444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

The Indian major home appliances market has witnessed significant growth in recent years. Home appliances play a crucial role in enhancing the comfort and convenience of households across the country. These appliances include refrigerators, washing machines, air conditioners, televisions, and kitchen appliances such as microwaves and ovens. The market for these products is driven by factors such as increasing disposable income, urbanization, changing lifestyles, and technological advancements.

Meaning

The major home appliances market in India refers to the industry involved in the manufacturing, distribution, and sale of essential household appliances. These appliances are designed to perform specific functions and make daily tasks easier for consumers. The market encompasses a wide range of products that cater to various needs and preferences of households.

Executive Summary

The Indian major home appliances market has experienced substantial growth in recent years, driven by various factors. Rising disposable income, expanding middle-class population, and changing consumer lifestyles have fueled the demand for home appliances. Technological advancements have also played a significant role in shaping the market landscape, with innovative features and smart functionalities becoming increasingly popular among consumers. However, the market faces challenges such as intense competition, price sensitivity, and the impact of the COVID-19 pandemic.

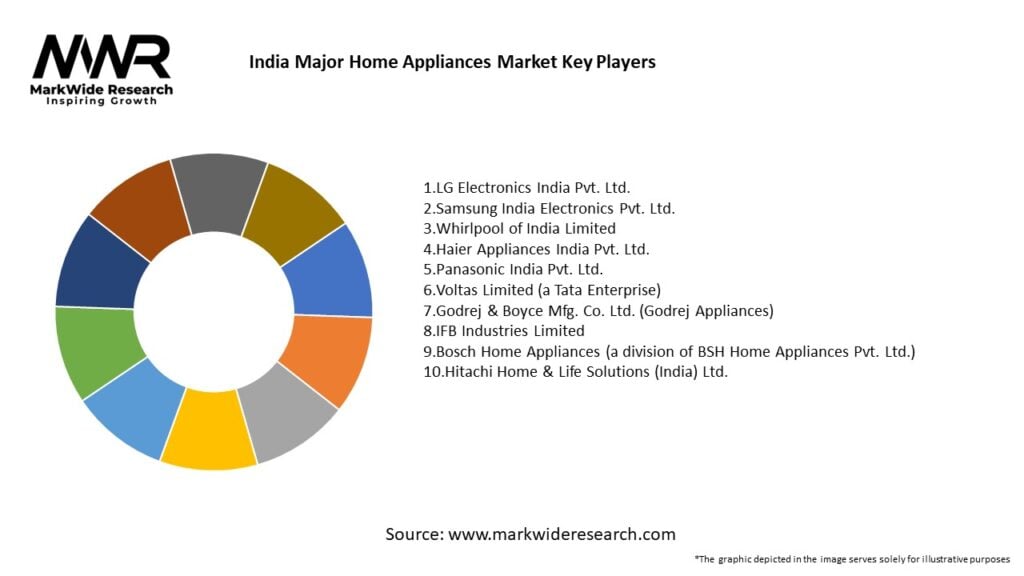

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Indian major home appliances market is dynamic and influenced by various factors. Changing consumer preferences, technological advancements, and market competition drive the dynamics of the industry. Manufacturers need to continuously innovate and adapt to these dynamics to stay competitive in the market. Consumer education, effective marketing strategies, and strong distribution networks are essential for sustained growth in this sector.

Regional Analysis

The major home appliances market in India exhibits regional variations in terms of demand and consumer preferences. The urban areas, especially metropolitan cities, contribute significantly to the overall market due to higher disposable incomes and greater awareness. However, the rural market holds immense potential, as increasing electrification and improving infrastructure create opportunities for market expansion. Manufacturers need to consider regional variations and tailor their products and marketing strategies accordingly.

Competitive Landscape

Leading Companies in the India Major Home Appliances Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The major home appliances market can be segmented based on product type, price range, distribution channel, and geography. Product type segmentation includes refrigerators, washing machines, air conditioners, televisions, and kitchen appliances. Price range segmentation caters to different consumer segments with varying budgets. Distribution channels include retail stores, e-commerce platforms, and direct sales. Geographically, the market can be divided into North India, South India, East India, West India, and Central India.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the major home appliances market can benefit in the following ways:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the major home appliances market in India. During the initial phase of the pandemic, the market experienced disruptions in manufacturing, supply chains, and consumer demand due to lockdowns and restrictions. However, as people spent more time at home, there was an increased focus on home comfort and convenience, leading to a surge in demand for home appliances. The shift to remote work and online education also fueled the need for appliances such as refrigerators, washing machines, and laptops. Manufacturers and retailers adapted to the changing market dynamics by leveraging online sales channels and implementing strict health and safety measures.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the major home appliances market in India appears promising. Factors such as rising disposable income, urbanization, and technological advancements will continue to drive market growth. The demand for smart appliances, energy-efficient models, and personalized solutions is expected to rise. Manufacturers will need to adapt to changing consumer preferences, invest in research and development, and strengthen their distribution networks to remain competitive in the evolving market.

Conclusion

The Indian major home appliances market is witnessing steady growth, driven by various factors such as rising disposable income, urbanization, changing consumer lifestyles, and technological advancements. While the market offers significant opportunities for industry participants, challenges such as price sensitivity and intense competition persist. To succeed in this dynamic market, manufacturers and retailers need to focus on innovation, customer-centric strategies, and expanding their presence in rural areas. By staying abreast of market trends and leveraging emerging opportunities, companies can position themselves for sustainable growth and success in the Indian major home appliances market.

What is Major Home Appliances?

Major home appliances refer to large machines used for household tasks such as cooking, cleaning, and food preservation. Common examples include refrigerators, washing machines, and ovens.

What are the key players in the India Major Home Appliances Market?

Key players in the India Major Home Appliances Market include LG Electronics, Samsung, and Whirlpool, among others. These companies are known for their innovative products and strong market presence.

What are the growth factors driving the India Major Home Appliances Market?

The growth of the India Major Home Appliances Market is driven by increasing urbanization, rising disposable incomes, and a growing preference for energy-efficient appliances. Additionally, advancements in technology and smart home integration are contributing to market expansion.

What challenges does the India Major Home Appliances Market face?

The India Major Home Appliances Market faces challenges such as intense competition, fluctuating raw material prices, and changing consumer preferences. Additionally, the market must navigate regulatory hurdles and sustainability concerns.

What opportunities exist in the India Major Home Appliances Market?

Opportunities in the India Major Home Appliances Market include the growing demand for smart appliances, increased focus on energy efficiency, and expansion into rural markets. Companies can also explore innovative product features to attract tech-savvy consumers.

What trends are shaping the India Major Home Appliances Market?

Trends in the India Major Home Appliances Market include the rise of smart home technology, increased emphasis on sustainability, and the popularity of multi-functional appliances. Consumers are increasingly looking for products that offer convenience and energy savings.

India Major Home Appliances Market

| Segmentation Details | Description |

|---|---|

| Product Type | Refrigerators, Washing Machines, Air Conditioners, Microwaves |

| End User | Residential, Commercial, Hospitality, Retail |

| Technology | Smart Appliances, Energy Efficient, IoT Enabled, Conventional |

| Distribution Channel | Online, Offline, Direct Sales, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the India Major Home Appliances Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at