444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The construction industry in Indonesia has been witnessing significant growth and development over the years. As one of the largest economies in Southeast Asia, Indonesia has been attracting substantial investments in its construction sector. The industry encompasses various segments, including residential, commercial, infrastructure, and industrial construction, making it a crucial driver of economic progress in the country.

Meaning:

Investment analysis of the construction industry in Indonesia refers to a comprehensive assessment of the market dynamics, key trends, opportunities, and challenges faced by industry participants and stakeholders. It involves studying the factors that influence the growth and profitability of construction-related businesses, thereby helping potential investors make informed decisions.

Executive Summary:

The investment analysis of the construction industry in Indonesia highlights the sector’s potential and growth prospects. With a focus on market insights, regional analysis, competitive landscape, and segmentation, this report aims to assist investors and stakeholders in understanding the industry’s current and future opportunities.

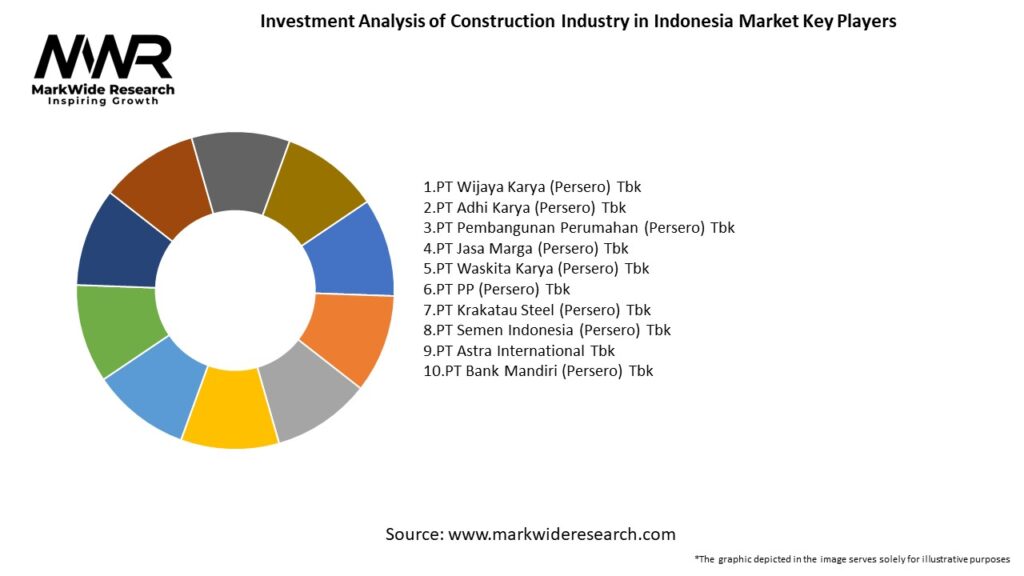

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The construction industry in Indonesia is influenced by a combination of factors, including economic growth, government policies, technological advancements, and demographic shifts. These dynamics continuously shape the market landscape, affecting investment decisions and strategies.

Regional Analysis:

The construction industry in Indonesia exhibits regional variations in terms of market demand, infrastructure development, and economic conditions. Java, being the most populous island, remains a major hub for construction activities, followed by Sumatra and Sulawesi.

Competitive Landscape:

Leading Companies in Investment Analysis of Construction Industry in Indonesia Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

