444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The investor relations solutions market plays a pivotal role in the financial world, facilitating effective communication between companies and their stakeholders, particularly investors and shareholders. In today’s fast-paced and information-driven landscape, companies need to maintain transparent and consistent interactions with their stakeholders to foster trust, attract potential investors, and enhance their corporate image. Investor relations solutions, through a blend of technology and strategic communications, enable businesses to achieve these goals efficiently and effectively.

Meaning

Investor relations solutions encompass a range of services, tools, and practices designed to manage, monitor, and enhance interactions between a company and its investors, shareholders, analysts, and other stakeholders. These solutions cater to various facets of investor relations, including financial reporting, shareholder engagement, regulatory compliance, and performance analysis. By utilizing these solutions, companies can bolster their credibility, strengthen investor confidence, and foster long-term relationships with their shareholders, ultimately contributing to sustainable growth and success.

Executive Summary

The investor relations solutions market is experiencing a significant upswing, driven by the growing emphasis on transparency and accountability in corporate communication. With businesses seeking to attract investments and maintain healthy relationships with investors, the demand for advanced, comprehensive, and user-friendly investor relations solutions has witnessed a surge. This executive summary sheds light on the key insights, trends, drivers, and challenges shaping the market, providing stakeholders with a comprehensive understanding of the market landscape.

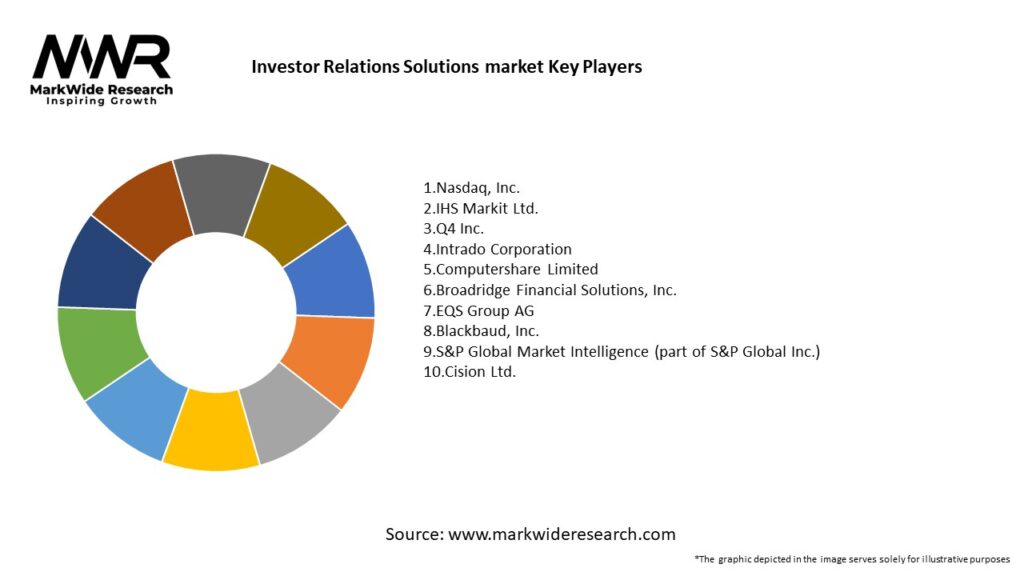

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The Investor Relations Solutions Market is driven by several key factors:

Market Restraints

Despite the promising growth, the Investor Relations Solutions Market faces several challenges:

Market Opportunities

The Investor Relations Solutions Market presents several opportunities for growth:

Market Dynamics

The Global Investor Relations Solutions Market is influenced by several key dynamics:

Regional Analysis

The Investor Relations Solutions Market is experiencing growth in various regions:

Competitive Landscape

Leading Companies in the Investor Relations Solutions Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Global Investor Relations Solutions Market can be segmented based on the following factors:

Solution Type

End-User

Region

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a profound impact on businesses worldwide, and the investor relations solutions market was no exception. The pandemic accelerated the adoption of virtual communication channels, prompting companies to leverage digital platforms for investor relations activities. While the pandemic posed challenges, it also highlighted the importance of effective communication during crises, emphasizing the need for robust and agile investor relations solutions.

Key Industry Developments

The investor relations solutions market has witnessed significant industry developments in recent years. Advancements in data analytics and visualization tools have revolutionized how companies present their financial performance and insights to investors. Moreover, the integration of ESG-focused reporting and sustainability metrics in investor relations practices has gained prominence, with investors placing increasing emphasis on responsible investing.

Analyst Suggestions

Industry analysts recommend that companies focus on adopting comprehensive and flexible investor relations solutions that cater to diverse stakeholder needs. Embracing AI-driven tools for automation and chatbots for interactive communication can streamline processes and enhance stakeholder engagement. Additionally, businesses should prioritize data security and compliance while implementing these solutions to maintain trust and confidentiality.

Future Outlook

The future of the investor relations solutions market appears promising, with technology continuing to be a driving force. Cloud-based solutions are expected to gain traction, offering cost-effective and scalable options for businesses of all sizes. Integration with emerging technologies like blockchain and virtual reality may revolutionize investor relations practices further. Moreover, companies must remain adaptive to changing regulatory requirements and investor preferences to thrive in this dynamic market.

Conclusion

The investor relations solutions market plays a vital role in fostering transparent and fruitful interactions between companies and their stakeholders. As businesses increasingly recognize the value of effective investor relations, the demand for advanced solutions will only grow. By embracing technology, adhering to best practices, and prioritizing stakeholder engagement, companies can pave the way for sustainable growth and success in an ever-evolving financial landscape.

What is Investor Relations Solutions?

Investor Relations Solutions refer to the tools and services that help companies manage their communication with investors, analysts, and stakeholders. These solutions often include financial reporting, shareholder engagement, and market analysis to enhance transparency and trust.

What are the key players in the Investor Relations Solutions market?

Key players in the Investor Relations Solutions market include companies like Q4 Inc., IHS Markit, and Nasdaq IR Intelligence, which provide various platforms and services for investor communication and analytics, among others.

What are the main drivers of growth in the Investor Relations Solutions market?

The growth of the Investor Relations Solutions market is driven by increasing demand for transparency in corporate governance, the rise of digital communication channels, and the need for real-time data analytics to inform investment decisions.

What challenges does the Investor Relations Solutions market face?

Challenges in the Investor Relations Solutions market include regulatory compliance complexities, the need for continuous technological updates, and the difficulty in effectively engaging a diverse investor base.

What opportunities exist in the Investor Relations Solutions market?

Opportunities in the Investor Relations Solutions market include the integration of artificial intelligence for predictive analytics, the expansion of ESG reporting tools, and the growing importance of social media in investor engagement.

What trends are shaping the Investor Relations Solutions market?

Trends in the Investor Relations Solutions market include the increasing use of virtual investor meetings, enhanced data visualization tools, and a focus on sustainability reporting to meet investor expectations.

Investor Relations Solutions market

| Segmentation Details | Description |

|---|---|

| Investor Type | Institutional Investors, Retail Investors, Hedge Funds, Private Equity |

| Service Type | Advisory Services, Communication Solutions, Reporting Tools, Analytics Platforms |

| Engagement Type | Annual Meetings, Roadshows, Webinars, Investor Conferences |

| Technology | Cloud Solutions, AI Analytics, CRM Systems, Data Visualization |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Investor Relations Solutions Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at