market is driven by factors such as increasing population, rising demand for quality education, and government initiatives to enhance educational standards. Additionally, the growing preference for international curricula contributes to market expansion.

What challenges does the KSA Private K12 Education Market face?

Challenges in the KSA Private K12 Education Market include regulatory hurdles, competition from public schools, and fluctuating economic conditions that may affect enrollment rates. Additionally, maintaining high educational standards can be a significant challenge for private institutions.

What opportunities exist in the KSA Private K12 Education Market?

Opportunities in the KSA Private K12 Education Market include the potential for expanding online education platforms, increasing investment in educational technology, and the demand for specialized programs in STEM and arts education. These trends can enhance the learning experience and attract more students.

What trends are shaping the KSA Private K12 Education Market?

Trends in the KSA Private K12 Education Market include the integration of technology in classrooms, a shift towards personalized learning experiences, and an emphasis on bilingual education. These trends reflect the evolving needs of students and parents in the education sector.

KSA Private K12 Education Market

| Segmentation Details | Description |

|---|---|

| School Type | International Schools, Private Schools, Charter Schools, Montessori Schools |

| Curriculum Type | British Curriculum, American Curriculum, IB Curriculum, National Curriculum |

| Student Age Group | Preschool, Primary, Secondary, High School |

| Enrollment Model | Full-Time, Part-Time, Online, Hybrid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the KSA Private K12 Education Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at