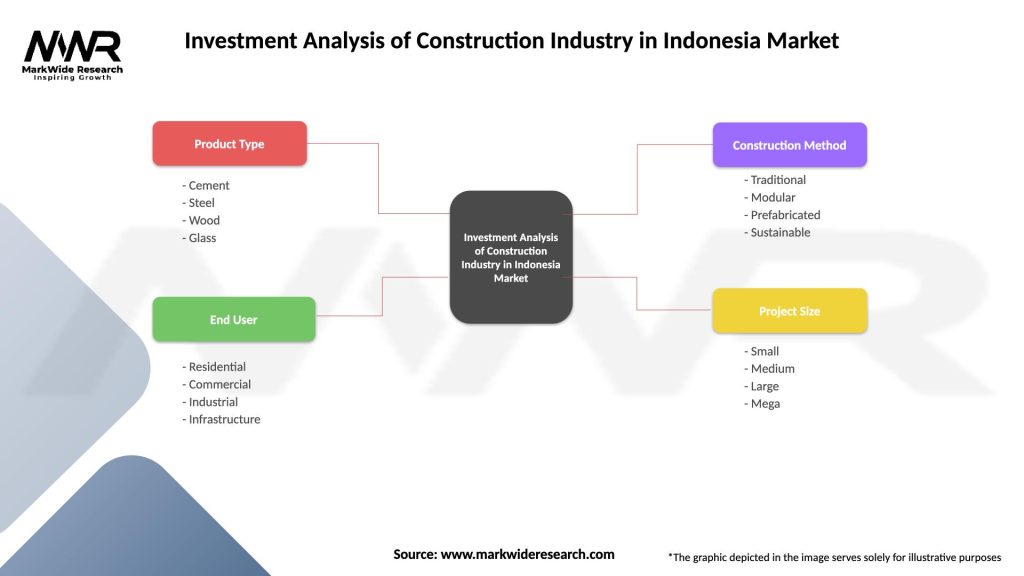

Segmentation:

The construction industry in Indonesia can be segmented based on:

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic had a temporary impact on the construction industry in Indonesia, leading to project delays and labor shortages. However, the sector showed resilience and has bounced back as economic activities resumed.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The construction industry in Indonesia is poised for substantial growth in the coming years. With continued government support for infrastructure projects and a focus on sustainable development, the sector presents attractive investment opportunities for both local and international investors.

Conclusion:

The investment analysis of the construction industry in Indonesia reveals a promising landscape with substantial growth potential. The market’s buoyancy is driven by infrastructure development, increasing urbanization, and a growing demand for housing and commercial spaces. By capitalizing on key market insights, leveraging technological advancements, and adopting sustainable practices, investors can position themselves for success in this dynamic and evolving sector. However, they must remain mindful of regulatory challenges and external factors that can impact profitability. Overall, Indonesia’s construction industry offers a fertile ground for strategic investments, ensuring steady returns and contributing to the nation’s economic progress.

What is Investment Analysis of Construction Industry in Indonesia?

Investment analysis of the construction industry in Indonesia involves evaluating the potential returns and risks associated with investing in construction projects, including residential, commercial, and infrastructure developments.

What are the key players in the Investment Analysis of Construction Industry in Indonesia Market?

Key players in the investment analysis of the construction industry in Indonesia include companies like PT Wijaya Karya, PT Pembangunan Perumahan, and PT Adhi Karya, among others.

What are the growth factors driving the Investment Analysis of Construction Industry in Indonesia Market?

The growth factors for the investment analysis of the construction industry in Indonesia include urbanization, government infrastructure spending, and increasing demand for housing and commercial spaces.

What challenges does the Investment Analysis of Construction Industry in Indonesia Market face?

Challenges in the investment analysis of the construction industry in Indonesia include regulatory hurdles, fluctuating material costs, and labor shortages, which can impact project timelines and budgets.

What opportunities exist in the Investment Analysis of Construction Industry in Indonesia Market?

Opportunities in the investment analysis of the construction industry in Indonesia include the development of smart cities, green building initiatives, and public-private partnerships that can enhance infrastructure development.

What trends are shaping the Investment Analysis of Construction Industry in Indonesia Market?

Trends influencing the investment analysis of the construction industry in Indonesia include the adoption of sustainable construction practices, the use of advanced construction technologies, and a focus on digital transformation in project management.

Investment Analysis of Construction Industry in Indonesia Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cement, Steel, Wood, Glass |

| End User | Residential, Commercial, Industrial, Infrastructure |

| Construction Method | Traditional, Modular, Prefabricated, Sustainable |

| Project Size | Small, Medium, Large, Mega |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Investment Analysis of Construction Industry in Indonesia Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at